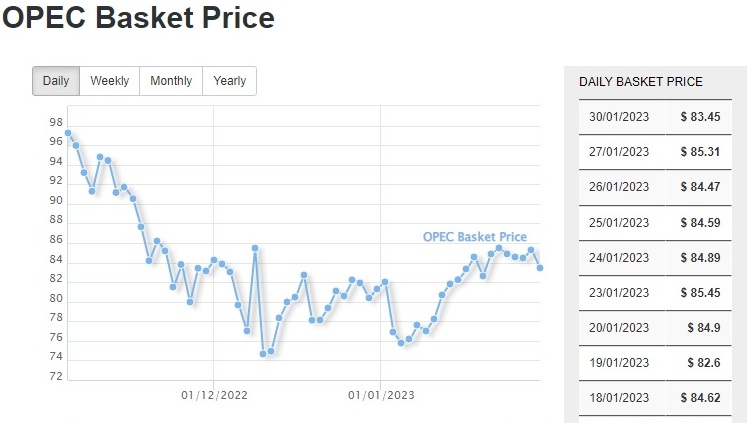

Oilandgaspress Energy Monitor. OPEC daily basket price at US$83.45/bl, 30 Jan. 2023

In its latest monthly World Economic Outlook, the IMF said Global growth is projected to fall from an estimated 3.4 percent in 2022 to 2.9 percent in 2023, then rise to 3.1 percent in 2024. The forecast for 2023 is 0.2 percentage point higher than predicted in the October 2022 World Economic Outlook (WEO) but below the historical (2000–19) average of 3.8 percent. The rise in central bank rates to fight inflation and Russia’s war in Ukraine continue to weigh on economic activity. The rapid spread of COVID-19 in China dampened growth in 2022, but the recent reopening has paved the way for a faster-than-expected recovery. Global inflation is expected to fall from 8.8 percent in 2022 to 6.6 percent in 2023 and 4.3 percent in 2024, still above pre-pandemic (2017–19) levels of about 3.5 percent. It also said that oil prices are set to be lower both this year and next than in 2022, a prediction based on the forecast of lower economic growth in both years. Read More

Shell is set to unveil record profits of more than £30 billion

The corporate giant is expected to say this week that annual profit more than doubled as the war in Ukraine restricted supplies from Russia, sending the price of gas and electricity rocketing. Shell says it expects to pay windfall taxes in the UK and European Union of around £1.6billion Read More

DNO ASA, the Norwegian oil and gas operator, reported the below transactions made under the Company’s share buyback program, which commenced 9 December 2022 and will end no later than 30 April 2023. For further information regarding the program, please see the Company’s stock exchange notification from 8 December 2022. Read More

Nigeria is seeking to overturn a 2017 ruling which ordered it to pay billions in damages after a gas deal with Process & Industrial Development Ltd, or P&ID, went sideways. The contract in question was struck in 2010, when Nigeria agreed to provide two decades’ worth of free gas to a facility P&ID would build in the country in exchange for processed gas for electricity generation. The British Virgin Islands-registered firm claims that the government failed to provide it with natural gas, and so it never built the planned refinery. Nigeria says the deal was fraudulent from the start, and that the company conducted a years-long campaign of bribery and lies involving former government officials to win the contract and compromise the state’s defense in the arbitration — allegations which P&ID staunchly denies. The firm initiated arbitration in 2012, and five years later, a UK court ordered Nigeria to pay P&ID $6.6 billion — an amount that has ballooned to more than $11 billion with interest.The fraud trial opened on Jan. 23 and is due to run for another six weeks. Read More

Dassault Systèmes and IBM announced an extension of their long-standing collaboration with the signature of a memorandum of understanding combining their technologies to address the sustainability challenges affecting asset-intensive industries.

In 2022, sustainability was identified by 58% of Energy and Resources CEOs as their greatest challenge, with 51% of them also considering it as a business opportunity that will drive growth. At the same time, 44% of CEOs cited a lack of insights from data as a problem. (Source: IBV 2022 CEO – Energy & Resources insights)

Today companies are confronted with not only rising energy prices but also supply chain and operational disruptions. These disruptions are due to multiple factors including geopolitical situations, an aging workforce, and climate-related risks. In response to these challenges, deploying new infrastructure quickly and efficiently as well as optimizing the operations of existing assets and extending their lifecycle is crucial. A company’s ability to harness actionable, data-driven insights is key to accelerate the transformation of assets that are safer, more efficient and more sustainable. To help companies ensure business continuity while achieving their sustainability goals, Dassault Systèmes and IBM have decided to combine Dassault Systèmes’ 3DEXPERIENCE platform and virtual twin experiences with IBM’s solutions for Asset Management, Resources Optimization, Environmental Risk Management and ESG governance. Read More

When batteries reach the end of their life, they can all be recycled. The materials recovered can be used in the manufacturing of new batteries, resulting in large sustainability gains. The recycled materials replace the need for newly mined materials, therefore lessening the amount of mining necessary for the clean energy transition and creating a domestic supply. These nascent industries are expanding rapidly and the Bipartisan Infrastructure Law investments are carefully aimed at addressing key challenges in repurposing, recycling, and the uptake of EVs. Read More

The U.S. House of Representatives passed a bill Friday aimed at limiting the president’s ability to draw down the nation’s Strategic Petroleum Reserve for any reason other than a “severe energy supply disruption.” The law is meant to prevent a repeat of President Joe Biden’s numerous withdrawals from the SPR in 2022 that Republicans contend were intended to lower consumer gas prices ahead of the midterm elections. The bill passed on a near party-line vote, 221-205, after more than six hours of individual House votes on various proposed amendments. Read More

Global oil demand is expected to peak between the late 2020s and early 2030s as the Russian invasion of Ukraine is accelerating investment in clean energy and governments are looking to bolster energy security with higher shares of renewables in the energy mix, BP said on Monday.

In one of the most closely-watched industry reports, the BP Energy Outlook 2023 with projections through 2050 says that oil demand falls over the outlook in all three scenarios as use in road transportation declines. Read More

| Oil and Gas Blends | Units | Oil Price $ | change |

| Crude Oil (WTI) | USD/bbl | $77.25 | Down |

| Crude Oil (Brent) | USD/bbl | $84.45 | Down |

| Bonny Light | USD/bbl | $85.86 | Down |

| Saharan Blend | USD/bbl | $85.60 | Down |

| Natural Gas | USD/MMBtu | $2.73 | Down |

| OPEC basket 30/01/23 | USD/bbl | $83.45 | Down |

Dana Incorporated (NYSE: DAN) will release its 2022 fourth-quarter and full-year financial results on Tuesday, Feb. 21, 2023. A press release will be issued at approximately 7 a.m. EST, followed by a conference call and webcast at 9 a.m. EST. Members of the company’s senior management team will be available at that time to discuss the results and answer related questions Read More

Baker Hughes Rig Count

U.S. Rig Count is unchanged from last week at 771 with oil rigs down 4 to 609, gas rigs up 4 to 160 and miscellaneous rigs unchanged at 2.

Canada Rig Count is up 6 from last week to 247, with oil rigs up 4 to 157, gas rigs up 2 to 90.

| Region | Period | Rig Count | Change from Prior |

| U.S.A | 27 January 2023 | 771 | — |

| Canada | 27 January 2023 | 247 | +6 |

| International | December 2022 | 900 | -10 |

The majority of Britishvolt’s 300 staff have been made immediately redundant as the troubled electric car battery maker fell into administration.

The company, which had planned to build Britain’s biggest electric car battery plant in Northumberland, had been on the brink for months.

Administrators at EY said Britishvolt collapsed ‘due to insufficient equity investment’ for both its ongoing research, and the development of its £3.8billion ‘gigafactory’ in the North East and its scale-up hub in the Midlands. Read More

Chevron Corporation (NYSE: CVX) reported earnings of $6.4 billion ($3.33 per share – diluted) for fourth quarter 2022, compared with $5.1 billion ($2.63 per share – diluted) in fourth quarter 2021. Included in the current quarter were $1.1 billion of international upstream write-off and impairment charges, and pension settlement costs of $17 million. Foreign currency effects decreased earnings by $405 million. Adjusted earnings of $7.9 billion ($4.09 per share – diluted) in fourth quarter 2022 compared to adjusted earnings of $4.9 billion ($2.56 per share – diluted) in fourth quarter 2021.

Chevron reported full-year 2022 earnings of $35.5 billion ($18.28 per share – diluted), compared with $15.6 billion ($8.14 per share – diluted) in 2021. Adjusted earnings of $36.5 billion ($18.83 per share – diluted) in 2022 compared to adjusted earnings of $15.6 billion ($8.13 per share – diluted) in 2021. For a reconciliation of adjusted earnings, see Attachment 6.

Sales and other operating revenues in fourth quarter 2022 were $55 billion, compared to $46 billion in the year-ago period. Read More

Shareholders’ Nomination Board, established by Neste Corporation’s Annual General Meeting (AGM) on 4 April 2013, has forwarded to the Board of Directors of the Company its proposals to the 2023 AGM.

Board Members

The Nomination Board proposes that Matti Kähkönen shall be re-elected as the Chair of the Board of Directors. In addition, the current members of the Board, John Abbott, Nick Elmslie, Martina Flöel, Just Jansz, Jari Rosendal, Eeva Sipilä and Johanna Söderström are proposed to be re-elected for a further term of office. The Nomination Board proposes that Eeva Sipilä shall be elected as the Vice Chair of the Board.

Further, the Nomination Board proposes that the Board shall have ten members and that Heikki Malinen and Kimmo Viertola shall be elected as new members.

All persons proposed for Board service have given their consent to serving on the Board and are considered to be independent of the Company and its major shareholders, with the exception of Director General Kimmo Viertola of the Ownership Steering Department in the Prime Minister’s Office of Finland, who is, based on his employment/service relationship, non-independent of the company’s significant shareholder (the State of Finland). Read More

TotalEnergies EP Canada Ltd announces that it has exercised its preemption right to acquire an additional 6.65% interest in the Fort Hills Energy Limited Partnership and associated sales and logistics agreements from Teck Resources Limited, for a consideration of 312 million Canadian Dollars.

Fort Hills is located 90 kilometers North of Fort McMurray in the Province of Alberta. Prior to the transaction, TotalEnergies EP Canada held a working interest of 24.58% in the Fort Hills project, and after the transaction it will hold 31.23%. TotalEnergies EP Canada also holds a 50% working interest in the Surmont project located in the region.

In line with its low-carbon strategy, TotalEnergies announced in September 2022 its intention to exit Canadian oil sands by spinning off TotalEnergies EP Canada in 2023. Through the acquisition of an additional interest in Fort Hills, TotalEnergies EP Canada is building the future for the spin-off entity in an asset with long-term growth potential. The spin-off is planned to be submitted to vote at TotalEnergies’ annual Shareholders’ Meeting in May 2023.

“By seizing this opportunity to grow its business under attractive conditions, TotalEnergies EP Canada will deliver value to the future shareholders of the spin-off entity”, said Jean-Pierre Sbraire, CFO of TotalEnergies. Read More

The Electrification of Everything

Indicators of the all-electric future surround us. California, the EU, and other governments will phase out the sale of gasoline-powered cars and trucks by 2035 and President Biden is planning to transition federal fleets to all-electric vehicles. Space exploration and research will become more common; robots will be used for personal and commercial use; the proliferation of artificial intelligence (AI) and mobile/wearable tech will continue to see exponential growth. Powered by consumer demand, technological advancements, government mandates, and environmental variables, it’s clear that the next ten years will see warp-speed growth into the electrification of everything era. Unfortunately li-ion battery chemistries using graphite anodes currently power all things electric and have reached the ceiling for their potential and no longer meet market expectations, requiring a deep rethink of li-ion chemistry.

To date, energy storage advancements have been incremental for li-ion, resulting in a potential performance that has topped out, approaching the practical limit of current state batteries. However, to meet the forecasted demand, as well as the realities of modern industry, incremental change doesn’t work anymore. We need to shift current li-ion chemestries toward energy storage technologies with better performance: lasting longer (high energy density), charging faster (eliminating charge anxiety), having a lower cost (ensuring widespread adoption), and achieving all of this today, not in five years (immediate scale with drop-in solutions).

While big advances have been made in lithium-ion battery technology, the “it” chemistry platform underlying nearly all things electric, the biggest hurdle to achieving the true goal persists—a transformational drop-in li-ion battery technology that helps bring EVs to cost parity with internal combustion engine cars and enables a new era of efficiency and power for all electronics. The electrification of everything “it” chemistry lies with silicon-based anodes, immediately turning today’s li-ion batteries into lithium-silicon batteries. Read More

As a means of storing and transporting renewable energy, green hydrogen is now considered a critical technology in the transition to renewable energy and the move toward a global net zero economy.There are numerous challenges to effecting such a monumental change in the energy sector, but one that requires a unique and digital response is tracking green hydrogen. Differentiating it from the other color grades — including blue, gray, and pink, which represent production methods with CO2e emissions or using nuclear power or fossil fuels — is critical to the success of decarbonization with green hydrogen. Read More

Chevron Names Mark A. Nelson Vice Chairman

Chevron Corporation (NYSE: CVX) today announced Mark A. Nelson, executive vice president, Strategy, Policy & Development, has been named vice chairman and executive vice president, Strategy, Policy & Development, effective February 1, 2023. In this new corporate officer role, Nelson will continue leading Chevron’s Strategy & Sustainability, Corporate Affairs, and Business Development functions, and take on additional corporate responsibilities. Read More

The Gas Exporting Countries Forum (GECF)today launched the latest edition of its annual Global Gas Outlook 2050 (Outlook), in the presence of the 2023 President of the GECF, HE Gabriel M. Obiang Lima, Minister of Mines and Hydrocarbons, Republic of Equatorial Guinea.

The key findings show that by 2050:

• Global GDP will more than double, from US$ 95 trillion todayto US$ 210 trillion in real term

• Population growth will see 1.8 billion additional people in 2050 with most of this rise taking place in Africa and the Asia Pacific

• Energy demand is expected to rise by 22% by 2050

• Natural gas’ share in the energy mix will go from 23% today to 26% in 2050

• Natural gas supply will increase by 36%

• Natural gas trade will expand by more than a third, led by LNG, which will overtake pipeline trade by 2026

• Upstream investment required over the forecast period is a hefty US$9.7 trillion Read More

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases