Crude oil: Sanctions threat counters tariff-driven demand worries

By Saxo’s Ole Hansen

London, March 25, 2025, (Oilandgaspress) ––Crude oil futures continue to recover from a USD 14 selloff that began in January following Trump’s combative inauguration speech, which signalled an inward political focus combined with aggressive trade policies, including tariffs, that were meant to Make America (not the world) Great Again. His speech and subsequent action, including his “drill, baby, drill” focus, saw the Brent and WTI crude oil futures slump back into the USD 60s per barrel before eventually stabilising, with the focus turning from a weakening economic outlook to sanctions, potentially reducing the overall level of output despite OPEC+ plans to begin tapering production cuts from next month.

In the past week, we have seen the US administration tighten sanctions on the Iranian oil trading network, and this was followed up yesterday when President Trump declared that the US will enforce a 25% tariff on any nation importing Venezuelan crude. Although the immediate market impact might be minimal, apart from supporting additional short covering from underinvested hedge funds, this action indicates a definite change, potentially signalling the White House’s willingness to sacrifice low oil prices to achieve wider strategic objectives—isolating Iran and Venezuela and increasing pressure on China.

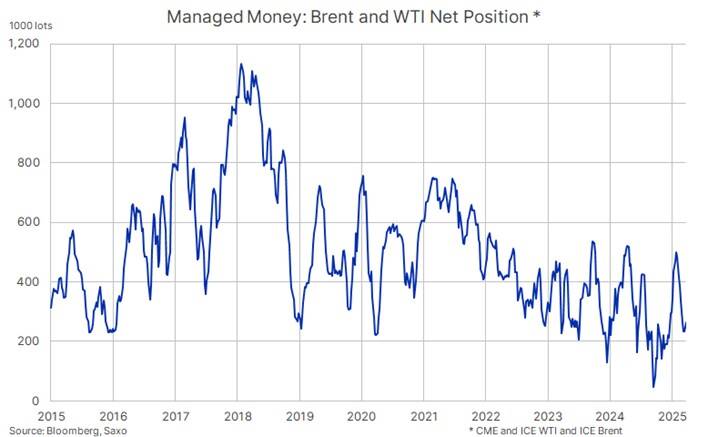

In the latest reporting week to 18 March, managed money accounts held a 262k contract net long in the three major crude oil futures contracts, down from a 500k peak eight weeks prior, and below the five-year average of around 425k contracts.

Managed money net long WTI and Brent crude oil futures

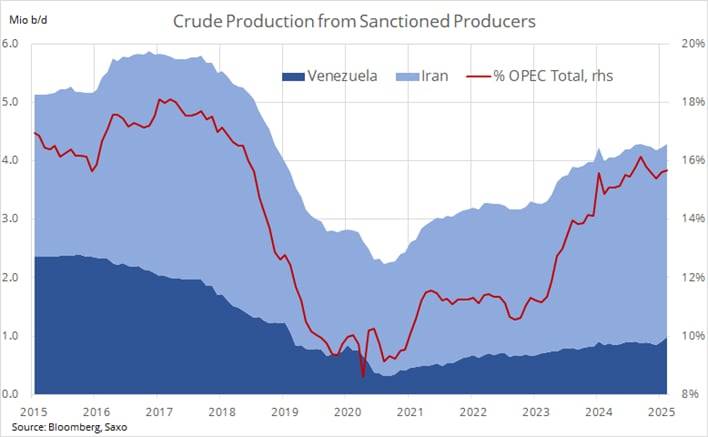

With US sanctions back in focus, it is worth noting that Iran and Venezuela have increased their crude oil production by 1.6 million barrels per day over the past four years. Meanwhile, other OPEC+ members, particularly in the GCC, have reduced output to maintain stable and high prices. As a result, Iran and Venezuela’s market share has risen from 11% to 16%. The planned OPEC+ production increases starting next month may, in the coming months, be fully offset by declines not only from these two countries but also from other producers adjusting output to comply with allocated quotas.

Iran and Venezuela crude oil production

Brent crude’s current momentum has taken prices to a three-week high, with the latest move being supported by a combination of underinvested hedge funds, improved risk sentiment following a softening in the tone regarding tariffs after Trump indicated some nations could receive breaks from “reciprocal” tariffs starting next week on 2 April, and not least, the mentioned secondary tariffs on buyers of Venezuelan crude, which, together with Iran sanctions, may help tighten supply.

Overall, we maintain our USD 65 to USD 85 range for the year, with the near-term upside potential being limited by resistance now seen in a band between USD 73.80, the 0.382 Fibonacci retracement of the January to March selloff, and USD 74.10, a level that provided support on several occasions last month before the eventual break triggered a slump extension to near USD 68.

Managed money net long in Brent and WTI crude oil futures

Information Source: