Daily Energy/Automotive News; Brent $75.60/bbl, WTI Crude $72.68/bbl,Gas $3.65/MMBtu

London, January 02, 2025 (Oilandgaspress) –- Oil prices began the 2025 trading year with a rise in Asia on Thursday as market sentiment turned positive on expectations of stronger economic and oil demand growth. Oil prices have been rangebound for most of the fourth quarter amid concerns about demand in China and other major economies and expectations of an oversupply this year. For 2024, oil saw a second consecutive year of annual declines, falling by about 3% compared to the last closing price of 2023.. Read More

Vestas announces a new order in Italy

| Country | Region | Customer | Project name | MW | Turbine variant | Service agreement | Delivery & commissioning |

| Italy | EMEA | Alerion San Marco | Valico Casone Cocca | 26 | 3 x V150- 6.0 MW and 2 x V117-4.2 MW | 10-year AOM 4000 | Delivery expected in Q4 of 2025, commissioning planned for Q1 of 2026. |

Stellantis N.V. announced that One Equity Partners (“OEP”), a middle market private equity firm, has completed its majority investment in Comau S.p.A. (“Comau”), a global technology company specializing in industrial automation and advanced robotics. This strategic move marks a significant milestone for Comau, positioning the company for enhanced growth and innovation. It also provides Stellantis with the ability to focus on core business activities in Europe. Comau has a local presence in all regions and a global network that is strengthened by its business and leadership continuity. As a standalone company, Comau will have access to additional funds to grow its competencies in diversified sectors. Read More

Vestas announces two new orders for a total of 108 MW

| Country | Region | Customer | Project name | MW | Turbine variant | Service agreement | Delivery & commissioning |

| Spain | EMEA | Undisclosed | Undisclosed | 50 | 11 x V150-4.5 MW wind turbines | 10-year AOM 4000 Service Agreement | Delivery expected in Q3 of 2025, commissioning planned Q1 of 2026. |

| France | EMEA | Undisclosed | Undisclosed | 59 | 10 x V136-3.45 MW turbines in 3.0 MW power mode8 x V126-3.45 MW turbines in 3.6 MW power mode | 25-year AOM 5000 Service Agreement | Delivery expected in first half of 2026, commissioning planned for second half of 2026. |

Vestas has received a 270 MW order to power an undisclosed wind project in the USA. The order consists of 60 V163-4.5 MW turbines, Vestas’ newest high-capacity factor turbine and the project has been developed by Steelhead Americas, Vestas’ North American development arm.

The order includes supply, delivery, and commissioning of the turbines, as well as a multi-year Active Output Management 5000 (AOM 5000) service agreement, designed to ensure optimised performance of the asset.

“We’re pleased to close out 2024 by continuing to deliver significant projects across the U.S. and meet the growing demand for homegrown electricity while strengthening America’s energy independence and security,” said Laura Beane, President, Vestas North America. “We’re also grateful to the expertise of Steelhead Americas for developing this project, a testament to their growing track record of creating meaningful business opportunities for communities across the U.S.”.

Steelhead Americas led all development efforts including permitting, land acquisition, and construction design to deliver the customer a project that is ready for construction and installation.

“Steelhead has a track-record of successfully delivering high-quality wind projects that fuel economic growth and bring meaningful local benefits,” said Chris Rogers, President, Steelhead Americas, a Vestas company. “This project exemplifies that success. By harnessing local wind resources and infrastructure, along with the support of local landowners eager to bring the benefits of wind energy, we can enhance grid reliability and strengthen the local economy.”

With a growing track record of opening new markets, including Mississippi and Arkansas, Steelhead is one of the few wind-focused traditional flip renewable energy developers remaining in the U.S that develop projects in-house from greenfield stage up to shovel ready. To date, Steelhead has delivered almost 4 GW of renewable energy projects in North America with over 5 GW in the pipeline, significantly contributing to Vestas global development track record of 28 GW project pipeline and 7 GW of firm order intake from development activities.

The customer of the project is undisclosed.

Turbine delivery begins in the first quarter of 2026. . Read More

Porsche congratulates Jacky Ickx on his 80th birthday

During his competitive career, he was not only considered a highly versatile racing driver, but also a master of wet-weather driving. Jacky Ickx was a major contribution to Porsche’s racing success in the 1970s and 1980s. Today, the Belgian-born former racing ace celebrates his 80th birthday. His career at Porsche is a prime example of how successfully drivers and brands can work together. Jacky Ickx triumphed in the 24 Hours of Le Mans a total of six times, four of which while he was representing Porsche. On 1 January 2025, the racing driver celebrates his 80th birthday. “We wish Jacky Ickx all the best and thank him for having written himself and Porsche into the history books of motor racing”, says Michael Steiner, Member of the Executive Board, Research and Development. “He impressed the company not only with his skills as a racing driver, but also with his passion, pursuit of excellence and modesty. Values that Porsche continues to embody to this day.” Read More

| Oil and Gas Blends | Units | Oil Price | Change |

| Crude Oil (WTI) | USD/bbl | $72.68 | Up |

| Crude Oil (Brent) | USD/bbl | $75.60 | Up |

| Bonny Light 31/12/24 CBN | USD/bbl | $75.18 | Up |

| Dubai | USD/bbl | $73.06 | Up |

| Natural Gas | USD/MMBtu | $3.65 | Down |

| Murban Crude | USD/bbl | $75.92 | Down |

| OPEC basket 31/12/24 | USD/bbl | $74.59 | Up |

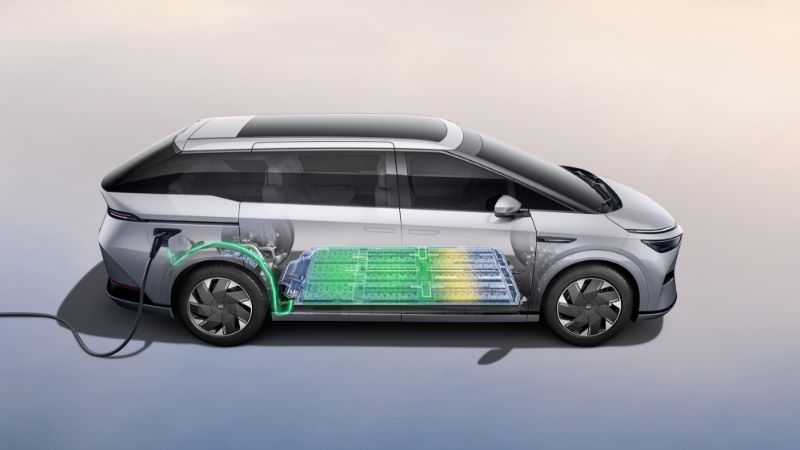

Xpeng Motors announced its latest delivery results, with monthly deliveries hitting a record high for four consecutive months! In December 2024, Xpeng Motors delivered a total of 36,695 new cars, an increase of 82% year-on-year and 19% month-on-month. Among them, Xpeng MONA M03 delivered more than 15,000 units; Xpeng P7+ delivered more than 10,000 units. In Q4 2024, Xpeng Motors delivered 91,507 units, setting a record high for single-quarter deliveries and exceeding the upper limit of Q4 delivery guidance..

In December, the delivery volume of Xiaopeng MONA M03 exceeded 15,000 units, and the delivery volume exceeded 10,000 units for four consecutive months and maintained healthy growth. In the same month, the 50,000th Xiaopeng MONA M03 rolled off the assembly line just four months after its launch, setting a record for the fastest production speed of Xiaopeng’s own new car, and also continuously breaking the record for the production speed of pure electric vehicles of new forces. At present, the production of Xiaopeng factory is fully accelerated, and one Xiaopeng MONA M03 can be produced every 72 seconds.

In December, Xpeng P7+ delivered more than 10,000 new cars. In the same month, Xpeng P7+ ushered in its second major OTA, and Xpeng XOS 5.5.0 started public beta, launching a set of software breakpoint-free “parking space to parking space” functions, with a high capacity limit and can be used in all scenarios. This is also the 373rd OTA version of Xpeng Motors in 2024 and the 1149th new function. In 2025, more efficient software OTA upgrades and Xpeng’s unique hardware OTA crowdfunding will be launched, fully opening the AI car OTA2.0 era, and walking with Pengyou all the way.

In December, the monthly active user penetration rate of XNGP urban intelligent driving reached 85%. In the same month, Xiaopeng Motors held the “Xiaopeng Turing AI Intelligent Driving Open Day” to showcase China’s first one-stage end-to-end empowerment of “parking space to parking space”. Next, Xiaopeng will expand the one-stage end-to-end capabilities to more scenarios to provide users with a better intelligent driving experience.

In December, Xpeng Motors completed the delivery of its 10,000th new car in Europe in Ebersberg, Germany, becoming the first pure electric new power car company to achieve 10,000 vehicle deliveries in Europe. In the same month, Xpeng Motors officially opened its first flagship store in Australia, and at the same time, Xpeng G6 was shipped to Australia on a large scale.

On January 1, the first anniversary of the launch of Xpeng X9, with its outstanding product strength and user reputation, the cumulative sales volume reached 21,642 units, continuing to lead the high-end pure electric MPV market. Xpeng X9 has undergone 12 OTA upgrades throughout the year, which not only achieved the most OTAs in its class, but also pioneered hardware OTA.

Starting from January 1, Xiaopeng Motors will immediately start distributing limited-time Spring Festival gift packages, providing Peng friends with 10,000 yuan in cash red envelopes and 888-kilowatt-hour electricity cards. We thank every Peng friend who loves Xiaopeng for their support. For details, please consult your local Xiaopeng Motors store.. Read More

Baker Hughes Rig Count: U.S. unchanged at 589 Canada -71 to 95; U.S. Rig Count is unchanged from last week at 589 with oil rigs unchanged at 483, gas rigs unchanged at 102 and miscellaneous rigs unchanged at 4.

Canada Rig Count is down 71 from last week to 95, with oil rigs down 66 to 44, gas rigs down 5 to 51 and miscellaneous rigs unchanged at 0.

International Rig Count is down 31 rigs from last month to 919 with land rigs down 14 to 712, offshore rigs down 17 to 207. International Rig Count is down 59 rigs from last year’s count of 978, with land rigs down 46, offshore rigs down 13.

The U.S. Offshore Rig Count is unchanged at 14, down 5 year-over-year.

The Worldwide Rig Count for October was 1,754, up 4 from the 1,751 counted in September 2024, and down 22, from the 1,776 counted in October 2023.

| Region | Period | Rig Count | Change |

| U.S.A | 27 December 2024 | 589 | 0 |

| Canada | 27 December 2024 | 95 | -71 |

| International | November 2024 | 919 | -31 |

Tata Motors Limited sales in the domestic & international market for Q3 FY 2024-25 stood at 2,35,599 vehicles, compared to 2,34,981 units during Q3 FY 2023-24.

Domestic Sales Performance:

| Category | Dec’24 | Dec’23 | % Change | Q3 FY25 | Q3 FY24 | % Change |

|---|---|---|---|---|---|---|

| Total Domestic Sales | 76,599 | 76,138 | 1% | 2,30,684 | 2,29,610 | 0% |

Commercial Vehicles:

| Category | Dec’24 | Dec’23 | % Change | Q3 FY25 | Q3 FY24 | % Change |

|---|---|---|---|---|---|---|

| HCV Trucks | 9,520 | 11,199 | -15% | 27,130 | 29,656 | -9% |

| ILMCV Trucks | 5,687 | 5,675 | 0% | 15,897 | 15,411 | 3% |

| Passenger Carriers | 4,144 | 3,060 | 35% | 10,001 | 7,704 | 30% |

| SCV cargo and pickup | 13,018 | 12,734 | 2% | 38,232 | 38,964 | -2% |

| Total CV Domestic | 32,369 | 32,668 | -1% | 91,260 | 91,735 | -1% |

| CV IB | 1,506 | 1,512 | 0% | 4,510 | 4,791 | -6% |

| Total CV | 33,875 | 34,180 | -1% | 95,770 | 96,526 | -1% |

Domestic sales of MH&ICV in Dec 2024, was 15,968 units vs 16,851 units in Dec 2023; In Q3 FY25 it was 44,023 units, compared to 44,365 units in Q3 FY24.

Domestic & International sales for MH&ICV in Dec 2024, was 16,604 units vs 17,591 units in Dec 2023; while in Q3 FY25 it stood at 46,108 units, vs 46,534 units in Q3 FY24.

Mr. Girish Wagh, Executive Director, Tata Motors Ltd. said, “Tata Motors Commercial Vehicles registered domestic sales of 91,260 units in Q3 FY25 witnessing a marginal year on year (YoY) decline of ~1% over Q3 FY24 and marking a significant improvement over the 19% YoY decline in sales recorded in Q2 FY25. Further, sales in December 2024 were ~24% higher than those recorded in November 2024.

Propelled by a resurgence in construction and mining activities post-monsoon, plus the festive season demand, HCV segment witnessed robust sequential quarter on quarter (QoQ) growth in sales during Q3 FY25, even as the YoY sales declined 9% due to limited growth in end-use segments. The ILMCV segment witnessed ~3% YoY growth, driven by strong demand, with the MCV segment continuing its robust growth trajectory to record a 40% YoY increase during Q3FY25.

Continuing its strong momentum, the Passenger Carrier segment witnessed a 30% YoY sales growth in Q3 FY25, with healthy demand from State Transport Undertakings (STUs) and the Staff/Tour & Travel segments. Small and light commercial vehicle sales experienced a marginal YoY decline of ~2% in Q3 FY25, primarily due to ongoing financing challenges faced by first-time users and rental customers in this category.

Looking ahead, we expect demand to improve in Q4 FY25 across most segments of the CV industry. The key aspects to watch out in 2025 will be government’s focus on infrastructure spend, and growth in end use segments, which will augur well for the commercial vehicles industry.”

Passenger Vehicles:

| Category | Dec’24 | Dec’23 | % Change | Q3 FY25 | Q3 FY24 | % Change |

|---|---|---|---|---|---|---|

| Total PV Domestic (includes EV) | 44,230 | 43,470 | 2% | 1,39,424 | 1,37,875 | 1% |

| PV IB | 59 | 205 | -71% | 405 | 580 | -30% |

| Total PV (includes EV) | 44,289 | 43,675 | 1% | 1,39,829 | 1,38,455 | 1% |

| EV (IB + Domestic) | 5562 | 5,006 | 11% | 16,119 | 15,232 | 6% |

Includes sales of Tata Motors Passenger Vehicles Limited and Tata Passenger Electric Mobility Limited, both subsidiaries of Tata Motors Limited.

Oil and Gas News Undiluted !!! �The squeaky wheel gets the oil�

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

OilandGasPress.com is a website that provides news, updates, and information related to the oil and gas industry. It covers a wide range of topics, including exploration, production, refining, transportation, distribution, and automotive market trends within the global energy sector. Visitors to the site can find articles, press releases, reports, and other resources relevant to professionals and enthusiasts interested in the energy, oil and gas industry.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: on Twitter | Instagram

Oil and gas press covers, Energy Monitor, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas,