Crude oil navigates mixed signals

Crude oil jumped on Tuesday after the U.S. Energy Information Administration in its monthly Short-term Energy Outlook maintained their forecast of an oversupplied market by early next year leading to gradually lower prices. The CEO of the world’s largest independent oil trader meanwhile said he was looking into a 2022 where tight supply could support a run up to 100 dollar per barrel. In the short term, however, the direction is likely to be dictated by developments in the gas market, not least in Europe which is seeing a sharp decline, and with that reduced demand for gas substitutes such as diesel and heating oil

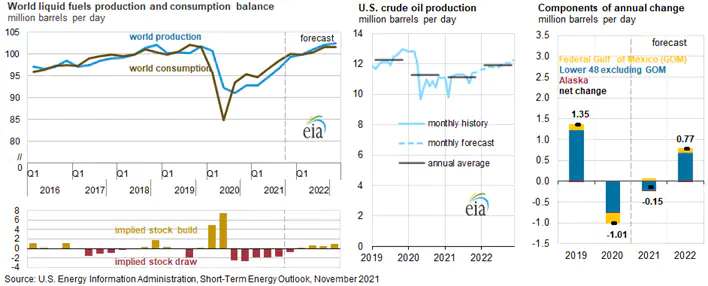

Crude oil jumped on Tuesday after the U.S. Energy Information Administration (EIA) in its monthly Short-term Energy Outlook (STEO)maintained their forecast of an oversupplied market by early next year, thereby indirectly agreeing with OPEC+ and their steady approach to rising production on a monthly basis by 400,000 barrels per day. The bullish market reaction to bearish news which included a forecast for rising US production, sprung out of the fact the Biden administration who earlier in the week had signaled they would announce an SPR release on Tuesday stepped away from doing so.

Crude oil jumped to near the recent high with no prospect for additional supplies to alleviate some of these concerns. So far today the oil market trades close to flat with falling gas prices in Europe potentially reducing some of the recent gas-to-oil switch support for oil.

A counter to EIA’s argument about a balancing market in early 2022 was given by Russell Hardy, the head of Vitol Group, the world’s biggest independent oil trader. Speaking online at the Reuters Commodity Trading Conference on Tuesday he said that global oil demand is back to 2019 levels and will exceed those during the first quarter of 2022. Not ruling out $100 per barrel Brent in 2022 he said oil market tightness will continue for the next 12 months with OPEC spare capacity down to between 2 and 3 million barrels per day.

Ahead of today’s weekly stock report from the EIA, the American Petroleum Institute late yesterday reported a price supportive 2.5-million-barrel drop in crude stocks and a near 8-million-barrel combined drop in gasoline and distillate stocks. The market will also be keeping an eye on flows in and out of Cushing, Oklahoma, the key delivery hub for WTI crude oil futures. A month-long drop in stocks to 26.4 million barrels, some 4.6 million above the August 2018 low, has supported the front end of the WTI curve resulting in very steep backwardations with the spot month of December trading some 11 dollars per barrel above the December 22 contract. The equivalent 12 month spread in Brent trades somewhat lower at 8.75 dollars per barrel.

As per the WTI chart below, the recent recovery has taken the price close to $85 and a potential breakout. Brent meanwhile currently sits around two dollars below a double top at $86.75. Whether or not the price will break higher at this stage will to a large extend depend on developments in the gas market, not least in Europe.

The Dutch TTF benchmark gas contract trades lower for a second day with a slump to a six-week low being driven by signs that Russia is gradually delivering the promised boost in supplies. The current price for first month gas trades at €64.3 per GWh or in dollar terms the equivalent of $21.75 per therm, a level that if maintained could slow the recent switch from gas to relatively cheaper priced fuels such as diesel, heating oil and propane.

With total gas held in storage facilities across Europe still trailing the five-year average by around 16 percent, a strong pick up in supplies via LNG imports and most importantly from Russia is needed to add further downside pressure on the price of gas, and with that also electricity prices. Traders will be watching next Monday’s auctions for December pipeline capacity as it will give a clear signal at a time where the market remains concerned that additional shipments from Russia could still be tied with the progress in the certification of the controversial Nord Stream 2 pipeline.

Information Source: Read More By Ole Hansen, Saxo Bank’s Head of Commodity Strategy

Oil and gas, press , | Energy, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar

Submitted By: Sam Dynevor, Account Executive, Greentarget