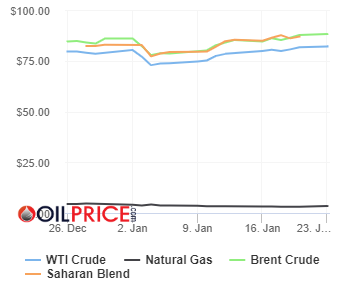

Energy News | January 23th, WTI Crude stood at $82.17/bl

China has set another record for solar power capacity last year as the country sped up renewable installations to reach its ambitious climate targets, according to a Bloomberg report. It said that the nation installed 87.4 GW of solar last year, beating 2021’s record of 54.9 GW.

Eni S.p.A. announces that the gross annual nominal interest rate of its first sustainability-linked bond dedicated to public in Italy (the “Bond”) has been set at 4.30%.

The offer of the Bond, which was initially expected to end on 3 February, was closed in advance on 20 January thanks to the high demand received from Italian investors.

The overall demand was over Euro 10 billion with requests received from over 300,000 investors. This has been the Italian record for a single tranche corporate bond issue aimed at retail. The extraordinary success of the offer demonstrates the strong appreciation among Italian investors for the soundness of Eni and its commitment to the energy transition. Read More

DNO ASA, the Norwegian oil and gas operator, today reported the below transactions made under the Company’s share buyback program, which commenced 9 December 2022 and will end no later than 30 April 2023. For further information regarding the program, please see the Company’s stock exchange notification from 8 December 2022. Read More

Global oil demand is set to rise by 1.9 mb/d in 2023, to a record 101.7 mb/d, with nearly half the gain from China following the lifting of its Covid restrictions. Jet fuel remains the largest source of growth, up 840 kb/d. OECD oil demand slumped by 900 kb/d in 4Q22 as weak industrial activity and weather effects lowered use, while non-OECD demand was 500 kb/d higher. World oil supply growth in 2023 is set to slow to 1 mb/d following last year’s OPEC+ led growth of 4.7 mb/d. An overall non-OPEC+ rise of 1.9 mb/d will be tempered by an OPEC+ drop of 870 kb/d due to expected declines in Russia. The US ranks as the world’s leading source of supply growth and, along with Canada, Brazil and Guyana, hits an annual production record for a second straight year. Global refinery activity was steady in December as US runs plunged 910 kb/d due to weather-related outages, but higher runs in Europe and Asia offset the fall. After an increase of 2.1 mb/d in 2022, refinery throughputs are set to grow by 1.5 mb/d in 2023, helped by 2.2 mb/d of capacity additions between 4Q22 and end-2023. Read More

| Oil and Gas Blends | Units | Oil Price $ | change |

| Crude Oil (WTI) | USD/bbl | $82.17 | Up |

| Crude Oil (Brent) | USD/bbl | $88.24 | Up |

| Bonny Light | USD/bbl | $87.40 | — |

| Saharan Blend | USD/bbl | $86.91 | — |

| Natural Gas | USD/MMBtu | $3.47 | Up |

| OPEC basket 20/01/23 | USD/bbl | $84.90 | Up |

The energy world is at the dawn of a new industrial age – the age of clean energy technology manufacturing – that is creating major new markets and millions of jobs but also raising new risks, prompting countries across the globe to devise industrial strategies to secure their place in the new global energy economy, according to a major new IEA report. Energy Technology Perspectives 2023, the latest instalment in one of the IEA’s flagship series, serves as the world’s first global guidebook for the clean technology industries of the future. It provides a comprehensive analysis of global manufacturing of clean energy technologies today – such as solar panels, wind turbines, EV batteries, electrolysers for hydrogen and heat pumps – and their supply chains around the world, as well as mapping out how they are likely to evolve as the clean energy transition advances in the years ahead.

The analysis shows the global market for key mass-manufactured clean energy technologies will be worth around USD 650 billion a year by 2030 – more than three times today’s level – if countries worldwide fully implement their announced energy and climate pledges. The related clean energy manufacturing jobs would more than double from 6 million today to nearly 14 million by 2030 – and further rapid industrial and employment growth is expected in the following decades as transitions progress. Read More

Petronet LNG Ltd recorded highest ever Turnover, PBT and PAT of Rs 46,025 Cr, Rs 3,517 Cr and Rs 2,626 respectively in the current nine months ended on 31st December, 2022. Highest ever PBT and PAT of Rs 1,586 Cr and Rs 1,181 Cr respectively in the current quarter Q3, FY 2022-23.

Growth in PBT and PAT in the current quarter Q3, FY 2022-23, over the PBT and PAT in the previous quarter Q2, FY 2022-23 by 60% and 59% respectively.

During the current quarter ended 31st December, 2022, Dahej terminal processed 154 TBTU of LNG as against 182 TBTU during the previous quarter ended 30th September, 2022 and 196 TBTU during the corresponding quarter ended 31st December, 2021. The overall LNG volume processed by the Company in the current quarter was 167 TBTU, as against the LNG volume processed in the previous and corresponding quarters, which stood at 192 TBTU and 208 TBTU respectively.

During the current nine months ended 31st December, 2022, Dahej terminal processed 532 TBTU of LNG as against 615 TBTU processed during the corresponding nine months ended 31st December, 2021. The overall LNG volume processed by the Company in the current nine months was 567 TBTU, as against the LNG volume processed in the corresponding nine months, which stood at 657 TBTU. The Company has reported highest ever PBT of Rs 1,586 Cr in the current quarter, as against Rs 994 Crore in the previous quarter and Rs 1,533 Cr in the corresponding quarter. The PAT of the current quarter is reported at Rs 1,181 Cr as against the PAT of the previous and corresponding quarters of Rs 744 Cr and Rs 1,144 Cr respectively. The Company has reported highest ever turnover of Rs 46,025 Cr in the current nine months as against Rs 32,008 Cr in the corresponding nine months, registering a growth of 44%. The Company has reported highest ever PBT and PAT of Rs 3,517 Cr and 2,626 Cr in the current nine months as against Rs 3,489 Cr and Rs 2,602 Cr respectively in the corresponding nine months. Due to foreign exchange volatility, the lease liability has an accounting impact of foreign exchange loss amounting to Rs 60 Cr in the current quarter, as per the provisions of the relevant Indian Accounting Standards (Ind AS). The Company was able to achieve robust financial results despite high LNG prices, owing to optimization in its operation. Read More

Africa Oil Corp. announced that the Company repurchased a total of 930,000 Africa Oil common shares during the period of January 16, 2023 to January 20, 2023 under the previously announced share buyback program. View PDF version.

The launch of Africa Oil’s normal course issuer bid (share buyback) program, announced by the Company on September 22, 2022, is being implemented in accordance with the Market Abuse Regulation (EU) No 596/2014 (MAR) and Commission Delegated Regulation (EU) No 2016/1052 (Safe Harbour Regulation) and the applicable rules and policies of the Toronto Stock Exchange (“TSX”), Nasdaq Stockholm, and applicable Canadian and Swedish securities laws.

During the period dated January 16, 2023 to January 20, 2023, the Company repurchased 470,000 Africa Oil common shares on the TSX and/or alternative Canadian trading systems. The repurchases were carried out by Scotia Capital Inc. on behalf of the Company. During the same period, the Company repurchased 460,000 Africa Oil common shares on Nasdaq Stockholm, and these repurchases were carried out by Pareto Securities on behalf of the Company.

All common shares repurchased by Africa Oil under the share buyback program will be cancelled. During the period dated January 16, 2023 to January 20, 2023, the Company cancelled 200,000 common shares repurchased under the share buyback program. Read More

Baker Hughes Rig Count

U.S. Rig Count 771 with oil rigs down 10 to 613, gas rigs up 6 to 156 and miscellaneous rigs unchanged at 2.

Canada Rig Count 241, with oil rigs up 12 to 153, gas rigs up 2 to 88.

| Region | Period | Rig Count | Change from Prior |

| U.S.A | 20 January 2023 | 771 | -4 |

| Canada | 20 January 2023 | 241 | +14 |

| International | December 2022 | 900 | -10 |

Maersk (Maersk) and DP World Jebel Ali Port have entered a long-term partnership through which both parties will collaborate on various aspects of service delivery and work towards a common goal of decarbonising logistics and serve their customers better. The long-term strategic partnership will give priority berthing for Maersk vessels, support for Maersk’s customers and implement new processes to improve quayside productivity, all leading to faster gate turnaround times at Jebel Ali Port and reduced bunker fuel consumption. Read More

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: @OilAndGasPress on Twitter |

Oil and gas press covers, Energy Monitor, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas, energy monitors,TotalEnergies, Shell, BP, Chevron