Energy / Automotive News As Reported to 02 March 2023

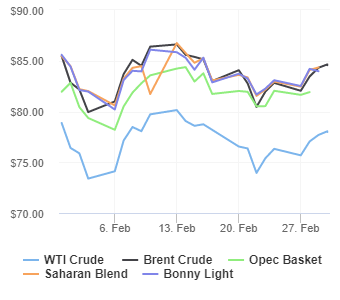

London, March 02, (Oilandgaspress) Brent Crude stood at $84.61/bl, WTI Crude stood at $77.98/bl

European countries and the UK imported 121 million tonnes of LNG in 2022, an increase of 60% compared to 2021, which enabled them to withstand a slump in Russian pipeline gas imports., Shell said in its annual LNG outlook

Toyota Mobility Foundation (TMF) started accepting applications for this year in the “Mobility for ALL―Bringing the Potential of Mobility to Everyone” category of its Make a Move Project, an idea contest aiming to realize the practical implementation of ideas and solutions in society. This contest, which started in 2022, focuses on motorsports and has been calling for ideas and solutions that will enable everyone, regardless of disability, to comfortably enjoy watching motorsports and traveling to the venues where they are held. In 2023, the eight teams of finalists selected last year will be joined by new teams participating from this year, further expanding the community of teams competing with and helping each other. Teams that pass the first round of screening will be awarded a grant of up to 20 million yen to conduct verification tests at the Super Taikyu race to be held at Mobility Resort Motegi on September 2-3, 2023. To have more people participate and work together on the project, this year’s verification testing will be conducted not only by the teams but also by people with disabilities and outside experts. Additionally, TMF plans to provide further support funds to the teams selected in the final screening to allow them to work towards the societal implementation of their ideas. Read More

ACWA Power announces the finalization and signing of the financing agreements by NGHC with the financing consortium for the NEOM Green Hydrogen Project (“NGHP”) at total investment cost of USD 8.5 billion, funded by a combination of long-term debt and equity. NGHC is a joint venture (JV) between ACWA Power, Air Products and NEOM Company, with ACWA Power holding a 33.3% equity stake. NGHP comprises the development, financing, design, engineering, procurement, manufacturing, factory testing, transportation, construction, erection, installation, completion, testing, commissioning, insurance, ownership, operation and maintenance of a world scale green hydrogen and green ammonia facility in the NEOM region of Saudi Arabia, under a 30-year green ammonia offtake contract with Air Products.

The total financing consists of USD 5,852 million senior debt and USD 475 million of mezzanine debt facilities, both arranged on a non-recourse project finance basis, as follows:

- USD 1,500 million from National Development Fund (NDF) on behalf of National Infrastructure Fund (NIF), under foundation.

- USD 1,250 million is in the form of SAR denominated financing from Saudi Industrial Development Fund (SIDF),

- The balance is from a consortium of financiers, structured as a combination of long term uncovered tranches and a Euler Hermes covered tranche, comprising, in no particular order, First Abu Dhabi Bank, HSBC, Standard Chartered Bank, Mitsubishi UFJ Financial Group, BNP Paribas, Abu Dhabi Commercial Bank, Natixis, Saudi British Bank, Sumitomo Mitsui Banking Corporation, Saudi National Bank, KFW, Riyad Bank, Norinchukin Bank, Mizuho Bank, Banque Saudi Fransi, Alinma Bank, APICORP, JP Morgan, DZ Bank, Korea Development Bank and Credit Agricole. Read More

ACWA Power Co. announces providing corporate guarantee (parent company guarantee) to Saudi National Bank (SNB) to support USD 100 million Equity Bridge Loan (EBL) facility provided to Shuaibah Holding Company (a subsidiary of ACWA Power) in relation to Al Shuaibah 1 & Al Shuaibah 2 Solar PV IPP. SNB is a related party to ACWA Power in accordance with the related party definition. Additionally, this transaction represents an indirect interest to Mr. Abdullah Al-Ruwais, a member of the Board of Directors of both ACWA Power and SNB. Read More

Enagás has acquired the Reganosa network of natural gas pipelines, which will enter into the shareholding of El Musel Regasification Plant with 25% Read More

