BP, Shell, TotalEnergies self-transformation into greener energy companies

Moody’s research on how exactly three oil majors BP, Shell and TotalEnergies are already transforming themselves into diversified energy companies:

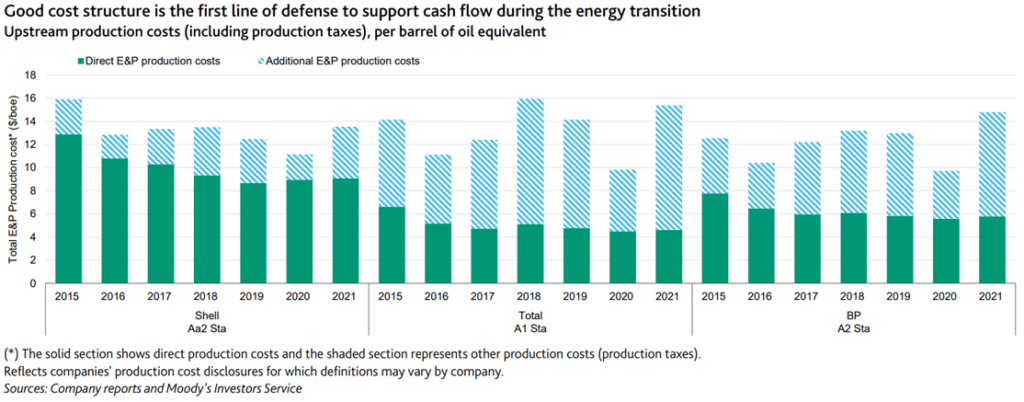

- Growing access to renewable energy, investing in existing lower-carbon operations and new energy growth markets – is what the strategies have in common for BP, Shell and TotalEnergies to transform into diversified energy companies in the coming decades. However, if that diversification comes with weaker profitability and cash flow generating capabilities / significant debt financing, the credit implications could also be negative

- Oil and gas will still continue to feed cash flow for at least this decade

- Each company paves its own way: Shell and TotalEnergies have larger gas and LNG businesses to leverage and potentially secure additional cash flow during the transition; BP expects to reduce oil and gas production the most by 2030

- The companies face a range of risks on their journeys: Growing renewable businesses brings the companies more into direct competition with utilities for projects. All three companies are investing in new markets from EV charging to hydrogen with quite uncertain profitability prospects. Execution risks are real. Many projects will take years to build and become operational.

Information Source: Read More

Energy Monitors | Electric Power | Natural Gas | Oil | Climate | Renewable | Wind | Transition | LPG | Solar | Electric | Biomass | Sustainability | Oil Price |