ADNOC Announces Inaugural Credit Rating

Abu Dhabi National Oil Company (“ADNOC”) announced today, that it has created a new, wholly owned subsidiary, ADNOC Murban RSC Ltd (“ADNOC Murban”), which will become the primary debt capital markets issuing and rated entity for ADNOC Group.

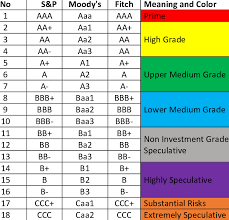

ADNOC Murban is expected to be rated “AA” by Standard & Poor’s (“S&P”), “Aa2” by Moody’s Investor Services (“Moody’s”) and “AA” by Fitch Ratings (“Fitch”) – aligned with ratings assigned to ADNOC’s shareholder, the Emirate of Abu Dhabi.

These strong ratings reflect ADNOC’s conservative and robust financial profile, resilient operations, and the low cost and low carbon intensity of ADNOC Murban’s onshore production.

ADNOC expects to maintain the “AA” instrument rating provided by Fitch of the 2024 ADNOC Distribution exchangeable bonds (ISIN: XS2348411062). Separately, ADNOC has requested the withdrawal of its Group-level credit rating, first assigned by Fitch in February 2019, given the establishment of ADNOC Murban as ADNOC’s primary capital markets issuing and rated entity.

ADNOC Murban intends to closely monitor market conditions and explore potential funding opportunities.

Information Source: Read More–>

Oil and gas, press , | Energy, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Electric,