Enagás and Reganosa have signed an agreement by which Enagás has acquired a network of 130 km of natural gas pipelines from Reganosa for 54 million euros. In return Reganosa has purchased a 25% stake in the El Musel Regasification plant in Gijon for 95 million euros. According to the agreement terms, Enagás acquires the whole of the transmission network which up to now was owned by Reganosa and consists of 130 km of gas pipelines of 80 bar. This network is included in the Backbone network and is key to guarantee the security of supply as well as the proper functioning of the Iberian gas market. It connects to the LNG terminal of Mugardos and the Tui – Llanera gas pipeline in Guitiriz and Abegondo. It has three measuring stations, three regulation and measurement stations and thirteen valve positions. The transmission network brings natural gas directly to the combined cycle power plants of As Pontes (800 MW) and Sabón (400 MW), to the refinery of A Coruña (120.000 barrels/day) and the towns of As Pontes and Cerceda. Read More

Energy for Growth, the training program launched by Enel in partnership with Elis, is expanding its reach to include the renewables sector, with the goal of training more than 2,000 new energy transition professionals by 2025 to be employed in the supplier companies of Enel Green Power.

Launched in 2022 with the goal of training 5,500 new smart grid operators within two years, the program has already attracted more than 12,000 applications and enabled more than 2,400 young people to obtain a professional qualification with the aim of finding employment in Enel’s supply chain companies. Now, it is aiming to create new specialized skills that support the development of power generation from renewable sources in Italy, helping to accelerate the country’s energy transition path. Read More

Biden-Harris Administration is making $250 million available to develop innovative strategies to cut climate pollution and build clean energy economies. These planning grants, through the U.S. Environmental Protection Agency (EPA), are the first tranche of funding going to states, local governments, Tribes, and territories from the $5 billion Climate Pollution Reduction Grants (CPRG) program created by President Biden’s Inflation Reduction Act. The program provides flexible planning resources for states, Tribes, territories, and municipalities to develop and implement scalable solutions that protect people from pollution and advance environmental justice.

All 50 states, the District of Columbia and Puerto Rico are eligible to receive $3 million in grant funds. In addition, each of the 67 most populous metropolitan areas in the country are eligible to receive $1 million for plans to tackle climate pollution locally. EPA is also making millions in noncompetitive planning grant funds available to territory and tribal governments. Later this year, EPA will launch a competition for $4.6 billion in funding to implement projects and initiatives included in these plans. States, cities, territories, and Tribes can also use this funding to develop strategies for using the other grant, loan, and tax provisions secured by President Biden’s historic legislation, including the Inflation Reduction Act and Bipartisan Infrastructure Law, to achieve their clean energy, climate, and environmental justice goals. Read More

The U.S. Environmental Protection Agency (EPA) is announcing that 86 U.S. manufacturing plants earned the agency’s ENERGY STAR certification in 2022, a designation reserved for manufacturing plants in the top 25% of energy efficiency in their sector. Together, these plants saved over 105 trillion British thermal units (Btus) of energy and prevented more than 6 million metric tons of carbon dioxide emissions, equivalent to the emissions from the electricity use of more than 1.1 million American homes.

“Industrial leadership in energy efficiency is critical to achieving our nation’s climate goals,” said EPA Administrator Michael S. Regan. “The savings from ENERGY STAR certified plants demonstrate how energy efficiency is both helping our manufacturing sector reduce costs and propelling America’s transition to a clean energy future.”

The industrial sector accounts for 30% of U.S. greenhouse emissions, primarily from energy use in manufacturing plants. ENERGY STAR certified plants have reduced their energy consumption through a variety of energy efficiency projects and management practices. Read More

Kent, a leading engineering company in oil and gas and low-carbon energy headquartered in Dubai, has launched its 2023 UAE Graduate Development Programme focusing on nurturing Emirati talent in support of UAE’s vision for economic competitiveness and growth.

Kent’s three-year graduate programme currently holds 23 Emirati nationals, and pushes for a flexible and tailored approach that focuses on the development of each candidate. Kent’s recruitment team looks to source graduates from official government bodies, such as the UAE government’s training programme in partnership with Abu Dhabi Global Market (ADGM) and Nafis. The graduates are then embedded into different business functions, including operations, HR, and finance, to give them a well-rounded experience of Kent as an organisation.

