Elliott Publishes Letter on SSE Calling for Immediate Action to Enhance Governance and Value

LONDON–(BUSINESS WIRE)–Elliott Advisors (UK) Limited, which advises funds (together “Elliott”), in its capacity as a top five investor in SSE plc (“SSE” or the “Company”) today sent a letter to SSE’s Chairman, outlining its conviction in the Company’s potential. The letter, sent in the wake of the Company’s disappointing announcement on 17 November and the resulting decline in SSE’s stock price, called on SSE to act expeditiously to restore investor confidence, lest the impairment in shareholder value become permanent.

Elliott believes that SSE’s high-quality portfolio of Networks and Renewables assets is worth £21 per share, and that the Company could have unlocked £5 billion of value through a listing of its Renewables business. In Elliott’s view, pursuing such a path could have simultaneously resolved SSE’s long-standing funding challenges and established the Company’s position as the U.K.’s renewables champion.

Unfortunately, according to the letter, SSE’s announcement on 17 November failed to provide any convincing explanation for why the Company was not pursuing a listing of Renewables. While SSE announced an initial sale of a minority stake in Networks, both the quantum and the timing of that transaction lacked ambition. Cutting the dividend disappointed many investors, particularly those who are income oriented and invest in SSE for the dividend stream it has historically provided. And the opaque review process raised serious questions about the legitimacy of the review and the adequacy of SSE’s corporate governance under which it was conducted.

Given the Company’s failure to put forth a comprehensive vision for how it can remedy its underperformance, Elliott challenges SSE to provide a detailed and credible plan to address investor concerns around SSE’s corporate governance, its ability to fund its growth in the long term, and its persistent undervaluation.

Among the steps the letter calls on SSE to pursue immediately are to 1) explore additional strategic initiatives, including a more ambitious disposal of Networks and a partial listing or partial disposal of Renewables; 2) add two new independent directors with renewables experience to the Board; and 3) create a strategic review committee composed of independent Board members.

Elliott concluded its letter by reiterating its willingness to work constructively with SSE on the needed changes, for the benefit of all with a stake in SSE’s future.

Full text is set out below:

7 December 2021

Sir John Manzoni KCB

Chairman

SSE

Inveralmond House

200 Dunkeld Road

Perth PH1 3AQ

cc. Members of the Board

Dear Sir John:

We are writing to you on behalf of funds advised by Elliott Advisors (UK) Limited (“Elliott” or “we”), which together represent one of the top five investors in SSE plc (“SSE” or the “Company”).

During our dialogue these past several months, we have shared with you our view that SSE owns one of the most attractive portfolios of Renewables and Networks assets. Yet SSE shareholders today receive only a fraction of the value of SSE’s businesses, which we believe are worth £21 per share (representing a ~30% upside to the current share price, or a £5 billion increase to the current market capitalisation). We discussed with you our view that SSE should list the entirety of its Renewables business, creating two standalone FTSE 100 U.K. companies, each better positioned to deliver on its respective distinct mission. And we demonstrated to you that a separation would resolve the long-term funding challenges that have hindered SSE’s growth historically, reversing years of share-price underperformance and allowing SSE to accelerate the green-energy investments required for it to become the U.K.’s renewables champion. A number of your competitors including Acciona, Eni and Iberdrola have already capitalised on this opportunity by advancing or examining plans to list their own renewables businesses.

The strategic initiatives announced on 17 November represent a first step in the evolution of SSE’s structure towards an eventual separation. It appears that our constructive dialogue contributed to your decision to materially increase the CapEx plan and to sell a stake in the Networks business. However, your announcement lacked ambition and disappointed your shareholders as well as many analysts and media commentators who were expecting more, as evidenced most clearly by the 4% drop in SSE’s share price on the day—amounting to close to £1 billion of market capitalisation destruction. Not only did SSE decide not to announce a bolder move towards a separation, it also added to the frustration of its investors by cutting the dividend without adequately addressing the Company’s long-term funding needs. One Barclays report summed it up well: “We see SSE trying to please everyone…as being a risk of pleasing no one.”

As the Company has failed to put forth a comprehensive vision for how it can remedy its persistent undervaluation, reverse its historical share-price underperformance and adequately fund Renewables growth beyond 2026 (a critical priority for accelerating the U.K.’s transition to Net Zero), we are making our views on SSE public today in the hope of fostering a broad and constructive debate on the right path forward for the Company and its stakeholders.

Our letter today is organised as follows:

- SSE Today: Despite SSE’s attractive renewable power generation and electricity transmission and distribution assets, the Company trades at a significant multiple discount to its Renewables peers and also suffers from deep, persistent share-price underperformance. These issues are directly attributable to the Company’s inefficient conglomerate structure, and they would be best addressed by separating the assets through a listing of the Renewables business.

- SSE’s Missed Opportunity: SSE’s announcement on 17 November failed to provide any convincing explanation for why the Company is not pursuing a listing of Renewables. While you announced an initial sale of a minority stake in Networks, both the quantum and the timing of that transaction lacked ambition. Cutting the dividend disappointed many investors, particularly those who are income oriented and invest in SSE for the dividend stream it has historically provided. Finally, the opaque review process raised serious questions about the legitimacy of the review and the adequacy of SSE’s corporate governance under which it was conducted.

- The Path Forward From Here: In the wake of the market’s verdict on the Company’s announced strategy, the right next step for SSE is to restore shareholder confidence by (1) pursuing additional initiatives for value creation (including a more ambitious disposal of Networks and a partial listing or partial disposal of Renewables); (2) enhancing corporate governance by adding renewables expertise to the Board; and (3) creating a Strategic Review Committee at the Board level tasked with overseeing the Company’s new strategy.

Our hope is that in bringing these issues and recommendations into the public sphere, we can succeed in achieving a set of outcomes that we believe all SSE stakeholders will support: A stronger, better-performing SSE that is well positioned to deliver superior long-term returns for shareholders and to make significant contributions to the U.K.’s Net Zero commitment.

SSE Today

SSE currently operates a portfolio of highly attractive electricity transmission and distribution assets with close to £8 billion of Regulated Asset Value, as well as renewable power generation assets ranging from hydro to onshore wind and offshore wind. In recent years, SSE has been a key player in the U.K.’s transition to alternative sources of energy. With 8GW of existing and pipeline offshore wind capacity in the U.K., currently the largest offshore wind market globally, SSE’s Renewables business offers potential for significant long-term value creation. SSE’s large pipeline of Renewables assets will play an important role in delivering on the U.K. Government’s ambition of achieving 40GW in offshore wind capacity by 2030 and achieving Net Zero by 2050.

SSE’s Networks business will also play an important role in this shift by enabling the distribution and transmission of electricity throughout the U.K. The transition will create opportunities for SSE to invest into Networks CapEx, driving attractive top-line growth and robust cash generation. However, we are concerned that these promising opportunities remain out of reach under SSE’s existing corporate structure, which has served as a ceiling on the Company’s ability to reach its full potential.

Despite this backdrop of favourable industry trends and its top-tier portfolio, SSE continues to disappoint those who depend on its success. SSE shareholders today receive only a fraction of the value of SSE’s businesses, and its persistent stock-price underperformance has been a problem that management has failed to address.

A History of Underperformance

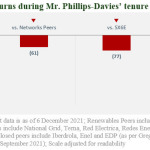

During the eight-year tenure of Mr. Phillips-Davies as CEO, SSE has underperformed the European Utilities index by 77%. If SSE had only performed in-line with this index, it would have generated an additional £11 billion of value for its shareholders. Additionally, SSE’s stock price has historically underperformed across all other relevant benchmarks, including among its closest peers.

See Figure 1: SSE total shareholder returns during Mr. Phillips-Davies’ tenure (%)

SSE’s relative valuation illustrates a profound loss of confidence amongst its shareholder base. Despite its significant exposure to high-quality Renewables assets that contributed more than 40% of the consolidated EBITDA in 2021, SSE currently trades at a steep discount to its Renewables peers and only in line with pure-play Networks peers that have no exposure to Renewables assets.

See Figure 2: 2-year forward EV/EBITDA ratio

The Drivers of SSE’s Undervaluation

The market’s failure to ascribe fair value to SSE and its portfolio is directly attributable to the Company’s inefficient conglomerate structure and confusing equity story. Renewables and Networks are intrinsically different businesses, supported by divergent shareholder registers, with individual funding needs, growth profiles and strategic priorities, which would be better addressed if the businesses were fully independent. SSE’s existing conglomerate structure forces the Renewables and Networks businesses to compete for capital expenditure and management’s attention.

This dynamic not only undermines the quality of each business, but also makes it harder for investors to understand and value the Company properly. Each business offers investors a distinct equity story. SSE’s Networks division is a stable, fully regulated business generating predictable cash flows that finance CapEx investments and dividends. SSE’s Renewables division is a high-growth business with substantial upfront equity investment requirements to build scale with attractive project-level returns. The confusion caused by the current conglomerate structure is a key driver of the undervaluation of SSE. As HSBC wrote: “the market is either pricing in a zero renewables pipeline until 2030 or is attaching too low a premium to SSE’s […] networks business.”

The table below illustrates the dramatic differences that give rise to SSE’s valuation challenges:

See Figure 3: The differences between SSE’s Networks and Renewables divisions

A closer look at SSE’s peers shows that there is a correlation between structural complexity and valuation. Renewable players with simple structures, such as Orsted or EDPR, achieve higher valuations and receive more credit for their growth pipeline than players with complex structures such as SSE. In other words, SSE’s best-in-class Renewables business cannot get a fair valuation as long as it remains within SSE’s conglomerate structure.

Overall, we believe the market ignores £5 billion of value because of SSE’s inefficient structure. This represents ~30% upside from today’s valuation. Our view is backed by a detailed valuation of SSE’s Renewables assets, on a project-by-project level, conducted with the help of a leading industry consultant. We also believe that the Renewables assets alone, including its offshore seabed leases, could command a valuation in excess of SSE’s current market cap.

The Renewables business is undermined not only by SSE’s structure, but also by its inadequate board. SSE struggles to make a credible case that Renewables is a priority when renewables experience is absent at the board level. In fact, not one of SSE’s independent board members has any meaningful operating experience in growing a large renewables business. This lack of expertise puts the Company at a strong disadvantage to its competitors. For example, out of the seven independent directors on Orsted’s board, three have renewables experience. This allows Orsted to benefit from better oversight of its management team and of its strategic decision process. Even the integrated utilities like Enel and Iberdrola have more renewables experience on their boards than SSE, despite the lower contribution of renewables to their overall business. This lack of experience at the board level provides yet another signal to the market that SSE is not making the most of its Renewables business. SSE deserves a best-in-class board with experience that aligns with its core businesses.

A Listing of SSE’s Renewables Business Remains the Best Course of Action

We believe the plan that we had discussed with you — a separation executed through a U.K. listing of SSE’s Renewables business — would have resulted in:

1) The creation of two U.K. energy champions: Following a listing, in which all Renewables Co shares would be distributed to SSE shareholders, both Renewables Co and Networks Co would become large, investable entities on the FTSE 100. Each company would have a fully focused leadership team and a best-in-class board with the right mix of independence, experience and expertise. Both companies would be able to tell their own unique equity stories clearly and focus on execution and appropriate capital allocation. As a result, investors would be able to value each entity at its fair value without applying a conglomerate discount.

2) Enhanced financial flexibility: Renewables Co would gain access to cheaper equity capital, creating an alternative to the current capital-recycling model. Today, the Renewables business is only able to raise equity at SSE’s P/E multiple of 17x. Based on our analysis, SSE’s Renewables peers have been able to raise capital at a median P/E multiple of 26x over the last three years. Once listed, Renewables Co would be able to raise capital and finance its growth at much more attractive terms.

3) Improved ESG capital inflows: A pure-play Renewables Co (and the first in the FTSE 100) will attract more ESG capital from active and passive investors alike, consistent with the COP26 target to mobilise international finance to support those on the forefront of today’s energy transition. In its current structure, some key ESG active managers are reluctant to invest in SSE. A pure-play renewables business of SSE’s size and quality would offer an appealing investment for ESG funds.

4) An acceleration of the achievement of strategic and Net Zero objectives: Beyond accelerating growth in the deployment of renewables in the U.K., Renewables Co would be able to leverage its offshore expertise to pursue international growth and capture a larger share of the global offshore market. Networks Co would be able to re-establish itself as an attractive dividend payer whilst facilitating the U.K.’s transition to Net Zero through investments in the electricity networks. In its current corporate structure, SSE is poorly equipped to deliver on these commitments.

While a full separation of Renewables was the optimal solution, there were other steps that the Board could have explored to unlock value and begin to separate these two distinct businesses, better positioning them for the future. For instance, the Company could have explored a partial listing of its Renewables business or a more ambitious asset-divestiture plan.

Instead, the Company moved forward with the plan it announced on 17 November, leaving investors and analysts disappointed not only by the Company’s lack of ambition in moving towards the separation, but also by the process through which it arrived at that path.

SSE’s Missed Opportunity

The negative share-price reaction on 17 November sent an unequivocal message: The new strategic plan does not adequately address SSE’s current set of challenges and opportunities. Investors were hoping for a more ambitious strategy, a more robust exploration of the strategic options available to the Company, and a clear and honest discussion about the best path forward. Instead, investors were left thoroughly frustrated, to the point where the stock opened -7%, before closing down -4%.

The perspectives that we shared with you were not addressed sufficiently or credibly and the market took notice. As a report from Sanford Bernstein incisively put it: “[T]he rejection of a renewables spin represents a missed opportunity to unlock further value, reflected in the share-price reaction today.” (Emphasis added.) Rather than offering investors a detailed and thorough explanation of the reasoning underpinning its decision, the Board instead relied upon vague generalities and poorly substantiated conclusions.

The market is clearly not convinced, and the negative reactions from many analysts and media commentators mirrored the decline in the stock price, hitting mainly on the following issues raised by SSE’s announcement:

1) No convincing explanation for not pursing a full or partial listing of the Renewables business: To explain away its decision not to pursue this path to value creation, SSE’s management team argued that a separation would lead to dis-synergies. As noted by a number of analysts, however, these comments on dis-synergies were simply not credible. To quote again from the Sanford Bernstein report, “[T]hese [£95m p.a. of] dis-synergies appear very high considering that even GE’s recent separation implies only $150-$200m p.a. and diminishing over time.”

Nor were the “pretty significant IT costs” mentioned by Gregor Alexander a satisfactory explanation as to why SSE is not pursuing a listing of Renewables that could unlock £5 billion of value for shareholders. Similarly, Mr. Alexander referenced a central Energy Portfolio Management function, which is a structure that can be maintained at arm’s length after a listing of Renewables, or alternatively can be provided at competitive rates on the market. The incremental financing costs Mr. Alexander described would be equally negligible, as illustrated by the fact that peers with lower credit ratings than SSE, such as National Grid and Acciona Renewables, have similar financing costs to SSE.

Equally unconvincing was management’s claim that a standalone Renewables business would not be able to pursue projects like Dogger Bank or Berwick Bank. SSE’s 40% share in Dogger Bank is equivalent to 1.4GW of offshore capacity. At the same time, RWE, a non-integrated player with a scale comparable to that of SSE’s Renewables, is developing 100% of Sofia Offshore, which is a 1.4GW sister project to Dogger Bank. Orsted, a pure-play renewables player, is also successfully developing the Hornsea Wind Farm, which is bigger than Dogger Bank and Berwick Bank. As noted by the Financial Times: “It is hard to believe that a standalone renewables business would have difficulty securing funding on attractive terms in the current climate. Management’s estimate of separation costs of £200m and £95m a year in extra costs after a split merit a raised eyebrow too…”1

The reality is that if SSE decided to list its Renewables business, it would be able to raise equity at far more attractive terms than currently. Contrary to management’s assertions, listing SSE’s Renewables business would enhance its ability to finance big projects by unlocking access to significantly lower-cost equity financing from the flood of ESG-focused investors who would be attracted to a pure-play green-energy champion.

2) The partial sale of Networks lacks ambition in both quantum and timing: While the decision to sell a minority stake in Networks represents a first step towards a separation, the unnecessary delay until 2023 creates uncertainty over whether the Company will be fully funded and whether it will be best positioned to take advantage of all growth opportunities until then. Several analysts raised this topic during the Q&A portion of the 17 November announcement, demanding more transparency on the size and timing of asset disposals.

Additionally, the unambitious target of selling only a 25% stake in the Networks business means that SSE will likely face further, long-term funding pressure, making SSE’s path to becoming the U.K.’s Renewables champion more difficult. SSE will indeed continue to see significant growth opportunities in Renewables well beyond 2026, and the current plan fails to set the Company on track to be able to raise low-cost equity capital to pursue this path, leaving further assets sales (ultimately resulting in a full separation) or dividend cuts as the only apparent alternatives.

This funding overhang, if not addressed, will continue to weigh down the share price. As J.P. Morgan warned: “We expect the shares to react negatively […] given […] the smaller than expected minority stake sale in networks, and the larger than expected dividend cut.” Given that Mr. Phillips-Davies said that SSE was “confident that [SSE] will dispose of [the Networks business] as and when [SSE] wants to,” it is unclear why the Company is not selling more than 25% of the business and why it is not selling it earlier than 2023. The planned minority sale is too little, too late; as noted by an analyst during the call, it is seemingly just a “halfway” measure that is not sufficient to solve its long-term funding challenges.

3) A deep dividend cut: By failing to address the Company’s funding challenge while cutting the dividend by close to 30%, SSE has managed to simultaneously alienate both the income investors and the growth investors who make up its shareholder base. As Barclays put it: “Consequently there may be a stock overhang from a combination of investors who were looking for demerger gratification (we see 2200-2300p breakup value) and income investors who see a <4% dividend yield as too low.” Societe Generale added, “The dividend cut comes as a disappointment.” Because the new strategy does not address the long-term funding challenges of SSE, investors rightly fear that there could be further pressure on the dividend in the future.

4) An opaque and deeply flawed strategic review process: The presentation of SSE’s new strategic plan left investors and analysts both confused and concerned. The arguments presented to the market against the listing of the Renewables business were perceived as perfunctory, dismissing strategic alternatives without proper due diligence.

The use of non-credible dis-synergies and inaccurate arguments about loss of scale to reject the separation raised further concerns about the integrity and thoroughness of the review process that the Board of SSE undertook. As The Times noted: “SSE messes up by refusing to acknowledge, let alone quantify, any potential benefits from a break-up. Phillips-Davies can’t bring himself to accept there could be any upside. And his ‘detailed external independent advice’ turns out to be just the company’s normal bankers.

Contacts

Elliott Advisors (UK) Limited

Sarah Rajani CFA

T: +44 (0)20 3009 1475

srajani@elliottadvisors.co.uk

Camarco

Billy Clegg

T: +44 (0)20 3757 4983

billy.clegg@camarco.co.uk

Monique Perks

T: +44 (0)20 3757 4995

monique.perks@camarco.co.uk