Renault Group Group’s release consolidated results for 2025 H1

Strengthens its presence in India

Appoints New Head of Investor Relations

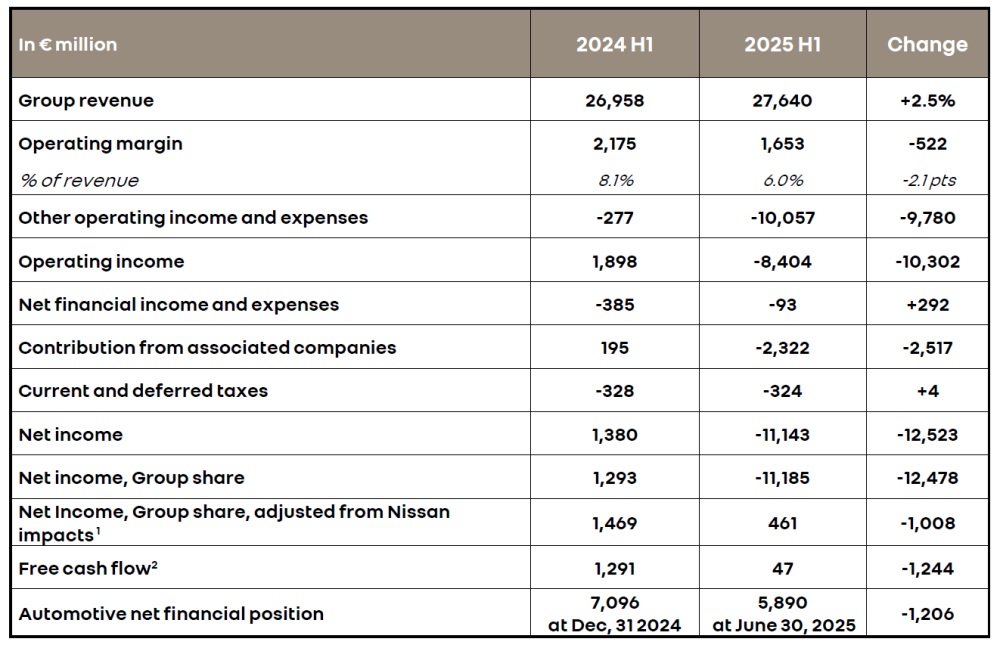

London, August 01, 2025, (Oilandgaspress) –––Group revenue reached €27,640 million, up 2.5% compared to 2024 H1. At constant exchange rates[6], it increased by 3.6%.

Automotive revenue stood at €24,490 million, up 0.5% compared to 2024 H1. It included -1.1 points of negative exchange rates effect (-€264 million) mainly related to the devaluation of the Turkish lira, Brazilian real and Argentinean peso. At constant exchange rates[6], it increased by +1.6%.

The Group posted an operating margin of €1,653 million or 6.0% of revenue versus 8.1% in 2024 H1.

Automotive operating margin stood at €989 million versus €1,600 million in 2024 H1. It represented 4.0% of Automotive revenue, versus 6.6% in 2024 H1.

The contribution of Mobilize Financial Services (Sales Financing) to the Group’s operating margin reached €668 million, up €75 million vs. 2024 H1, mainly thanks to the continuous strong growth of the customer financing activity as well as the positive margin evolution.

Other operating income and expenses were negative at -€10.1 billion (vs -€0.3 billion in 2024 H1). It mainly included the non-cash loss linked to the change of the accounting treatment of Renault Group’s stake in Nissan for -€9.3 billion[8] (cf press release of July 1, 2025).

1 – H1 2024: +€264m positive contribution in associated companies, -€440 million capital loss on the disposal of Nissan shares.

H1 2025: -€2,331m negative contribution of associated companies, and -€9,315 million loss resulting from the evolution of the accounting treatment for the investment in Nissan.

2 – Free cash flow: cash flows after interest and tax (excluding dividends received from publicly listed companies) minus tangible and intangible investments net of disposals +/- change in the working capital requirement, and minus cash flows relating to material non-recurring and long-standing litigations.

From 2025 onwards, cash flows relating to material non-recurring and long-standing litigations will be excluded from free cash flow, in order to better reflect cash flows of the ordinary activities of the Automotive business. Payments made in respect of such flows represent -83 million euros at end-June 2025 and mainly relate to settlements of tax litigations from previous financial years. Free cash flow for 2024 H1 has been restated accordingly and increased by 34 million euros.

Information Source: Read More

energy news,oil market ,gas prices ,Oil and gas press, Energy , Climate, Gas,Renewable, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas,

London, August 01, 2025, (Oilandgaspress) –––Renault Group is accelerating its development in India, one of the most dynamic automotive markets in the world. As part of its strategy to make the country a key international hub, the Group has taken a major step forward by acquiring Nissan’s remaining 51% stake in their joint plant in Chennai (Renault Nissan Automotive India Private Ltd – “RNAIPL”), thus becoming its sole owner. RNAIPL will now be fully consolidated in Renault Group’s consolidated financial statements. This move is part of a broader momentum, highlighted by the opening of Renault Group’s largest design center outside France, announced in April, and the launch of the New Renault Triber — the first model in an ambitious product offensive that will include four new vehicles. The company aims to strengthen its sales in the Indian market and expand its exports from this major industrial hub. To support this transformation, Stéphane Deblaise will take over as CEO of Renault Group in India, effective September 1, 2025.

Renault Group looks to India as a key driver of international expansion

Renault Group now fully owns its Chennai plant, renowned for its operational excellence. This strategic move strengthens the Group’s ambition to make India a key pillar of its international growth.

Information Source: Read More

London, August 01, 2025, (Oilandgaspress) –––Renault Group announces the appointment of Florent Chaix, currently Investor relations manager, to the position of Head of Investor relations, effective immediately. He succeeds Philippine de Schonen, who will oversee a transition period and retain her role as Director of Mergers and Acquisitions before leaving the company on September 12, 2025, to pursue a new professional challenge. Florent Chaix reports to Duncan Minto, Chief Financial Officer of Renault Group.

Information Source: Read More

energy news,oil market ,gas prices ,Oil and gas press, Energy , Climate, Gas,Renewable, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas,