Daily Energy/Automotive News; High storage levels indicate an oversupplied natural gas market and lower natural gas prices.

London, 28 February 2024, (Oilandgaspress): -High natural gas production, low natural gas consumption, and higher natural gas inventories than the previous five-year (2018–22) average contributed to prices declining for much of 2023 and the first two months of 2024. U.S. dry natural gas production generally rose throughout 2023, averaging a record high of 105.7 billion cubic feet per day (Bcf/d) in December 2023, according to data from S&P Global Commodity Insights. Read full article

Nel ASA: Exploring a spin-off and separate listing of the Fueling division

Nel ASA (Nel, OSE:NEL) has initiated a process to explore and prepare for a potential spin-off and separate listing of its Fueling division with the intention to create two independent pure-play companies aiming to become market leaders in their respective fields.

“We have seen limited synergies between the Fueling and Electrolyser divisions and believe each business will be better positioned to become market leaders in their respective fields by operating independently,” says Nel’s CEO, Håkon Volldal.

One year ago, when Nel presented its fourth quarter 2022 report, the company stated it was considering strategic actions for its Fueling division. Nel is now exploring spinning off the Fueling division as a dividend-in-kind to all existing Nel ASA shareholders and applying for listing of the shares in the separate fueling company on an OSE regulated market during 2024.

This will create two streamlined and focused companies that can pursue their individual strategic agendas. Nel will ensure that the independent fueling company will have a sufficient liquidity runway at the time of listing.

“The underlying market drivers for electrolysers and hydrogen fueling stations remain strong. We believe that two independent and focused companies represent the structure that maximizes the likelihood of success for each business and therefore long-term shareholder value,” Volldal says.

The decision to spin off and separately list the Fueling division has not yet been concluded and no assurances can currently be given that it will be completed. If completed, the shares of Nel (comprising its Electrolyser division) will remain listed on the OSE under the ticker “NEL”. Carnegie AS has been engaged as financial advisor to assist Nel in this process, and Wikborg Rein Advokatfirma AS is acting as Nel’s legal counsel. Read full article

BW Energy: Fourth Quarter and Full Year Results 2023

• Q4 EBITDA of USD 133.4 million and net profit of USD 80.2 million

• Full-year revenue of USD 0.5 billion (+83%) with EBITDA of USD 241.0 million (+56%) and net profit of USD 81.0 million (+80%)

• Q4 gross production of 3.03 million barrels with 2.48 million net to BW Energy

• Four liftings of 2.7 million barrels (net BWE) at average realised price of USD ~82 per barrel

• Achieved combined production milestone of 50,000 operated barrels per day in October

• Maintained a strong balance sheet with cash position of USD 194 million

• Completed acquisition of FPSO Cidade de Vitória

• Discovery of Hibiscus South

• MoU signed with Cosco Shipping Heavy Industry for FPSO BW Maromba upgrade

BW Energy, operator of the Dussafu Marin licence in Gabon and the Golfinho cluster offshore Brazil, reported EBITDA for the fourth quarter of 2023 of USD 133.4 million, up from USD 49.7 million in the third quarter of 2023, due to increased production and liftings.

Gross production from the operated assets was ~33,000 barrels of oil per day in the quarter, up 20% from the previous quarter. This includes a full quarter of production from the Tortue and Hibiscus fields in the Dussafu licence (73.5% working interest) and the Golfinho field (100% working interest) after assuming ownership in late August.

Full-year 2023 production was approximately 7.6 million barrels of oil, up 97% from 2022. Full-year EBITDA was USD 241 million (USD 154.2 million). Read full article

Woodside has signed a sale and purchase agreement (SPA) with Korea Gas Corporation (KOGAS) for the long-term supply of liquefied natural gas (LNG) to Korea. The SPA provides for the supply of approximately 0.5 million tonnes per annum of LNG for a period of 10.5 years on a delivered basis, commencing in 2026 subject to customary conditions precedent. LNG delivered to KOGAS under the SPA will be sourced from uncommitted volumes across Woodside’s global portfolio, including the Scarborough Energy Project which is targeting first LNG cargo in 2026.

Woodside CEO Meg O’Neill said the SPA was significant as Woodside’s first long-term supply agreement into Korea, the world’s third largest LNG market. She said the agreement reinforced the ongoing contribution of Woodside’s LNG towards the energy security needs of major customers in the region. “Woodside is pleased to be a long-term supplier of LNG to KOGAS, a leading global energy company and one of the world’s largest LNG importers. “This agreement is further demonstration of ongoing robust demand for Woodside’s products from major energy customers in our region. “Our LNG can help customers such as KOGAS meet their energy security needs, while also supporting regional decarbonisation goals.”

KOGAS President and CEO Choi Yeon-hye said she was pleased to conclude the SPA with Woodside. “This SPA has enabled KOGAS to enlarge the customer base in the domestic power market, reinforcing our role as a leading natural gas supplier in Korea. “By leveraging this SPA, we look forward to further expanding our business opportunities with Woodside in the LNG industry.” Read full article

KBR announced today that it will hold a webcast of their Sustainable Technology Solutions (STS) Primer on Tuesday, March 12, 2024, beginning at 8:00 a.m. Central Time (9:00 a.m. Eastern Time). The company plans to publish its STS Primer presentation in conjunction with the webcast. Read full article

Biden-Harris Administration announces over $1 billion to start new cleanup projects and continue work at 100 Superfund sites across the country. Thanks to this third and final wave of investment from President Biden’s Bipartisan Infrastructure Law, EPA is funding all the construction work that is ready to begin at Superfund sites nationwide. Today, Feb. 27, 2024, the U.S. Environmental Protection Agency announced a third and final wave of more than $1 billion for cleanup projects at more than 100 Superfund sites across the country as part of President Biden’s Investing in America agenda. This funding is made possible by the President’s Bipartisan Infrastructure Law and will launch new cleanup projects at 25 Superfund sites and continue other cleanups at over 85 Superfund sites.

Thousands of contaminated sites exist nationally due to hazardous waste being dumped, left out in the open, or otherwise improperly managed. These sites can include toxic chemicals from manufacturing facilities, processing plants, landfills and mining, and can harm the health and well-being of local communities in urban and rural areas. More than one in four Black and Hispanic Americans live within three miles of a Superfund site.

Today’s investment is the final wave of funding from the $3.5 billion allocated for Superfund cleanup work in the President’s Bipartisan Infrastructure Law. So far, EPA has deployed more than $2 billion for cleanup activities at more than 150 Superfund National Priorities List sites. Thanks to President Biden’s commitment to addressing legacy pollution and improving public health, EPA has been able to provide as much funding for cleanup work in the past two years as it did in the previous five years while delivering on President Biden’s Justice40 Initiative, which set a goal to deliver 40% of the overall benefits of certain federal investments to disadvantaged communities that are marginalized by underinvestment and overburdened by pollution. Read full article

Initially scheduled for last weekend, the FIA Endurance World Championship Prologue was postponed until Monday and Tuesday due to delayed sea-freight. The first official gathering of the 2024 season brought the competitors at Lusail, where the opening race of the calendar will take place on Saturday. Alpine Endurance Team made the most of this reduced track time to prepare its Hypercar for its competition debut. The crews of Charles Milesi, Ferdinand Habsburg and Paul-Loup Chatin in the #35 car and Matthieu Vaxiviere, Mick Schumacher and Nicolas Lapierre in the #36 car aimed to check all the systems and acquire as much information as possible on this new track for the discipline. At 6pm on Monday, Paul-Loup Chatin and Nicolas Lapierre were the first to get behind the wheel of the Alpine A424s in an official session. Both began to work hard on the 5,418-metre circuit before handing over to their teammates. With over a thousand kilometres covered in five hours, the team continued its programme the following day in two three-hour sessions. Continuing the stints, the team gathered crucial data on their Hypercar and the development of the Michelin tyres. Despite an engine issue in the morning on the #35 car, Alpine broke the two-hundred-lap barrier and lowered its reference times under the impetus of Charles Milesi and Nicolas Lapierre. Les Bleus finished the Prologue with 467 laps completed, a total of more than 2,530 kilometres on a very particular track that the team was discovering. At the conclusion of the final session, the mechanics embarked on a race against the clock to completely service both cars. Meanwhile, the engineers and drivers are now working hard to analyse the data gathered before the Alpine A424’s racing debut on this same circuit. Read full article

Toyota Motor Corporation (TMC) announces its sales, production, and export results for January 2024 including those for subsidiaries Daihatsu Motor Co., Ltd. and Hino Motors, Ltd. To view more information on the sales, production, and export results by country and region, including specific details on the reasons for any changes in results, data from the past 10 years of sales, production, and export results, and data concerning electrified vehicle sales and Lexus sales, please download the document titled “Detailed data” from the top of this page. This document also includes sales, production, and export results and data concerning electrified vehicles sales and Lexus sales for every month in the past two years. Read More

NOD Green light for Eldfisk nord

The authorities have given Conoco Phillips consent to start up Eldfisk nord in the North Sea.

This is an installation consisting of two seabed templates for production and one for water injection – a total of nine production wells and five injection wells. Start-up is expected during the first quarter. According to the operator, the resource potential is projected to be 50-90 million barrels of oil. The investment amounts to nearly NOK 13 billion (USD 1.24 billion). The Eldfisk field is located in block 2/7 and is part of the Greater Ekofisk Area. Eldfisk nord will help increase the recovery rate from the two formations, Ekofisk and Tor. Conoco-Phillips’ partners in production licence 018 are Total Energies, Vår Energi, Sval Energi and Petoro. Read More

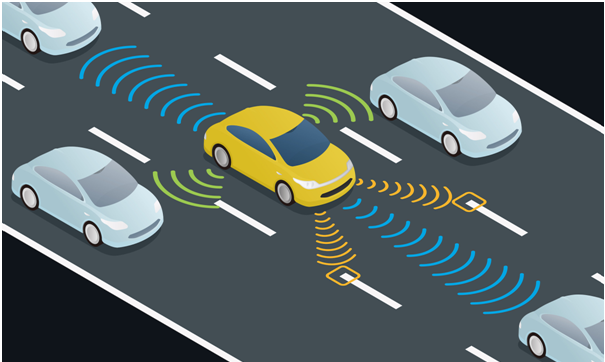

Apple has scrapped efforts to build its own self-driving electric car. They said the decision was shared by chief operating officer Jeff Williams and Kevin Lynch, a vice president in charge of the project. The two executives told staff members that the project will begin winding down and that many employees on the car team – known as the Special Projects Group, or SPG – will be shifted to the artificial intelligence division under executive John Giannandrea.

They will focus on generative-AI projects, an increasingly key priority for the company. Apple was facing a cooling market for EVs. Sales growth lost steam in recent months after high prices and a lack of charging stations discouraged mainstream buyers from shifting to all-electric vehicles. Read More

During the period from 19 to 23 February 2024, Eni acquired on the Euronext Milan no. 2,107,832 shares (equal to 0.06% of the share capital), at a weighted average price per share equal to 14.2281 euro, for a total consideration of 29,990,500.04 euro within the second tranche of the treasury shares program approved by the Shareholders’ Meeting on 10 May 2023, previously subject to disclosure pursuant to art. 144-bis of Consob Regulation 11971/1999.

On the basis of the information provided by the intermediary appointed to make the purchases, here below a synthesis of transactions for the purchase of treasury shares on the Euronext Milan on a daily basis: Read More

Tata Motors, the Ahmedabad District Co-operative Milk Producers Union Limited and the Gujarat Dairy Development Board, have ignited a new ‘White Revolution’ in and around Sanand. The initiative has catalysed a socio economic transformation for the beneficiaries, enriching their lives with improved access to education and healthcare facilities, and elevating their status within the community. By leveraging technology and cooperatives, more than 1600 women from the distant regions of Sanand have brought about a remarkable change in the social and economic conditions of rural Gujarat.

India, the world’s largest milk producer, has a low per capita yield. Dairy farming, traditionally led by women from the Bharwar and Koli Patel communities in Sanand, serves as a supplementary income source. These women, often gifted a cow or buffalo as a wedding present, handle the entire dairy farming value chain, from fodder to milk sales.

Tata Motors, a few years ago, introduced these women to the benefits of cooperatives and technology to enhance their dairy output and income. This strategic intervention led to the introduction of Automated Milk Collection Systems and Bulk Milk Chilling Units, transforming the lives of over 4496 cooperative members across 32 villages. In addition to establishing infrastructure, Tata Motors has played a pivotal role in imparting essential training, thereby instilling hope and promoting sustainability within these communities.

Increased income has empowered these women to send their children to school and aspire for better opportunities. Read More

Tata Motors Samaj Vikas Kendra (SVK) has helped these women master the craft of ‘Chikankari’ and organise themselves into groups to run a successful business venture basis this skill. The project has had an enduring impact on other women leading to active engagement of more than 150 women to form SHGs and actively engage in credit and thrift activities thus mobilising a remarkable Rs.25 lakhs over the past 16 years.

Tata Motors SVK began work on this project in 2007 wherein they worked on a two prong strategy, to revive the handicraft also linking it to social economic development of women. SVK established a dedicated training centre for women from 15 villages in and around, to equip them with the required skillset and apprise them of the market trends. In 2011, the scope of the SHG Federation programme was enhanced to include newer skillsets like production of jute bags, candles, herbal Gulal, cloth bags, artificial jewellery, etc.

Tata Motors also helped these women leverage various women welfare schemes run by the Government of Uttar Pradesh to enhance their skills and tap into opportunities to generate income. Now these women are serving as harbingers of change wherein they have not just attained financial freedom but fostered a social change breaking down societal barriers thus paving way for gender equality. Read More

| Oil and Gas Blends | Units | Oil Price US$/bbl | Change |

| Crude Oil (WTI) | USD/bbl | $78.81 | Up |

| Crude Oil (Brent) | USD/bbl | $83.64 | Up |

| Bonny Light | USD/bbl | $85.03 | Down |

| Saharan Blend | USD/bbl | $84.54 | Up |

| Natural Gas | USD/MMBtu | $1.86 | Up |

| OPEC basket 27/02/24 | USD/bbl | $82.22 | Down |

Stellantis N.V. announced today that pursuant to its Share Buyback Program (or the “Program”) announced on February 15, 2024, covering up to €3 billion (total purchase price excluding ancillary costs) to be executed in the open market, Stellantis has signed a share buyback agreement for the first tranche of its Program with an investment firm that will make its trading decisions concerning the timing of purchases independently of Stellantis.

This agreement will cover a maximum amount of up to €1 billion (of the €3 billion Share Buyback Program). The first tranche of the Program shall start on February 28, 2024 and end no later than June 5, 2024.

The Company intends to cancel the common shares acquired through its €3 billion Share Buyback Program apart from a portion of up to €0.5 billion, which will be utilized to execute future employee stock purchase plan activities and equity-based compensation. This is intended to support the benefits of expanding and strengthening the ownership culture of our teams, while avoiding dilution of existing shareholders.

The buyback of common shares in relation to this announcement will be carried out under the authority granted by the general meeting of shareholders held on April 13, 2023, up to a maximum of 10% of the Company’s capital, or any renewed or extended authorization to be granted at a future general meeting of the Company. The purchase price per common share will be no higher than an amount equal to 110% of the market price of the shares on the NYSE, Euronext Milan or Euronext Paris. The market price will be calculated as the average of the highest price on each of the five days of trading prior to the date on which the acquisition is made, as shown in the official price list of the NYSE, Euronext Milan or Euronext Paris. The share buybacks will be carried out subject to market conditions and in compliance with applicable rules and regulations, including the Market Abuse Regulation 596/2014 and the Commission Delegated Regulation (EU) 2016/1052. Read full article

In 2023, the Circular Economy business unit, one of the seven accretive Business Units highlighted by Stellantis in its Dare Forward 2030 strategic plan, demonstrated once again its dynamism, potential and pivotal role within the Company, especially in its goal to become a net zero carbon corporation by 2038*.

Stellantis’ Circular Economy business, which is based on the 4R strategy – Reman, Repair, Reuse, Recycle – saw its global sales rise by 18% in 2023, year-on-year. Across the 4Rs, Stellantis’ overall sustainable parts portfolio has grown considerably and now covers 15.2% of customers aftersales needs.

Stellantis’ Circular Economy business is expanding worldwide. In November 2023, Stellantis inaugurated the first SUSTAINera Circular Economy Hub in Mirafiori plant complex (Turin, Italy), which handles the remanufacturing of engines, gearboxes, and high-voltage EV batteries, as well as vehicle reconditioning and dismantling, creating a center of excellence aimed at industrializing the recovery and sustainable reuse of parts and materials.

In Europe in 2023, Stellantis created SUSTAINera VALORAUTO SAS, a joint venture with Galloo, to offer individuals and professionals a comprehensive solution for the take-back and recycling of end-of-life vehicles and launched the online service early January 2024 (www.valorauto.com). Stellantis also signed a Memorandum of Understanding with Orano, for a future joint venture for the recycling of electric vehicle batteries in Europe and North America.

In Brazil, SUSTAINera won the Automotive Business Award 2023 in the ESG Category. This award honors innovative forward-thinking companies that make a positive impact on the automotive and mobility sector.

Remanufacturing at the heart of Stellantis’ Circular Economy success

Remanufacturing is the principal pillar in Stellantis’ 4R strategy in Circular Economy. With sales up by 14% in 2023, the SUSTAINera label once again proved its ability to meet the growing demand for sustainable and affordable automotive parts. Read more

Oil price stuck in neutral despite underlying strength

Summary: The WTI and Brent crude futures contracts continue to trade within relative narrow ranges with the technical-driven trade the focus at a time when the fundamental drivers have struggled to dictate the direction of prices. Some underlying fundamental strength has emerged this month with widening price differences between monthly contracts indicating a more robust outlook across parts of the physical market. Today, the market will be watching EIA’s weekly crude and fuel stock report after the API reported a bigger-than-expected increase in crude stockpiles. The WTI and Brent crude futures contracts continue to trade within relative narrow ranges, in WTI between USD 76 and 80, and Brent between USD 81 and 84, with the technical-driven trade the focus at a time when the fundamental drivers have struggled to dictate the direction of prices. Overall, we maintain the view Brent and WTI will likely remain rangebound, respectively around USD 80 and USD 75 per barrel during the first quarter and next, but with disruption risks in the Middle East and OPEC+ production restraint potentially leaving the risk/reward skewed to the upside. In the short term, the market will be focusing on WTI and whether traders will be successful in pushing the price through resistance just below USD 80, a level that was unsuccessfully challenged last week. Brent, meanwhile, has got more work to do before potentially attempting a breakout, with the level to watch for that to happen being somewhat higher at USD 85.Read full article

The Opel Corsa has been shining in new splendour for a few months now – more modern, digital and diverse than ever with the characteristic Opel Vizor brand face and two electric drives. Opel is now expanding the drive range for the small car bestseller. The Opel Corsa is now available for the first time as a hybrid with 48-volt technology. The new Corsa Hybrid comes with extensive equipment with prices starting at €26,100 (all prices RRP including VAT in Germany).

The system features a lithium-ion battery that is recharged automatically under certain driving conditions and new turbocharged 1.2-litre three-cylinder petrol engines with 74 kW/100 hp and 100 kW/136 hp that have been developed especially for the hybrid application. The engines are coupled to a new electrified six-speed dual clutch transmission and a 21 kW/28 hp electric motor. Hybrid technology offers a wide range of advantages, especially for “electrification novices” who usually travel in urban environments: Compared to its purely conventional counterpart, fuel consumption and CO2 emissions are reduced by around 18 percent, and Corsa Hybrid customers can drive locally emissions-free at low speeds in the city and enjoy a high level of driving comfort thanks to the optimal coordination of the system. Thanks to the compact design of the hybrid system, no space is lost in the interior – and drivers do not have to recharge their Corsa Hybrid from an external source such as a socket or charging station. Read full article

The Neue Klasse is the start of the new BMW model generation. It represents the BMW Group’s bold departure into a new era of individual mobility. For BMW, change and openness to new developments have always been part of its DNA – whether in the field of aircraft engines, motorcycles or the automotive sector. One example was the introduction of the “Neue Klasse” at the beginning of the 1960s. The first vehicle in this class, the BMW 1500, marked the beginning of a new era. The accompanying changes in almost all areas of the company laid the foundations for the BMW brand as we know it today – and for the BMW Group. After many decades in which BMW has proven its innovative strength time and again, another quantum leap is now imminent: from 2025 onwards, there will be a Neue Klasse that will set new standards for digitalisation, electrification and circularity. The name “Neue Klasse” is a deliberate reference to that earlier era in which BMW undertook a major transformation: the “Neue Klasse” of 1961, when the sporty BMW 1500 mid-size sedan was launched on the market and accompanied by restructuring in sales and production. With its lightweight construction and previously unrivalled aerodynamics, the car captured the spirit of the times. In addition, investments were made in new production halls, innovative manufacturing methods and a flexible production network of all BMW plants. At the same time, the company focused increasingly on automation and electronic data processing. Read full article

Baker Hughes Rig Count: U.S. +5 to 626 Canada -3 to 231

U.S. Rig Count is up 5 from last week to 626 with oil rigs up 6 to 503, gas rigs down 1 to 120 and miscellaneous rigs unchanged at 3.

Canada Rig Count is down 3 from last week to 231, with oil rigs down 3 to 141, and gas rigs unchanged at 90.

International Rig Count is up 10 rigs from last month to 965 with land rigs up 5 to 740, offshore rigs up 5 to 225. International Rig Count is up 64 rigs from last year’s count of 901, with land rigs up 65, offshore rigs down 1.

| Region | Period | Rig Count | Change |

| U.S.A | 23 February 2024 | 626 | +5 |

| Canada | 23 February 2024 | 231 | -3 |

| International | January 2024 | 965 | +10 |

Horisont Energi’s presented at SpareBank 1 Markets Energy Conference 2024, in Oslo today. The Co-CEO and founder Bjørgulf Haukelidsæter Eidesen gave an update on the company’s three business units, clean ammonia, infrastructure, and carbon capture and storage.

Horisont Energi is accelerating the transition to carbon neutrality through pioneering projects. Read More

Oil and Gas News Undiluted !!! �The squeaky wheel gets the oil�

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: @OilAndGasPress on Twitter |

Oil and gas press covers, Energy Monitor, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas,

Subscribe to Oil, Gas, Energy News Release Service