Citizen Energy Continues Mid-Continent Success with Accretive Consolidation

TULSA, Okla.–(BUSINESS WIRE)–Tulsa-based Citizen Energy announced it has closed an acquisition of substantially all of the oil and gas properties of Red Bluff Resources and Bricktown Energy with an April 1, 2022 effective date.

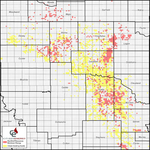

The acquisition will generate a 18% increase in Citizen’s daily production and includes an additional ~13,000 BOEPD (56% liquids), 200 operated wells, and 739 non-op wells. Citizen’s existing ~245,000 net acre position coupled with Sellers ~80,000 net acres will create a dominant Mid-Continent footprint.

Pro forma for the acquisition, Citizen assets will consist of ~86,000 BOEPD, 720+ operated wells, 326,000+ net acres (98% HBP), and a projected next twelve months EBITDAX of ~$750-$800 million. Citizen expects the acquisition to be highly accretive to shareholder returns and set Citizen on a trajectory to become one of the top private producers in the U.S.

Baker Botts served as legal counsel for Buyers. Kirkland & Ellis served as legal counsel and JPMorgan served as the exclusive financial advisor for the Sellers.

Debt Financing

Concurrently with the acquisition, the Company announced the closing of $250 million of Senior Secured Second Lien Notes (the “Notes”) on June 29, 2022 maturing on June 29, 2027. The Company used the net proceeds from the Notes to fund the acquisition and to pay down borrowings under the Company’s revolving credit facility. The Company secured financing for the transaction from certain private funds managed by EIG, an institutional capital provider throughout the energy value chain.

The Company also announced an amendment to its senior secured revolving credit facility with JPMorgan Chase Bank, N.A., as administrative agent, and a syndicate of 14 lenders. The borrowing base and elected commitment amounts under the facility has been increased from $850 million to $1 billion in connection with the acquisition.

About Citizen

Citizen Energy is an integrated oil and natural gas company engaged in the acquisition, development, production, exploration and sale of crude oil and natural gas properties located in Oklahoma, primarily targeting the Meramec and Woodford Shale formations. In addition to its upstream properties, Citizen operates ~213 miles of natural gas gathering pipelines, 225 MMcf/d of gas processing capacity, and ~103 miles of water gathering pipelines (“Midstream Properties”).

Contacts

Bryan Hawkins

918-949-4680

bryan@ce2ok.com