Energy, Oil and Gas News to 02/02/23

Shell told investors that adjusted earnings before interest, tax, depreciation and amortisation (EBITDA) leapt 53 per cent against the previous year, after energy prices were catapulted higher following the Russian invasion of Ukraine. Adjusted earnings, including taxes, more than doubled to $39.9 billion (£32.2 billion).Shell chief executive Wael Sawan said: ‘Our results in Q4 and across the full year demonstrate the strength of Shell’s differentiated portfolio, as well as our capacity to deliver vital energy to our customers in a volatile world. ‘We believe that Shell is well positioned to be the trusted partner through the energy transition. ‘As we continue to put our Powering Progress strategy into action, we will build on our core strengths, further simplify the organisation and focus on performance. ‘We intend to remain disciplined while delivering compelling shareholder returns, as demonstrated by the 15 per cent dividend increase and the four-billion-dollar share buyback programme announced today.’ Read More

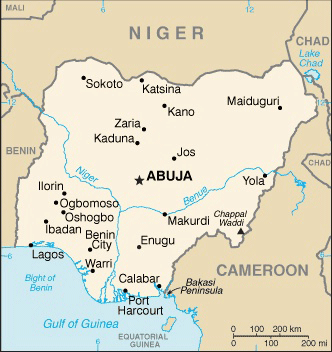

Moody’s Investors Service (“Moody’s”) has downgraded the Government of Nigeria’s long-term foreign-currency and local-currency issuer ratings as well as its foreign currency senior unsecured debt ratings to Caa1 from B3 and changed the outlook to stable. Moody’s has also downgraded Nigeria’s foreign currency senior unsecured MTN program rating to (P)Caa1 from (P)B3. Today’s rating action concludes the review for downgrade initiated on 21 October 2022.Moody’s has also lowered Nigeria’s local currency (LC) and foreign currency (FC) country ceilings to B2 and Caa1 respectively, from B1 and B3 respectively. The LC country ceiling at B2 remains two notches above the sovereign issuer rating, incorporating some degree of unpredictability of government actions, political risk and the reliance on a single revenue source. The FC country ceiling at Caa1 remains two notches below the LC country ceiling, reflecting significant transfer and convertibility risks given the track record of imposition of capital controls in times of low oil prices or falling oil production. Read More

OMV Petrom, the largest integrated energy company in South-Eastern Europe, adds approximately EUR 2 Mn to its contribution for the modernization of the Ploiesti Emergency County Hospital`s operating block. This new contribution comes in addition to the EUR 3 million sponsorship made in 2022. The amount is dedicated to the rehabilitation of the operating rooms by equipping them with modern medical equipment. Ploiesti County Emergency Hospital is the most important medical unit in Prahova County, as it is the only hospital in the area equipped with plastic surgery departments, reconstructive micro-surgery, and treatment of patients with burns. Read More

OMV Petrom Group Report January – December 2022 and Q4/22.Consolidated sales revenues of RON 61,344 mn for 2022 increased by 136% compared to 2021, mainly supported by higher commodity prices and higher sales volumes of petroleum products and electricity, partly offset by lower gas sales volumes. Refining and Marketing segment represented 51% of total consolidated sales, while Gas and Power segment accounted for 49%. Sales from Exploration and Production segment accounted only for 0.1% after the divestment of Kazakhstan subsidiaries in Q2/21 (sales in Exploration and Production being largely intra-group sales rather than third-party sales). Base dividend proposal for 2022: RON 0.0375/shareiv, up 10% yoy; a special dividend is also planned to be paid in 2023, with the exact value to be announced in mid-2023 Read More

OMV Group Report January – December and Q4 2022. Clean CCS Operating Result grew slightly to EUR 2,101 mn, due to better performance in Refining & Marketing and Exploration & Production

Clean CCS net income attributable to stockholders of the parent decreased to EUR 700 mn; clean CCS Earnings Per Share were EUR 2.14

Cash flow from operating activities excluding net working capital effects decreased to EUR 1,233 mn

Organic free cash flow before dividends totaled EUR 534 mn

Clean CCS ROACE stood at 19%

Total Recordable Injury Rate (TRIR) was 1.23

Regular dividend per share of EUR 2.80 proposed2, up 22% compared to the previous year. In addition, special dividend of EUR 2.25 proposed Read More

Shell’s profits increased to £32 billion ($39.9bn) in 2022 due to soaring oil prices in the wake of Russia’s invasion of Ukraine.

The figure presented the company’s highest profit in its 115-year history and surpassed the expectations of industry experts.

It comes amid continued questions over the scale of windfall taxes on energy producers, which have benefited from higher prices. Read More

Enagás subsidiary Scale Gas and Knutsen inaugurate the first LNG supply ship to be built in Spain and will have Barcelona as its base port Read More

The US Coast Guard released the Maritime Cybersecurity Assessment & Annex Guide (MCAAG), to help Maritime Transportation Security Act (MTSA)-regulated facilities and other Marine Transportation System (MTS) stakeholders address cyber risks. Read More

Ofgem statement on British Gas prepayment meter installations

An Ofgem spokesperson said: “These are extremely serious allegations from The Times. We are launching an urgent investigation into British Gas and we won’t hesitate to take firm enforcement action. “It is unacceptable for any supplier to impose forced installations on vulnerable customers struggling to pay their bills before all other options have been exhausted and without carrying out thorough checks to ensure it is safe and practicable to do so.

“We have launched a major market-wide review investigating the rapid growth in prepayment meter installations and potential breaches of licences driving it.

“We are clear that suppliers must work hard to look after their customers at this time, especially those who are vulnerable. The energy crisis is no excuse for unacceptable behaviour towards any customer, particularly those in vulnerable circumstances.” Read More

Aneo buys two Swedish wind farms in an acquisition valuing the farms in excess of 100 MEUR. The investment is Aneo’s first outside Norway.

Aneo’s overall growth target is 10 to 12 TWh wind power by 2030, and Sweden is one of the most important regions for the company’s growth strategy.

— The acquisition of the Grimsås og Brännliden wind farms is an important first step towards establishing Aneo as a fully integrated wind power player in Sweden, says EVP Growth Renewable Energy in Aneo, Kari Skeidsvoll Moe. Power to 18.000 Swedish households Read More

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: @OilAndGasPress on Twitter |

Oil and gas press covers, Energy Monitor, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas, energy monitors,TotalEnergies, Shell, BP, Chevron