Energy/Automotive News| WTI Crude $78.68/bbl, Brent $83.49/bbl, Natural Gas $2.21/MMBtu

London ,06 May 2024, (Oilandgaspress): — Oil futures up today after Saudi Arabia increased June crude prices for most regions and as the prospect of a Gaza ceasefire deal appeared slim, renewing fears the Israel-Hamas conflict could still widen in the key oil producing region.

Neste and the Singapore Airlines (SIA) Group have signed an agreement for the purchase of 1,000 tons of neat Neste MY Sustainable Aviation Fuel™. This will make SIA and Scoot, the two airlines in the Group, the first carriers to receive sustainable aviation fuel (SAF), produced at Neste’s refinery in the country, at Changi Airport.

Neste will blend the SAF with conventional jet fuel according to the required safety specifications, and deliver the blended jet fuel to Changi Airport’s fuel hydrant system in two batches – once in the second quarter of 2024 and once in the fourth quarter of this year. This milestone will also mark the first direct supply of Neste’s SAF to airlines at Changi Airport, reinforcing their end-to-end SAF supply chain capabilities in Singapore. This follows the completion of the expansion of Neste’s Singapore refinery in May 2023. The refinery has the capacity to produce a million tonnes of SAF each year, making it the world’s largest SAF production facility. Neste’s SAF, which is made from 100% renewable waste and residue raw materials, reduces greenhouse gas emissions by up to 80%* over the fuel’s life cycle. Blended with conventional jet fuel, it seamlessly integrates with existing aircraft engines and fuelling infrastructure.

“This agreement with Neste is an important milestone in the SIA Group’s journey to have a minimum of 5% sustainable aviation fuel in our total fuel uplift by 2030. Close collaboration with our partners and stakeholders, both in Singapore and globally, plays a critical role in our long-term decarbonisation goals. A more sustainable aviation industry will ensure that future generations continue to benefit from the global connectivity, economic prosperity, and people links that air travel fosters,” said Ms Lee Wen Fen, Chief Sustainability Officer, Singapore Airlines. Read More

Chevron Pipe Line Company (CPL), a subsidiary of Chevron Corporation, and American Aerospace Technologies, Inc. (AATI) received a first-of-its-kind waiver from the U.S. Federal Aviation Administration (FAA) to conduct unmanned aircraft surveillance in the San Joaquin Valley. The AiRanger Unmanned Aircraft System (UAS) was designed by AATI, a leader in intelligent airborne sensing and surveillance services for energy and other critical infrastructure, to support Beyond Visual Line of Sight (BVLOS) aerial surveillance for Chevron’s pipeline and production facilities.The Detect and Avoid (DAA) system’s capabilities were demonstrated during flight operations in Buttonwillow, California, in October 2023. Following the demonstration and FAA observed testing, the Agency issued a 91.113 Waiver and granted a 44807 Exemption (“Waiver and Exemption”). The Waiver and Exemption authorizes AATI to utilize the onboard detect and avoid system to comply with aircraft right of way rules when operating BVLOS. The AiRanger is the first UAS to demonstrate compliance with industry consensus standards for the DAA system and reach this milestone. The AiRanger UAS is a fixed-wing, unmanned aircraft system capable of long-range operations beyond visual line of sight. The aircraft weighs 220 pounds with a wingspan of about 18 feet and can fly over 700 miles and up to 17 hours at up to 17,000 feet. Read More

KBR announced today it has been awarded a multiple award, Indefinite Delivery Indefinite Quantity (IDIQ) contract by the U.S. Naval Facilities Engineering Systems Command for global contingency services. Under the Global Contingency Services Multiple Award Contract (GCSMAC) III, KBR will compete on IDIQ task orders to provide mission-critical support to U.S. Navy facilities around the world. The contract period begins April 2024 and lasts 8.5 years, with a current ceiling value of $2 billion. The task orders are expected to be a combination of cost-plus-award-fee and firm fixed price. The purpose of the contract is to provide short-term facility support services in support of natural disasters, humanitarian efforts, military actions, and to cover incumbent contractors’ nonperformance or potential breaks in service at various locations throughout the world. Tasks may include IT support and management, force protection, airfield and port operations, healthcare support, fleet and family readiness, utilities and transportation, among other support services.

“KBR understands how critical the U.S. Navy’s mission is to safety and security around the globe,” said Byron Bright, KBR Government Solutions U.S. President. “With our decades of experience supporting the U.S. military worldwide, KBR leverages our global supply chain, agile workforce and rapid deployment capabilities to respond to the Navy’s needs and to conduct contingency operations anywhere in the world. And with a growing emphasis on the Indo-Pacific region, KBR is positioned to expand support to the Navy in INDOPACOM.” . Read More

Odfjell SE: Invitation to 2024 Capital Markets Day

Odfjell has the pleasure of inviting investors, analysts, media and other stakeholders to attend our annual Capital Markets Day on Monday 13 May, 10:00 – 13:00 CET.

The meeting will take place at Hotel Continental, Stortingsgata 24/26, Oslo. Read More

The new CLE 53 4MATIC+ Cabriolet (energy consumption combined: 9.8-9.6 l/100 km | CO₂ emissions combined: 223-217 g/km | CO₂ class: G)[1] now joins the SL Roadster as the second model from Mercedes-AMG for open-top driving fun. With its extensive standard equipment, spacious interior and comfort features including AIRCAP® or AIRSCARF®, the four-seater is fully suitable for year-round driving. The 3.0-litre in-line six-cylinder engine with twin turbocharging has an output of 330 kW (449 hp) thanks to its exhaust turbocharger and additional electric compressor. The engine has a maximum torque of 560 Nm (600 Nm in overboost for up to 10 seconds). The integrated starter generator briefly provides an additional 17 kW (23 hp) of boost power and 205 Nm of torque. It also feeds the 48-volt electrical system. Other technical features of the new model include the AMG SPEEDSHIFT TCT 9G transmission, fully variable all-wheel drive AMG Performance 4MATIC+ and active rear-axle steering.The new CLE 53 4MATIC+ uses an extensively upgraded version of the proven M256 3.0-litre in-line six-cylinder turbocharged engine. Now called M256M, this version of the high-performance engine impresses above all through its optimised combustion chambers with redesigned intake and exhaust ports. It also has new piston rings, modified injection and a new exhaust turbocharger, which offers an increased boost pressure of 1.5 bar (previously 1.1 bar). This results in a higher torque of 560 Nm in continuous operation and 600 Nm in overboost for up to ten seconds.

More crucial than the absolute torque is the improved torque build-up and more harmonious engine response. This is made possible by the additional electric compressor, which has also been enhanced. It can now run almost continuously for a longer period of time, an upgrade that customers will notice particularly in the medium rev range. This, in turn, allowed for a larger exhaust turbocharger for higher peak performance. Read More

Stellantis Pro One commercial vehicles offensive delivered an excellent performance in the first quarter of 2024, accounting for one-third of Net revenues reported by Stellantis. The performance highlights the strength of Stellantis Pro One in global markets and puts it on track to achieve global leadership in commercial vehicles by 2027 and reach the targets outlined in the Dare Forward 2030 strategic plan.

Stellantis Pro One Middle East and Africa region market share reached 26% in the first quarter of 2024. In addition, it maintained the No. 1 position in both EU30 and South America regions. For EU30 BEV (battery electric vehicle) sales for the quarter, Pro One takes the top spot with 33% market share, with the Peugeot brand leading across the region.“The Q1 2024 sales performance in commercial vehicles confirms and validates our Stellantis Pro One strategy,” said Xavier Peugeot, Stellantis Senior Vice President, Commercial Vehicles Business. “The enthusiastic welcome of our entirely new van line-up, combined with new connected services and concrete hydrogen fuel cell propulsion van offers confirm Stellantis’ position as the relevant choice for professionals.” Regional highlights include: . Read More

The Opel Zafira is the perfect spacious people carrier for travelling with friends or family. The conversion specialists at Crosscamp clearly agree: they have transformed the Zafira into a practical, flexible and comfortable urban camper – in two versions. The Crosscamp Urban Camper Lite comes as a versatile everyday vehicle which, thanks to its flexible equipment options, is the ideal companion for short trips. The Crosscamp Urban Camper Full is already equipped with many permanent fixtures even for longer holiday trips. Both Crosscamp variants based on the Opel Zafira have one thing in common: the 4.95 metre long camper vans have sleeping space for up to four people. Additionally, both offer maximum safety on the road and when manoeuvring with numerous Opel assistance systems, including a 180-degree rear-view camera with bird’s eye view. Standard features such as the front seats that rotate by 180 degrees, heat and sound insulation glazing, dual-zone automatic climate control and easy-care wood-effect sandwich flooring further enhance travel comfort. Outside, standard piping strips are installed on both sides of the van to provide a secure hold for solar sails or awning supports on the campsite. A further practical detail when driving to the city for sightseeing: thanks to its height of only 1.99 metres, Crosscamp Urban Camper drivers can even access most public car parks. Read More

.

Bugatti has launched a new online portal to bring together the full range of Bugatti lifestyle products – from rare objet d’art to scale model Bugatti – to a global audience. The revamped digital space represents the first time that consumers can access all these products in one place, available for delivery all over the world. At the core of the Bugatti brand experience lies three crucial pillars: innovation, personalization and state-of-the-art technology. These principles have allowed Bugatti to evolve from being “only” a world-leading hyper sports car manufacturer to an international luxury brand that projects excellence beyond the automobile.

Over the past few years, Bugatti Brand Lifestyle has flourished with ambitious new partnerships and authentic collaborations with brands that always strive to push the boundaries within their respective fields. A diverse range of products cater for all enthusiasts of the Bugatti brand, from clothing pieces through to premium headphones.

Readily available products like these ones – which also include Carbon Champagne for Bugatti, Bugatti e-scooters and Bugatti Smartwatches – can be ordered and shipped worldwide directly from the site. Bespoke and rare products, such as the 75% scale model of the famous Bugatti Type 35: the Baby Bugatti II, fine timepieces from Jacob & Co, world-leading audio systems from TIDAL or high-security safe collections from Buben & Zörweg are also displayed with the option for customers to request a callback within 24 hours to hone their wishes. Read full article

The Saudi Fund for Development (SFD) is set to provide financing for a water treatment and biogas energy generation project in Central America. The SFD has just signed a Memorandum of Understanding (MoU) with the Republic of El Salvador, aiming to establish a framework for promoting development cooperation between the two parties.

The Memorandum represents a step towards financing a project for water treatment and biogas energy generation through the waters of the Acelhuate River, through an accessible development loan provided by the Saudi Fund for Development. The loan agreement will be signed in coordination between the two parties. This MoU comes within the framework of the Fund’s developmental efforts to support the growth of vital opportunities in various developing countries around the world, aiming at achieving international prosperity for the beneficiary communities.. Read full article

The Saudi Fund for Development (SFD) and UK’s Foreign, Commonwealth and Development Office (FCDO) signed a Joint Cooperation Arrangement (JCA) in Riyadh, in the presence of the Supervisor General of King Salman Humanitarian Aid and Relief Centre (KSrelief), H.E. Dr. Abdullah Al Rabeeah, the UK’s Deputy Foreign Secretary and Minister of State, Rt Hon. Andrew Mitchell MP, and H.E. the CEO of the Saudi Fund for Development, Mr. Sultan bin Abdulrahman Al-Marshad. The signing ceremony took place on the sidelines of the second strategic dialogue on humanitarian assistance and international development at KSRelief HQ.

As part of the JCA, SFD and FCDO will collaborate to enhance development effectiveness and policy issues of mutual interest. Additionally, both parties will focus on effectively delivering the international development agenda for their respective organizations, while strengthening their capacities to better respond to overseas development needs. The goals and objectives outlined as part of the JCA will provide support for the world’s poorest and most vulnerable people through improved donor coordination, enhanced transparency and accountability of aid, and effective monitoring and evaluation.. Read full article

Aramco is exploring the formation of a joint venture in the Saudi Aramco Jubail Refinery Company (“SASREF”) with Chinese partner Rongsheng Petrochemical Co. Ltd. (“Rongsheng”) and significant investments in the Saudi and Chinese petrochemical sectors, in partnership with Rongsheng.

The Company recently signed a cooperation framework agreement that envisions Rongsheng’s potential acquisition of a 50% stake in SASREF. The agreement also lays the groundwork for the development of a liquids-to-chemicals expansion project at SASREF, in addition to Aramco’s potential acquisition of a 50% stake in Rongsheng affiliate Ningbo Zhongjin Petrochemical Co. Ltd. (ZJPC) and participation in ZJPC’s expansion project. Read More

ADNOC, G42 and Presight AI Holding PLC (‘Presight’), an ADX publicly listed company, announced a new shareholding structure for AIQ. Under the agreement, Artificial Intelligence (AI) and Big Data Analytics leader Presight will acquire a 51% stake in AIQ with ADNOC retaining a 49% shareholding (previously G42 40%, ADNOC 60%). AIQ will continue as a standalone company, leveraging data to deliver transformational AI-powered solutions to the energy sector. The transaction is subject to Presight’s shareholder and regulatory approval. As part of the transaction, ADNOC will receive 4% in Presight shares currently from G42, in exchange for 11% of its shareholding in AIQ, which, at current Presight market value, values AIQ at over $1.4 billion. His Excellency Dr. Sultan Ahmed Al Jaber, Minister of Industry and Advanced Technology and ADNOC Managing Director and Group CEO, will assume the role of AIQ’s Chairman. His Excellency Mansoor Al Mansoori, Member of Abu Dhabi Executive Council and Chairman of the Department of Health, Abu Dhabi and Chairman of Presight will be the Vice-Chairman. The transaction will combine AIQ’s breakthrough AI energy solutions with Presight’s cross-sector big data analytics, product development, and international markets access to position AIQ as a leading energy-focused AI organization. By integrating AIQ and Presight’s big data analytics and AI offerings, the companies will realize operational efficiencies and synergies while meeting a wider array of customer requirements, and deliver greater value for ADNOC, Presight, G42 and the UAE. Read More

On April 25, CNOOC Limited announced its operating results for the first quarter of 2024.

In the first quarter, the company pressed ahead with oil and gas exploration and development, advanced the enhancement of quality and efficiency, and consolidated its advantage of cost competitiveness. Net production of oil and gas and net profit attributable to equity shareholders achieved strong growth, both hitting new highs for the same period. During the quarter, CNOOC Limited recorded a total net production of 180.1 million barrels of oil equivalent (“BOE”), representing an increase of 9.9% year-on-year (“YoY”). The net production from China grew by 6.9% YoY to 123.2 million BOE, which was mainly attributable to the production from the newly commissioned projects. Overseas net production rose by 16.9% YoY to 56.9 million BOE, which was mainly driven by increased production from Guyana and Canada.

The company made 2 new discoveries and successfully appraised 4 oil and gas structures. In particular, Bozhong 8-3 South in offshore China was successfully appraised, opening up a new exploration chapter in ultra-deep plays offshore China. Overseas, a new discovery, Bluefin, was made at the Stabroek block in Guyana, further expanding the resource base in the southeastern portion of the block. During the period, Suizhong 36-1/Luda 5-2 Oilfield Secondary Adjustment and Development Project commenced production. Other major new projects, such as the Shenhai-1 Phase II Natural Gas Development Project, progressed smoothly.

In the first quarter of 2024, in spite of lower international oil prices, CNOOC Limited generated a net profit attributable to equity shareholders of RMB39.7 billion, representing a YoY growth of 23.7%, showing strong value creation capability. The all-in cost was US$27.59 per BOE, a decrease of 2.2% YoY. The company’s capital expenditures amounted to approximately RMB29 billion, increased by 17.3% YoY, which was mainly because of the increased workloads at projects under construction and adjustment wells. Read More

PetroChina Company Limited announced that the Company’s operating results for the first quarter of 2024 hit another historic high for the same period, as it coordinated the production and operation, promoted work safety and environmental protection, enhanced operational quality and profitability, and pursued reform, innovation and green transition. While persistent efforts were made to optimize the production, operation and product structure, the Company stepped up marketing efforts and carried out stringent cost control. Both of its oil and natural gas industrial chains ran in a safe, smooth and profitable manner along with rapid growth in emerging businesses including new energies and new materials. In accordance with IFRS, the Company’s revenue for the first quarter grew by 10.9% year-on-year to RMB 812.18 billion. Its net profit attributable to owners of the Company grew by 4.7% year-on-year to RMB 45.68 billion. The Company kicked off the year 2024 with high-quality and profitable growth Read More

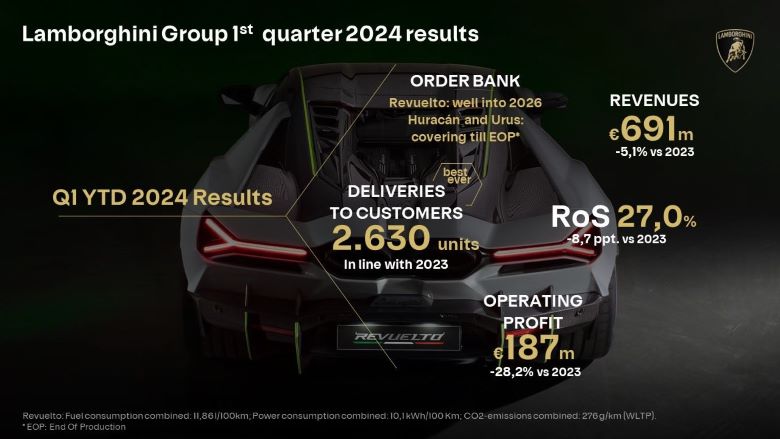

After a record-breaking 2023, in which unprecedented numbers were recorded in terms of deliveries and profitability, Automobili Lamborghini’s first quarter of 2024 closes with positive numbers. Turnover stands at €691 million, the operating profit reached €187 million translating into a profitability of 27,0%. These figures confirm the stability and strategic strength of the Sant’Agata Bolognese-based company. In detail, the first quarter ended for Automobili Lamborghini with its best-ever quarterly deliveries result, with 2,630 cars delivered. Despite a slight drop in the first three months of 2024, the US market remains the top country in terms of deliveries. The overall performance nevertheless confirms excellent results. In terms of deliveries in the macro-areas, the three regions EMEA, Americas and APAC recorded 1,278, 856 and 496 cars respectively. The results achieved by Automobili Lamborghini in the first three months demonstrate the resilience of the brand and reflect the strategic decisions the company has implemented in 2024. These include the rebalancing of deliveries over each quarter, which aims for a more even spread of deliveries throughout the year.

The order bank remains strong, with Revuelto maintaining a lead time of more than two years and the Huracán, the successor of which will sport a new hybrid powertrain, remaining covered until the end of manufacture. For the Urus S and Performante, the order bank is also fully covered until the close of production, expected by the end of the year.

Automobili Lamborghini opens the second quarter of 2024 with the launch of the new Urus SE[4], the Sant’Agata Bolognese carmaker’s first hybrid super SUV, holding excellent prospects for achieving the targets set. Read More

Porsche Classic Factory Restoration

Klaus Kariegus has gathered a total of 40 years of experience: Even before Porsche Classic Factory Restoration was established, the trained mechanic was working on gearboxes in its precursor, the factory repair department. The qualification programme for his successor was as demanding as ever – there was no room for slacking, even between family. In addition to various restorations, the father-and-son team has produced a proud small series of 50 gearboxes for the 911 (type 993) in these six months – an invaluable pool of spare parts for the worldwide customers whom Porsche Classic supplies with spare parts.

In the course of a Porsche factory restoration, the engine and gearbox are almost entirely dismantled, cleaned and inspected. Worn or defective parts are replaced or, if possible, also repaired and restored if requested by the customer. “Finding the cause of the fault, such as a gear jumping, is often real detective work. The years of experience often help, as you often remember where there have previously been problems with the same gearbox,” says Klaus.

Once refitted, the gearbox then has to prove its performance with an extensive test run. “That was always the most exciting moment, when the boss went out on a test drive,” says Klaus Kariegus with a smile. There are no test benches in the gearbox department that can be used to determine whether or not it will function correctly in advance. “But in the vast majority of cases, Uwe Makrutzki came back from the test run with a big grin and everything had worked properly” Kariegus Senior continued. In many cases, gearboxes are not installed on site, but sent to Porsche Classic Partners worldwide. Read More

The engine of the Porsche 911 has come a long way over the past 60 years, now with four times the power from twice the displacement. Its drive technology has continued to develop, but the fundamental concept has remained unchanged—whether naturally aspirated, as a turbo, or in the future even as an ultra-sporty hybrid. Each generation of the 911 achieves new milestones in drive technology. In the early 1970s, Porsche put the increased power of turbocharging to the test in racing with great success. The technology was ready for series production in 1974, and Porsche presented the 911 Turbo (known internally as the 930). With 260 PS, it was one of the fastest cars of its time. Technologically speaking, Porsche was one step ahead of the competition. For the first time, boost pressure was regulated with a controlled valve on the exhaust side, taming power delivery and making the turbocharged engine suitable for everyday use. With its displacement increased to three liters, the Turbo engine was aspirated engines of the 911. Thanks to its unique combination of turbocharger and fuel injection, the 911 Turbo fulfilled the stringent American emissions regulations from the very start. Read more

Baker Hughes Rig Count: : U.S. -8 to 605 Canada +2 to 120

U.S. Rig Count is down 8 from last week to 605 with oil rigs down 7 to 499, gas rigs down 3 to 102 and miscellaneous rigs up 2 to 4.

Canada Rig Count is up 2 from last week to 120, with oil rigs up 4 to 60, and gas rigs down 2 to 60.

International Rig Count is up 7 rigs from last month to 978 with land rigs up 7 to 743, offshore rigs unchanged at 235

The Worldwide Rig Count for April was 1,726, down 67 from the 1,793 counted in March 2024, and down 82,from the 1,808 counted in April 2023.

BP is expected to reverse a previous commitment to reduce oil and gas production by the end of the decade amid a broader pivot in the industry to continue providing the hydrocarbons the world needs, some of the biggest shareholders in the UK-based supermajor told the Financial Times.

BP’s peer Shell has already eased its carbon intensity target for 2030 as it has shifted away from clean power sales to retail customers. Read more

Oil and Gas News Undiluted !!! �The squeaky wheel gets the oil�

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: @OilAndGasPress on Twitter |

Oil and gas press covers, Energy Monitor, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas,

Subscribe to Oil, Gas, Energy News Release Service