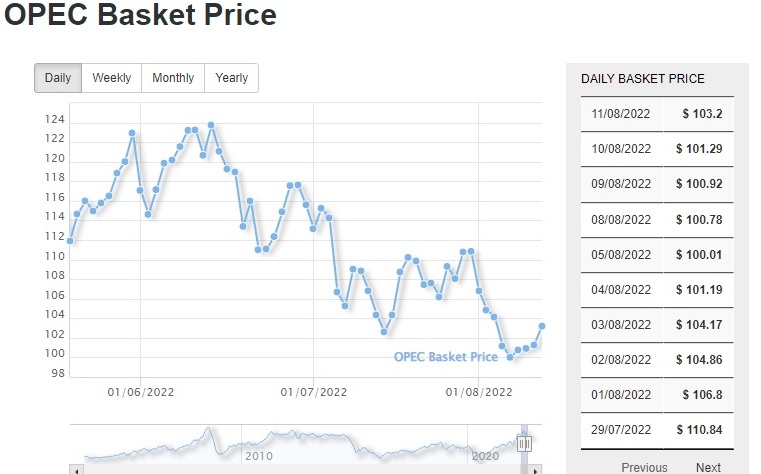

Energy top stories to 12/08/22. OPEC daily basket price stood at $103.20/bl, 11 August 2022

China Petrochemical Group, Sinopec, says it has discovered a massive oilfield in the Tarim Basin, containing 1.7 billion tons of oil reserves. The discovery is the result of exploration in the Shunbei oil and gas field, said to be one of the deepest commercial fields in the world, in the country’s Xinjiang region. Read More–>

Saudi Electricity Company (SEC), Saudi Arabia’s premier electricity service provider, today signed an agreement to obtain a USD-denominated $3 billion international syndicate facility from 15 leading regional and international lenders.

Covering a five-year tenor, the unsecured facility will be used to refinance an existing syndicated facility, initially raised in 2017 and set to mature in August of 2022, as well as fund the company’s capital expenditure needs, said an SEC statement.

SEC also announced obtaining a $567.5 million Export Credit Agency (ECA) facility, covering a 14-year tenor, to finance its Saudi Arabia – Egypt electricity interconnection project. Read More–>

Genel Energy plc (‘Genel’) notes that DNO ASA, as operator of the Tawke PSC (Genel 25% working interest), has today issued an update on licence activity.

Gross production at the Tawke licence averaged 106,900 bopd during the second quarter, of which Peshkabir contributed 62,300 bopd and Tawke 44,600 bopd, the latter representing the first quarterly production increase since 2015 at this legacy field as new wells are drilled, workovers conducted on existing ones and gas injection continued.

In the second quarter, four new production wells were brought onstream on the Tawke licence with three at Tawke and one at Peshkabir. Together with wells drilled in the first quarter, natural field decline has been arrested and reversed, including at Tawke, raising DNO’s full-year projection to 107,000-109,000 bopd (previously 105,000 bopd).

Genel’s production guidance for 2022 is unchanged, with net portfolio production currently expected between 30-31,000 bopd for the full-year. More

Lime Petroleum AS (“Lime Petroleum”) has on 10 August 2022, entered into a sale and purchase agreement with KUFPEC Norway AS (“KUFPEC”), to acquire KUFPEC’s 10 per cent interests in the Yme Field (as defined herein) on the Norwegian North Sea, fora post-tax consideration of US$68.053 million (about NOK 633 million (the “Acquisition”). The Yme Field is operated by Repsol Norge AS.

The Acquisition further strengthens Lime Petroleum’s position as a full-fledged exploration and production player in the Norwegian Continental Shelf, following its acquisition of a 33.8434 per cent interest in the producing Brage Field in2021. Production from the Yme Field will contribute to the Rex Group’s target of reaching production of 20,000 bpd across various geographies. The Yme Field is located in PL 316 and PL316B on the Norwegian Continental Shelf. According to the Norwegian Petroleum Directorate, Yme is a field in the south-eastern part of the Norwegian sector of the North Sea, 130 kilometres northeast of the Ula field (the “Yme Field”). The water depth is 100 metres. The field comprises two separate main structures, Gamma and Beta, which are 12 kilometres apart. The reservoirs are in sandstone of Middle Jurassic age in the Sandnes Formation, at a depth of 3,150 metres. Read More

Lime Petroleum AS (“LPA”) today announced that oil production in July 2022 from the Brage Field in Norway, net to LPA, amounted to 2,999 barrels of oil equivalent per day (boepd). LPA holds a 33.8434per cent interest in the Brage Field. The operator of the Brage Field is Wintershall Dea Norge AS. Read More–>

Global crude/condensates loadings rise in July , Key takeaways for July loadings:

Total OPEC crude loadings stood at around 22mbd in July, approx. 600kbd higher than June, but loadings from the rest of the word (excluding Russia), rose by 1.55mbd over the same period to also reach 22mbd

Russian loadings remain largely unchanged m-o-m at 4.9mbd, but a reduction in flows from the Far East Russia, Siberia and the Baltics was offset by higher Black Sea loadings

Within the core OPEC group, Saudi loadings continued to be the main source of growth, rising by around 700kbd m-o-m to 8.2mbd – the highest monthly total seen since April 2020 – UAE and Iraq loadings also increased m-o-m by a combined 550kbd

Nigerian loadings continued their downward trajectory in July, falling to just 1.2 mbd, a new record low – changes to loadings schedules and more general concerns over the reliability of exports have also dampened traders’ interest

Looking at non-OPEC+ loadings, a key source of growth in July was from the Americas, as the US, Brazil and Mexico all increased loading activity by a combined 600kbd – though Europe is keen on taking more transatlantic crude, stronger Asian demand has pulled more cargoes further east Read More

| Oil and Gas Blends | Units | Oil Price $ | change |

| Crude Oil (WTI) | USD/bbl | $94.36 | Up |

| Crude Oil (Brent) | USD/bbl | $99.81 | Up |

| Bonny Light | USD/bbl | $118.10 | Up |

| Saharan Blend | USD/bbl | $117.77 | — |

| Natural Gas | USD/MMBtu | $8.75 | Up |

| OPEC basket 11/08/22 | USD/bbl | $103.2 | Up |

International Rig Count is up 9 rigs from last month to 833 with land rigs up 12 to 633, offshore rigs down 3 to 200.

| Region | Period | Rig Count | Change from Prior |

| U.S.A | 05 August 2022 | 764 | -3 |

| Canada | 05 August 2022 | 203 | -1 |

| International | July 2022 | 833 | +9 |

President Energy (AIM: PPC), the international energy company announces key highlights from the independently reviewed results from the first six months of the year to 30 June 2022 (“H1”) in Argentina in accordance with Argentine reporting rules.

H1 Argentina Financial Results

Pursuant to the Mini-Bond issued last year and announced in November 2021 and extended earlier this year., President’s Argentina subsidiary, President Petroleum S.A (“PPSA”) as stated in the Company’s announcement on 13 May 2022, the Company is obliged to file auditor reviewed results in Argentina for each calendar quarter.

The results of PPSA for H1 have been reviewed by Crowe, the President Group auditors and are today filed with the relevant Argentine authorities. The results have been determined under Argentine GAAP rules. Such filing does not relate to President Group as a whole, only PPSA. The difference in accounting standards will produce anomalies in the various versions of the accounts.

The H1 Argentina Financial Report, converted from Argentine Peso’s into United States Dollars shows inter alia:

• Turnover in excess of US$18 million. President is currently projecting turnover in Argentina for

the full year in excess of US$40 million

• The results do not include any beneficial impact from the successful new wells in Salta. These

are expected to positively impact results in H2 2022

• Profit before tax* for H1 of US$8.1 million

• During H1 the average oil reference price in Rio Negro for domestic sales was US$54 per barrel

• Currently the reference price for domestic sales in Argentina is US$67 per barrel

• During H1 President exported part of its production on three occasions and partial export of production has continued into Q3 2022. Read More–>

Archer Aviation Inc. announced that it has received a $10 million pre-delivery payment from United Airlines for 100 of the company’s initial production eVTOL aircraft. The payment represents a watershed moment for the eVTOL industry, validating confidence in the commercialization of eVTOL aircraft and Archer’s leadership. United is making the deposit on 100 of Archer’s production aircraft which it agreed to purchase in 2021. Read More–>

Hapag-Lloyd has concluded the first half of 2022 with an EBITDA of USD 10.9 billion (EUR 10 billion). The EBIT rose to USD 9.9 billion (EUR 9.1 billion), and the Group profit climbed to USD 9.5 billion (EUR 8.7 billion).

“We have benefitted from significantly improved freight rates and look back on an extraordinarily strong business performance on the whole in the first half year. At the same time, a steep rise in all cost categories is putting increased pressure on our unit costs,” said Rolf Habben Jansen, CEO of Hapag-Lloyd AG.

Revenues increased in the first half year of 2022 to USD 18.6 billion (EUR 17 billion). This can mainly be attributed to a much higher average freight rate of 2,855 USD/ TEU (H1 2021: 1,612 USD/ TEU) and a stronger US dollar.

Global supply chains remain under significant pressure due to persistent capacity bottlenecks in ports and congested hinterland infrastructures, which together is resulting in longer turnaround times for ships and containers. Overall, transport volumes in the first half of 2022 were on a par with the prior-year level, at approximately 6 million TEU. The result was impacted by significantly higher expenses for container handling and charter ships as well as by a 67 per cent increase in the average bunker consumption price, to USD 703 per tonne (H1 2021: USD 421 per tonne). Read More–>

OilandGasPress Energy Newsbites and Analysis Roundup |Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: @OilAndGasPress on Twitter |