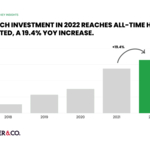

New Data from Net Zero Insights and Alder & Co. Shows Europe Closing Gap in Climate Tech Investment Compared to U.S.

Combined Funding in Europe and North America Reaches an All-Time High of $82B in 2022, with Europe Growing 26% Faster than the U.S.

LONDON & PORTLAND, Ore.–(BUSINESS WIRE)–Net Zero Insights, the leading market intelligence platform for climate tech in Europe and North America together with Alder & Co., a purpose-driven climate tech marketing agency, today announced year-end climate tech investment results for 2022 totaling a record-setting sum of $82 billion, a 20% increase compared to 2021. While the majority, $43.9 billion, came from the U.S., Europe’s total funding reached $35.6B, representing a 33% year-over-year increase, compared to only 7% in the U.S.

Europe’s funding surge of 33% was driven by investments in energy, which saw an increase in funding by 81% ($18.5B), followed by transport ($9.4B), circular economy ($7.1B) and industry ($6B). The sectors showing the strongest growth in Europe are industry (+645%), GHG capture, removal and storage (+457%) and emissions control, reporting and offsetting (+433%). Climate tech companies from the United Kingdom scored the highest funding ($8.1B), followed by Sweden ($7.7B) and Germany ($5.3B). Finland saw the biggest year-over-year growth of any European country driven by four mega-deals respectively across supply chain tracking, climate fintech, quantum computing and circular electronics.

“Unsurprisingly, energy was the strongest sector in Europe, with investors seeing a resurgence of renewable energy projects and technologies to strengthen Europe’s energy independence,” said Frederico Cristoforoni, co-founder, Net Zero Insights. “Europe is also banking on hydrogen and decarbonizing heavy industry.”

In 2022 solutions to decarbonize industry generated momentum as more investment poured into hardware. Even excluding the mega-round raised for H2 Green Steel of $4.54B, (the largest ever climate tech investment in Europe), the industry sector almost doubled year-over-year investment.

H2 Green Steel was far from the only substantially large investment, as mega-rounds accounted for 6.6% of rounds in 2022, showing a growing maturity of the ecosystem. Other mega-rounds included Northvolt, TerraWatt Infrastructure, Flexport and Enpal.

While venture capital and overall funding slowed down in the U.S., the median deal size increased significantly from $2.4M to $5.5M, a growth of 132%. From a challenge perspective, GHG capture, removal and storage was by far the fastest growing sector in the U.S. with a year-over-year growth rate of +1632%, translating to a total of $1.4B.

The recently passed Inflation Reduction Act (IRA) was the single largest investment in climate and energy in American history at $369B. Included within are appropriations of $250B in loans: $11.7B for new loans, $100B for increasing existing loans and $5B for a new loan program, the Energy Infrastructure Reinvestment (EIR).

“We expect 2023 to be a big year for transatlantic partnerships in climate tech,” said Melanie Adamson, chief marketing strategist, Alder & Co. “With European climate tech companies closing the funding gap vis-a-vis their North American counterparts, we’re seeing companies seeking collaboration and expansion opportunities on both sides of the Atlantic.” For more details on climate tech investment by sector, funding, and geography, read the report here.

About Net Zero Insights

Net Zero Insights operates the Net0 Platform – today probably the most comprehensive database of climate tech startups and SMEs operating in Europe and North America. Investors, corporates and decision-makers work with us to gain insight into financial and tech trends by accessing data on funding rounds, activity sectors, technology, patents, contact details, and much more. Find out more: netzeroinsights.com

About Alder & Co

Alder & Co. is a leading, global strategic brand marketing agency with the mission to drive the adoption of climate technologies until they become universal. Alder partners with forward-facing, innovative climate tech companies who need progressive brand & marketing strategies to drive growth, secure investment and make the impact needed to address our generation’s most urgent crisis – our environment. Find out more: alderagency.com

Contacts

Whitney McGoram: whitney@alderagency.com