Energy News Releases to 03/12/22 . OPEC daily basket price at $84.39/bl, 01 Dec. 2022

Organisation of Petroleum Exporting Countries (OPEC) announced that it will cut its oil production by two million barrels a day. OPEC and non-OPEC producers, a group of 23 oil-producing nations known as OPEC+, decided to stick to its existing policy of reducing oil production by 2 million barrels per day, or about 2% of world demand, from November until the end of 2023.

TC Energy Corporation (TSX, NYSE: TRP) (TC Energy or the Company) will host its annual Investor Day today. During the event we will provide an overview of our corporate strategy and highlight our continued approach to delivering long-term shareholder value as we prudently manage our extensive opportunity set ahead. We are reaffirming our long-term comparable EBITDA growth outlook of six per cent by 2026 and three to five per cent annual dividend growth rate.

“We have an industry-leading $34 billion of fully sanctioned, secured capital projects and an unparalleled opportunity-set that will continue to differentiate TC Energy as a leader in the energy infrastructure space,” said François Poirier, TC Energy’s President and Chief Executive Officer. “We are leveraging our extensive North American footprint to expand and extend the reach of our services that will also align with the evolving energy mix and needs of our customers.” TC Energy’s secured capital program is expected to be primarily funded through a combination of increasing cash flows, incremental long-term debt and hybrid capacity, and other sources of capital. We expect that any funding requirements exceeding our targeted annual capital expenditure range of $5 to $7 billion will be funded through our flexible $5+ billion divestiture program that is expected to be executed during 2023. Any potential impact on our growth trajectory out to 2026 will be determined by the timing and proceeds of assets monetized, along with the contribution from projects yet to be sanctioned. However, the additional financial flexibility created through this process will enhance our strategic positioning to deliver shareholder value over the medium to long term. We remain committed to concluding our discounted Dividend Reinvestment Program with the dividend declarations for the quarter-ending June 30, 2023. Read More

Saudi Arabia’s Energy Minister Prince Abdulaziz bin Salman has announced the discovery of two new natural gas fields in the Kingdom.

The “Awtad” unconventional natural gas field was discovered southwest of the Ghawar field, 142 kilometers southwest of the city of Hofuf, according to the Saudi Press Agency.

The “Al-Dahna” unconventional natural gas field is located 230 kilometers southwest of the city of Dhahran.

Both fields were discovered by Saudi Aramco. Read More

Switzerland will ban the use of electric cars for ‘non-essential’ journeys if the country runs out of energy this winter, the government has announced.

Emergency plans drawn up in the event the Swiss are hit by blackouts also call for shop opening hours to be reduced by up to two hours per day, heating systems in nightclubs to be turned off, and other buildings to be heated to no more than 20C. The country gets around 60 per cent of its energy from hydroelectric power stations, such as dams across rivers or generators placed between lakes.

Around a third of its power comes from nuclear, which the government has committed to phasing out, and the remaining comes from a mixture of traditional fossil fuel plants and solar or wind generation.

Overall, Switzerland produces enough electricity each year to keep the lights on – but that statistic masks huge discrepancies month-to-month. Read More

Plenitude has signed an agreement to acquire 100% of PLT (PLT Energia S.r.l and SEF S.r.l. and their respective subsidiaries and affiliates), an integrated Italian group producing electricity from renewables and supplying energy to retail customers.

Through this synergistic operation with its portfolio of renewable assets and retail customers, Plenitude is strengthening its presence in Italy and Spain consolidating a vertically integrated platform which includes:

over 400 MW (>80% wind power) of assets in Italy, 80% already operational and 20% under construction with start-up expected by 2024;

1.2 GW of projects under development (>80% wind power) in Italy and Spain, 60% of which in advanced maturity stage. Thanks to them, Plenitude’s pipeline of renewable energy projects will expand reaching a total of about 13 GW;

90,000 retail customers in Italy;

a team of 150 people with many years of experience in wind and photovoltaic technologies, with skills ranging from development, construction and maintenance of renewable energy plants to sales to retail customers. Read More

