Energy News to 14/11/22. OPEC daily basket price stood at $94.84/bl, 11 Nov. 2022

Oil prices rose on Friday as a slowdown in inflation in the US eased concerns about the Federal Reserve’s future rate hikes, while China’s Covid-19 policy continued to cloud the demand outlook in the world’s second-largest oil consumer.

CME Group Inc., declared a fourth-quarter dividend of $1.00 per share. The dividend is payable December 28, 2022, to shareholders of record as of December 9, 2022. Read More

Markets for crude oil and its products have found themselves mired in extraordinarily strong crosscurrents, from cuts to production from major producers to uncertainty over global demand that have had a push-pull effect on prices and market volatility.

Some of the factors at play in the oil market include:

Inventories of gasoline and ultra-low sulfur diesel (ULSD) are at exceptionally low levels, at least in the U.S. While crude oil inventory levels are at somewhat more typical levels, the overall crude oil and products inventory situation shows potentially tight supplies heading into winter (Figure 1).

On October 5, OPEC+ announced that it would cut production by two million barrels per day, the equivalent of approximately 2% of global crude oil output.

The U.S. replied to the production cut by extending its drawdown of the Strategic Petroleum Reserve, which has already been reduced by nearly more than a third from its previous levels (Figure 2). In the short run, this contributes an additional 1 million barrels per day of crude to the market, but the drawdown cannot be sustained indefinitely.

The global economy is slowing amid the most rapid pace of monetary policy tightening in the U.S. and Europe in decades to beat back the surge in inflation. Many other nations, including Australia, Brazil, Canada and Mexico, have seen much tighter monetary policy.

China’s economy remains beset with COVID lockdowns and a faltering property sector, both of which are eating into its once fast-growing demand for crude oil and its products.

The Russo-Ukrainian war continues to generate widespread uncertainty across commodity markets, impacting both the supply and demand equations. Read More

ACWA Power’s ‘Innovation Day’ – the company’s private event at COP 27 on 14th November will showcase how the company is ‘Innovatively Implementing Giga scale Projects Globally’. Joined by experts, the day’s agenda features panel sessions on the Neom Green Hydrogen Company (NGHC), of which ACWA Power, Air Products and NEOM are equal joint venture (JV) partners, building the world’s largest plant to produce green hydrogen at scale. Panel sessions will also focus on the pioneering water desalination technologies that are reducing energy consumption by over 70% – the session coincides with Water Day at COP 27.

ACWA Power has had a presence in Egypt since 2019, and has three renewable energy projects in the country: 120MW Benban project solar plant, the 200MW Kom Ombo solar plant and the 1.1GW Suez Wind Energy project, currently under development. Read More

Oman Investment Authority (OIA) signed a Memorandum of Understanding (MoU) with ACWA Power, KSA, to explore the feasibility of investment of up to 10% in the development, construction, and operation of the 1.1GW Suez Wind Energy project. This investment is in line with the Sultanate’s commitment and pioneering role in reducing CO2 emissions and mitigating the adverse effects of climate change and is building on cooperation and partnership with the Kingdom of Saudi Arabia and the Arab Republic of Egypt. This project is valued at USD 1.5 billion.The MoU was signed on the sidelines of the 27th Conference of the Parties of the UNFCCC (COP 27) in Sharm El Sheikh – Egypt. Read More

Neptune Energy advised that its Q3 2022 results for the period ended 30 September 2022 will be announced on Thursday, 17 November 2022.

A webcast for Analysts and Bondholders of the Senior Secured Notes in Neptune Energy Bondco plc will be held at 10.00 (GMT) on 17 November 2022. There will also be the opportunity for participants to join via a conference call facility. Read More

From 11 November 2022, the shares in Equinor will be traded ex dividend USD 0.70 (ordinary dividend of USD 0.20 and extraordinary dividend of USD 0.50).

This information is subject to the disclosure requirements pursuant to Section 5-12 of the Norwegian Securities Trading Act Read More

Fitch Ratings has downgraded Nigeria’s Long-Term Foreign-Currency Issuer Default Rating (IDR) to ‘B-‘ from ‘B’ with a stable outlook amidst macroeconomic uncertainties, noting that the interest payments on debt stock exceed government revenue in the first half of 2022. The rating agency said the downgrade to ‘B-‘ reflects continued deterioration in Nigeria’s government debt servicing costs and external liquidity despite high oil prices in 2022. Read More

Africa Oil Corp. announce that the Company repurchased a total of 2,074,350 Africa Oil common shares during the period of November 7, 2022 to November 11, 2022 under the previously announced share buyback program.

The launch of Africa Oil’s normal course issuer bid (share buyback) program, announced by the Company on September 22, 2022, is being implemented in accordance with the Market Abuse Regulation (EU) No 596/2014 (MAR) and Commission Delegated Regulation (EU) No 2016/1052 (Safe Harbour Regulation) and the applicable rules and policies of the Toronto Stock Exchange (“TSX”), Nasdaq Stockholm, and applicable Canadian and Swedish securities laws.

During the period dated November 7, 2022 to November 11, 2022, the Company repurchased 834,350 Africa Oil common shares on the TSX and/or alternative Canadian trading systems. The repurchases were carried out by Scotia Capital Inc. on behalf of the Company. During the same period, the Company repurchased 1,240,000 Africa Oil common shares on Nasdaq Stockholm, and these repurchases were carried out by Pareto Securities on behalf of the Company.

All common shares repurchased by Africa Oil under the share buyback program will be cancelled. During the period dated November 7, 2022 to November 11, 2022, the Company cancelled 2,424,960 common shares repurchased under the share buyback program. Read More

As Green Careers Week draws to a close, a new poll reveals more than 96% of climate-ambitious local leaders see green jobs and skills as the key to unlocking Net Zero, but they need more support from the Government.

More than 9 in 10 (97%) local authority officials, leaders and councillors polled agreed that local skills development is a priority for delivering Net Zero.

Every respondent either strongly agreed (83%) or agreed (17%) that they need “more support from Government to unlock Net Zero jobs and skills in our region.”

In response to the poll, one councillor from a metropolitan district council in the north of England said: “We need all Universities, businesses and government to do less talking and more action, legislation, funding and support if they are serious about Net Zero jobs and skills.”

The poll of UK100 members — the UK’s only network of local authorities committed to Net Zero and clean air — coincides with the release of a new UK100 Skills for Local Net Zero Delivery insight briefing.

The briefing — released during Green Careers Week — explores the barriers to developing the jobs and skills identified by local authorities as necessary for delivering on the UK’s Net Zero goal.

Through interviews with local authority representatives from councils from Brighton & Hove City Council to the West of England Combined Authority, trade unions, and BEIS and DEFRA, the briefing explores the short-term and overlapping government schemes for skills development to identify gaps and opportunities.

In an interview for the briefing, Kate Kennally, Chief Executive of Cornwall Council, says: “Local authorities have a unique and powerful role in developing skills for Net Zero. We are best placed to coordinate collective action by local businesses, educators, and communities. We need policy, frameworks and funding that recognise this.”

The main barriers identified by the briefing include:

Lack of business confidence and employer demand for skills

Limited, short term and competitive local authority funding

Lack of funding for Further Education Read More

A plan by the European Space Agency (ESA) to harvest energy from the sun and beam the solar energy back down to Earth is still in the testing phase, but the hope is to have a solar space farm that generates energy equal to that of a nuclear power plant, reported Euronews Green.

“[Such a project] would ensure that Europe becomes a key player — and potentially leader — in the international race towards scalable clean energy solutions for mitigating climate change,” a statement from the ESA said, as Euronews Green reported.

According to Space Energy Initiative (SEI) co-chairman Martin Soltau, harvesting solar energy from space could be implemented as early as 2035, reported BBC News.

Cassiopeia is a project by SEI that involves using large satellites to harvest solar energy while orbiting high above the Earth. Soltau said the power generated could be almost limitless. Read More

It is the first platform in Africa to be decommissioned in a project led by environmental quality services company, EQS, with a Saab Seaeye Falcon underwater robot deployed for the task.

Chief Technical Officer at EQS, Carlos Rodrigues says, “By operating the Seaeye Falcon and all its related capabilities, EQS is supporting its aim to fulfil specific works in a safe and cost-effective manner delivering accurate and relevant information.”

The Falcon is assisting in the survey and mapping of all underwater components, including checking the wellhead, pipelines and the surrounding maritime environment.

Baseline environmental conditions are determined by taking water and sediment samples at several stations and at different depths, focussing on biological matter, namely zooplankton, phytoplankton, and benthos.

Significant marine growth already exists throughout the structure with abundant marine life already in the area for populating the rig when toppled on its side to become an artificial reef.

Once decommissioning is complete, a series of surveys will be scheduled to monitor the evolution of marine growth on the newly created reef.

EQS selected the Seaeye Falcon for its ability to handle an array of cameras, sensors, tooling and complex data gathering systems that include a digital multi-frequency profiling sonar.

Having reached the end of its service life the rig’s transformation into a reef is being undertaken under the auspices of The Ministry of Mineral Resources, Oil and Gas of Angola.

EQS helps offshore energy clients navigate the complex environmental regulatory landscape including compliance, HSE subjects, and business liabilities.

The mission involves a multi-disciplinary team from different companies and sectors of activity, including marine biology, hydrographic surveys, quality inspectors and personnel specialised in survey equipment such as the Falcon.

Future work involves clearing an area of fish nets, restoring platform signalling and marking, positioning of signal buoys and confirmation of pipeline locations along with the surveys to monitor marine growth. Read More

World’s first resident subsea contract has been awarded to Modus by Equinor Energy for the autonomous deployment of a Saab Sabertooth underwater robot, which will remain docked on the seabed between tasks.Residency of robotic systems will reduce operational expenditure, remove humans from offshore work, and reduce environmental impact, says the industry.

The Saab Sabertooth will remain at a subsea docking station for charging and data transfer between missions at the Johan Sverdrup oil field, Norway.

Over-the-horizon mission management will come from Modus’ Command and Control Centre at their UK head office.

Modus was one of Saab’s first commercial customers for the Sabertooth system and both organisations have a strong and collaborative relationship.

Modus chose Sabertooth as the world’s only roaming and hovering multi-role, 360° manoeuvrable system that enables fully flexible dual autonomous and intervention operations from a single platform, fitted with cameras, sonars and tooling.

Behind the Sabertooth’s success is 10 years’ development by Saab Seaeye engineers in Sweden and the UK, where advanced military and commercial technologies were integrated to create the innovative Sabertooth concept and its multirole capability. Read More

| Oil and Gas Blends | Units | Oil Price $ | change |

| Crude Oil (WTI) | USD/bbl | $88.56 | Down |

| Crude Oil (Brent) | USD/bbl | $95.67 | Down |

| Bonny Light | USD/bbl | $96.15 | — |

| Saharan Blend | USD/bbl | $97.63 | — |

| Natural Gas | USD/MMBtu | $6.22 | Up |

| OPEC basket 11/11/22 | USD/bbl | $94.84 | Up |

Power production from the first turbine in the floating wind farm Hywind Tampen in the North Sea started at 12:55 CET on 13 November. The power was delivered to the Gullfaks A platform in the North Sea.

“I am proud that we have now started production at Hywind Tampen, Norway’s first and the world’s largest floating wind farm. This is a unique project, the first wind farm in the world powering producing oil and gas installations,” says Geir Tungesvik, Equinor’s executive vice president for Projects, Drilling and Procurement.

Owned by the Gullfaks and Snorre partners, the Hywind Tampen wind farm is expected to meet about 35 percent of the electricity demand of the two fields. This will cut CO2 emissions from the fields by about 200,000 tonnes per year. Read More

China continues to dominate BloombergNEF’s (BNEF) global lithium-ion battery supply chain ranking, for the third time in a row, for both 2022 and its projection for 2027, thanks to continued support for the electric vehicle demand and raw materials investments. Read More

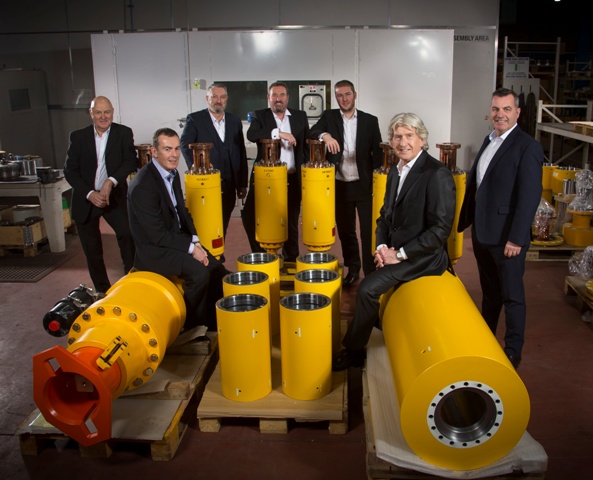

Manufacturing, assembly and testing specialist Express Engineering is expanding and recruiting in response to further growth in global subsea markets.

The international business, based in Gateshead in the North of England, has been enjoying buoyant growth during the last 18 months and is now recruiting to meet further expansion, primarily in the oil and gas sector.

With buoyant oil and gas prices and optimistic five-year forecasts from energy specialists like Westwood, Express Engineering is already seeing a strong upturn in sales for its key products as well as in components for the defence industry.

Since embarking on a refocused business strategy, Express Engineering has seen sales in the oil and gas sector grow significantly resulting in a jump in revenues from £20m in 2019 to an expected £38m this year, forecast to rise to £45m in 2023.

Market intelligence shows a positive outlook for subsea ‘tree’ awards for the next few years, placing Express Engineering in a key position with customers in the subsea equipment sector. Outsourcing and supply chain management will also be an integral part of the accelerated growth strategy. Read More

Two people were killed in an accident involving a Tesla electric car in the southern Chinese province of Guangdong on November 5, 2022. Surveillance footage showed the Model Y vehicle pulling over to apparently park when it suddenly accelerated and took off

Tesla will assist Chinese authorities in investigating the Tesla Model Y crash in Guangdong, China, which killed two and injured three. The accident happened on November 5, and video has been circulating on Chinese social media. Read More

Baker Hughes Rig Count

U.S. Rig Count is up 9 from last week to 779 with oil rigs up 9 to 622, gas rigs unchanged at 155 and miscellaneous rigs unchanged at 2. Canada Rig Count is down 9 from last week to 200, with oil rigs down 8 to 133, gas rigs down 1 to 67.

| Region | Period | Rig Count | Change from Prior |

| U.S.A | 11 November 2022 | 779 | +9 |

| Canada | 11 November 2022 | 200 | -9 |

| International | October 2022 | 911 | +32 |

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: @OilAndGasPress on Twitter |

Oil and gas press covers, Energy Monitor, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas, energy monitors,TotalEnergies, Shell, BP, Chevron