Energy/Automotive News| WTI Crude $79.43/bbl, Brent $83.12/bbl, Opec $82.65/bbl

London, 04 March 2024, (Oilandgaspress): -Global energy-related carbon dioxide (CO2) emissions rose less strongly in 2023 than the year before even as total energy demand growth accelerated, our new analysis shows, with continued expansion of solar PV, wind, nuclear power and electric cars helping the world avoid greater use of fossil fuels. Without clean energy technologies, the global increase in CO2 emissions in the last five years would have been three times larger.

Emissions increased by 410 million tonnes, or 1.1%, in 2023 – compared with a rise of 490 million tonnes the year before – taking them to a record level of 37.4 billion tonnes. An exceptional shortfall in hydropower due to extreme droughts – in China, the United States and several other economies – resulted in over 40% of the rise in emissions in 2023 as countries turned largely to fossil fuel alternatives to plug the gap. Had it not been for the unusually low hydropower output, global CO2 emissions from electricity generation would have declined last year, making the overall rise in energy-related emissions significantly smaller. Read More

Patrick Pouyanné, Chairman and CEO of TotalEnergies, met yesterday in Bahrain with His Highness Shaikh Nasser bin Hamad Al Khalifa, His Majesty the King’s Representative for Humanitarian Works and Youth Affairs and Chairman of Bapco Energies- the integrated energy company leading the energy transition in the Kingdom of Bahrain – and Mark Thomas, Group CEO of Bapco Energies.

The meeting laid the foundations for cooperation between TotalEnergies and Bapco Energies, under which TotalEnergies will support Bapco Energies in optimizing its Sitra refinery, which is currently being upgraded, and in trading of its petroleum products. TotalEnergies will bring its global oil and feedstock supply capacity, as well as its refining and trading expertise. “We are pleased to have been selected by the Bahraini authorities to support Bapco Energies in optimizing their downstream petroleum operations, with a view to maximizing value for Bahrain. I sincerely hope that this new partnership marks the beginning of a promising relationship between TotalEnergies and the Kingdom of Bahrain,” said Patrick Pouyanné, Chairman and CEO of TotalEnergies. “We are indeed a global integrated energy company and are willing to bring for the benefit of the Kingdom of Bahrein and Bapco Energies our full expertise along integrated oil, LNG and power value chains. We will work to extend our collaboration beyond oil and petroleum products to potential future developments in other energies, such as LNG or renewable power.” Read full article

Lotus Technology Inc., a leading global luxury electric vehicle maker, rang opening bell at the Nasdaq stock exchange in New York City in celebration of its public listing. The Company’s American depositary shares (“ADSs”) commenced trading today on the Nasdaq Stock Market LLC (“Nasdaq”) under the ticker symbol “LOT” following the completion of its business combination on February 22, 2024, with L Catterton Asia Acquisition Corp (“LCAA”), a special purpose acquisition company (“SPAC”) formed by affiliates of L Catterton, a leading global consumer-focused investment firm.

Lotus Tech CEO Qingfeng Feng was joined by members of the Lotus Tech and L Catterton teams in New York City to witness this important milestone, which will help Lotus Tech to further its mission of becoming an advanced, fully electric, intelligent, and sustainable luxury mobility provider under the brand’s Vision80 strategy.

“This is an exciting moment for all of us at Lotus Technology,” said Mr. Feng. “I would like to extend my appreciation to our shareholders, partners, suppliers, our outstanding employees, and most importantly, our customers, for their support. We are proud to carry Lotus’s heritage into the future, and to open a new chapter in the Lotus story with our public listing today.” Read full article

Lotus Technology Inc., a leading global luxury electric vehicle maker, and L Catterton Asia Acquisition Corp, a special purpose acquisition company formed by affiliates of L Catterton, a leading global consumer-focused investment firm, today announced the completion of their previously announced business combination (“Business Combination”).

The listed company following the Business Combination is “Lotus Technology Inc.” and its American depositary shares (“ADSs”) are expected to commence trading on the Nasdaq Stock Market LLC (“Nasdaq”) under the ticker symbol “LOT” on February 23, 2024.

The announcement of the completion of the Business Combination comes after LCAA shareholders voted to approve the transaction on February 2, 2024. As a result of the Business Combination, LCAA became a wholly owned subsidiary of Lotus Tech and is expected to be delisted from the Nasdaq. Read full article

Li Auto Inc. announced that the Company delivered 20,251 vehicles in February 2024, up 21.8% year over year. The cumulative deliveries of Li Auto vehicles reached 684,780 as of the end of February 2024. “Even with the impact of Chinese New Year and some trims of Li L series models sold out as we prepare for switching to new models, our average daily delivery in February (excluding the eight-day Chinese New Year holiday period) still increased significantly compared with that of February 2023. We are scheduled to officially launch the long-expected Li MEGA and 2024 Li L series models at our spring launch event this afternoon. Li MEGA is a revolutionary model meticulously crafted to meet the needs of multi-generational households, boasting remarkable product strengths, and effectively addressing the long-standing challenges of range anxiety of BEVs. Additionally, our 2024 Li L7, Li L8, and Li L9 models will come equipped with enhanced functions and features to better serve our family users. With the release and deliveries of these new models, we target to have our monthly deliveries rebound to 50,000 vehicles in March,” commented Xiang Li, chairman and chief executive officer of Li Auto. As of February 29, 2024, the Company had 475 retail stores in 142 cities, as well as 355 servicing centers and Li Auto-authorized body and paint shops operating in 209 cities. Read full article

Li Auto Inc., a leader in China’s new energy vehicle market, hosted its 2024 Spring Launch Event and officially launched Li MEGA, its high-tech flagship family MPV. As the Company’s first high-voltage battery electric vehicle, Li MEGA provides big families with a blend of energy replenishment experience as efficient as traditional ICE vehicle refueling, next-generation design and exceptionally low drag coefficient, roomy and comfortable space, flagship-level performance and safety features, and superior intelligent experience.

At the event, the Company also launched its 2024 Li L7, Li L8, and Li L9 models, which further enhance product capabilities through upgrades in the range-extension system, chassis system, safety features, comfort configurations, and vehicle intelligence to better meet the needs of family users.

Deliveries of Li MEGA and 2024 Li L7, Li L8, and Li L9 will commence in March 2024. The following table sets forth their retail prices.

| Trim | Li MEGA | 2024 Li L7 | 2024 Li L8 | 2024 Li L9 | ||||

| Max | 559,800 | 379,800 | 399,800 | 459,800 | ||||

| Pro | — | 349,800 | 369,800 | 429,800 | ||||

| Air | — | 319,800 | 339,800 | — | ||||

| (Unit: RMB) | ||||||||

Nissan has confirmed that it has halted production of the LEAF electric car at its Sunderland factory after more than a decade and more than 270,000 cars built. It is due to be replaced by an all-new model, but we will have to wait until 2026 before it goes on sale.

A Nissan spokesperson said: “After 13 years of great success, the Nissan LEAF, the world’s first mass-market 100% electric vehicle, is approaching the end of its life cycle in Europe. Depending on the market’s inventory, European customers will be able to place their orders until vehicle stocks run out.

“Nissan has already announced a new line-up of 100% electric vehicles for the European market to be produced in Sunderland plant as part of our commitment to sustainability and electrification.”

Customers will still be able to buy a car from existing inventory, with stocks expected to last until the end of 2024. The LEAF will continue to be built in Japan and the US, but these cars will not be sold in the UK. Read full article

With over 2,500 kilometres covered during the Prologue, Alpine Endurance Team embarked humbly on the A424’s racing debut in the FIA World Endurance Championship Hypercar category.

The team continued its week with 220 laps of free practice on Thursday and Friday at the Lusail International Circuit. The first qualifying session of the season saw Nicolas Lapierre finish 14th with the #36, less than twelve-hundredths of a second shy of a place in Hyperpole and first among the new manufacturers in Hypercar. Meanwhile, Paul-Loup Chatin qualified three places further back in the #35.

On Saturday, the two Alpine A424s made their first start, with Nicolas Lapierre and Ferdinand Habsburg avoiding the hazards of the first corner. On hard tyres, both drivers applied themselves in their double stint, and the #35 car briefly took the lead just before the two-hour mark.