Hess Corporation (NYSE: HES) and the Government of Guyana today announced an agreement for Hess to purchase high quality carbon credits for a minimum of $750 million between 2022 and 2032 directly from the Government of Guyana. This agreement will serve to support Guyana’s efforts to protect the country’s vast forests and provide capital to improve the lives of Guyana’s citizens through investments made by the Government as part of Guyana’s Low Carbon Development Strategy (LCDS) 2030. Guyana’s President, Dr. Irfaan Ali was joined today by Vice President, Dr. Bharrat Jagdeo and John Hess, CEO of Hess Corporation for a signing ceremony to commemorate this historic agreement. The multi-year agreement is for 37.5 million REDD+ jurisdictional carbon credits (current and future issuances). These credits will be on the ART (Architecture for REDD+ Transactions) registry and will be independently verified to represent permanent and additional emissions reductions under ART’s REDD+ Environmental Excellence Standard 2.0 (TREES). Avoiding global deforestation is foundational to the Paris Agreement’s aim of limiting the global average temperature rise to well below 2°C and was one of the major commitments made at the COP26 climate summit, where more than 130 countries, including Guyana, pledged to end deforestation by 2030. Guyana’s more than 18 million hectares of forests are estimated to store approximately 20 billion tonnes of carbon dioxide equivalent1. Through Guyana’s Low Carbon Development Strategy 2030, the country has a roadmap for preserving its forests, while growing its economy and creating a development pathway that is diverse and includes opportunities for all Guyanese citizens. The purchase of these carbon credits is an important part of Hess’ commitment to support global efforts to address climate change and for the company to achieve net zero greenhouse gas emissions by 2050. The agreement adds to the company’s ongoing and successful emissions reduction efforts, which are described in Hess’ annual Sustainability Reports. Read More

Exxon Mobil Corporation said that Lawrence “Larry” W. Kellner and John D. Harris II have joined its board of directors. Kellner is the former chairman and chief executive officer of Continental Airlines and current chairman of the board for the Boeing Company. Harris is the former chief executive officer of Raytheon International Inc., a wholly owned subsidiary of Raytheon Company, a global engineering and technology company focused on aviation, space and defense. Read More

BP faced a renewed backlash over its involvement in Russia after it was accused of earning ‘blood money’ by a top aide to Ukraine president Volodymyr Zelensky.

BP pledged after Vladimir Putin’s invasion of Ukraine in February that it would sell its 19.75 per cent stake in Russian oil firm Rosneft – but nine months later still holds the stock.

Oleg Ustenko, Zelensky’s chief economic adviser, said in a letter to BP boss Bernard Looney that there was ‘no evidence on which to judge BP’s claim’ that it was trying to pull out. BP has not received any dividends from Rosneft since it announced that it planned to divest its stake, and took a one off £18.7billion hit as it wrote off the value of the shareholding.

Its dividend from Rosneft is supposed to be paid into a restricted Russian account which it can only access by permission of the Kremlin. In theory, the account should have received a payout of more than £600million though BP said it had not been notified of any such transfer. Read More

BP p.l.c. (“bp”) today announced the appointment to its board of Hina Nagarajan as a non-executive director. Her appointment will take effect from 1 March 2023.

Ms Nagarajan has been the Managing Director and Chief Executive Officer of United Spirits Limited (Diageo plc’s listed Indian subsidiary) since July 2021. Ms Nagarajan is also a member of the Board of The Advertising Standards Council of India and is a Director and Co-chairperson of International Spirits and Wines Association of India. Prior to joining Diageo, Ms Nagarajan spent over 30 years in the FMCG industry and held several leadership positions at Reckitt, Mary Kay India and Nestle India.

Helge Lund, chair of bp, said: “On behalf of the board, I am delighted to welcome Hina to bp. Hina has a proven track record in business transformation and development in complex emerging markets. In particular, she brings deep and wide-ranging experience in customer-focused FMCG businesses, an area of increasing strategic importance for bp. The board will benefit greatly from her insights and experience and we look forward to working with her.”

At the date of this announcement Ms Nagarajan is currently the Managing Director & Chief Executive Officer at United Spirits Limited (Diageo plc’s listed Indian subsidiary). Within the last five years, Ms Nagarajan has been a Non-Executive Director at two other companies which were publicly quoted during such time: Guinness Ghana Breweries Plc and Seychelles Breweries Limited. There are no additional matters that require disclosure under 9.6.13R of the UK Listing Rules. Read More

Neptune Energy and its licence partners today announced a new discovery at the Calypso exploration well (PL938) in the Norwegian Sea.

Preliminary estimates are between 1 – 3.5 million standard cubic meters (MSm3) of recoverable oil equivalents, corresponding to 6-22 million barrels of oil equivalent (boe).

Calypso is Neptune Energy’s third discovery in six months on the Norwegian Continental Shelf.

Managing Director for Neptune Energy in Norway and the UK, Odin Estensen, said: “We actively explore in areas close to existing infrastructure. These near-field discoveries allow for low cost and low carbon developments.

“Initial analysis of Calypso indicates commercial potential. Together with our partners in the Calypso licence we will now study options to effectively develop the discovery using nearby infrastructure.”

The Calypso discovery is located within one of Neptune’s core areas, 14 kilometres north-west of the Draugen field and 22 kilometres north-east of the Njord A platform.

Well 6407/8-8S was drilled to a vertical depth of 3,496 metres and encountered an estimated 8 metre thick gas column and 30-metre thick oil column in a 131 metre thick Garn Formation sandstone reservoir, of good to very good quality.

Calypso was drilled by the Deepsea Yantai, a semi-submersible rig owned by CIMC and operated by Odfjell Drilling.

Partners: Neptune Energy (operator, 30%), OKEA ASA (30%), Pandion Energy AS (20%) and Vår Energi ASA (20%) Read More

Just Stop Oil supporters have briefly occupied beds and sofas in Harrods to demand that the government Just Stop Fuel Poverty by insulating homes and ending our reliance on expensive, dangerous and dirty fossil fuels. At around 1pm, 4 Just Stop Oil supporters occupied beds and sofas in Harrods department store on Brompton Road in central London and displayed signs reading “Just Stop Oil, Just Start Insulation”, “Just Stop Fuel Poverty” and “Oil Equals Death”. They were rapidly escorted out of the store by around 20 security guards. Just Stop Oil supporters are acting in solidarity with Fuel Poverty Action’s Energy For All campaign and the Don’t Pay UK campaign. The action is one of several Warm-Ups taking place across the UK in towns and cities including Glasgow, Liverpool, Bristol and London in support of the Warm This Winter coalition’s Day of Action on fuel poverty Read More

RMI, founded as Rocky Mountain Institute, has released a detailed analysis to show that swift action in the oil refinery industry could significantly accelerate progress toward the 50 percent cut in global greenhouse gas (GHG) emissions required in this decade to avoid a climate disaster.

Oil refineries are one of the largest direct consumers of oil and gas products. Cutting even 1 percent of the direct emissions from the sector would equal to taking 3 million gasoline-powered cars off the road. The greatest opportunity for climate action wins lies within the industry’s concentration: less than 900 global refineries are the sole transformers of combusted oil compared with the millions of wells filling thousands of oil tanks for billions of consumers. Although fossil fuel end use for transportation and power has traditionally dominated climate action conversations, remaining oil sourcing and products must rapidly reduce emissions to meet 2030 goals. Refineries influence the entire oil supply chain as the essential and transformative step between crude oil production and petroleum product end use. Focusing on the refining segment when analyzing lifecycle emissions, the oil sector can provide a significant down payment toward a safe climate future. RMI’s Climate Intelligence Program targets decarbonization opportunities for this sector, given the significant role petrochemical products such as plastics and fiber composites will play in clean energy infrastructure like solar panels and wind turbines. Read More

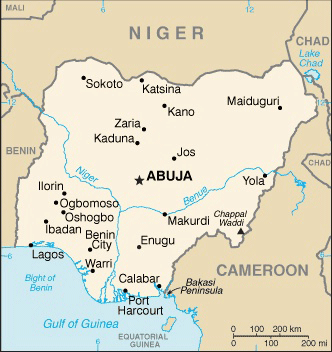

RMI launched the Energy Transition Academy (ETA) Global Fellowship Program in Nigeria, with funding support from Shell.

The Nigeria fellowship program offering is the first ETA Global Fellowship Program for West Africa and the third cohort of the global program. With this expansion, the ETA Global Fellowship Program now includes 48 energy professionals from 16 countries spanning the Caribbean and sub-Saharan Africa.

The fellowship program is designed to support utilities in advancing renewable energy projects, promoting reliable and resilient energy access, and acting on climate change.

This cohort includes 20 participants representing four Nigerian distribution network companies (DisCos), including Abuja Electricity Distribution Co., Ikeja Electric, Eko Electricity Distribution Co., and Ibadan Electricity Distribution Co.

Fellows have backgrounds in a range of disciplines such as engineering, project management, finance, and law. In the new group, 35 percent are women, representing a concerted effort by RMI and participating DisCos to diversify participants.

“The ETA Global Fellowship Program is designed to build the capacity of local distribution companies by upskilling well-positioned professionals who can serve as clean energy champions to advance the development and scaling of utility-enabled renewable energy projects in Nigeria,” says Raul Alfaro-Pelico, Senior Director, Energy Transition Academy, RMI.

“This capacity growth is critical to meet the goals of Nigeria’s Energy Transition Plan. Inclusion of a balance of young professionals, seasoned energy practitioners, and women representing the sector is critical to advancing the energy transition in Nigeria.”

Universal access to electricity in Nigeria is a national development priority. Today, more than 90 million Nigerians lack access to electricity and millions of those connected to the grid have less than 12 hours of electricity per day.

“The Nigeria Energy Transition Plan seeks to add 30 GW of new installed capacity by 2030, with at least 30 percent sourced from renewable energy. As noted in the national plan, Nigeria’s net-zero pathway will result in significant net job creation with up to 340,000 jobs added by 2030 and 840,000 by 2060,” says Suleiman Babamanu, Nigeria Program Director, RMI. Read More

| Oil and Gas Blends | Units | Oil Price $ | change |

| Crude Oil (WTI) | USD/bbl | $79.98 | Down |

| Crude Oil (Brent) | USD/bbl | $85.57 | Down |

| Bonny Light | USD/bbl | $85.49 | Down |

| Saharan Blend | USD/bbl | $85.38 | Up |

| Natural Gas | USD/MMBtu | $6.28 | Down |

| OPEC basket 01/12/22 | USD/bbl | $84.39 | Up |

RMI forecasts the US transportation sector must reduce greenhouse gas (GHG) emissions by at least 45% by 2030 to achieve a 1.5°C climate-aligned future. Emissions reduction at this scale requires 70 million electric vehicles (EVs) on the road in the United States and a 20% reduction in vehicle miles traveled. Currently, most EV charging in the United States is level two (L2), typically between 7 kW and 19 kW, with charging units often installed in a private garage or at the workplace. Other charging levels available include slower level one (L1) chargers — a standard US wall outlet — and much faster level three (L3) chargers, also known as direct current fast-chargers (DCFC), which can deliver anywhere from 50 kW to 350 kW of power.[1] Although L2 charging is ideal for drivers who have private parking, it is not sufficient to support a full transition to EVs.

That transition will require a much stronger fast-charging infrastructure available to the public, especially for commercial drivers, who drive much more than the average driver. Locations with continuous turnover of arriving and departing vehicles with short dwell times such as airports will also need to provide fast chargers. In fact, to power tens of millions of EVs, the United States will require 15 times the number of current chargers[2] The more than 20,000 airports across the country can provide additional transportation services and support clean transportation by offering EV charging infrastructure for a broad range of drivers.[3] To strengthen charging infrastructure effectively and in a timely manner, airports should work closely with their utilities to identify the range of possible infrastructure costs associated with an electrified future. Next, airports must follow the planning and permitting timing constraints of their utility to optimize the technical and business approach to meet demand while maintaining affordable charging prices. Considering that within one decade EVs will have 50% or more market share, what may seem to airports as a risky gamble today may well prove to be the bare minimum. Read More

The 34th OPEC and non-OPEC Ministerial Meeting took place by videoconference on Sunday, 4 December 2022.

In line with the decision of the OPEC and non-OPEC Participating Countries in the Declaration of Cooperation at the 33rd OPEC and non-OPEC Ministerial Meeting on 5 October 2022, which was purely driven by market considerations and recognized in retrospect by the market participants to have been the necessary and the right course of action towards stabilizing global oil markets; and adhering to the approach of being proactive and pre-emptive, the Participating Countries reiterated their readiness to meet at any time and take immediate additional measures to address market developments and support the balance of the oil market and its stability if necessary.

The Participating Countries decided to:

Reaffirm the decision of the 10th OPEC and non-OPEC Ministerial Meeting on 12 April 2020 and further endorsed in subsequent meetings, including the 19th OPEC and non-OPEC Ministerial Meeting on 18 July 2021 and the 33rd OPEC and non-OPEC Ministerial Meeting on 5 October 2022, including the adjustment of the frequency of the monthly meetings to become every two months for the Joint Ministerial Monitoring Committee (JMMC) and the authority of the JMMC to hold additional meetings, or to request an OPEC and non-OPEC Ministerial Meeting at any time to address market developments if necessary.

Reiterate the critical importance of adhering to full conformity and compensation mechanism taking advantage of the extension approved on the 33rd OPEC and non-OPEC Ministerial Meeting. Hold the 35th OPEC and non-OPEC Ministerial Meeting on 4 June 2023. Read More

Poland has agreed to a $60 price cap on Russian crude oil, Poland’s Ambassador to the EU, Andrzej Sados, said on Friday.

The EU tentatively agreed on a $60 oil cap yesterday, but analysts feared that Poland—originally holding out for a much lower price cap—would refuse to sign off on a $60 cap.

The G7 proposal to cap the price of Russian seaborne crude oil initially met resistance from Poland, Estonia, and Lithuania as those countries were hoping for a much lower cap—even a $20 or $30 cap. Because Poland’s ask was so much lower than what the EU had proposed, it was doubtful whether Poland would go along.

The window of opportunity for getting the G7 price cap fixed at a specific level was quickly coming to a close, with the price cap set to go into effect on Monday, December 5. Market uncertainty about the price cap, as

The U.S. has pushed hard for an acceptable price cap—one much higher than Poland wanted–to keep oil prices in check.

Poland agreed to the $60 cap with a caveat—the price cap also includes a mechanism for keeping the price capped at a level that is at least 5% below the market rate. The full details of the price cap plan will be published in the EU legal journal on Sunday, with all 27 EU countries now in line to officially sign onto the deal.

The price cap allows non-EU countries to continue to trade in seaborne Russian crude oil. It will however, prevent shipping and insuring—done mostly by G7 countries—unless the price at which it was purchased falls under the price cap. Read More

Aker BP won in the two categories best “Mid Cap” and “Deal of the Year”.

It is the acquisition and integration of Lundin Energy Norway that is awarded “Deal of the Year”.

The jury states; “With the integration of Lundin, Aker BP is the largest listed E&P company focused exclusively on the Norwegian Continental Shelf and has been lauded across the sector. Lundin held a portfolio of high-quality, low-emissions assets and synergies, that came at a premium but were worth every penny. Any deal of such size and stature will be challenging to get over the line, however in this instance, it was done so with superb and ultimately, successful execution.” The jury also mentions the acquisition of Lundin in the “Mid Cap” category as well; “Having previously struggled to compete for capital within the BP business, under the new structure Aker BP has seen successful expansion. Most notably, the 2022 acquisition of Lundin provided more scale and enhanced greening credentials. Following the merger Aker BP is working on a total of 15 development projects on the Norwegian Continental Shelf and is set to invest over $15billion in the area over the next 5-6 years. This investment is expected to increase production by 125 000bpd by 2028, a significant addition to the company’s current 400 000bpd.”

Aker BP’s CEO, Karl Johnny Hersvik was proud to accept the awards. Read More

Aker BP’s board has approved that the operator Aker BP will vote in favour of submitting Plans for Development and Operation (PDO) for the NOAKA field development project, the Valhall PWP-Fenris project, the Skarv Satellite Project and the Utsira High projects.

The final approvals to submit the PDOs are expected to take place in the respective licences during the first half of December, after which the PDOs will be submitted to Norwegian authorities.

Net to Aker BP, the oil and gas resources in the projects are estimated to approximately 730 million barrels of oil equivalent, in line with the company’s July strategy update when adjusting for the previously announced postponement of the Wisting project.

Aker BP’s share of the investments in the projects are estimated to approximately USD 19 billion (nominal) in the period 2023-2028, and the corresponding average break-even oil price is estimated to USD 35-40 per barrel (calculated with 10 percent discount rate and accounting for the announced changes to the Norwegian Petroleum Tax adding on average USD 5-6/bbl to the break-even of the projects). Read More

Baker Hughes Rig Count

| Region | Period | Rig Count | Change from Prior |

| U.S.A | 30 November 2022 | 784 | — |

| Canada | 30 November 2022 | 195 | +1 |

| International | November 2022 | 910 | -1 |

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: @OilAndGasPress on Twitter |

Oil and gas press covers, Energy Monitor, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas, energy monitors,TotalEnergies, Shell, BP, Chevron