Energy News to 10 May 2022. OPEC daily basket price stood at $112.48/bl, 09 May 2022

Saudi Arabia lowered its June official selling price differentials for crude oil to China-

Of all fossil fuels, natural gas has the smallest carbon footprint. The challenge is to further reduce its emissions by eliminating so-called fugitive methane emissions, the elimination of process flaring, the integration of renewables into production activities, the use of carbon capture, utilisation and storage (CCUS) technologies, Natural Climate Solutions projects and blue hydrogen production. In parallel, natural gas will be increasingly complemented by biogas.

In this context, gas plays a central role in Eni’s strategy to achieve zero net GHG emissions (scope 1,2,3) by 2050, contributing to the goal of offering our customers increasingly decarbonised products and services. It remains a key element not only for Eni’s business, but also to strengthen the security of energy supply. The combination of these two aspects – reduction of GHG emissions and energy security – makes natural gas a major contributor to the energy transition. For these reasons, the gas component will become increasingly dominant in Eni’s production mix, accounting for 60% of hydrocarbon production in 2030 and over 90% in 2050, in a context in which overall hydrocarbon production is expected to reach a plateau in 2025 and then decline over time.

The use of natural gas to improve energy access is also part of our commitment to the United Nations Sustainable Development Goals (SDGs). Adopting a lower-impact energy mix of gas and renewables is part of our energy access projects in the countries in which we operate, particularly in sub-Saharan Africa, where more than half a billion people do not have access to electricity despite the wide availability of energy sources. Read More

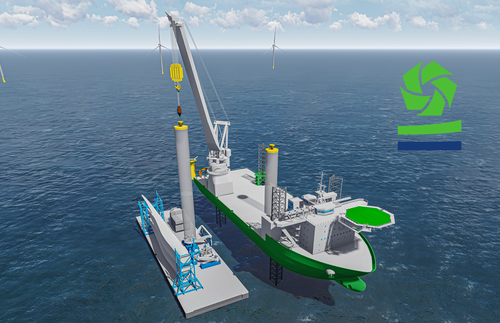

Heerema’s Floating to Floating installation method was developed to deliver solutions to industry challenges, such as efficient use of resources like steel and port infrastructure, offshore logistics and maintenance, and reaching the required scale and rate of installation.

Currently, there are various proposed methods that involve assembling floating foundations (floaters) in port before wet-towing to the field. This presents logistical challenges, as well as there being pressure on the number of suitable harbors. Therefore, Heerema has developed an alternative method that does not require a wet-tow and removes the need for marshalling yards. Using the floating to floating installation method floaters can be constructed on land before being dry-towed on a transport vessel to the location. After arrival, they will be installed using Heerema’s floating installation frame to lift the floaters from the vessel. After that, they will be installed on location. Heerema’s floating installation frame will submerge the floaters down by weight, removing the need for high-tech ballasting or tensioning systems and reducing installation duration. The bottom foundation work can be executed in parallel by optimizing the capabilities of Heerema’s semi-submersible crane vessels. Read More

Golar LNG’s 1st Quarter 2022 results will be released before the NASDAQ opens on Thursday, May 26, 2022. In connection with this a webcast presentation will be held at 3:00 P.M (London Time) on Thursday May 26, 2022. Read More

A.P. Moller – Maersk (Maersk) delivered record results for Q1 2022 across its businesses, driven by higher rates and strong long-term partnerships with customers seeking end-to-end supply chain support. Revenue was up 55pct. to USD 19.3bn, EBITDA more than doubled to USD 9.1bn and free cash flow increased to USD 6bn.