Mick Schumacher and Charles Milesi took over shortly afterwards to continue their teammates’ efforts despite a five-second penalty for incorrect positioning during a pit-stop for the #35 and contact with an LMGT3 for the #36. Matthieu Vaxiviere and Paul-Loup Chatin relayed them, with each putting in a double stint on hard tyres.

As night fell, Mick Schumacher and Ferdinand Habsburg were back behind the wheel, with the hard compound on the left flank and medium tyres on the right. On a track becoming increasingly treacherous with gravel on the racing line, the two trios increased the pace before handing over the final sprint to Nicolas Lapierre and Charles Milesi.. Read full article

JLR today announced it will generate more than a quarter of its UK electricity** from new onsite and near site renewable energy projects, slashing energy bills and reducing reliance on grid energy.

The plans form part of its global renewable strategy, which aims to increase self-generated energy to 36.4% of its global consumption by 2030.

JLR’s new off-grid energy projects aim to produce almost 120 Mega Watts (MW) of renewable energy at their peak, enough to power nearly 44,500 homes or charge 2.7 million I-PACE batteries annually.

Central to these plans is the installation of a variety of solar types designed to maximise the unique qualities of each of JLR’s global sites, initially focussing on key manufacturing and non-production locations in the UK, including its Halewood plant in Merseyside, the newly named Electric Propulsion Manufacturing Centre (EPMC) in Wolverhampton, and its Gaydon headquarters.

A mix of rooftop and ground-mounted panels, as well as solar car ports to power processes and electric car charging, will boost self-generated energy capability from solar by 16%. All sites will retain import grid connections to ensure security of supply.

Work is now underway to deliver these projects with the first three scheduled for completion by the end of 2026. Planning is already granted for an 18.2MW ground-mounted solar array at the company’s headquarters in Gaydon. Combined with a roof-mounted solar array already onsite, the electricity generated will provide the facility with around 40% of its energy needs.

Self-generated solar capacity at the EPMC will increase by a staggering 145% through the expansion of existing rooftop arrays to generate 18.9 MW, enough power to cover 37% of the site’s total consumption. JLR has already rolled out energy efficiency projects across the business, reducing emissions by 26% in 2023 compared to 2020. A total of 53 energy optimisation projects were successfully implemented in the last year with savings in CO2e of 10.9kt, equivalent to 5,450,000 fire extinguishers.

JLR is also piloting a global smart energy metering system at its manufacturing sites with the support of a strategic partner, while continuing to purchase 100% renewable-backed electricity for all core UK operations.

Combined, these additional efficiency measures, renewable initiatives, grid decarbonisation and degasification projects, will deliver JLR’s goal to cut carbon emissions across its operations by 46% by 2030. Read full article

BMW is going all-in on hydrogen: they’ve moved on from electrics and have already launched their new car – Lagrada.

In the past few years, the worldwide automotive industry has been searching for cleaner alternatives to traditional combustion engines. Battery-electric vehicles (BEVs) have gained popularity, but there are still concerns about range and infrastructure. In this scenario, hydrogen fuel cell electric cars (FCEVs) present an appealing option.

Global sales of hydrogen fuel cell vehicles (FCEVs) exceeded 72,000 units as of 2023. Even though this number is continually rising, it still only makes up a small part of the entire auto market. In addition, global passenger car sales reached around 80 million units in 2023. As a result, the ratio of hydrogen cars to the overall automotive industry is approximately 1 to 1.1, which means that for every hydrogen car sold globally, there will be approximately 1.1 conventional gasoline or diesel vehicles.

Despite widespread skepticism, BMW is one of the manufacturers and policymakers that believe that the lightest atomic element holds the key to achieving carbon neutrality—for personal vehicles, commercial trucks, and the electrical grid. Read full article

BMW is putting faith in its new hydrogen SUV

The iX5 Hydrogen produces electricity via a hydrogen fuel cell, which drives the electric motor while releasing only water vapor from the tailpipe. The iX5 Hydrogen has a range of up to 300 miles on a single tank of hydrogen and can be refueled in about 3-4 minutes.

Aside from its clean emissions, the BMW iX5 Hydrogen has impressive performance credentials. With 401 horsepower, it can accelerate from 0 to 60 mph in less than 6 seconds, providing a thrilling driving experience. It maintains highway prowess with a top speed of more than 112 miles per hour. The 6 kg hydrogen tank provides a reasonable range, and the quick refueling time of 3-4 minutes ensures minimal downtime on the road.

Additionally, the BMW iX5 Hydrogen has a large range and low refueling periods, making it a potentially viable alternative to gasoline-powered automobiles. However, difficulties with hydrogen infrastructure and pricing must be addressed before it can be broadly used. Remember that the hydrogen engine is a concept car with no set price and is not yet available for purchase. The BMW iX5 Hydrogen will eventually be available for consumer purchase, but this depends on different market conditions. Read More

China says its maglev hyperloop train has broken the world speed record in a test run, reaching a blistering 387 mph (623 km/h). Ultimately, its makers want to build a train more than three times as fast that will break the sound barrier and outpace airplanes.

The maglev train, dubbed the T-Flight, was built by the state-owned China Aerospace Science and Industry Corporation (CASIC), New Atlas reported. Hyperloop trains work by pushing magnetically levitating pods through tunnels with very little air resistance. The previous record holder for the fastest maglev train is the L0 Series SCMaglev in Japan, according to JRPass, which can hit a top speed of 375 mph (630 km/h). Read More

Kent announced that it has been awarded a five-year global commissioning framework agreement by bp. Under the agreement, Kent’s specialists will be fully integrated within bp’s commissioning and completions management team, ensuring a standardised approach across all projects and business units globally. This strategic approach will embed a commissioning readiness culture, as well as provide oversight and assurance of commissioning delivery through the utilisation of proven technology. The framework agreement extends to the end of 2028, with a possible extension. The services will be executed by Kent’s CCS Center of Excellence (CoE) and regional operations.

Kent’s decades of experience in end-to-end CCS services were key in being awarded a framework agreement. Kent’s approach of integrating commissioning throughout all project stages ensures certainty on quality, cost and schedule, leading to optimised operational uptime and ensuring project start-ups that are flawless. Commenting on the award is Tush Doshi, Chief Operating Officer at Kent, “We are proud to strengthen our longstanding relationship with bp. This framework agreement is a testament to our team’s world-class approach and ability to deliver results across the value chain. We look forward to working with bp to achieve best-in-class commissioning performance.”

John Kennedy, VP Project Management at bp, further commented, “Transforming our approach to commissioning delivery is a key factor in bp’s mission to continuously improve project delivery. This agreement is an enabler to that mission, leveraging Kent’s CCS capability throughout the lifecycle of projects, and building on a long-term relationship that has contributed to successful delivery across our global portfolio, including projects in Azerbaijan, Egypt and Trinidad.” Read More

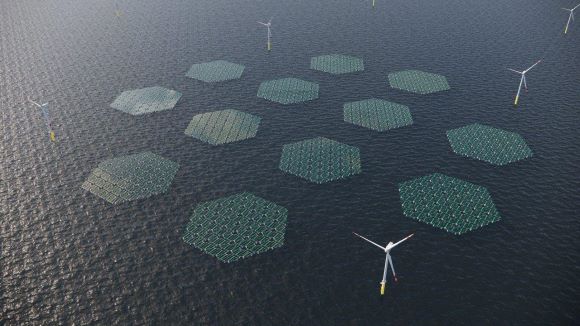

Nautical SUNRISE Project to facilitate R&D of the largest Offshore Floating Solar power plant in the world

The Nautical SUNRISE project is set to support the world’s largest Offshore Floating Solar power installation. The € 8.4 million project, supported with € 6.8 million of the Horizon Europe programme, kicked off in December 2023 to execute research and development on offshore floating solar (OFS) systems and its components. The outcomes of the project will enable the large-scale deployment and commercialisation of OFS systems in the future, both as standalone systems and integrated into offshore wind farms.

This project is aiming to design, build, and showcase a 5 MW offshore floating solar system using the modular solution of Dutch floating solar company SolarDuck. With RWE providing the investment for the installation and deployment, the system is planned to be electrically integrated, certified, and located within RWE’s OranjeWind (Hollandse Kust West VII) wind farm off the west coast of The Netherlands.

