Energy News to 03/11/22. OPEC daily basket price stood at $94.74/bl, 02 Nov. 2022

US Federal Reserve, approved a fourth-straight rate hike of three-quarters of a percentage point on Wednesday as part of its aggressive battle to bring down inflation.This is the fourth time in a row they have increased rates. This brings the benchmark lending rate to a new target range of 3.75% to 4%. The highest since January 2008. Bank of England raises interest rates by 0.75% to 3%

The COP27 host nation, Egypt, possesses a raft of natural resources that could help it meet its renewables targets. Together with other countries in the region, it has considerable amounts of available land, year-round sunshine, high wind speeds and proximity to big energy markets in Europe. Egypt has already pledged to increase the shares of solar, wind, hydrogen and hydropower in its energy mix, with the goal of producing 42% of its energy from new and renewable sources by 2035, up from around 20% now. So how exactly does Egypt plan to utilize its renewable potential, and what lessons could it hold for other Middle Eastern and North African nations? Read More

Britain’s car theft capital has been named as Romford, in East London, taking the mantle from neighbouring Ilford, which had earned the unwanted crown last year.

The locations with the worst record for stolen motors were identified by analysing the number of motorists per area who reported a vehicle pinched in the last five years.

Data from 16 million insurance enquiries in the last year found that 19.87 of drivers per 1,000 in the large town in the London Borough of Havering had made a claim after their car was stolen, which is more than anywhere else in the country, says MoneySuperMarket. At the safest end of the table, Inverness in the north of Scotland reported a car theft rate of just 0.08, followed by another Scottish town, Dumfries and Galloway (0.36) and Llandrindod Wells in Wales (0.47). When analysed by region, London is the least secure region for people’s motors, with a car theft rate of 11.55 per 1,000 enquiries. Read More

Eurotherm is a premier provider of temperature, power and process control, measurement and data management equipment, systems, software and services for global industrial markets. The company employs about 650 people worldwide, with headquarters in Worthing, U.K. and core manufacturing operations in Ledziny, Poland. Watlow will establish Eurotherm’s sites in Worthing, U.K. and Dardilly, France as Advanced Development Centers for its electronics and controls product offering and plans to invest in Eurotherm’s facility in Poland to become Watlow’s Manufacturing Center of Excellence in Europe. This additional capacity and capability also provide a path to growth in other parts of the world including the Americas and Asia. Read More

During the period from October 24 to October 28, 2022, Eni acquired n. 12,439,005 shares, at a weighted average price per share equal to 12.6142 euro, for a total consideration of 156,908,552.98 euro within the authorization to purchase treasury shares approved at Eni’s Shareholders’ Meeting on 11 May 2022, previously subject to disclosure pursuant to art. 144-bis of Consob Regulation 11971/1999.

On the basis of the information provided by the intermediary appointed to make the purchases, the following are details of transactions for the purchase of treasury shares on the Euronext Milan on a daily basis: Read More

BIMCO has hired Gudrun Janssens as Manager, Intergovernmental Engagement, at its new office in Brussels, as the organisation seeks to be closer to the EU decision-making process and continue to expand its global reach.Gudrun Janssens comes from a position as Head of Environmental and Technical Affairs at the Royal Belgian Shipowners’ Association, a position she has held since 2019. Prior to this, she held a position as Director, Maritime Safety and Environment at the European Community Shipowners’ Associations in Brussels. She will be joining BIMCO on 1 November 2022 when the new office in Brussels opens. Read More

India has been increasing its oil imports from Russia – so much so that they made up 23% of the country’s total oil intake in September, their highest ever share. India is also now Russia’s second-biggest oil customer after China. The shift is a result of India benefiting from discounted prices for Russian oil, after Moscow lost some of its Western customers because of its war on Ukraine. Read More

QatarEnergy announced an oil discovery in the 4-BRSA-1386D-RJS well in Brazil’s world class Sépia oil field, which is located in the prolific Santos Basin in water depths of about 2,000 meters off the coast of Rio de Janeiro.