In Q1 we delivered the best earnings quarter ever in A.P. Moller – Maersk with growth across Ocean, Logistics and Terminals. The increased earnings are driven by freight rates and by contracts being signed at higher levels. While global supply chains remain under significant pressure, we continue to demonstrate superior ability to help customers overcome logistic challenges. In Logistics, we enjoyed strong demand for products and solutions across our portfolio leading to the 5th quarter in a row with organic growth of more than 30pct. while Terminals presented its best quarter ever. In Ocean, revenue increased 64pct. to USD 15.6bn during Q1 as strong rates more than offset a 7pct. decline in volumes. Revenue for the full year is expected to continue to be strong as the increase in freight rates on our long-term contract portfolio will add approximately USD 10bn to revenue in 2022 compared to 2021. This will more than offset the significant increase in costs, which were up 21% in the first quarter given higher fuel costs and inflationary pressure on network and container handling costs.In Q1, revenue in Logistics grew 41pct. to USD 2.9bn compared to same quarter last year as both existing and new customers continue to buy into the full value proposition of integrated solutions. At the same time Maersk continues to invest in acquisitions that add capabilities within technology and e-commerce and strengthen the portfolio such as Pilot Freight Services, which closed on 2 May 2022.

In Terminals, revenue increased to USD 1.1bn in Q1 compared to USD 915m last year and the return on invested capital (ROIC) ended on a record 12.5pct. before impairment in GPI of USD 485m following the exit of the Russian market. The process around the sale of GPI is ongoing. Results in Terminals are driven by higher storage income in NAM, improvement in revenue per move and a volume growth in the overall contracting market. Read More

Noble Corporation First Quarter Results

Contract drilling services revenue for the first quarter of 2022 totaled $195 million compared to $192 million in the fourth quarter of 2021. Marketed fleet utilization was 75 percent in the three months ended March 31, 2022 compared to 77 percent in the fourth quarter of 2021. Contract drilling services costs for the first quarter were $166 million, down from $183 million in the fourth quarter of 2021.

Adjusted EBITDA for the three months ended March 31, 2022 was $27 million compared to $12 million in the fourth quarter of 2021. Capital expenditures totaled $45 million in the first quarter, which includes $11 million of client reimbursable investments. Upon emergence from restructuring, Noble adopted fresh-start accounting which resulted in Noble becoming a new reporting entity for accounting and financial reporting purposes. Accordingly, financial statements and notes after February 5, 2021 are not comparable to financial statements and notes prior to that date. As required by GAAP, results must be presented separately for the predecessor period up to February 5, 2021 (the “Predecessor” period) and the successor period from February 6, 2021 through all dates after (the “Successor” period). Read More

Southwest Gas Rises After Reaching Deal With Icahn to Oust CEO

Southwest Gas Holdings, Inc. announced that it has entered into a settlement agreement (the “Agreement”) with Carl Icahn (“Mr. Icahn”) and his affiliated entities. Pursuant to the Agreement, at least three, and up to four, new directors will join the Southwest Gas Board of Directors (the “Board”). Following the 2022 Annual Meeting of Stockholders (the “Annual Meeting”), the Board will continue the previously announced review of a full range of strategic alternatives to maximize stockholder value including a sale of the Company, a separate sale of one or more of its business units and/or the spin-off of Centuri, which is expected to be tax-free to stockholders. Under the terms of the Agreement, the composition of the Board will be amended as follows: Read More

Oman has jumped from a budget deficit last year to a $930 surplus as of the end of the first quarter of 2022, thanks to a significant increase in oil revenues by more than 70%, Reuters reported.

Oman saw gas revenue for Q1 more than double. In March, Oman’s oil production reached a two-year high, with the country–a member of the Gulf Cooperation Council (GCC)–meeting its quota as outlined in the OPEC+ production deal for the first time in 2022. Oman’s oil production averaged 1.04 million barrels per day in March–a production level the country hasn’t reached since this same period in 2020, right before the pandemic. The Sultanate’s total crude oil exports rose by 18% at the end of March 2022, compared to the same month a year ago, with exports to South Korea ramping up by over 99%, according to the Times of Oman At the same time, Oman has seen production at its refineries and across its petroleum industry decline by 25% year-on-year for the month of March, according to official data. While the production of standard-grade petrol increased by just over 27% for the period, that was offset by declines in the production of M-95 fuel, diesel and aviation fuel, media cited data from Oman’s National Centre for Statistics and Information as saying. Oman’s production of M-95 fuel fell by 34.3% year-on-year, with sales down 12.3% and export down by 18.6%. More

Neptune Energy to spend $1 billion to support UK energy security

Neptune Energy announced today it will spend more than $1 billion1 over the next five years securing energy supplies for the UK and speeding the transition to net zero.

Neptune currently operates around 11% of the UK’s gas supply from fields in the UK’s Southern North Sea and the Norwegian North Sea. It is one of the UK’s lowest carbon producers, with the carbon intensity of its production at 1.7 kg CO2/boe compared with the industry average of 20 kg CO2/boe2.

Following the publication of the Government’s British Energy Security Strategy, Neptune will accelerate investment to increase energy supply to the UK.

Supporting energy security in the short-term

• Doubled gas production from its Duva field in Norway to around 13 kboepd, which will supply enough gas to heat an additional 350,000 UK homes.

• Beginning infill drilling at Neptune’s operated Cygnus field in the UK next month, with the 10th well due onstream in October and plans for an 11th well to be brought onstream next year, helping to maintain production from Cygnus and offset natural decline.

• Could supply even more energy if the UK’s Gas Safety Management Regulations are more closely aligned with European standards. Read More

Equinor and Sval Energi have entered into an agreement for the sale of Equinor’s non-operated share in the Greater Ekofisk Area and a minority share in Martin Linge (19%).

The agreement includes 7.604% of Ekofisk area licenses PL018, PL018B and PL275 (including the Ekofisk, Eldfisk and Embla fields, and 6.63922% in the Tor Unit).

With this agreement, Equinor will no longer have any ownership interests in the Greater Ekofisk Area but will retain a 51% ownership share in Martin Linge and continue as the operator of the field. The deal also includes the sale of Equinor’s interest in Norpipe Oil AS (18.5%), part of the infrastructure transporting oil from the Greater Ekofisk Area to land. The agreement includes a cash consideration of USD 1 billion and a contingent payment structure linked to realised oil and gas prices for both assets for 2022 and 2023. Read More

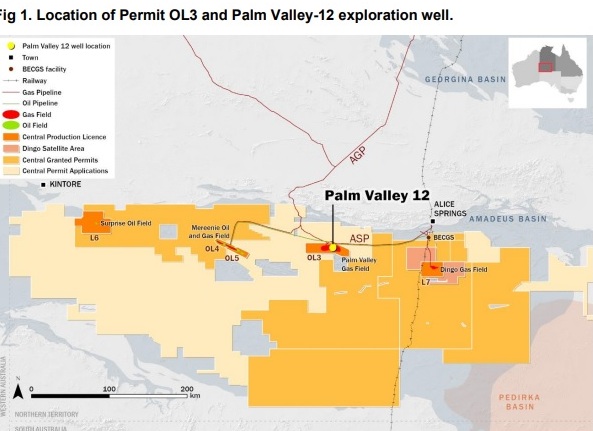

Central Petroleum Limited (“Central”) (ASX: CTP) advises that on 9 May 2022, the Palm Valley 12 (PV12) well in OL3, Southwest of Alice Springs in the Northern Territory, had reached a depth of 1,103m at 0600 hrs ACST. In the past week a total of 283m of drilling has occurred reaching the planned total depth for the 17.5” hole section at 1,103m on 5 May 2022. Consequent to reaching total depth, the 13 3/8” casing has been run and cemented, the blowout preventer and surface equipment has been pressure tested and the well is anticipated to commence drilling ahead in 12 ¼” hole from 10 May 2022. The PV12 well has two alternate objectives, consisting of a deeper gas exploration target or a shallower gas appraisal lateral that could become a production well. The primary exploration target is the Arumbera Sandstone at an anticipated depth of 3,560m. The PV12 well is the first of a 2-well drilling program that also includes the Dingo-5 exploration / production well. Both wells are being drilled under joint ventures between Central (50% interest), New Zealand Oil & Gas Limited (ASX: NZO) (35% interest) and Cue Energy Resources Limited (ASX: CUE) (15% interest) and are scheduled to be completed this year. Read More

| Oil and Gas Blends | Units | Oil Price $ | change |

| Crude Oil (WTI) | USD/bbl | $102.70 | Down |

| Crude Oil (Brent) | USD/bbl | $105.45 | Down |

| Bonny Light | USD/bbl | $108.28 | Down |

| Saharan Blend | USD/bbl | $108.93 | Down |

| Natural Gas | USD/MMBtu | $7.12 | Down |

| OPEC basket 09/05/22 | USD/bbl | $112.48 | Down |

DEME has entered into an agreement with German shipping and logistics company Harren & Partner to sell the DP2 jack-up installation vessel ‘Thor’.

The vessel is sold after a successful career of more than 10 years in the DEME fleet, whereby it was largely deployed for the installation and maintenance of offshore wind farms. DEME has already established the most modern and versatile fleet in the offshore wind industry, with five jack-up installation vessels. Soon DEME will again add to the fleet when it welcomes the new DP3 offshore installation vessel ‘Orion’, which features a 5,000-tonne crane, and is the first of its kind in the sector. Meanwhile, in Taiwan, DEME and its partner CSBC are building ‘Green Jade’. These two giants will bring a game-changing installation concept to the offshore energy market. Read More

DEME Offshore US has taken a major step forward in the further development of a US Jones Act compliant feeder solution for the upcoming offshore wind projects by entering into a long-term agreement with Barge Master. The two companies will work closely together to develop motion compensation technology which will be deployed in a pioneering feeder concept on the Vineyard Wind 1 project – the first commercial-scale offshore wind farm in the US. In 2021 DEME Offshore US secured a transport and installation contract for the 62 GE Haliade offshore wind turbines for the Vineyard Wind 1 project, which is located off the coast of Massachusetts. In addition to the installation of the turbines, DEME Offshore will also handle the transportation and installation of the monopile foundations, transition pieces, offshore substation and scour protection for the wind turbine foundations, as well as the offshore substation foundation and platform. DEME Offshore US is partnering leading US company Foss Maritime in the development of the smart feeder barge concept to ensure that it is fully compliant with the Jones Act. Following on from this, DEME Offshore US has now announced a five-year agreement with the Dutch company Barge Master, where it will utilise four motion compensation platforms which will be installed on the US- flagged Foss Maritime barges. Read More

A liquified natural gas (LNG) crisis is brewing for European countries dealing with energy insecurity in the wake of Russia’s invasion of Ukraine, as demand will outstrip supply by the end of this year, Rystad Energy research shows. Although soaring demand has spurred the greatest rush of new LNG projects worldwide in more than a decade, construction timelines mean material relief is unlikely only after 2024.

Global LNG demand is expected to hit 436 million tonnes in 2022, outpacing the available supply of just 410 million tonnes. A perfect winter storm may be forming for Europe as the continent seeks to limit Russian gas flows. The supply imbalance and high prices will set the scene for the most bullish environment for LNG projects in more than a decade, although supply from these projects will only arrive and provide relief from after 2024 The European Union’s REPowerEU plan has set an ambitious target to reduce dependence on Russian gas by 66% within this year – an aim that will clash with the EU’s goal of replenishing gas storage to 80% of capacity by 1 November. By shunning Russian gas, Europe has destabilized the entire global LNG market that began the year with a precarious balance after a tumultuous 2021. The decision to sharply reduce reliance on Russian gas and LNG from current levels of between 30-40% will transform the global LNG market, resulting in a steep increase in energy-security based European LNG demand that current and under-development projects will not be able to supply. Russia last year sent 155 billion cubic meters (Bcm) of gas to Europe, providing more than 31% of the region’s gas supply. Replacing a significant portion of this will be exceedingly difficult, with far-reaching consequences for Europe’s population, economy, and for the role of gas in the region’s energy transition. This will also likely create a boom for LNG producers elsewhere of a scale and duration not seen in over a decade.

“There simply is not enough LNG around to meet demand. In the short term this will make for a hard winter in Europe. For producers, it suggests the next LNG boom is here, but it will arrive too late to meet the sharp spike in demand. The stage is set for a sustained supply deficit, high prices, extreme volatility, bullish markets, and heightened LNG geopolitics,” says Kaushal Ramesh, senior analyst for Gas and LNG at Rystad Energy. Read More

| Region | Period | Rig Count | Change from Prior |

| U.S.A | 06 May 2022 | 705 | +3 |

| Canada | 06 May 2022 | 91 | -4 |

| International | April 2022 | 806 | -9 |

OilandGasPress Energy Newsbites and Analysis Roundup |Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.