CME Group to Launch Lithium Carbonate Futures

(Oilandgaspress) CME Group today announced that it will launch a Lithium Carbonate futures contract on July 17, 2023, pending all relevant regulatory reviews.

Lithium Carbonate CIF CJK (Fastmarkets) will be financially-settled based on the battery-grade Lithium Carbonate assessment published by Fastmarkets. Lithium Carbonate futures are complementary to CME Group’s Lithium Hydroxide CIF CJK (Fastmarkets) futures and will help establish a forward curve for Lithium Carbonate, offering market participants more transparency and choice for their different battery chemistry preferences.

“As electric vehicle sales continue to surge, we are pleased to introduce a second Lithium futures contract, which will provide market participants with more tools to manage price risk across a variety of raw battery materials,” said Jin Chang, Managing Director and Global Head of Metals at CME Group. “CME Group first entered the battery metals space just a few years ago and has quickly become the venue of choice for managing EV risk. Open interest in our Cobalt contract recently hit a record of over 20,000 tons, and trading in our Lithium Hydroxide contract has already surpassed full-year 2022 volume, with over 2,000 tons traded year-to date, versus 400 tons last year.”

CME Group offers risk management products across a wide range of electric vehicle components, including battery metals, Copper, Silver, Aluminum and Steel. These products continue to grow along with Cobalt and Lithium:

• Copper futures and options volume year-to-date is up 38%

• Aluminum futures volume year-to-date is up 305%

• Silver futures and options volume year-to-date is up 15%

• Steel futures and options volume year-to-date is up 28%

Lithium Carbonate futures will be listed by and subject to the rules of COMEX.

Information Source: Read More

Energy Monitors , Electric Power , Natural Gas , Oil , Climate , Renewable , Wind , Transition , LPG , Solar , Electric , Biomass , Sustainability , Oil Price , Electric Vehicles,

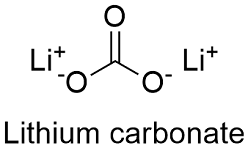

Lithium carbonate is an inorganic compound, the lithium salt of carbonic acid with the formula Li ₂CO ₃. This white salt is widely used in processing metal oxides.