Among the graduates is Amna Al-Ali, an Environmental and Sustainability Engineer who has been on the programme for over two years. Amna shared: “I’ve had the best opportunity to learn a range of skills throughout my time with the team here at Kent. As a woman in STEM and Emirati it’s great to know that global companies are dedicating their time and resources to supporting our career growth and development.” Read More

Saudi Aramco is interested in investing in an LNG export facility outside Saudi Arabia and is in early talks with developers aiming to secure a stake in a project in the United States or Asia, Bloomberg reported on Wednesday, quoting sources familiar with the matter. The Saudi oil giant, the world’s largest oil company by both production and market capitalization, prefers an LNG plant that could easily export the fuel to Asia, according to Bloomberg’s sources. Apart from investing in a stake, Aramco is also reportedly looking to secure a long-term off-take agreement with the project developer, the sources added. Read More

Commodities have started March on a firmer footing after China data confirmed that activity in the world’s biggest consumer of raw materials is picking up momentum. In addition, industrial metals including silver was supported by the first rise in China’s home sales in 20 months. Additional support has been provided by a softer dollar after weaker US data led the market to question whether three additional 25 basis point rate hikes are necessary

Commodities have started March on a firmer footing after China data confirmed that activity in the world’s biggest consumer of raw materials is picking up momentum. An overnight report showed Manufacturing Purchasing Managers Index (NBS Manufacturing PMI) surging to 52.6 in February, the highest level since 2012, and up from 50.1 in January. Another report showed China’s home sales rising for the first time in 20 months, after policy markers stepped up their support for a struggling sector.

The surge in the PMI data is the latest confirmation of the economic recovery in the making from the confluence of the reopening from Covid-19 containment and upturns in the credit cycle and the regulatory cycle (normalization and stability instead of tightening), and the emergent tendency of a more conciliatory external policy as noted in our Q1 outlook. February’s losses across key commodities from energy to industrial and precious metals were primarily driven by continued strength in US economic numbers, including inflation, forcing the Fed to turn up the hawkish rhetoric, and the market responded by raising the expected terminal Fed funds rate by 0.4% to 5.4% while at the same time sending bond yields towards a cycle high and the dollar higher, thereby hurting risk sentiment across stock and commodity markets. Read More

Nel ASA has today resolved to grant 1 370 000 options under its revised share option plan. The strike price is 17.023, a premium of 8% over the highest of the closing share price on March 1, 2023 and the volume-weighted average price over the past five preceding trading days. The vesting time is three years and the options expired after five years. A total number of 1 370 000 share options were granted following the newly adopted long term incentive (LTI) program. Each option, when exercised, will give the right to acquire one share in the Company. The options are granted without consideration. Pursuant to the vesting schedule, 100% of the options will vest three years after the day of grant. Vesting requires the option holder still to be an employee in the Company. The options that have not been exercised will lapse five years after the date of the grant. The gain per option is capped at a maximum of NOK 10 up from the strike price. Read More

Delta, a global leader in power and thermal management solutions, will be present at Solar Solutions international, hosted at the Expo Haarlemmermeer, the Netherlands. Delta will showcase its full range of Flex Series string inverters, which are suitable for residential, commercial and industrial rooftop PV installations. In addition, Delta will demonstrate its PV inverter monitoring solution, along with its Integrated Bluetooth® solution that enables smartphones to be connected to the inverter for easy commissioning with the DeltaSolar app. With decades of experience in developing solar inverter solutions, combined with its global resources and partner network, Delta is well placed to empower customers to make the transition to more efficient and sustainable energy resources. Read More

Lilium N.V. (NASDAQ: LILM), developer of the first all-electric vertical take-off and landing (“eVTOL”) jet, has teamed with Collins Aerospace, to design, develop and build the Lilium Jet’s inceptors – the innovative sidestick system used by the pilot to control the aircraft. Collins Aerospace is a leader in technologically advanced and intelligent solutions for the global aerospace and defense industry and a Raytheon Technologies business.

The Lilium Jet inceptors will provide safe and intuitive handling qualities, easy access to functionalities, and an aesthetic, ergonomic design. While integrating all conventional mechanical and electrical flight controls into two sidesticks, the Collins Aerospace system brings a new piloting philosophy for single pilot operations in the eVTOL realm. The system will also be designed to bring significant space and weight savings compared to conventional sidesticks.

