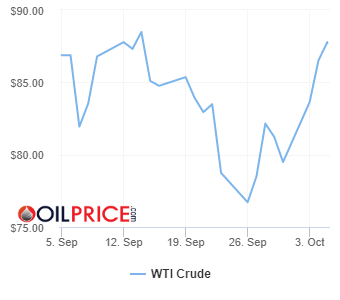

Energy News to 05/10/22. OPEC daily basket price stood at $92.13/bl, 04 Oct. 2022

Britain sends warships to the North Sea to protect underwater gas and oil pipelines and internet cables from Russian sabotage after Nordstream was blown up in suspected Kremlin attackType 23 frigate HMS Somerset and survey ship HMS Enterprise have been deployed amid fears that pipelines, rigs and undersea cables that countries including Britain rely upon for energy are at risk of further attacks. Defence Secretary Ben Wallace has acted to ‘reassure’ those working near the pipelines after Western intelligence agencies were blindsided by the pipeline blasts. Read More

Orrön Energy AB announced the composition of the Nomination Committee for the 2023 Annual General Meeting (“AGM”) to be held on 4 May 2023 in Stockholm.

The Nomination Committee has been formed with the following members:

Ian H. Lundin (Nemesia S.à.r.l.)

Oskar Börjesson (Livförsäkringsbolaget Skandia, ömsesidigt)

Mikael A. Pettersson (Dita Invest Holding AB)

Grace Reksten Skaugen, Chair of the Board of Directors of Orrön Energy

At the Nomination Committee’s first meeting, Ian H. Lundin was elected as Chair of the Nomination Committee.

The Nomination Committee shall make recommendations to the 2023 AGM regarding:

Election of the Chair of the 2023 AGM

Remuneration of the members of the Board of Directors, distinguishing between the Chair and other members, and remuneration for Board Committee work

Election of members of the Board of Directors, including number of members

Election of the Chair of the Board of Directors

Remuneration of the auditor

Election of the auditor

Nomination Committee Process for the 2024 AGM, if any amendments are proposed to the Process for the 2023 AGM

Shareholders who wish to present a motion to the Nomination Committee regarding the above-mentioned issues should contact the Chair of the Nomination Committee, Ian H. Lundin, at nomcom@orron.com not later than 30 January 2023. Read More

Kent, a leading engineering company in oil and gas and Hydrogen (H2) technologies, has been appointed as the FEED Contractor for aspects of Hydrogen Supply and Resilience for Cadent’s UK Hydrogen Village project. Kent has been involved in over fifty hydrogen projects worldwide and is an engineering partner at HyNet (NW England).

Progressive Energy Limited (PEL) has appointed Kent to develop a Front-End Engineering Design (FEED) to deliver hydrogen at the correct specification and availability for Cadent’s proposed Hydrogen Village project.

The primary purpose of the Hydrogen Village project is to demonstrate how to facilitate the decarbonisation of home and commercial heating by replacing domestic natural gas supply with hydrogen using existing local gas pipes.

Hydrogen demonstration projects, such as the proposed programme in Whitby, Ellesmere Port, are part of the plan to reduce household and commercial CO₂ emissions to reach the UK’s 2050 net zero targets. Kent’s scope of work for this project will include:

Develop the FEED design for a Hydrogen Supply compound, which will handle Hydrogen before it is injected into a pipeline to supply Whitby Village in Ellesmere Port.

Provide sufficient Hydrogen buffer storage to meet intraday design peak and comply with all Safety regulations.

Develop FEED design for supporting infrastructure and utilities, ensuring the required resilience of the Hydrogen supply to Whitby.

Matt Wills, Market Director, Low Carbon, and Onshore Projects at Kent, said, “This win is a testament to the fantastic work we have been doing on Hydrogen projects in the UK. We look forward to continuing our working relationship with PEL having worked with them on HyNet for several years. It is a milestone project which, if it progresses to the next stage, will demonstrate how the rest of the UK could decarbonise heating and cooking in homes.” Read More Submitted by: Media Zoo

The Nigerian local currency, the naira, depreciated by about 6% at the Investors and Exporters foreign exchange (FX) window in September 2022 following as the market recorded higher demand for foreign currencies for imports.In a bid to push for exchange rate stability, multilateral lender, International Monetary Fund, IMF, continues to advise the apex bank on the need to converge its multi-tiered exchange rates.

The Central Bank of Nigeria still hopes to continue to support the naira across the foreign exchange market, though the nation’s external reserves remain sufficient for the currency fight. However, the external reserve has been declining over the past four weeks as global prices of oil receded. At the parallel market, rates opened at ₦703.00 and closed at ₦745.00, depreciating 1.8%. Read More

During the period from September 26 to September 30, 2022, Eni acquired n. 12,741,793 shares, at a weighted average price per share equal to 10.7868 euro, for a total consideration of 137,442,635.50 euro within the authorization to purchase treasury shares approved at Eni’s Shareholders’ Meeting on 11 May 2022, previously subject to disclosure pursuant to art. 144-bis of Consob Regulation 11971/1999.

On the basis of the information provided by the intermediary appointed to make the purchases, the following are details of transactions for the purchase of treasury shares on the Euronext Milan on a daily basis: Read More

Around 30 supporters of Just Stop Oil have disrupted traffic in Westminster today for the fifth day in a row to demand an end to new oil and gas. [1]

The group sat down on the approach roads to Lambeth Bridge at 11.30am establishing roadblocks and halting traffic on two key roads. Some have glued themselves to the road, and a number have locked on.

The actions this month are timed to coincide with the planned launch of a new round of oil and gas licensing by the North Sea Transition Authority (NSTA) in which over 100 new licences for oil and gas projects are likely to be awarded. The NSTAs chief executive said yesterday that a number of gas projects in the southern North Sea will be fast tracked although this will do nothing to reduce the UK’s dependence on imported fossil fuels.[2]

Just Stop Oil’s occupation of Westminster also comes against a background of an energy price hike on October 1st which means almost 8 million households are expected to fall into fuel poverty by April 1st 2023, while energy companies make massive profits. Our Prime Minister has made it clear that she has no plan to deal with the crisis that does not involve further suffering for the most vulnerable and tax giveaways for the rich. [3] Read More

Fitch upgrades Neptune Energy rating

Neptune Energy announced today that Fitch has upgraded Neptune Energy Group Midco Ltd corporate credit rating to BB+ from BB. The outlook is Stable

Fitch has also upgraded Neptune Energy Bondco Plc’s senior $850 million senior notes due 2025 to BB+ from BB. Read More

CME Group, today reported its September and Q3 2022 market statistics, showing average daily volume (ADV) increased 36% to 25.7 million contracts in September, representing the company’s highest September ADV on record. Q3 ADV increased 26% to 22.4 million contracts, the company’s fourth-highest quarterly volume ever.

September 2022 ADV across asset classes includes:

Interest Rate ADV of 11.3 million contracts

Record Equity Index ADV of 9.4 million contracts

Options ADV of 4.7 million contracts

Energy ADV of 1.8 million contracts

Record Foreign Exchange ADV of 1.5 million contracts

Agricultural ADV of 1.2 million contracts

Metals ADV of 525,000 contracts Read More

The 7th pan-European environmental assessment, was today presented at the 9th Environment for Europe Ministerial Conference, the United Nations’ highest body on environmental policy in the region – covering 54 countries across the European Union, European Free Trade Association members, the Balkans, the Caucasus, Eastern Europe and Central Asia.

The joint report by the United Nations Economic Commission for Europe (UNECE) and the United Nations Environment Programme (UNEP) calls for greater action to tackle the triple planetary crisis affecting climate, nature and pollution, whose effects are taking their toll more than ever on the lives and wellbeing of people in the pan-European region. Read More

The United Nations Environment Programme (UNEP) and the Green Finance Institute (GFI) are partnering to host a special podcast series to highlight the role of finance and natural climate solutions in the run up to COP27.

This five-episode series – Financing Nature: COP27 Special – will build awareness of the need for private finance in delivering the nature-positive outcomes we urgently need for climate mitigation and adaptation. The first episode will be broadcast today on Wednesday 5 October, and will feature Sagarika Chatterjee, the Glasgow Financial Alliance for Net Zero (GFANZ) Secretariat and Finance Lead, Climate Action Champions.

“UNEP has identified that if the world is to meet its climate change, biodiversity, and land degradation targets, it needs to close a $4.1 trillion financing gap in nature by 2050. The stakes are higher than ever, biodiversity and nature must be at the forefront of the COP27 climate agenda. Egypt represents a unique opportunity to accelerate the implementation of effective nature-positive solutions for people, economies, and the well-being of future generations” said Susan Gardner, Director, Ecosystems Division, UNEP.

Investments in nature restoration, protection and nature-based solutions are increasing, but not at the scale required to tackle the interdependent crises of climate change and biodiversity loss. Read More

The UN Climate Change Conference (COP 27) will be held from 6 to 18 November in Sharm El-Sheikh, Egypt. The 1st Meeting of the Intergovernmental Negotiating Committee (INC-1) on plastic pollution will take place from 28 November to 2 December in Punta del Este, Uruguay, and the UN Biological Diversity Conference (COP15) will happen in Montreal, Canada from 7 to 19 December.

In the coming months, the UN Environment Programme (UNEP) will also publish major reports, including the Emissions Gap Reportin October and the Adaptation Gap Report in November. In December, the United Nations will honour this year’s Champions of the Earth and announce the first-ever World Restoration Flagships. Read More

A consortium led by zero-emission solutions provider Unitrove, which created the world’s first liquid hydrogen bunkering facility, has won thousands of pounds of government funding to explore the development of an innovative zero-emission multi-fuel station (ZEMFS) that would power hydrogen and electric ships.

The novel design concept, which is planned to be operational by March 2025, will use liquid hydrogen as the basis for providing three fuelling options for powering small craft: liquid hydrogen, compressed gaseous hydrogen, and electric charging.

The other winning members of the consortium include ACUA Ocean, manufacturers of hydrogen-powered maritime autonomous surface ships; Zero Emissions Maritime Technology (ZEMTech), a marine-focused project management and delivery company; and the University of Strathclyde, a leading maritime research institution. The project is further supported by MJR Power & Automation, Orkney College UHI, and the Port of Tyne.

The project is part of the Clean Maritime Demonstration Competition Round 2 (CMDC2) launched in May 2022, funded by the Department for Transport (DfT), and delivered in partnership with Innovate UK. As part of the CMDC2, the Department allocated over £14 million to 31 projects supported by 121 organisations from across the UK to deliver feasibility studies and collaborative research and development projects in clean maritime solutions. Read More

Equity markets in the GCC declined in September amid concerns over the global economy, rising inflation and lower oil prices.

Markets across the region moved in tandem with global markets last month, with the S&P GCC composite index slipping by 7%, Kuwait Financial Centre (Markaz) said in its latest analysis. Kuwait, Saudi Arabia and Qatar equity indices fell the most, losing 7.8%, 7.1% and 5.4%, respectively, Markaz said in a report. Dubai equity index fell by 3% while Abu Dhabi posted a 1.3% decline over the same period. Read More–>

Qatar’s trade surplus jumped 89% year-on-year (YoY) in August 2022 on the back of higher gas exports.

The liquefied natural gas (LNG) producer has expanded exports to meet higher demand from Europe, which is looking to shift away from its traditional supplier, Russia.

Qatar’s total exports of goods amounted to around QAR46.8 billion ($13 billion), up 72% compared to August 2021, and an increase of 5.5% compared to July 2022, according to data released on Tuesday by the government’s Planning and Statistics Authority.

The increase in total exports was mainly due to higher exports of gas. Qatar’s export of petroleum gases and other gaseous hydrocarbons doubled to QAR33.5 billion YoY in August 2022. Export of crude rose nearly 30% to QAR5.2 billion, while non-crude petroleum oils rose over 15% to QAR2.9 billion. Read More

Microban International is proud to present LapisShield™, a novel, non-heavy-metal technology designed to seamlessly integrate antimicrobial functionality into any water-based coating formulation. This broad-spectrum antimicrobial technology is proven to inhibit bacterial growth by up to 99.99 %, and prevents the growth of mold and mildew, helping to protect treated surfaces from various sources of microbial degradation.

LapisShield is the newest coatings innovation from the leader in antimicrobial technologies, demonstrating the company’s continuing drive to deliver more sustainable solutions to deter microbial growth. With this state-of-the-art technology, manufacturers can enhance their coatings with the power of product protection against the detrimental effects of microbes – including stains, odors and premature degradation – extending the lifetime of coated products. LapisShield offers superior quality and stability by optimizing processing and manufacturing requirements. It also allows coating batches to be stored for future use, preventing unnecessary waste and optimizing resources for more sustainable coatings manufacturing.

LapisShield is specifically designed to meet the needs of the water-based coatings industry, a sector that is constantly striving for clearer and more environmentally friendly systems that create a seamless finish. This ground-breaking technology is compatible with thin coating systems and offers enhanced UV stability, limiting impacts on the optical properties of water-based coatings, and making them ideal for transparent glass or plastic applications. Michael Ruby, President of Microban International, commented: “We are excited to introduce LapisShield as the latest example of Microban’s commitment to developing sustainable, non-heavy-metal antimicrobial technologies for its partners worldwide. Our coatings experts have worked tirelessly to deliver a more environmentally friendly technology that offers the best quality and compatibility for water-based coating systems. The fantastic stability and clarity of LapisShield allows it to be easily integrated with a wide variety of coatings systems, including anti-fingerprint and anti-smudge formulations, and applications requiring optically clear performance.” Read More

EPA Announces Innovative Effort to Bring New Chemicals Used in Electric Vehicle, Semiconductor, Clean Energy Sectors to Market

The U.S. Environmental Protection Agency (EPA) announced a new effort under the Toxic Substances Control Act (TSCA) to implement a streamlined and efficient process under the New Chemicals Program to assess risk and apply mitigation measures, as appropriate, for new chemicals with applications in batteries, electric vehicles, semiconductors and renewable energy generation.

Under TSCA, EPA’s New Chemicals Program plays an important role by reviewing all new chemical substances before they enter the marketplace in order to bring innovative chemistries to market in a way that does not harm human health or the environment.

“From job creation to energy security – clean energy sectors will power the future of our country,” said Assistant Administrator for the Office of Chemical Safety and Pollution Prevention Michal Freedhoff. “Streamlining our review of new chemical substances that make up electric vehicle batteries and that can be used in other vital emerging markets will allow manufacturers to super-charge production, bolstering our economy and advancing the Biden-Harris Administration’s goals to protect the environment and combat the climate crisis.”

The new process is for mixed metal oxides (MMOs), including new and modified cathode active materials (CAMs). MMOs are innovative chemistries and have numerous electrical applications in batteries as well as use as catalysts, adsorbents, and in ceramics. Notably, MMOs, including CAMs, are a key component in lithium-ion batteries used in electric vehicles, which are a growing and important industry. New MMOs can also be used for semi-conductors, and renewable energy generation and storage, such as solar cells and wind power turbines. They typically consist of lithium, nickel, cobalt and other metals, and they are the key material used in the production of the cathode in battery cells, which are subsequently assembled into a battery. Read More

Puzzling production cut by OPEC may drag out global slowdown

Commenting on OPEC+ cutting output by 2mn barrels a day, Ole Hansen, Head of Commodity Strategy at Saxo, said: “The OPEC+ group of producers, as speculated, decided to cut their baseline production by 2 million barrels per day. A decision that, given the undercompliance from several major producers including Russia, Nigeria and Angola, will likely translate into a somewhat lower impact of around 1 million barrels per day. However, by taking this step the group has moved closer to their baseline, making the impact of a potential future production cut somewhat bigger.

“Cutting production at this time has been a bit of mystery to me given the fact the price has not fallen much below the $90-100 Brent range that seems to be acceptable to most producers. The winner is Russia while the loser is the global consumer who does not need higher energy prices going into an economic slowdown. Russia is currently producing well below its baseline and will therefore not be obliged to make any cut, but with the upcoming embargo on its oil Russia is likely to see a further loss in production while having to accept a deeper discount of the oil sells. What makes this cut even more difficult to understand from a supply and demand perspective is the comment from Russian Deputy PM Novak that Russia won’t sell oil to countries that adopt a price cap, and that Russian production may fall further. This decision risks agitating the US while potentially leading the FOMC to keep tightening for longer as inflation will become more sticky. The result being a stronger dollar, higher bond yields and a global economic slowdown that may end up taking longer to reverse.” Read More

Shell’s chief executive has called on governments to tax energy companies to ‘protect the poorest’ in society.

Ben van Beurden – the outgoing boss of one of the world’s largest gas companies – has urged governments to impose a windfall tax on corporations.

The appeal comes as energy costs continue to soar. Read More

Galatasaray football club previously set a world record in March for the amount of megawatts produced by the stadium’s solar panels, earning it a place in the Guinness World Records. The club and the energy company running the system, Enerjisa, were presented with a certificate acknowledging the feat of producing 4.2 megawatts from 10,404 panels on the roof of the Ali Sami Yen Spor Kompleksi Stadium in Istanbul. Read More

The World Bank has classified Ghana as a high debt distress country as it projects the nation’s debt to Gross Domestic Product (GDP) of 104.6% by the end of 2022.

According to its October 2022 Africa Pulse Report, debt is expected to jump significantly, from 76.6% a year earlier, amid a widened government deficit, massive weakening of the cedi, and rising debt service costs.

It is also forecasting debt to GDP of 99.7% and 101.8% of GDP in 2023 and 2024, respectively. The size of Ghana’s economy is estimated at about $72 billion, whilst it is expected to spend about 70% of revenue this year to service its debt. Read More

Turkey’s leading electricity distribution and retail sales company, Enerjisa Enerji, whose business strategy is based on sustainability, was deemed worthy of a total of 3 awards in the Ethics and Environmental Responsibility branch of the “Excellence in Corporate Social Responsibility” category of the international Communitas Awards, where the most socially responsible projects compete. became the company with the most awards. The Sustainable Energy Based Tourism Practice Center (SENTRUM), which was established in cooperation with Enerjisa Enerji, UNDP and Sabancı University, continues to attract international attention in the field of social responsibility. SENTRUM is the Leader of the Ethical and Environmental Responsibility branch of the ” Excellence in Corporate Social Responsibility ” category of the Enerjisa Energy Communitas Awards and the Green Initiative .was selected as the project and was awarded 2 awards. Read More

| Oil and Gas Blends | Units | Oil Price $ | change |

| Crude Oil (WTI) | USD/bbl | $87.68 | Up |

| Crude Oil (Brent) | USD/bbl | $93.30 | Up |

| Bonny Light | USD/bbl | $93.36 | Up |

| Saharan Blend | USD/bbl | $93.95 | Up |

| Natural Gas | USD/MMBtu | $6.97 | Up |

| OPEC basket 04/10/22 | USD/bbl | $92.13 | Up |

The 45th Meeting of the Joint Ministerial Monitoring Committee (JMMC) and the 33rd OPEC and Non-OPEC Ministerial Meeting took place in person at the OPEC Secretariat in Vienna, Austria, on Wednesday, 5 October 2022.

In light of the uncertainty that surrounds the global economic and oil market outlooks, and the need to enhance the long-term guidance for the oil market, and in line with the successful approach of being proactive, and preemptive, which has been consistently adopted by OPEC and Non-OPEC Participating Countries in the Declaration of Cooperation, the Participating Countries decided to:

Reaffirm the decision of the 10th OPEC and non-OPEC Ministerial Meeting on 12 April 2020 and further endorsed in subsequent meetings including the 19th OPEC and non-OPEC Ministerial Meeting on 18 July 2021.

Extend the duration of Declaration of Cooperation until the 31st of December 2023

Adjust downward the overall production by 2 mb/d, from the August 2022 required production levels, starting November 2022 for OPEC and Non-OPEC Participating Countries as per the attached table.

Reconfirm the baseline adjustment approved at the 19th OPEC and non-OPEC Ministerial Meeting.

Adjust the frequency of the monthly meetings to become every two months for the Joint Ministerial Monitoring Committee (JMMC).

Hold the OPEC and non-OPEC Ministerial Meeting (ONOMM) every 6 months in accordance with the ordinary OPEC scheduled conference.

Grant the JMMC the authority to hold additional meetings, or to request an OPEC and non-OPEC Ministerial Meeting at any time to address market developments if necessary.

Extend the compensation period to the 31st of March 2023. Compensation plans should be submitted in accordance with the statement of the 15th OPEC and Non-OPEC Ministerial Meeting.

Reiterate the critical importance of adhering to full conformity.

Hold the 34th OPEC and Non-OPEC Ministerial Meeting on 4 December 2022. Read More

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: @OilAndGasPress on Twitter |

Oil and gas press covers, Energy, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas, News and Analysis