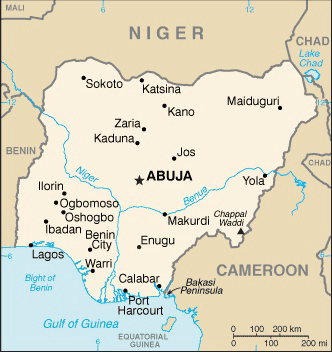

IMF Concludes 2021 Article IV Consultation with Nigeria

On January 31, 2022, the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation [1] with Nigeria.

The Nigerian economy is recovering from a historic downturn benefitting from government policy support, rising oil prices and international financial assistance. Nigeria exited the recession in 2020Q4 and output rose by 4.1 percent (y-o-y) in the third quarter, with broad-based growth except for the oil sector, which is facing security and technical challenges. Growth is projected at 3 percent for 2021. Headline inflation rose sharply during the pandemic reaching a peak of 18.2 percent y-o-y in March 2021 but has since declined to 15.6 percent in December helped by the new harvest season and opening of land borders. Reported unemployment rates (end 2020) are yet to come down but more recent COVID-19 monthly surveys show employment back at its pre-pandemic level.

Despite the recovery in oil prices, the general government fiscal deficit is projected to widen in 2021 to 5.9 percent of GDP, reflecting implicit fuel subsidies and higher security spending. Moreover, the consolidated government revenue-to-GDP ratio at 7.5 percent remains among the lowest in the world. After registering a historic deficit in 2020, the current account improved in 2021 and gross FX reserves have improved, supported by the IMF’s SDR allocation and Eurobond placements in September 2021.

Notwithstanding the authorities’ proactive approach to contain COVID-19 infection rates and fatalities and the recent growth improvement, socio-economic conditions remain a challenge. Levels of food insecurity have risen and the poverty rate is estimated to have risen during the pandemic.

The outlook faces balanced risks. On the downside, low vaccination rates expose Nigeria to future pandemic waves and new variants, including the ongoing Omicron variant, while higher debt service to government revenues (through higher US interest rates and/or increased borrowing) pose risks for fiscal sustainability. A worsening of violence and insecurity could also derail the recovery. On the upside, the non-oil sector could be stronger, benefitting from its recent growth momentum, supportive credit policies, and higher production from the new Dangote refinery. Nigeria’s ratification of the African Continental Free Trade Agreement could also yield a positive boost to the non-oil sector while oil production could rebound, supported by the more generous terms of the Petroleum Industry Act.

Information Source: Read More–>

Oil and gas, press , | Energy, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Electric,