Energy / Automotive News As Reported to 9 Feb 2023

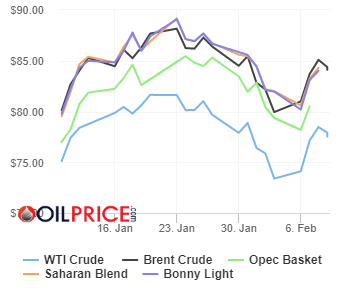

OPEC daily basket price at US$81.86/bl, WTI Crude stood at $77.424/bl

APA Corporation announced the successful drilling and flow testing of the Sapakara South-2 (SPS-2) appraisal well, the second appraisal well to test the previously announced discovery. The well is located approximately 4.6 kilometers (3 miles) south of the Sapakara South-1 (SPS-1) appraisal well.

SPS-2 encountered approximately 36 meters (118 feet) of net oil pay in high-quality Campano-Maastrichtian reservoir. Data collected from the flow test and subsequent pressure build-up indicated incremental connected resource of more than 200 million barrels (MMbbls) of oil in place. Read More

Odfjell SE Board of Directors have approved a dividend payment of USD 0.61 per share based on the Company’s second half 2022 financial result.

Key information relating to the dividend payment:

Declared dividend: USD 0.61 per outstanding share

Declared currency: NOK, based on the spot Bloomberg USDNOK fix (BFIX) at 12:00hrs CET on 9 February 2023

Last day including: 10 February 2023

Ex-div date: 13 February 2023

Record date: 14 February 2023

Payment date: 21 February 2023

Please note the correct ex-div date will be 13 February 2023, not 10 February 2023 as informed in the 4Q22 report. Read More

Flotation Energy and Vårgrønn leading developers and owners of offshore wind projects, have submitted a Marine Licence application for the Green Volt floating offshore windfarm. This consent application could allow the project to start generating power in the mid-2020s, making it the most advanced oil and gas decarbonisation project in the UK. Flotation Energy and Vårgrønn are applying for a lease for Green Volt under the Crown Estate Scotland’s Innovation and Targeted Oil and Gas (INTOG) round.

Located 80km east, offshore from Peterhead, the Green Volt project will use up to 35 floating wind turbines to deliver 500 MW of renewable energy. This project has the potential to generate enough green power to electrify all major oil and gas platforms in the Outer Moray Firth area. The project will also deliver renewable electricity to consumers across the UK.

Offering affordable and reliable electrification from 2026, the Green Volt floating offshore windfarm will enable oil and gas operators to play a critical role in the energy transition. The project will dramatically reduce greenhouse gas emissions from oil and gas platforms, saving over a million tonnes of carbon each year.

Green Volt will support The North Sea Transition Deal’s goal to halve offshore emissions by 2030, as well as making a significant contribution to meeting Scotland’s 2045 Net Zero target.For further information, please contact: Natasha Chudasama , flotationenergy@pagodapr.com, Pagoda Public Relations Read More

Mitsubishi Power, a power solutions brand of Mitsubishi Heavy Industries, Ltd. (MHI), has received an order for two M701F gas turbines, two steam turbines, and auxiliary equipment for expansion of Talimarjan Thermal Power Plant (TPP) located in the south of the Republic of Uzbekistan. Mitsubishi Power’s client for the project is Intecsa Ingenieria Industrial S.A., a Spanish engineering firm specialized in fertilizers, power generation, refining, petrochemical, recycling, mining and new energies. The operation of this plant is scheduled in 2025. The event marks Mitsubishi Power’s second order for core components at the Talimarjan TPP, following receipt of an order for two sets of M701F gas turbines and generators for the TPP’s Unit 1 in 2013. The new power generation facilities are aimed to provide reliable power supply to consumers in Samarkand and Bukhara regions, seven pumping stations on the Karshi main canal and many other settlements. The operation of this plant will additionally produce 7.2 million MWh of power per year. Mitsubishi Power’s high-efficiency gas turbines will enable a savings of 520 million cubic meters of natural gas, resulting in a reduction in carbon emissions by 1,500 tonnes per year. Mitsubishi Power will supply the core components of the gas turbine combined cycle (GTCC) plant from Japan, including the M701F gas turbines, steam turbines, generators and auxiliary equipment. The gas turbines will be manufactured at the Takasago Machinery Works (Takasago, Hyogo), and the steam turbines at the Hitachi Works (Hitachi, Ibaraki). The generators will be manufactured by Mitsubishi Electric Corporation. Mitsubishi Power’s F Series gas turbines can accommodate diverse fuels, and since their market launch in 1991, Mitsubishi Power’s power generation gas turbines, recognized for their high efficiency and operability, have attracted expanding orders worldwide, with cumulative orders currently exceeding 300 units. Read More

DNO ASA reported record revenues of USD 1,377 million and operating profit of USD 431 million in 2022, driven by high oil and gas prices and solid operational performance but tempered by non-cash North Sea impairments of USD 371 million. DNO exited the year with cash deposits of USD 954 million and net cash of USD 388 million on the back of an all-time high free cash flow of USD 619 million. The Company slashed its borrowings through bond repurchases of USD 264 million and repayment of USD 60 million of reserve-based bank loans. Cash was returned to shareholders through quarterly dividends totaling USD 73 million and share buybacks totaling USD 12 million, representing a fourfold increase in shareholder distributions from a year earlier. “The Company stepped up payouts as a pivot towards shareholders who ultimately rank highest among our stakeholders,” said DNO’s Executive Chairman Bijan Mossavar-Rahmani. Gross operated production in the Kurdistan region of Iraq averaged 107,600 barrels of oil per day (bopd) in 2022, of which the Peshkabir field contributed 62,000 bopd and the Tawke field 45,100 bopd. Of the total, 80,700 bopd were net to DNO. Read More

DNO ASA announced that pursuant to the authorization granted at the Annual General Meeting held on 25 May 2022, the Board of Directors has approved a dividend payment of NOK 0.25 per share to be made on or about 22 February 2023 to all shareholders of record as of 15 February 2023. DNO shares will be traded ex-dividend as of 14 February 2023.

Dividend amount: NOK 0.25 per share

Declared currency: NOK

Last day including right: 13 February 2023

Ex-date: 14 February 2023

Record date: 15 February 2023

Payment date: 22 February 2023 (on or about)

Date of approval: 8 February 2023, based on authorization granted 25 May 2022 Read More

Basin Transit Authority (MBTA) has authorized, on behalf of the California Association for Coordinated Transportation (CALACT), Endera for their B-Series all-electric buses in the largest statewide purchasing contract in US history. Endera was awarded the contract for up to 1,000 electric shuttles through its distribution partner, Coachwest Luxury & Performance Motorcars (Coachwest). CALACT association’s membership of transit agencies, as well as city and county governments, can now purchase Endera’s B-Series all-electric shuttles through a streamlined process which complies with federal and state purchasing regulations.

CALACT is the largest state transit association in the United States and helps fleet operators avoid lengthy and expensive individual procurement efforts. With over 300 members, CALACT works to promote professional excellence, stimulate ideas for effective community transit, and advocate for improved public transportation in all parts of California.An estimated 1,000 electric shuttles are expected to be purchased from the CALACT contract by 2025, with additional electric buses procured over the entire 5-year contract period, making it the most of any state purchasing contracts for electric buses in the United States. Read More

Global EV battery market share in 2022

Chinese companies, including CATL and BYD, saw explosive growth in the power battery market last year, while Korean and Japanese manufacturers were not performing as brightly, according to a report today by South Korean market research firm SNE Research. For the full year 2022, total battery consumption for EVs registered in each country, including BEVs, PHEVs and HEVs, was 517.9 GWh, up 71.8 percent from 301.5 GWh the previous year, according to the report. CATL’s installed power battery volume in 2022 was 191.6 GWh, up 92.5 percent year-on-year, and continues to rank first in the world with a 37.0 percent share. LG Energy Solution of South Korea had an installed base of 70.4 GWh in 2022, up 18.5 percent year-on-year, ranking second in the world with a 13.6 percent market share. BYD had 70.4 GWh of power batteries installed in 2022, up 167.1 percent from 26.4 GWh in 2021, ranking third in the world with a 13.6 percent share of the global total. Read More

Watson Farley & Williams (“WFW”) has advised Bayerische Landesbank (“BayernLB”) on a €15m loan granted to Blue Elephant Energy GmbH (“Blue Elephant”) to refinance an Italian solar PV portfolio it owns via its subsidiary BEE Piemonte S.r.l. The facility will also finance the costs for revamping of the portfolio.

The portfolio comprises six solar PV parks located in Piedmont in northern Italy. Operational since 2011, the portfolio has a total installed capacity of circa 4 MW and it benefits from feed-in tariffs provided by Gestore dei Servizi Energetici – GSE S.p.A. (“GSE”), the Italian government body promoting renewable energy and energy efficiency.

Munich-based BayernLB is one of Germany’s five publicly regulated Landesbanken. Majority-owned by the State of Bavaria, it is Germany’s seventh largest financial institution. Blue Elephant acquires and operates solar parks and wind farms in eight countries with a focus on Western-Europe. Its renewable energy assets contribute to the supply of sustainable energy by saving more than 699,000 tons of CO2 and providing more than 540,000 households with clean energy in 2022.

The WFW Italy Finance team that advised BayernLB was led by Banking & Finance Counsel Matteo Trabacchin, working closely with Finance Partner Mario D’Ovidio, assisted by Associates Dario Matrecano, Daniele Sani and Giulia Chiarvesio, and Trainee Marta Lomuscio. Administrative Law Partner Tiziana Manenti provided advice on regulatory matters of the transaction, assisted by Senior Associates Cristina Betti and Anthony Bellacci. Read More

Watson Farley & Williams (“WFW”) has advised Tor Boreas Ltd. (“Tor Boreas”) on the senior and junior bond financing of a windfarm support vessel to be constructed at Tor’s facilities in Turkey, delivered to Tor Boreas and operated by Tor Group in the UK. The bonds are listed on The International Stock Exchange.

Tor Boreas is part of UK-headquartered shipbuilder the Tor Group. This transaction represents a further step in the group’s ongoing diversification plan.

The WFW London Assets and Structured Finance team advising Tor Boreas was led by Partner Patrick Moore working closely with Senior Associate Emeline Yew. Partner Simon Ovenden and Associate Chris Madoc-Jones advised on the Capital Markets aspects of the deal.

Patrick commented: “It was a pleasure to advise Tor Boreas on this transaction. This deal highlights WFW’s reputation as asset finance and capital markets experts in the maritime sector and further adds to our extensive credentials advising on offshore support vessel transactions”. Read More

Peel Hunt advised Diversified Energy Company on its successful US$163.0m fund raise by way of placing and Retail Offer on the REX Platform.

Diversified Energy Company announced that it had successfully raised gross proceeds of US$163.0 million (approximately £134.9 million) (US$156.4 million net of expenses, approximately £129.4 million net of expenses), by way of a placing of new ordinary shares of £0.01 each in the Company and an offer by the Company on the REX Platform of new ordinary shares of £0.01 each in the Company.

The Fundraising was completed at a price of 105 pence per Fundraising Share. The Fundraising Shares will, subject to the passing of the Resolutions at the General Meeting and Admission, represent 15.2% of the Company’s existing ordinary share capital, or 128,444,000 new Ordinary Shares in total. The Fundraising Price is equal to a 5.2% discount from the closing mid-market price on 8 February 2023. Diversified Energy Company consulted with and received strong support from many of its largest shareholders prior to the Fundraising. The Company’s management team actively participated in the structuring and allocation of the Fundraising and were advised by Peel Hunt, Stifel and Tennyson Securities acting as Joint Global Coordinator and Joint Broker. The fundraise will partially fund the acquisition of c.17Mboe/d production and c.25MM PDP reserves in the Central Region from Tanos Energy representing $250m. Read More

Sunrise Joint Venture (SJV), comprising TIMOR GAP (56.56%), Operator Woodside Energy (33.44%), and Osaka Gas Australia (10.00%), hereby jointly affirms its commitment to undertake a concept select program for the development of the Greater Sunrise fields. The SJV will consider all of the key issues for delivering the gas, for processing and LNG sales, to TimorLeste compared to delivering the gas to Australia. The studies will incorporate and update previous work by utilising the latest technologies and cost estimates

while also considering the socio-economic, capacity building, safety, environmental, strategic and security benefits of the various options. The studies will include evaluation of which option provides the most meaningful benefit for the people of Timor-Leste. The SJV is aiming to complete the concept select program expeditiously given the benefits that could flow from developing the Sunrise fields. TIMOR GAP President and CEO Antonio de Sousa said he was pleased that TIMOR GAP’s efforts have substantially contributed towards realising the long-awaited goal of developing Greater Sunrise. Read More

| Oil and Gas Blends | Units | Oil Price $ | change |

| Crude Oil (WTI) | USD/bbl | $77.53 | Down |

| Crude Oil (Brent) | USD/bbl | $84.11 | Down |

| Bonny Light | USD/bbl | $84.01 | Up |

| Saharan Blend | USD/bbl | $84.30 | Up |

| Natural Gas | USD/MMBtu | $2.43 | Down |

| OPEC basket 08/02/23 | USD/bbl | $81.86 | Up |

Fukuoka Prefecture, Commercial Japan Partnership Technologies Corporation (CJPT), and Kyushu Railway Company (JR Kyushu) have entered an agreement to conduct trials of a small fuel cell electric bus (FC bus) that runs on hydrogen, an environmentally-friendly next-generation energy source, on the BRT Hikoboshi Line (officially “Hitahikosan Line BRT”), a bus rapid transit system planned for launch around the summer of 2023.

This initiative will be the first implementation of the partnership agreement between Fukuoka Prefecture and CJPT, entered into on December 26 last year, to expand commercial FC mobility and create a sustainable hydrogen society with the aim of achieving carbon neutrality. Fukuoka Prefecture and CJPT will work with JR Kyushu to hold the trials with a view to bringing FC mobility to local transportation.

With the cooperation of communities along the line, JR Kyushu is working toward the launch of the BRT Hikoboshi Line, which is under development based on the concept of being “kind to people, communities, and the future.” Expectations are that the trials of a next-generation small FC bus will further advance efforts toward regional development as an environmentally friendly transportation option. Read More

A review article by a team of researchers supported by the Toyota Mobility Foundation (TMF) has been published in the International Journal of Hydrogen Energy, a world-renowned scientific journal issued by the Dutch academic publisher Elsevier.To realize a decarbonized society, the introduction of a large amount of renewable energy is essential. However, renewable energy is characterized by the fact that its ability to generate power fluctuates depending on the weather and the time of day. There is hope that hydrogen can serve as a regulating force to adjust such fluctuations in power, and water electrolysis is a key technology for converting that energy.

This review article investigated a wide range of issues for each major water electrolysis method, such as restrictions on using renewable energy as a power source for water electrolysis, the durability of water electrolyzers, and catalyst degradation. It then described the performance requirements for water electrolysis systems and materials that can adapt to renewable energy fluctuations and the issues that need to be discussed going forward. Read More

The new “garden” near the main entrance of Toyota West Virginia supercharges the idea of “flower power.”

Five recently installed SmartFlower solar arrays help power the facility’s employee services buildings, which are home to popular destinations like the uniform store, footwear store, credit union, clinic and pharmacy. The flowers also help power three EV charging stations.Much like a sunflower, SmartFlowers bloom at sunrise and follow the sun’s path throughout the day, allowing them to effectively capture the sun’s rays. Because they maintain a 90-degree angle to the sun, the power they produce is optimized over that of traditional solar panels. At sunset, the flowers fold back up and await sunrise the following morning. The petals are self-cleaning, lined with tiny brushes that remove dirt and debris when they open and close. Read More

Baker Hughes Rig Count

International Rig Count is up 1 rig from last month to 901 with land rigs down 9 to 675, offshore rigs up 10 to 226.

