Apex International Energy Issues Upbeat Operations and Commercial Update

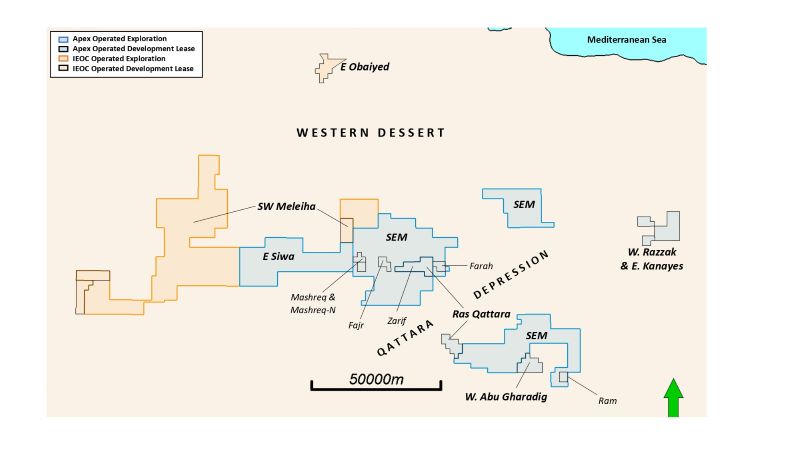

London, July 01 2024 , (Oilandgaspress) ––– Apex International Energy (Apex or the “Company”) today provided an update on operations and commercial developments from its eight concessions (6 operated) in the Western Desert oil producing region of Egypt for the first half of 2024.

Operations Overview

To date in 2024, Apex has drilled 10 wells. Six of the 10 drilled wells are currently producing, one has been completed as a water supply well for a water injection project, two are discoveries waiting on completions and one was a dry hole. The drilling campaign utilizing the EDC-65 rig has focused on continued development of Apex’s Fajr and Farah fields, delineation of the Mashreq-N and RAM fields and exploration, all in the Southeast Meleiha (SEM) concession, and drilling a commitment well in the Zarif field in the Ras Qattara concession.

The most recent Fajr well, the Fajr-40, tested at a sustained rate of 500 barrels of oil per day (bopd) from the Upper Bahariya (UBAH) formation in late May and has now been placed into production. The successful test of the UBAH establishes the viability of further development of this horizon in the Fajr field area as well as the later recompletion to the UBAH formation in the existing Middle Bahariya (MBAH) producers once the MBAH is depleted in those wells.

In the Zarif field, the Zarif 47 drilled in February 2023, which was the last commitment well under the old Ras Qattara concession agreement, and the Zarif 49 drilled in April 2024, which is one of two commitment wells required under the newly signed Ras Qattara concession agreement, were both completed as producers in the UBAH and placed into production earlier in the second quarter.

The RAM-3 well drilled in May provided further delineation of the RAM field in the Qattara Depression (discovered August 2023) and tested gas and condensate from the Lower Bahariya and Middle Bahariya. The well will be temporarily abandoned for a possible future gas completion, potentially in conjunction with future deep gas exploration prospects in the vicinity.

In its non-operated concessions (25% interest; IEOC-operated), gas production from the Faramid project in the East Obaiyed concession has remained stable at approximately 23 million cubic feet per day, or 3,830 boepd (960 boepd net to Apex) from two wells. In the South West Meleiha concession, the SMEL C-1X exploration well encountered oil in the Bahariya formation and was placed on production in May at a rate of approximately 400 bopd (100 bopd net to Apex).

Total working interest production has hit 12,000 boepd on several occasions and averaged between 11,500-12,000 boepd throughout 1H 2024, placing Apex amongst the top 10 liquids producers in Egypt.

On the exploration front, in the Qattara Depression in the SEM concession, drilling of the SEMR-D1X exploration well started in late May. The well reached TD at approximately 9,000 feet-MD. The well encountered 81 feet of continuous, highly porous gas pay in the Dabaa formation, 28 feet of calculated gas pay in the Apollonia Formation and 12 feet of oil pay in the Upper Bahariya (UBAH). No commercial hydrocarbons were found in the primary target Alam El-Bueib (AEB) sandstones, and the lower portion of the well has been plugged and abandoned in preparation for testing of the UBAH pay zone.

The EDC-65 rig will next drill the SEMR-E1X exploration well. This well targets the AEB while also having prospectivity in the Bahariya and other shallower horizons. Following the SEMR-E1X, the EDC-65 rig will be released while the Company assesses the data gathered from operations to date in 2024 and plans future development and exploration campaigns.

In East Siwa, where Apex operates with IEOC as a 50% partner, reprocessing of 2D seismic data is almost complete, after which an exploration drilling location will be selected from among the identified prospects.

The Company’s independent reserve auditors recently completed their assessment of reserves as of year-end 2023. Audited 2P reserves stood at 29.1 mmboe (Apex working interest) versus 25.5 mmboe at year-end 2022, an increase of 14%. This is in line with the Company’s internal estimates of approximately 30 million mmboe as of that date, and places Apex among the top 10 commercial reserves holders in the Western Desert as of that date.

Commercial Overview

On May 27, 2024, the Minister of Petroleum signed the new concession agreement for Ras Qattara between the government of Egypt, EGPC, Apex and INA-Industrija Nafte, d.d., with a firm term of 5 years, with an option to extend for an additional 5 years with Minister approval. This new agreement includes terms that will extend the economic life and ultimate recovery from the field and includes a two-well drilling commitment, the first of which, the Zarif 49, was completed and placed into production earlier this year.

Apex is currently negotiating with EGPC to extend the term of its SEM exploration acreage for 3 years beyond its upcoming expiration date in November 2024, and to modernize commercial terms in the West Razzak and East Kanayes concessions that host the mature Aghar and other oil fields. The new fiscal terms would extend the economic life of the Aghar fields and allow more efficient depletion of reserves.

The Company’s total budgetary commitment to exploration, development and production operations in Egypt during 2024 exceeds $100 million, including operating and capital expenditures for the work program.

Finally, Apex announces the retirement of Keith Dowling, the Company’s Vice President of Engineering and Managing Director/General Manager of the PetroFarah joint venture, effective July 31, 2024. Mr. Dowling, a co-founder of the Company, joined Apex in 2016 and has been in the Cairo office since 2019. Tom Everitt, who comes from a 30-year career in the upstream oil industry, primarily with Shell, including 6 years in Egypt, will be joining Apex in Cairo and assuming Mr. Dowling’s responsibilities and positions upon his departure.

Information Source: Read More

Oil and gas press covers, Energy Monitor, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas,