Energy News to 21/10/22. OPEC daily basket price stood at $92.48/bl, 20 Oct. 2022

Crude oil exports from the United States to France have fallen to zero for the first time in four years, Bloomberg has reported, citing industrial action at French refineries that has now spilled into other sectors as well.

Stellantis has rubber-stamped plans to axe 138 dealerships as part of wider plans to streamline its business amid a drastic shake-up in management.

In a media call, Stellantis UK group boss Paul Willcox and network development director Lee Titchner revealed ‘significant’ restructuring plans for Stellantis’s UK operations. It includes senior management changes, simplification of dealers’ business models and a refreshed dealer network to encompass multi-franchising. Read More

INEOS Enterprises announced an agreement to acquire ASHTA Chemicals Inc, from Bigshire Mexico S. de R.L. de C.V. The deal, which consists of a 100ktpa Potassium Hydroxide (KOH)/65 ktpa Chlorine plant, is targeted to close before the end of 2022, subject to regulatory approvals.

ASHTA Chemicals manufacture and market chlorine and a range of potassium-based chemicals to a wide variety of end use markets including liquid fertilizers, runway de-icers, food ingredients, pharmaceuticals, and agricultural applications. The business employs around 110 people at its site in Ashtabula, Ohio, close to the INEOS Pigments operations, from where it operates a recently commissioned membrane cell technology chlor-alkali unit. Read More

INEOS O&P Europe has announced a €30m investment in the conversion of its plant in Lillo, at the Port of Antwerp, to enable its existing capacity to produce either monomodal or bi-modal grades of high-density polyethylene (HDPE). This will allow Ineos to meet the strong demand for durable high-end applications such as cable ducts and pipes used to transport green energy sources such as renewable power and hydrogen, whilst enabling the business to follow market trends as society reduces single use packaging. HDPE is a key building block for producing a wide variety of goods, including many of those that will play an essential role in the transition to net zero.

INEOS will use its proprietary technology to build on its leading position as a supplier to the high-density pressure pipe market, working with customers to supply key regions and segments such as drinking water, gas, sewage and industrial applications including geothermal and biogas. The investment will also enable INEOS to meet growing demand for applications that will be critical to the new energy economy, for example: pressure pipe grids for transporting hydrogen; long-distance underground cable ducts networks for wind farms and transportation of other forms of renewable power; electrification infrastructure; and CO2 capture, transport and storage processes. The unique combination of properties offered by INEOS’ bimodal HDPE polymers means many of these products can be installed and operated safely for at least 50 years. They also offer more efficient, lower emission solutions for transporting important utilities and goods around Europe’s cities. Read More

Neste will publish its third quarter 2022 results on Thursday, 27 October 2022 at approximately 9 a.m. (EET). The release will be available on the Neste website immediately after publishing. A conference call in English for investors and analysts will be held on Thursday, 27 October 2022, at 3 p.m. Finland / 1 p.m. London / 8 a.m. New York. Read More

KBR announced it once again served as co-lead sponsor of the 38th Annual Army Ten-Miler and, for the first time this year, proudly served as the official sponsor of the Army Ten-Miler Shadow Run Series. This year, the signature Army Ten-Miler race returned to in-person running on Sunday, Oct. 9 in Washington, D.C. KBR has been a major sponsor of this event since 2005.The Army Ten-Miler is the third largest 10-mile race in the world, with a mission to support Army outreach, build morale and promote physical fitness. This year, the race attracted approximately 20,000 runners and hundreds of volunteers. To date, the Army Ten-Miler has generated more than $8 million for the Army’s Morale, Welfare and Recreation (MWR) programs.

At the race, KBR’s sponsorship provided free shuttle service, hospitality tents, water, pre-packaged meal boxes, and a reunion area where family and friends connect with runners. KBR also sponsored the Hooah Tent Zone where attendees and soldiers mingled after the race. Within the zone, KBR continued its tradition of serving Wisconsin bratwursts and provided a photo booth to document the day.

The Army Ten-Miler Shadow Run Series provides an opportunity for Army personnel and families stationed overseas to participate in the race. KBR’s sponsorship covered MWR-hosted Shadow Run events at 22 sites across four continents, with a total of 3,500 runners. Read More

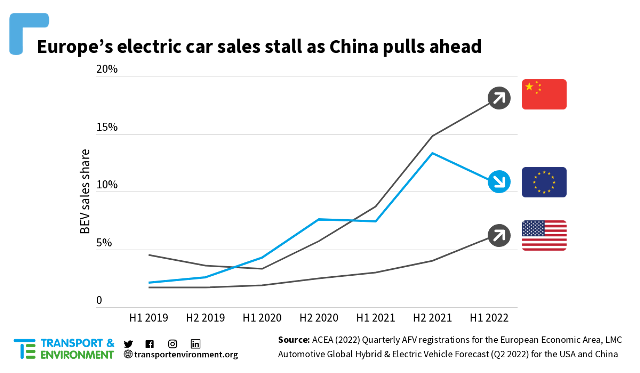

Chinese carmakers are starting to get a firm foothold on the European market, accounting for 5% of all BEVs sold so far this year. Based on current trends, they could be providing Europe with 9% to 18% of its battery electrics (BEV) in 2025, a new Transport & Environment study shows. The group warns that a failure of EU carmakers to scale up BEV supply could result in overseas companies capturing most of the mass market in Europe.The share of electric car sales in Europe dropped to 11% for the first half of 2022, down from 13% in the second half of last year. Growing electric vehicle sales in the United States and China suggest that a lack of regulatory incentives, not a supply chain crunch, is the main cause of Europe’s sluggish electrification efforts, says T&E.

BEV sales in China soared to nearly 18% of the new car market in the first half of 2022 while the share of EVs in the US grew 50%. In that same period the share of BEVs in Europe fell by two percentage points with Europeans facing excruciatingly long waiting times for electric models. Read More

As Europe looks to reduce its dependence on fossil fuels, a whole new market for LNG is growing to power ships.In 2030 Europe’s shipping industry will need over 6.3 million metric tonnes of LNG to power its growing fleet of gas-powered ships – enough to power 7 millions homes – a new Transport & Environment (T&E) study shows. This will only increase Europe’s dependence on fossil fuels, says T&E, which has labelled the switch to LNG as irresponsible in times of energy crisis.Shipping is a huge source of carbon emissions, responsible for roughly the same amount of global emissions as flying. The shipping industry and many European politicians are pushing for liquified natural gas (LNG) as a ‘clean’ alternative to traditional fuels. However, roughly 80% of Europe’s LNG used by ships today is worse for the climate than the fuels it replaces due to the release of the potent gas methane.

But, as T&E’s study shows, Europe’s policymakers should also be worried about the impact the switch to LNG-powered shipping will have on energy security. T&E’s analysis shows that over 200,000 households could be supplied with the gas required to power today’s fleet of LNG-powered ships. With LNG set to power a quarter of EU shipping’s energy needs in 2030, the number of households could rise to 7 million – enough to heat all the homes in Belgium or Sweden. Read More

Europe’s lawmakers voted today in favour of a 2% mandate for green shipping fuels by 2030. Transport & Environment (T&E) welcomes the world’s first measure to decarbonise shipping fuels but says much more will be needed to get shipping to zero emissions.

Delphine Gozillon, sustainable shipping officer at T&E, said: “This is the beginning of the end for fossil fuels in Europe’s shipping industry. The green shipping fuel mandate will kickstart the production of hydrogen-based fuels by providing investment security for fuel producers. But 2% will not be enough if we are to stick to 1.5 degrees. The EU must build on this and go bolder. There is a clear will to clean up the shipping industry. This is just the start.”

T&E has called on the EU to raise this mandate – otherwise known as a sub-quota – to at least 6% in 2035. 50 industry organisations and NGOs from all over Europe, including Unilever, Siemens and Alstom have backed this. The group also called for a removal of the exemption for companies with three ships or less, which would exempt 60% of shipping companies. This was rejected by the Parliament.

The Parliament also failed to announce a greenhouse gas (GHG) reduction target of 100% in 2050 which would effectively phase-out greenhouse gas emitting fuels. This puts the EU’s domestic shipping ambition at odds with its claims to be a global green shipping leader internationally, says T&E.

The Parliament did reduce incentives for fossil gas by introducing stricter GHG targets. This will shorten the lifetime of LNG as a compliance option, but it will not be enough to stop shipping’s worrying shift to LNG, warns T&E. However, as Delphine Gozillon concludes “it does signal that there is no long-term future for fossil LNG in shipping.” Read More

| Oil and Gas Blends | Units | Oil Price $ | change |

| Crude Oil (WTI) | USD/bbl | $83.89 | Down |

| Crude Oil (Brent) | USD/bbl | $91.72 | Down |

| Bonny Light | USD/bbl | $93.62 | Up |

| Saharan Blend | USD/bbl | $93.78 | Up |

| Natural Gas | USD/MMBtu | $5.20 | Down |

| OPEC basket 20/10/22 | USD/bbl | $92.48 | Up |

The European Parliament has backed electric car charging targets that, if accepted by governments, would ensure that drivers can publicly re-charge in every corner of Europe by 2025 at the latest. Green group Transport & Environment (T&E) welcomed today’s vote for the Alternative Infrastructure Regulation to require charging hubs every 60km along major roads and comprehensive coverage on minor roads and in towns and cities too.

Drivers could expect to easily find charging in central and eastern Europe as the Parliament wants higher charger-per-vehicles targets for countries with low electric vehicle take-up. In more mature EV markets, countries would be required to provide 1kW of charging per battery electric vehicle on the road. This allows governments the flexibility to decide if more fast chargers or slow charging stations will meet the needs of their road users. Crucially, drivers would be able to use their bank cards to pay at every public charger in Europe.Electric trucks would also have plenty of public charge points under the Parliament’s proposed targets. EU countries would be required to have 2,000kW charging capacity every 60km along the bloc’s main transport routes (TEN-T core network) in 2025, rising to 5,000kW in 2030. From 2030 onwards the targets will apply to the entire TEN-T road network. Recharging at a 700-900kW charger during a mandatory driver rest-break is enough for almost all trucks to complete their daily journey. Read More

20 Just Stop Oil supporters walked onto Knightsbridge in central London and disrupted traffic by sitting in the road with banners. Some supporters glued onto the tarmac and others locked themselves together. Two supporters have also sprayed the outside of Harrods department store with orange paint. A spokesperson for Just Stop Oil said: “Our government is criminally incompetent and morally bankrupt. They are actively seeking to accelerate fossil fuel production, which will kill millons of people, while failing to address the worst cost of living crisis this country has ever seen. Vulnerable people will be freezing to death in their homes this winter, while the government refuses to tax the rich and the big energy companies that are profiting from our misery. “We owe it to our young people to stop fossil fuels, we owe it to our workers to create a just transition to a zero carbon economy, we owe it to our old people to enable them to live with dignity. We need to rapidly reduce the demand for fossil fuel energy through a mssaive programme of renewables, insulation and free public transport paid for by taxing the fossil fuel companies obscene profits, and the rich who avoid paying their fair share.” Read More

Woodside CEO Meg O’Neill said production and revenue rose in the third quarter, reflecting the first full three months of contribution from the former BHP petroleum business. “This is our first full quarter following the merger and these results demonstrate the new, expanded Woodside is delivering what we promised: safe, reliable energy from a more diverse portfolio. “Production for the period was 51.2 million barrels of oil equivalent (MMboe), up 52% from the second quarter and more than twice the level in the corresponding period of last year. “Strong operational performance across the combined portfolio has allowed us to upgrade our full-year production guidance to 153 – 157 MMboe. “Our investment in the Pluto-KGP Interconnector is creating significant value, enabling the acceleration of 2.3 MMboe of Pluto gas using available production capacity at the Karratha Gas Plant. “Sales volume for the third quarter climbed 59% from the preceding three months to 57.1 MMboe. Revenue increased 70% to $5,858 million, reflecting both higher sales volume and average portfolio realised price, which rose 7% to $102 per barrel of oil equivalent.

“Work on our major projects progressed to plan. The first stage of the Pluto Train 2 construction accommodation village in Karratha has been completed and fabrication of the subsea flowlines for the development of Scarborough commenced.

“Overall, the Scarborough and Pluto Train 2 projects combined were 21% complete at the end of the quarter and remain on track for targeted first LNG cargo in 2026.

“At Sangomar the subsea installation campaign began in September and development drilling progressed, with six of the planned 23 wells now complete. The project was 70% complete at quarter end with first oil targeted for the second half of 2023.

“Two long-term marketing deals signed during the quarter will strengthen Woodside’s trading position in the Atlantic Basin. Woodside entered into a long-term sale and purchase agreement (SPA) with Uniper Global Commodities to supply LNG from our global portfolio from 2023 into Europe, where buyers are urgently seeking alternatives to Russian gas. We also signed an SPA for supply from the proposed Commonwealth LNG export facility in Louisiana.

“We announced plans for the Hydrogen Refueller @H2Perth, a self-contained hydrogen production, storage and refuelling station, which would assist in stimulating the hydrogen economy in Western Australia. “We also awarded a contract in October for electrolysers for the proposed H2OK hydrogen project, a significant milestone towards our targeted final investment decision in 2023. Front-end engineering design activities for H2OK are well advanced. “Woodside’s plans to build carbon capture and storage capability progressed during the quarter with the award of a greenhouse gas assessment permit over the Calliance field in August. We are also participating in

joint ventures which were awarded greenhouse gas assessment permits in the Northern Carnarvon and Bonaparte basins. “We took decisive action to initiate an exit from our exploration position in the Orphan Basin, offshore Canada, consistent with our exploration focus on clear pathways to commercialisation,” she said. Read More

UK Government has won a vote against a Labour motion to ban fracking but the Tory chief has reportedly resigned in a furore as MPs were voting.

The government won by 326 to 230 against the banning of fracking. That reprsented a majority of 96 with 40 Tories not voting with the government – including Kwasi Kwarteng Nadine Dorries and Theresa May – and risking losing the whip.The division list showed 40 Conservative MPs did not take part in the fracking vote.

They cannot all be considered to be abstentions, with some likely to have been on Government business. Read More

Nigeria’s plan to lengthen debt maturity may amount to a default under Moody’s definition, the global ratings agency said in a new release.

Finance Minister, Ahmed Zainab, told Bloomberg recently that Africa’s most populous country with a $450 billion gross domestic product size plans to restructure its external debts. However, Debt Management Office has said the country has no plan to restructure its debt. In the first half of 2022, Nigeria’s external debts printed at $40.064 billion. A breakdown of the sum indicates that about 48% of the sum is owed to multi-lateral lenders. Read More

The Nigerian government has agreed to securitise more than N20 trillion in tranches of overdraft advances collected from the Central Bank, the nation’s lender of last resort. The apex bank had in breach of its own act extended overdraft to the government to support its wobbling fiscal position amidst rising debt profile.

The refund will be issued in the form of Treasury Bills and Bonds to be issued for subscription, according to the Minister of Finance, Budget and National Planning, Mrs Zainab Ahmed. Read More

The Carbon Footprints of Premier League Clubs Competing in Europe. With European competitions constantly expanding the number of teams participating and the geographical catchment area, Premier League teams’ Co2 footprint has naturally increased around European away days. Last season saw the introduction of the Europa Conference League, which meant more teams being invited into competitive European football, and another piece of silverware on offer.

To see how this has affected the Co2 emissions produced by clubs travelling to all corners of Europe for the group stages, OLBG has calculated each clubs’ carbon footprint.

Results are based on 30 people (the approximate size of the playing squad and coaching staff making the journey) travelling to and from the nearest airports based on the fixture. Here’s how each Premier League club’s carbon footprint competing in the Champions League, Europa League and Europa Conference League compares… Read More

Baker Hughes Rig Count

U.S. Rig Count is up 7 from last week to 769 with oil rigs up 8 to 610, gas rigs down 1 to 157 and miscellaneous rigs unchanged at 2. Canada is up 1 to 216 rigs. with oil rigs up 2 to 150, gas rigs down 1 to 66.

| Region | Period | Rig Count | Change from Prior |

| U.S.A | 14 October 2022 | 769 | +7 |

| Canada | 14 October 2022 | 216 | +1 |

| International | September 2022 | 879 | +19 |

Volta Trucks, the leading and disruptive full-electric commercial vehicle manufacturer and services provider, has confirmed the details of its first ‘Volta Trucks Hub’ in the UK, serving the battery electric Volta Zero vehicles that will operate on the streets of London from early 2023. The Hub is the second service and maintenance facility announced by Volta Trucks, after Bonneuil-sur-Marne in Paris, with further centres in other European cities to be announced in due course.

The Volta Trucks Hub in London is on White Hart Lane in Tottenham, north London, near many of Volta Trucks initial UK-based customers, and within easy reach of all of east and west London’s significant logistics centres. The facility covers 30,000 sq feet, operating eight workshop bays. It will also accommodate a showroom, admin offices, a Volta Trucks Academy training centre and Call Centre that will provide the interface between customers and the company’s team of technical and commercial experts.

With sustainability at the heart of the Volta Trucks brand, the new Volta Trucks Hub in London is at the cutting edge of building design. The property, managed by LaSalle Investment Management, has a photovoltaic panel system on its roof, converting sunlight into energy for the site, and a passive solar wall, optimising the heating and ventilation of the building. It is also designed with a charging infrastructure to support 50kW fast charging of Volta Zero vehicles while they are being maintained. Overall, the facility has an A+ EPC rating and has been designed to achieve the BREAAM ‘Excellent’ rating.

The Volta Trucks Hub in London is part of a wider representation strategy that will see a vehicle service offering across all launch locations of Paris, London, Madrid, Milan, the Rhine-Ruhr region of Germany, and the Randstad region of the Netherlands. The network of Hubs will be a critical enabler of the company’s innovative Truck as a Service offer, that sets out to revolutionise the finance and servicing of commercial vehicle fleets. Read More

Indonesia Energy Corporation (NYSE American: INDO) (“IEC”), an oil and gas exploration and production company focused on Indonesia, announced that it has discovered oil in its “Kruh 28” well. Kruh 28 is the second of two back-to-back wells being drilled by IEC during 2022 at its 63,000-acre Kruh Block.

The Kruh 28 well reached the final total depth at 3,475 feet depth on September 16, 2022. Approximately 135 feet of oil sands were encountered at Kruh 28 between the depths of 3,165 and 3,300 feet. This oil-bearing interval (meaning the top of the oil zone to the bottom of the oil zone) in the Kruh 28 well was 6 feet thicker and therefore larger than anticipated, meaning that the total reserve potential for Kruh 28 could be larger than anticipated. Based on these drilling results and testing, IEC expects production could begin at Kruh 28 by the end of November 2022.

In addition, as previously announced, IEC unexpectedly found evidence of a potential natural gas bearing reservoir between the 976 and 1,006 feet interval with 30 feet net thickness. This initial evidence was supported by both wireline logging and geologic logging data, and subsequent gas flaring.

Moreover, in an effort to maximize the potential of Kruh Block after several encouraging new oil discoveries made by IEC during 2021 and 2022, after production begins at Kruh 27 and Kruh 28, but before continuing with additional production drilling operations, IEC is planning to conduct significant new seismic operations across the entire Kruh Block. IEC believes that this new work, together with what has been learned from recent oil and gas discoveries, will greatly assist IEC in ascertaining the best locations to re-start a continuous drilling campaign at Kruh Block that will look to develop not only the one formation currently being targeted, but to look to develop what appears to be at least two potential additional oil formations that could contain significant commercial quantites of oil and natural gas. Completion and full interpretation of this seismic operations will take approximately 12 months, after which IEC plans to re-start its continuous drilling campaign at Kruh Block. IEC still plans on drilling a total of 18 new wells at Kruh Block, four of which have already been completed, but now by the end of 2025 rather than 2024 as previously announced. This change in the Kruh Block drilling program was previously disclosed in IEC’s mid-year Form 6-K report filed with the SEC on September 29, 2022.

IEC can conduct this new, potential maximizing seismic work based on its fundraising efforts during 2022, where the Company has raised approximately $12 million (net of fees and expenses) from investors. Read More

Trillion Energy International Inc. announced preliminary gas indications from our South Akçakoca 2 well. On October 15, South Akcakoca 2 reached 2,826 metres total depth (TD), which is 1,543.6 metres true vertical depth (TVD). This gas well is the first of our multi-well program on our 49% owned SASB gas field, Black Sea, Turkiye.

The logging while drilling (“LWD”) results suggest there is 32.0 metres of potential natural gas pay within 5 sands in the Akcakoca Member (SASB production zone), with two sands greater than 10 meters of gas pay each. In addition, the LWD identified gas sands also had natural gas detected at surface in the mud logging.

The 7” production casing is set and cemented. Completion, perforation and actual testing to determine natural gas production rates will occur in the following days. Read More

Shearwater GeoServices Holding AS announced the award of a large US Gulf of Mexico Ocean Bottom program, Engagement 3, the second project award under the recently announced Global Agreement with WesternGeco. The contract secures WesternGeco access for follow-on projects, providing certainty for continued acquisition using this technology in the Gulf of Mexico to accelerate and de-risk new development projects. The three-month survey is expected to cover a nodal area of approximately 2,400 sqkm. The project builds on Shearwater’s experience from similar OBN geophysical data acquisition executed in the Gulf of Mexico in 2020. Sparse node projects use ultralong-offset OBN data to resolve subsurface imaging challenges by integrating new data with existing wide and full azimuth data to provide new geological insight. Shearwater will deploy the high-end seismic vessels SW Gallien and SW Mikkelsen as source vessels for the project, working in combination with ROV node deployment. Both vessels are expected to continue to execute projects in the fast-growing OBN market. Read More

------------------------------------------------------------------------------------------------ OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: @OilAndGasPress on Twitter |