Lilium’s collaboration with Collins Aerospace continues Lilium’s strategy of teaming up with established tier one aerospace suppliers to support certification and prepare the industrial ramp-up. As part of the supplier agreement, Collins Aerospace, with its extensive experience in developing and certifying inceptors for commercial jets, will certify the Lilium Jet’s inceptors to commercial aviation standards. Read More

The Board of Directors of Hess Corporation (NYSE: HES) today declared a regular quarterly dividend of 43.75 cents per share payable on the Common Stock of the Corporation on March 30, 2023 to holders of record at the close of business on March 13, 2023. The dividend represents an approximate 17% increase compared to the dividend for the fourth quarter of 2022, which equals a 25 cent increase per share on an annualized basis. Read More

| Oil and Gas Blends | Units | Oil Price $ | change |

| Crude Oil (WTI) | USD/bbl | $77.97 | Up |

| Crude Oil (Brent) | USD/bbl | $84.58 | Up |

| Bonny Light | USD/bbl | $83.97 | Up |

| Saharan Blend | USD/bbl | $84.34 | Up |

| Natural Gas | USD/MMBtu | $2.73 | Up |

| OPEC basket 01/03/23 | USD/bbl | $82.57 | Up |

The Executive Board of the International Monetary Fund (IMF) today approved a disbursement of SDR 86.1 million (about US$114.8 million) under the Food Shock Window of the Rapid Credit Facility (RCF) to help South Sudan address urgent balance of payment needs arising from heightened food insecurity. Four consecutive years of intense flooding and the fallout from Russia’s war in Ukraine, on the heels of the COVID-19 pandemic, have exacerbated an already-dire humanitarian situation in South Sudan. A combination of flooding and the rising price of staples have exposed 8.3 million people (about two-thirds of the population) to acute food insecurity. The disbursement is expected to provide South Sudan with fiscal space to address food insecurity while maintaining social and growth-enhancing spending as well as boosting reserves.

The authorities are committed to using resources transparently and intend to channel US$20 million of the disbursement through the existing systems of trusted development partners to provide immediate humanitarian assistance that addresses food insecurity. Transparency in the use of the portion of the disbursement made available to the budget will be ensured through regular reports and an audit, which will be published. Read More

Subsea 7 S.A. announced today results of Subsea7 Group (the Group, Subsea7) for the fourth quarter and full year which ended 31 December 2022. Unless otherwise stated the comparative period is the full year which ended 31 December 2021.

Full year highlights

• Full year Adjusted EBITDA of $559 million resulting in a margin of 11%

• Highest order intake since 2013 at over $7 billion

• Backlog of $9.0 billion, of which $4.2 billion to be executed in 2023 and $3.0 billion in 2024

• Cash and cash equivalents of $646 million and net cash of $33 million including lease liabilities

• High tendering activity with continued momentum in pricing

• Recent awards and ongoing bids underpin management’s confidence in the outlook, including a return of Adjusted EBITDA margins to through-cycle levels of 15-20% over the coming four years

• Reflecting the Board’s confidence in the outlook for Subsea7, it will propose for approval by shareholders at April’s AGM a dividend of NOK 4.00 per share, including the NOK 1.00 per share regular dividend Read More

Subsea 7 S.A. today announced that, marking confidence in the financial position and outlook for the Group, the Board of Directors will recommend to shareholders at the Annual General Meeting (“AGM”) that a dividend of NOK 4.00 per share be paid, equivalent to a total dividend of approximately $110 million.

The AGM is scheduled to take place at 15:00 (local time) on 18 April 2023 at the Company’s registered office, 412F, route d’Esch, L-1471 Luxembourg.

An Extraordinary General Meeting (“EGM”) will also take place at the Company’s registered office immediately after the AGM on 18 April 2023 in order to consider a renewal of the authority of the Board of Directors to repurchase and subsequently cancel the Company’s shares and also to consider a renewal of the Company’s authorised share capital.

The proposed agenda and the notice to convene the AGM and EGM will be published and distributed to eligible shareholders on 17 March 2023. The holders of American Depositary Receipts (“ADRs”) on record at the close of business on 6 March 2023 and the holders of common shares on record at the close of business on 4 April 2023 will be entitled to vote. The deadline for submission of votes for holders of ADRs is 6 April 2023 and for holders of common shares is 12 April 2023.

If the AGM approves the proposed payment of a dividend of NOK 4.00 per share, the last day the shares will be traded including the right to receive a dividend will be 19 April 2023. The first trading date ex-dividend will be 20 April 2023 and holders of common shares and ADRs on record at the close of business on 21 April 2023 will be entitled to the dividend. The date of payment of the dividend will be 28 April 2023 for holders of common shares and ADRs. Read More

Neste welcomes the German government’s plan to approve the sales of 100% synthetic fuels at fuel stations. So far, the sales of synthetic fuels, such as e-fuels and renewable diesel (also known as “HVO”), in Germany have been largely limited to fuel blends in which these fuels have represented about 26 percent maximum. The sales of unblended 100% renewable diesel has previously only been allowed in specific segments, such as in non-road vehicles and public transportation. The planned approval by the government would in the near future allow 100% renewable diesel to be sold and used unblended in all segments in Germany. Read More

CATL, the world’s largest battery maker, did something totally unexpected. It offered several customers an opportunity to lock in battery supplies at sharply lower prices if they agreed to make CATL their supplier for at least 80% of the batteries they buy to power their electric cars. The discount offer included a provision that rocked the industry. CATL agreed to lock in new prices based on an assumption that the price of lithium carbonate would be half what it is today in the foreseeable future.

The price of lithium carbonate, one of the essential ingredients in a lithium-ion battery, rocketed to as much as $86,000 a ton last year, causing the cost of batteries for electric cars to climb by as much as 24% last year after 9 years of steadily declining prices. Spot prices were at $70,000 a ton recently according to Barron’s, but the deal CATL has offered to NIO and Zeekr is based on an expected price for lithium carbonate of $30,000 a ton by the end of this year. Read More

BW Energy Announce Fourth Quarter and Full Year Results 2022

Q4 EBITDA of USD 21.8 million and net loss of USD 8.0 million

Q4 gross production of 883,000 barrels with 649,000 million net to BW Energy

Completed one lifting of 680,000 barrels (net BWE) at a price of USD ~73 per barrel

Maintained a strong balance sheet with cash position of USD 210.8 million

Hibiscus / Ruche development on track for first oil in late Q1 2023 following start of drilling operations and completion of subsea activities in early January

Planned first oil from Maromba revised to H2 2026

Full-year EBITDA of USD 154.2 million and net profit of USD 45 million

EBITDA for the fourth quarter of 2022 was USD 21.8 million, down from USD 61.5 million in the third quarter of 2022, mainly due to a decrease in the realised oil price. One lifting to BW Energy is scheduled in the first quarter of 2023. The drilling campaign at the Hibiscus field commenced at the start of 2023 and is progressing in line with the schedule for first oil from the Hibiscus / Ruche development towards the end of the first quarter of 2023.

“We continue to progress multiple strategic initiatives for long-term value creation through phased development of proven resources and repurposing of existing energy infrastructure. This is reflected in the fast-track Hibiscus / Ruche development which is set to yield a material increase in oil production and a step change in our cash generation as we successively start to add new producing wells. We are also moving towards completion of the acquisitions of the Golfinho and Camarupim Clusters in Brazil, which will add further production and access to low-risk development opportunities,” said Carl K. Arnet, the CEO of BW Energy.

BW Energy completed one lifting in the fourth quarter and realised a price of USD 73 per barrel. BW Energy’s share of gross production was approximately 649,000 barrels of oil. The net sold volume, which is the basis for revenue recognition in the financial statement, was 745,000 barrels including 65,000 barrels of quarterly Domestic Market Obligation (DMO) deliveries with an under-lift position of 76,000 barrels at the end of the period. Read More

Dana Incorporated announced today that it has been honored with Heavy Duty Trucking (HDT) magazine’s 2023 Top 20 Products Award for its Spicer Electrified Zero-8™ e-Axles. The family of single and tandem e-Axles are designed for a wide variety of Class 7 and 8 applications.

The Zero-8 e-Axles easily integrate into most existing chassis and leverage Dana’s vertically integrated and reliable technologies, including Dana TM4™ motors and inverters, Spicer® high-efficiency axle gearing, high-performance Dana Graziano® synchronizers, transmission controllers, system software, and shift system and controls. The e-Axle portfolio meets the diverse requirements of Class 7 and 8 EV architectures with 4×2, 6×2, and 6×4 multi-speed e-Axle systems for the most significant global electric-vehicle applications.

“Dana is honored to receive this award and pleased to offer the industry our Zero-8 e-Axles for full-scale adoption on both battery-electric and hydrogen fuel-cell applications,” said Ryan Laskey, senior vice president of Commercial Vehicle Drive and Motion Systems for Dana. “This distinction highlights our commitment to providing our customers with the best purpose-built, zero-emission solutions as the commercial-vehicle segment continues to progress to fully electrified platforms.”

The annual Top 20 products are selected by HDT’s experienced editorial staff, with the help of a panel of fleet executives designated from its Editorial Advisory Board and Truck Fleet Innovators group. Awarded products are those deemed the most significant for innovation, ability to address an industry issue, and the potential to affect a fleet’s bottom line. HDT announced the 2023 Top 20 Products at this year’s Technology and Maintenance Council’s Annual Meeting & Transportation Technology Exhibition. Read More

THE EU parliament has this month voted on the end of privately-owned internal combustion engine vehicles, etching 2035 in stone, as the year the petrol ban will come in.

The ban will now come into effect, making the sale of new petrol and diesel cars basically impossible. The official standing is that carmakers must hit a 100 percent reduction in the output of CO2 from new vehicles, driving the final nail in the coffin of petrol power. The ruling though doesn’t yet affect motorcycle production, and lobby groups like the BMF, MCIA and NMC are all working hard to drive home the importance of the powered two-wheeler in the modern world.

The petrol ban will not completely arrive in 2035, and instead, the amount of petrol-powered cars are being reduced in stages. By 2030, car makers must have reduced CO2 emissions from new cars by 55 percent compared to 2021 levels. The speed of reduction was increased recently (with the previous number being 35 percent by 2030) as EU lawmakers look to speed up the uptake of EVs across the continent. In total 340 MEPs voted in favour of the petrol ban, against 279 MEPs who were against it. In total 21 MEPs abstained from taking part in the vote. The new law does include a loophole, for smaller niche manufacturers. It states that brands that make fewer vehicles, less than 10,000 units a year, can ask for weaker targets for up to a year after the ban comes in. Read More

Texas-based law firm Vinson and Elkins has received more than $2.6 million for its role as legal advisor to Iraq’s Ministry of Oil in the United States.

According to documents filed under the US’s Foreign Agents Registration Act (FARA), the sum relates to the six-month period to the end of January.

The Ministry of Oil engaged the firm in July 2022 to advise it regarding an arbitration proceeding between Iraq and the Republic of Turkey.

Partner James Lloyd Loftis was to receive a fee of $900 per hour for his advice in this matter. Read More

A Russian ship has been detected at an offshore wind farm in the North Sea as it tried to map out energy infrastructure, MIVD head General Jan Swillens said at a news conference. The vessel was escorted out of the North Sea by Dutch marine and coast guard ships before any sabotage effort could become successful, he added.

“We saw in recent months Russian actors tried to uncover how the energy system works in the North Sea. It is the first time we have seen this,” Swillens said.

“Russia is mapping how our wind parks in the North Sea function. They are very interested in how they could sabotage the energy infrastructure.” Read More

Sakuu has invented a fully industrialized process for printing batteries using a proprietary multi-material, multi-layer approach in a parallel and dry process, instead of slow layer-on-layer printing or screen-printing—inherently wet processes that require significant energy to remove unwanted solvents and are susceptible to poor printing quality and unreliable production. The Sakuu invention can deliver low-cost high-speed manufacturing capability coupled with flexibility in shape and form, while also delivering batteries in core categories that matter most to clients and customers alike. For example, Sakuu’s first printed batteries have demonstrated successful cycling performance at C/5, IC current rates, and expectations are to achieve high energy density at 800–1000 Wh/l.

Utilizing proprietary lithium metal battery chemistry, Sakuu’s printing process starts with raw material and ends with a ready-to-use patterned battery, creating a new paradigm in manufacturing and energy storage. The achievement of patterned battery printing enables a more effective use of battery cell volume with new pathways in thermal dynamic regulation. This allows integration of fixturing, sensors, and thermal transport pathways, as well as regulation through the patterned design—especially when thin sub-cell battery structures are stacked with identical patterned openings for thermal management in alignment. Read More

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: @OilAndGasPress on Twitter |

Oil and gas press covers, Energy Monitor, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas, energy monitors,TotalEnergies, Shell, BP, Chevron