U.S. Rig Count is down 12 from last week to 759 with oil rigs down 10 to 599, gas rigs down 2 to 158 and miscellaneous rigs unchanged at 2.

Canada Rig Count is up 2 from last week to 249, with oil rigs up 2 to 159, gas rigs unchanged at 90.

| Region | Period | Rig Count | Change from Prior |

| U.S.A | 03 February 2023 | 759 | -12 |

| Canada | 03 February 2023 | 249 | +2 |

| International | January 2023 | 901 | +1 |

The second generation Toyota C-HR will be produced at Toyota Motor Manufacturing Turkey (TMMT) in Sakarya. Available in hybrid and plug-in hybrid versions, the new Toyota C-HR will also be the first plug-in hybrid passenger car to be produced in Turkey. In addition, TMMT will be Toyota’s first European plant to start producing plug-in hybrid vehicles, and the first to be equipped with a battery production line.

The 100% electrified powertrain line-up of the new Toyota C-HR reflects Toyota’s commitment to offer appropriate carbon reduction opportunities to the largest and most competitive market segment in Europe. In addition to the hybrid version, the new plug-in hybrid Toyota C-HR with locally assembled batteries will further expand Toyota’s multi-technology offer towards its target of 100% CO2 reduction in its vehicle line-up in Europe1 by 2035.

Start of plug-in hybrid vehicle and battery production marks a strategic milestone in Europe

Alongside the vehicle production line, TMMT will build a new plug-in battery assembly line with a capacity of 75,000 units per year within its facility. Plug-in hybrid battery assembly will start in December 2023, creating around 60 new skilled jobs.

The creation of a battery assembly line in TMMT is a strategic milestone for Toyota’s electrification transformation and will also support other Toyota Europe plants in the future with capable manpower and know-how. Total investment for this project will be around €317million, bringing the overall cumulative investment in TMMT to around €2.3billion. In scope of the new model investment, TMMT will improve and enhance its production line, whilst laying down the framework to meet the future requirements of production diversity and flexibility – a key factor in Toyota Europe’s business sustainability strategy. Read More

LUKOIL and KazMunayGas signed several agreements today in Astana regarding the Kalamkas-Sea, Khazar, Auezov project in the Kazakhstan sector of the Caspian Sea. The agreemnets will come into force following the completion of the sale and purchase transaction between LUKOIL and KazMunayGas that will result in both companies holding equal shares in the operating company for the project. Read More

GE Digital, an integral part of GE Vernova’s portfolio of energy businesses, today announced new enhancements to its cloud-based Manufacturing Execution Systems (MES) software in the Proficy Smart Factory portfolio at the 27th Annual ARC Industry Forum currently taking place February 6–9 in Orlando, Florida. Lowering capital expenditures (CAPEX) and operating expenses (OPEX) compared to on-premises implementations, the Proficy Smart Factory cloud MES software can help process, discrete, and mixed-environment manufacturers of any size to reduce total cost of ownership (TCO) up to 30%, decrease maintenance, and improve security.

Fully hosted as a managed service, Proficy Smart Factory cloud MES provides companies with the robust, composable no-code technology to improve their operations in real-time, along with the flexibility to deploy in a way that best suits their needs. Manufacturers can decrease maintenance resource overhead and increase performance with the latest features and newest software releases provided quickly through the cloud infrastructure. With a cloud-based, managed MES solution, manufacturers will no longer have to worry about patching the OS and supporting software; additionally, manufacturers can increase security through software managed at scale including GE Digital-managed security updates. Read More

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: @OilAndGasPress on Twitter |

Oil and gas press covers, Energy Monitor, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas, energy monitors,TotalEnergies, Shell, BP, Chevron