DNO Kurdistan Production Continues to Climb

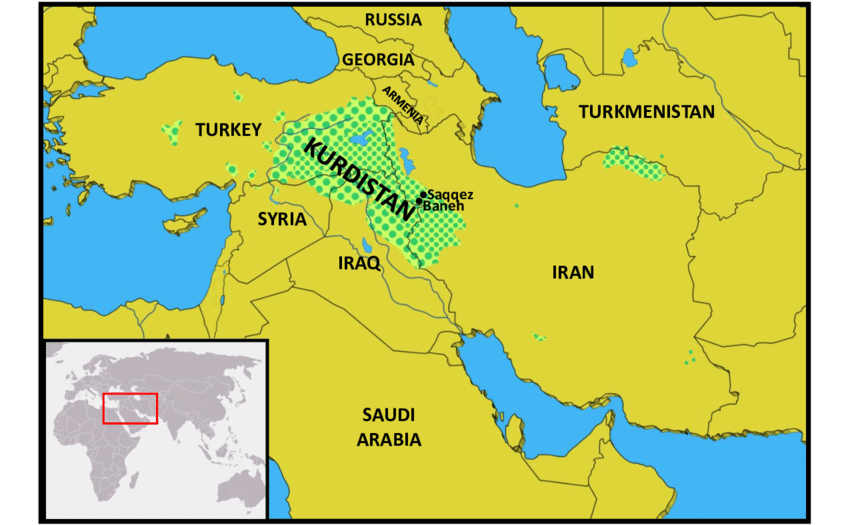

London, 19 December 2023, (Oilandgaspress): – DNO ASA, the Norwegian oil and gas operator, today announced that gross production from its operated Tawke license in the Kurdistan region of Iraq continues to climb, with the December to date average approaching 90,000 barrels of oil per day (bopd).

That lifts the projected fourth quarter 2023 figure to 65,000 bopd, up from 26,000 bopd in the third quarter and zero production in the second quarter, following closure of the Iraq-Türkiye Pipeline in March 2023.

Of the total Tawke license production, close to 40 percent represents the Company’s current entitlement share, which is sold to local buyers at prices in the low to mid-USD 30s per barrel. All such sales are conditional on advance payment in US dollars to DNO to eliminate any risk of arrears build up.

In addition to stepping up local sales, DNO has reduced costs materially since the pipeline closure, with operational spend in the Tawke license averaging some 65 percent below the pre-export shutdown level. The Tawke license holds the legacy Tawke field in production since 2007 and the Peshkabir field in production since 2017. Both fields were developed and put in production less than two years following discovery.

“These are resilient fields and DNO is a resilient company,” said DNO Executive Chairman Bijan Mossavar-Rahmani. “Even with local sales prices as low as half of those realized from export sales through Türkiye, strong production generates material free cash flow for DNO,” he added.

“We remain confident that the latest challenges facing DNO and the other international oil companies will be resolved once again and we remain committed to growing our business in Kurdistan as we have over the past two decades,” Mr. Mossavar-Rahmani said. “And that is notwithstanding a pivot to Norway where we have been reporting exploration discovery after discovery over the past two to three years.”

DNO is planning to drill another well in the Baeshiqa license in Kurdistan in 2024 following a discovery made in 2019.

Information Source: Read full article

Energy ,Petrol , Electric Power , Natural Gas , Oil , Climate , Renewable , Wind , EV , LPG , Solar , Electric , Electric Vehicles, Hydrogen, Oil Price ,Crude Oil, Supply, Biomass , Sustainability,