QatarEnergy acquired a working interest in the Sépia Co-Participated Area in December 2021 during the 2nd Transfer-of-Rights Surplus Bidding Round, which was organized and managed by Brazil’s National Agency for Petroleum, Natural Gas and Biofuels (ANP). The Area is operated by Petrobras (with a participating interest of about 52%) in partnership with TotalEnergies (19.2%), QatarEnergy (14.4%) and Petronas Petróleo Brasil Ltda (14.4%), with Pre Sal Petróleo S.A. (PPSA) as manager. The Sepia shared reservoir is currently producing about 170,000 barrels of oil per day.

Commenting on this occasion, His Excellency Mr. Saad Sherida Al-Kaabi, the Minister of State for Energy Affairs, the President and CEO of QatarEnergy, said: “We are encouraged by this discovery, which comes as a result of strategic cooperation with reputable partners in our effort to unlock more global energy resources as part of our comprehensive growth strategy. On this occasion, I would like to congratulate our partners, and l look forward to more future achievements.”

The discovery is significant in that the well penetrated a net oil column, which is one of the thickest ever encountered in Brazil. Partners will continue operations to characterize the conditions of the discovered reservoirs and verify the extent of the discovery by conducting well tests. Read More

Aker Horizons ASA (OSE: “AKH”), a developer of green energy and green industry, announced results for the third quarter 2022. The company’s Net Asset Value (“NAV”) fell to NOK 16.5 billion in the three months to 30 September 2022, from NOK 17.4 billion at the end of the previous quarter.

Third-quarter highlights:

The combination of portfolio companies Mainstream Renewable Power and Aker Offshore Wind was completed, establishing Mainstream as a global frontrunner in offshore wind and creating a stronger renewable company with a 19 GW net global pipeline of projects under development, construction and operation across solar, onshore wind and offshore wind

Mainstream and Actis signed an agreement to sell Lekela Power, Africa’s largest pure-play renewable energy independent power producer, to Infinity Group and Africa Finance Corporation Mainstream and its partner Ocean Winds were appointed preferred bidder by Crown Estate Scotland for an area with the potential for a 1.8 GW offshore wind farm off the Shetland Islands in Scotland Aker Horizons signed a land lease agreement and entered a Power Purchase Agreement with the local municipality for the 20 MW first phase of the hydrogen project planned at Rjukan Read More

Zephyr Energy plc announced that it has received approval of its Application for Permit to Drill (“APD”) from the U.S. Bureau of Land Management (the “BLM”), the final regulatory approval required to spud the State 36-2 LNW-CC well on its project in the Paradox Basin, Utah, U.S. (the “Paradox project”). Zephyr simultaneously received approval of its APD for the State 36-3 LN-C9 exploration well, which has been permitted to target the shallower C9 reservoir and which is planned to be drilled from the same well pad.

The State 36-2 LNW-CC well is fully-funded and will target the Cane Creek reservoir. Drilling is planned to a total depth at 20,456 feet measured depth (9,598 feet true vertical depth) incorporating a 10,346 feet horizontal reservoir section. The well’s objective is to further delineate the Cane Creek reservoir beyond the productive State 16-2 LN-CC well and the nearby Federal 28-11 well (which was recently acquired by Zephyr https://www.zephyrplc.com/investors/regulatory-news-alerts/ and is currently shut-in due to infrastructure constraints – details of which were announced by the Company on 14 September 2022). Read More

Gridserve has installed what it says is the UK’s fastest car charger for public usage at its Electric Forecourt in Braintree, Essex. The DC unit is capable of delivering a maximum output of up to 360kW, meaning it can add approximately 100 miles in less than five minutes.

The charger has two CCS connectors with longer cables, contactless payment and easy access for wheelchair users. Its positioning at the site allows for HGVs and cars towing caravans to charge without blocking other users. The installation of this ABB Terra 360 charger is a trial of the technology for Gridserve which, if successful, could become a regular at Electric Forecourts and Electric Super Hubs on the Electric Highway. This latest addition to the site now enables 36 electric cars to be charged simultaneously. The Braintree Electric Forecourt is the fifth most popular charging location in England, according to data from Zap-Map. Read More

U.S. Department of Energy Announces $43 Million to Support the Clean Energy Transition in Communities Across the Country

Research Projects Across 19 States, the District of Columbia, and Puerto Rico Will Help Communities Improve Energy Planning, Increase Grid Resilience, and Restore Power After Disasters Read More

Embraer announced that it has signed several Memorandums of Understanding (MoUs) with the aerospace companies ASTG (Aerospace Technology of Global), EMK (EM Korea Co.) and Kencoa Aerospace, from South Korea with the objective of strengthening collaboration with Korean defense industry partners for the future supply of parts for the C-390 Millennium aircraft. The C-390 Millennium aircraft is competing in the Large Transport Aircraft (LTA) II Program being run by the Defense Acquisition Program Administration (DAPA).

The potential supply of South Korean manufactured parts will contribute to the offset requirements of the LTA II Program. The MoUs intend to create long-term business relationships between the parties which will endure for the LTA II Program and beyond. Local industry capabilities can also be part of future developments within Embraer’s existing platforms such as the C-390 Millennium as well as new aircraft, vehicles, and systems.

“Embraer is very confident on the mutual benefits to be gained from this collaboration, thus creating a sustainable and growing relationship between Embraer and the partners in South Korea”, said Jackson Schneider, President & CEO, Embraer Defense & Security. “By offering more than 50 years of experience in aviation, technology and innovation, Embraer is looking to establish meaningful partnerships in South Korea to create new businesses and solutions.”

The C-390 Millennium and its aerial refueling configuration, the KC-390, are the new generation of multi-mission military transport delivering unrivaled mobility and cargo capacity, rapid re-configuration, high availability, enhanced comfort, as well as optimal management of reduced operational costs throughout its lifecycle, all on a single platform. Read More

| Oil and Gas Blends | Units | Oil Price $ | change |

| Crude Oil (WTI) | USD/bbl | $88.93 | Up |

| Crude Oil (Brent) | USD/bbl | $95.23 | Up |

| Bonny Light | USD/bbl | $97.14 | Up |

| Saharan Blend | USD/bbl | $99.25 | Up |

| Natural Gas | USD/MMBtu | $6.01 | Up |

| OPEC basket 02/11/22 | USD/bbl | $94.74 | Up |

Embraer-X, the disruptive innovation arm of Embraer, for the first time, will be participating in the Web Summit Lisbon 2022, one of the largest technology and innovation event in the world. The company will take part in two panels at the Brasil Apex Pavilion, and will discuss the impacts and new opportunities created by the digital revolution in the mobility segment. The presentations will highlight Embraer’s journey of adopting technologies and digital work, including the decision to create Embraer-X and the incubation of new businesses, such as Eve Air Mobility, a company created to accelerate the development of the urban air mobility industry. In 2020, Embraer-X carried out a successful spin-off process with Eve becoming an independent company with shares traded on the New York Stock Exchange. Eve’s co-CEO André Stein will participate in the Web Summit panel “Eve – 3D mobility is coming to a city near you”, which will take place on Friday, November 4th.

Another business that is being incubated within Embraer-X, is Beacon, they are currently in the acceleration phase and looking for partners to scale up. Beacon is a digital collaboration platform that has already begun to transform aircraft maintenance operations with an initial focus on the concept of rapid return to operations, or RTS (Return To Service). Read More

SAUDIA, the national flag carrier of Saudi Arabia, and Lilium N.V. (NASDAQ: LILM) (“Lilium”), developer of the first all-electric vertical take-off and landing (“eVTOL”) jet, at the sixth edition of the Future Investment Initiative (FII), announced a Memorandum of Understanding (MoU) for the proposed development and operation by SAUDIA of an eVTOL network across Saudi Arabia. The proposed arrangement will make SAUDIA the first airline in the MENA region to purchase 100 Lilium Jets alongside yearly support services.

With zero operating emissions, the Lilium Jet will enable sustainable and time-saving travel. SAUDIA intends to launch a state-of-the-art service with the purchase of 100 Lilium Jets including new electric point-to-point connections as well as seamless feeder connections to SAUDIA’s hubs for business class guests. Lilium Jet’s flexible cabin architecture is expected to enable a range of spacious interior configurations that are well suited to the needs of the premium market, which Lilium believes can help drive the early adoption of eVTOL aircraft required to scale.

SAUDIA also expects to support Lilium with the necessary regulatory approval processes in Saudi Arabia for certification of the Lilium Jet and any other required regulatory approvals. As the national flag carrier of Saudi Arabia, SAUDIA currently serves a network of more than 100 domestic and international destinations with its world-renowned service and hospitality. Lilium and SAUDIA plan to combine SAUDIA’s unrivalled market knowledge and Lilium’s unique eVTOL aircraft to transform the Kingdom’s domestic air transport sector. Captain Ibrahim S. Koshy, Chief Executive Officer of SAUDIA said: “SAUDIA, building on its commitment to be an industry leading airline committed to sustainability, consider our eVTOL network project with Lilium to be an undertaking of great significance for the Kingdom’s aviation industry and will contribute effectively to spurring sustainable tourism in Saudi using zero-emission aviation. SAUDIA intends to meet a growing demand for regional air mobility and offer our valued Guests a superior on-board experience. The potential for such an airborne transit network is limitless”.

Alexander Asseily, Vice Chairman of Lilium said: “We are thrilled to work with innovative partners for whom sustainability is a priority. This partnership with SAUDIA, our first in the Middle East, is an exciting development for Lilium. We look forward to working with SAUDIA to deploy an eVTOL network across Saudi Arabia.”

The proposed arrangement between SAUDIA and Lilium is subject to the parties completing a feasibility assessment, agreeing to commercial terms, and entering into definitive agreements with respect thereto and satisfaction of certain conditions. Read More

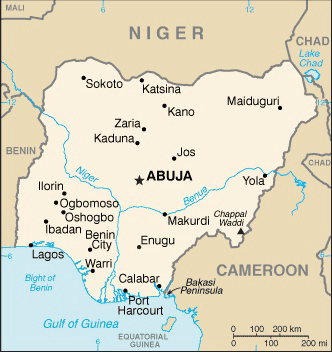

Addax Petroleum exits Nigeria

The Nigerian National Petroleum Company (NNPC) Limited on Tuesday announced it has signed a settlement and exit agreement with Sinopec’s Addax Petroleum Development (Nigeria) to exit its four major oil mining blocks in the country. With this agreement, according to NNPC Limited, Addax has ceased to be the Production Sharing Contract (PSC) contractor for the Oil Mining Leases (OML) 123/124 and OMLs 126/137. The NNPCL Chief Finance Officer, Umar Ajiya, signed the agreement on behalf of the company, while the Managing Director of Addax Petroleum, Yonghong Chen, signed on behalf of his company. The signing of the agreement took place at the NNPC headquarters office in Abuja. “Earlier today, NNPC Limited and Addax Petroleum Development (Nigeria) Ltd signed a Memorandum of Understanding (MoU) on the Transfer, Settlement and Exit Agreement (TSEA) for Oil Mining Leases (OML) 123/124 and OMLs 126/137,” the state oil firm said on its official Twitter page on Tuesday. Read More

After a prolonged dispute that hobbled oil production at Oil Mining Leases (OMLs) 123, 124, 126 and 137, operated by Addax Petroleum Nigeria Limited, the company has reached a close-out and signing ceremony of an asset transfer, settlement and exit agreement with the Nigerian National Petroleum Company Limited (NNPC). A statement from the national oil firm stated that the dispute has now been amicably resolved to pave way for the much-needed investment and growth on the oil blocks. Read More

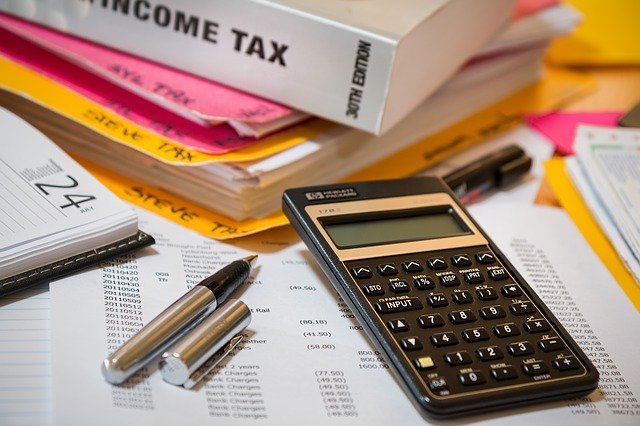

Woodside has paid more than A$13 billion in Australian taxes and royalties since 2011.

Our Australian taxes are paid by a number of Woodside entities: Woodside Petroleum Ltd (now known as ‘Woodside Energy Group Ltd’); and the 90%-owned ‘Burrup’ entities, Burrup Facilities Company Pty Ltd and Burrup Train 1 Pty Ltd, which support our Pluto Project.

The data reported in the Australian Taxation Office (ATO) 2020-21 Report of entity tax information shows that in respect of the financial year ended 30 June 2021, the three Woodside corporate entities had combined taxable income of approximately A$1.5 billion and income tax payable of approximately A$390 million. Our Australian corporate income tax payments were lower in the 2020-21 income year due to losses incurred during the COVID-19 pandemic and associated market conditions. In addition to the ATO data, Woodside reports its Australian tax contributions for the previous calendar year on a cash paid basis.

In 2021, Woodside paid A$658 million in taxes and royalties to the Australian Commonwealth and State governments, which included A$333 million in corporate income tax. This will be significantly higher in 2022. From January to October 2022, Woodside has already paid more than A$2 billion in taxes and royalties, including A$700 million in corporate income tax and A$700 million in Petroleum Resource Rent Tax (see attached Tax Data Information Sheet). Woodside CEO Meg O’Neill said the company had made a significant contribution to Australia’s tax revenue over the past decade.

“Woodside is proud of the contribution we make to the communities where we live and work and we do the right thing when it comes to paying our taxes. As one of Australia’s largest taxpayers, Woodside is subject to the ATO’s Justified Trust program, designed to assure that companies are paying the right amount of tax. “We actively participate in several ESG rating indices and our transparent approach to tax reporting is reflected in our inclusion within the leading group, relative to our industry peers.

“Woodside values the trust of all our employees, joint venture partners, contractors, suppliers and customers, and we know that transparency and accountability are core to maintaining that trust,” she said. Read More

Occidental (NYSE: OXY) announced today that its Board of Directors has declared a regular quarterly dividend of $0.13 per share on common stock payable on January 17, 2023, to stockholders of record as of December 12, 2022. Read More

This year there are six new entrants to the league table. European operator Fastned, which has recently been expanding its UK charging network, has opened a handful of ultra-rapid hubs this year – and enters the list in joint-first place.

On-street provider Connected Kerb has shot into joint-fourth position, after rapid growth this year has seen its network expand to more than 1,000 chargers. Zap-Pay partner Mer also makes the league table for the first time, coming joint-seventh alongside Pod Point and ubitricity.

British smart energy technology business, Indra, has announced the results from the first-ever NHS project to use pioneering Vehicle-to-Grid (V2G) technology, in partnership with Manchester University NHS Foundation Trust (MFT) and Hitachi ZeroCarbon, part of Hitachi Europe. The two-year study, which ended in June 2022, explored the potential cost savings and added benefits of V2G charging for commercial fleets.

The trial involved five Hitachi-funded V2G units, developed by Indra, at sites across Withington Community Hospital and Trafford General Hospital. Results from the trial period show that the Foundation Trust was able to reduce its peak hour use electricity costs by £90 a month, thanks to an average reduction of 6p per kWh, which, over the course of a year, translates into a saving of £1,075. As well as lowering energy bills, the Indra V2G bi-directional electric vehicle (EV) chargers also helped both hospitals reduce their carbon footprint by assisting the national electricity network with load demand by scheduling the hospital vehicles to charge off peak. Results also suggest that the V2G charging had a positive effect on the battery health of the electric vehicle fleet. Read More

Baker Hughes Rig Count

Total U.S. Rig Count 768 with oil rigs 610, gas rigs 156 and miscellaneous rigs 2.

Total Canada Rig Count 212, with oil rigs 145, gas rigs 67.

| Region | Period | Rig Count | Change from Prior |

| U.S.A | 28 October 2022 | 768 | -3 |

| Canada | 28 October 2022 | 212 | +2 |

| International | September 2022 | 879 | +19 |

Greenpeace investigators expose environmental crimes

Every year Greenpeace investigators expose the environmental scandals companies and governments want to hide. Dean Plant, our head of investigations, shares five moments when they made all the difference. Using satellite services, we monitor places that otherwise stay out of sight. Using drones, trackers and covert cameras, we check out areas where we suspect our planet is at risk and plan our next moves. With subscriptions to ship-tracking databases and media outlets, we follow commodities like soya, timber, crude oil and gas, so we can expose the companies that damage our planet and hold them to account. Read More

The burning question at the upcoming 27th UN Climate Conference (COP27) is whether richer, historically more polluting governments are going to pay up for the loss and damage caused by climate change. With final preparations underway, Greenpeace said significant progress can be made on the justice and support countries most impacted by past, present and future climate disasters deserve. The climate crisis could be solved with science, solidarity and accountability, by way of real financial commitments for a clean, safe and fair future for all.

COP27 could succeed if the following agreements were made:

Deliver new money for countries and communities most vulnerable to climate change to address the loss and damages from past, present and near future climate disasters through the establishment of a Loss and Damage Finance Facility.

Ensure US $100bn pledge is implemented to support low income countries to adapt and increase resilience to climate change impacts, honouring the commitment made by rich countries at COP26 to double funding for adaptation by 2025.

See all countries adopt a just transition approach to a fast and fair phase out of all fossil fuel use, including putting an immediate end to all new fossil fuel projects as recommended by the International Energy Agency.

Make it clear that limiting temperature rise to 1.5C by 2100 is the only acceptable interpretation of the Paris Agreement and acknowledge the 1.5°C aligned global phase out dates for the production and consumption of coal, gas and oil.

Recognise the role of nature in climate mitigation, adaptation, as a cultural and spiritual symbol and as a home to diverse flora and fauna. Protecting and restoring nature must be done in parallel to the fossil-fuel phase-out and with the active participation of Indigenous Peoples and local communities. Read More

Criminal elements in Nigeria and politicians that had previously hoarded the local currency brought large funds out from their private vaults in exchange for foreign currencies as CBN announced the deadline for old currency notes to be taken to local banks. FX traders and other Broadstreet analysts believe the naira redesign has spurred dollar purchases by individuals on the black market, where the currency is freely traded – albeit – unregulated. Read More

------------------------------------------------------------------------------------------------ OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: @OilAndGasPress on Twitter |

Oil and gas press covers, Energy, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas, energy monitors,TotalEnergies, Shell, BP, Chevron