Prior to the offshore deployment, the Nautical SUNRISE consortium will conduct extensive research and testing to ensure the reliability, survivability, electrical stability, and yield of offshore floating solar systems. A comprehensive scale-up plan will address the challenges and create opportunities to drive forward the commercialisation of offshore floating solar systems. With sustainability in mind, Nautical SUNRISE is committed to consider the environmental impact and sustainability of OFS. The project will assess the environmental footprint, circularity, and full life cycle sustainability of offshore floating solar systems. This assessment will not only cover the demonstrator project but also include multiple GW-scale commercial projects, ensuring a comprehensive understanding of the technology’s ecological implications.

The Nautical SUNRISE consortium is looking forward to paving the way for a new era in offshore renewable energy, contributing to a more sustainable future for generations to come. Read More

Africa Oil Corp. announced that the Company repurchased a total of 424,125 Africa Oil common shares during the period of February 26, 2024 to March 1, 2024 under the previously announced share buyback program.

The launch of Africa Oil’s normal course issuer bid (share buyback) program, announced by the Company on December 4, 2023, is being implemented in accordance with the Market Abuse Regulation (EU) No 596/2014 (MAR) and Commission Delegated Regulation (EU) No 2016/1052 (Safe Harbour Regulation) and the applicable rules and policies of the Toronto Stock Exchange (“TSX”), Nasdaq Stockholm, and applicable Canadian and Swedish securities laws.

During the period dated February 26, 2024 to March 1, 2024, the Company repurchased 156,000 Africa Oil common shares on the TSX and/or alternative Canadian trading systems. The repurchases were carried out by Scotia Capital Inc. on behalf of the Company. During the same period, the Company repurchased 268,125 Africa Oil common shares on Nasdaq Stockholm, and these repurchases were carried out by Pareto Securities on behalf of the Company. Read More

New Delhi: State-owned Solar Energy Corporation of India (SECI) is planning to issue a tender for a concentrated solar-thermal power (CSP) storage project by next year. The tender is in the designing stage and will be issued for an initial capacity of 500 megawatt (MW) round-the-clock green energy.

Probable locations for the project development will be Gujarat, Rajasthan, or Andhra Pradesh due to higher solar radiation in these states, SECI’s Chairman and Managing Director R P Gupta told ETEnergyWorld. Read More

The OPEC Secretariat noted the announcements of several OPEC+ countries extending additional voluntary cuts of 2.2 million barrels per day, aimed at supporting the stability and balance of oil markets. These voluntary cuts are calculated from the 2024 required production level as per the 35th OPEC Ministerial Meeting held on June 4, 2023, and are in addition to the voluntary cuts previously announced in April 2023 and later extended until the end of 2024.

These additional voluntary cuts are announced by the following OPEC+ countries : Saudi Arabia (1,000 thousand barrels per day); Iraq (220 thousand barrels per day); United Arab Emirates (163 thousand barrels per day); Kuwait (135 thousand barrels per day); Kazakhstan (82 thousand barrels per day); Algeria (51 thousand barrels per day); and Oman (42 thousand barrels per day) for the second quarter of 2024. Afterwards, in order to support market stability, these voluntary cuts will be returned gradually subject to market conditions.

The above will be in addition to the announced voluntary cut by the Russian Federation of 471 thousand barrels per day for the same period (second quarter of 2024), which will be from crude oil production and exports as follows:

In April 350 thousand barrels per day from production and 121 thousand barrels per day from exports.

In May 400 thousand barrels per day from production and 71 thousand barrels per day from exports.

In June 471 thousand barrels per day totally from production.

Russia’s voluntary production cut is in addition to the voluntary cut of 500 thousand barrels per day previously announced in April 2023, which extends until the end of December 2024. The export cut will be made from the average export levels of the months of May and June of 2023. Read More

| Oil and Gas Blends | Units | Oil Price US$/bbl | Change |

| Crude Oil (WTI) | USD/bbl | $79.64 | Up |

| Crude Oil (Brent) | USD/bbl | $83.31 | Up |

| Bonny Light | USD/bbl | $87.20 | Up |

| Saharan Blend | USD/bbl | $87.28 | Up |

| Natural Gas | USD/MMBtu | $1.93 | Up |

| OPEC basket 01/03/24 | USD/bbl | $82.65 | Up |

Fervo Energy (“Fervo”), the leader in next-generation geothermal development announced that it has raised $244 million in new funding led by Devon Energy, a pioneer in shale oil and gas. This financing will unlock Fervo’s next phase of growth, deploying proven technology adapted from the oil and gas industry at scale to deliver commercially viable 24/7 carbon-free energy.

Galvanize Climate Solutions, John Arnold, Liberty Mutual Investments, Marunouchi Innovation Partners, Mercuria, and Mitsubishi Heavy Industries also joined the round alongside existing investors Capricorn’s Technology Impact Fund, Congruent Ventures, DCVC, Elemental Excelerator, Helmerich & Payne, and Impact Science Ventures.

“Demand for around-the-clock clean energy has never been higher, and next-generation geothermal is uniquely positioned to meet this demand,” said Tim Latimer, Fervo CEO and Co-Founder. “Our technology is fully derisked, our pricing is already competitive, and our resource pipeline is vast. This investment enables Fervo to continue to position geothermal at the heart of 24/7 carbon-free energy production.”. Read full article

Neste launched its new emission reduction solution, Neste Impact, for businesses looking to reduce the carbon footprint of their air travel and transport activities. The solution is based on purchasing Neste MY Sustainable Aviation Fuel™ with which greenhouse gas emissions (GHG) can be reduced by up to 80%* over the life cycle of the fuel compared to using fossil jet fuel.

Neste Impact enables businesses to turn their climate targets into measurable actions to reduce their aviation related emissions. Neste helps a business translate its climate targets into specific, measurable targets to reduce emissions from the business’s air travel and transport. The targeted emissions reduction can be achieved by replacing fossil jet fuel with a corresponding amount of SAF purchased from Neste. Neste ensures the SAF is supplied to a partner airline and the purchased amount is verifiably used to replace fossil fuel. After the SAF has been used, the business receives a third-party verified report, enabling it to credibly report the achieved emissions savings contributing to their sustainability targets.

“The urgency for climate action has never been greater, and businesses are increasingly looking for solutions that help them to reduce their aviation related carbon footprint. However, it can be a challenge to find a credible solution, particularly considering the ever-increasing reporting requirements and public demand for transparency. Neste Impact provides an easy to use solution for verified emission reductions, provided by the world’s leading producer of SAF,” said Kristina Öström, Vice President Marketing, Brand and Partnerships from the renewable aviation business at Neste.

Neste Impact is aligned with the Aviation Guidance of the Science Based Targets initiative (SBTi), the gold standard in climate reporting. It follows a book and claim approach, but unlike many other book and claim solutions, Neste ensures the SAF is delivered and used specifically in the aviation sector to replace fossil jet fuel, following the SBTi Aviation Guidance criteria. The related emission reduction achieved is third-party verified and further validated through the ISCC SAFc registry, enabling businesses to credibly report the achieved reductions towards their Science Based Targets or similar sustainability targets. The SAF volumes sold are not used to meet fuel mandates or other similar regulatory requirements on SAF use; instead, they provide additional emission reductions in aviation. Read more

Baker Hughes Rig Count: U.S. +3 to 629 Canada +0 to 231

U.S. Rig Count is up 3 from last week to 629 with oil rigs up 3 to 506, gas rigs down 1 to 119 and miscellaneous rigs up 1 to 4.

Canada Rig Count is unchanged from last week at 231, with oil rigs up 3 to 144, and gas rigs down 3 to 87.

International Rig Count is down 7 rigs from last month to 958 with land rigs down 5 to 735, offshore rigs down 2 to 223.

The Worldwide Rig Count for February was 1,813, up 30 from the 1,784 counted in January 2024, and down 108, from the 1,921 counted in February 2023.

| Region | Period | Rig Count | Change |

| U.S.A | 01 March 2024 | 629 | +3 |

| Canada | 01 March 2024 | 231 | – |

| International | February 2024 | 958. | – 7 |

Oil and Gas News Undiluted !!! �The squeaky wheel gets the oil�

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: @OilAndGasPress on Twitter |

Oil and gas press covers, Energy Monitor, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas,