EIA statement on the factors leading to uncertainty in Short-Term Energy Outlooks

The U.S. Energy Information Administration’s (EIA) Short-Term Energy Outlook (STEO) analyzes current market conditions every month and forecasts energy supply, consumption, prices, and other trends over the short-term.

As the United States and global economies have recovered from the pandemic and energy prices have risen from the lows of 2020 and early 2021, our forecasts have been subject to greater-than-usual uncertainty—something we emphasize in the first paragraph of every STEO. This uncertainty has increased significantly following Russia’s further invasion of Ukraine.

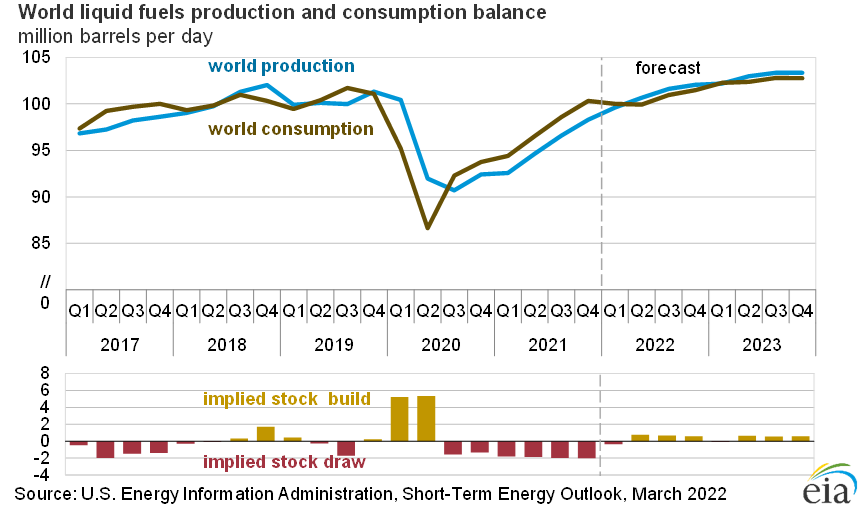

We believe it is more important to understand all the factors generating the uncertainty around our March STEO forecasts than it is to understand the forecasts themselves. Recent events in the oil market have occurred amid a backdrop of already low inventory levels, which have amplified oil price volatility and contributed to high oil prices.

Some of the most consequential factors we are watching include the following possibilities:

Nations could choose to ban imports of Russian energy

Additional sanctions against Russia could be announced

Corporations could take additional independent actions that would affect Russia’s oil output

Producers of crude oil outside Russia could respond to higher prices by increasing production

In recent months, we have consistently forecast that global production of energy commodities such as crude oil will increase this year to balance demand that has increased more rapidly since mid-2020. We still forecast this. We expect global oil production in 2022 will increase to the point of beginning to restore depleted global inventories, which could contribute to some declines in crude oil prices. However, the Russian action in Ukraine and the global response to it make these forecasts highly uncertain.

EIA will continue to monitor market dynamics in the energy sector and publish updated information to support a fuller understanding of the evolving situation.

Information Source: Read More–>

Energy, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Commodity, Coal, Electric Power, Energy Transition, LNG, Natural Gas, Oil,