Energy News Dec. 29, 2023| WTI Crude $72.06/bbl, Brent $77.57/bbl, Opec $80.84/bbl

London, 29 December, 2023, (Oilandgaspress): – GasBuddy expects lower gasoline and diesel prices in 2024. GasBuddy’s annual Fuel Price outlook highlights key trends in gasoline and diesel prices, forecasting that, after two years of above average gas prices, 2024 will bring relief at the pump for consumers as several factors contribute to less of a pinch at the pump. GasBuddy expects the yearly national average will drop from $3.51 per gallon this year to $3.38 in 2024.

Highlights from GasBuddy’s 2024 Fuel Outlook:

Gas prices still could fall below a national average of $3 per gallon this winter before potentially rising, getting close to $4 per gallon as summer approaches.

Drivers in some West Coast cities could again briefly see prices above $6 per gallon, although most major U.S. cities will see prices peak near $4 per gallon in 2024.

Americans are expected to spend a combined $446.9 billion on gasoline in 2024. Average yearly spending per household will fall to an estimated $2,407, down 2% from 2023, and over 12% from 2022.

Electric vehicles (EVs) and the 2024 presidential election have the potential to impact fuel prices in the year ahead, with a potential slowdown in the EV transition at stake.

Memorial Day will be the priciest 2024 holiday at the pump, with the national average price of gasoline expected to be $3.56-$4.04 per gallon on the holiday. Read More

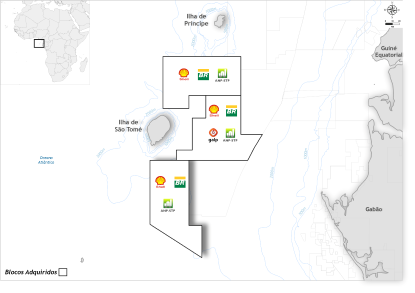

Petrobras PETR4.SA said on Wednesday its board had approved the acquisition of stakes in three oil exploration blocks operated by Shell SHEL.L in Sao Tome and Principe, marking its return to oil exploration in Africa. Petrobras will own a 45% stake in blocks 10 and 13, and a 25% stake in block 11.

Scatec ASA has today closed the divestment of its 52.5% equity share in the 40 MW Mocuba solar power plant in Mozambique to Globeleq for USD 8.5 million (NOK 86 million). “We are pleased to have closed this transaction, which is in line with our strategy to optimise our portfolio including the divestment of smaller assets in non-focus markets,” says Scatec CEO Terje Pilskog. “The transaction’s success will free up resources for our targeted markets and generate funds for fresh ventures in renewable energy. We are delighted to have completed a value-enhancing deal and have full confidence that Globeleq will be a good owner of the asset in the future. I would like to thank the Government of Mozambique, Electricidade de Moçambique and our team who worked on the project delivering electricity to the nation.”

The transaction will generate a net accounting gain of approximately USD 4 million on a consolidated basis and USD 3 million on a proportionate basis.

Globeleq is an independent power producer in Sub-Saharan Africa, with over 2.1 GW power production capacity in operation or under construction. The company is owned 70% by British International Investment and 30% by Norfund. The Mocuba solar power plant is located in the Zambézia Province of Mozambique and was commissioned in August 2019. The project has an annual production of approximately 75 GWh and holds a 25-year PPA with the state-owned utility, EDM. As part of the transaction, Globeleq will assume responsibility for operations & maintenance and asset management services for the power plant. Read More

Scatec ASA, a leading renewable energy provider, has reached financial close on the first 60 megawatt (MW) of the 120 MW Mmadinare Solar Complex in Botswana and is preparing for construction start of the first utility-scale solar project in the African nation.

In August 2022, Scatec, and the Botswana Power Corporation (BPC) signed a binding 25-year power purchase agreement (PPA) for the construction of a 60 MW solar PV facility in the Mmadinare District. In the third quarter 2023, Scatec was awarded a 60 MW expansion to the project, taking the total capacity to 120 MW. The estimated total capital expenditure for the 120 MW project is BWP 1.4 billion (USD 104 million) with an estimated EPC contract value to Scatec of BWP 1.2 billion (USD 90 million). The solar power plants are estimated to be financed by BWP 936 million (USD 68 million) of non-recourse project debt and equity from Scatec. Financing for the first 60 MW will be provided by the Rand Merchant Bank in Botswana and the World Bank’s International Finance Corporation (IFC). Scatec owns 100% of the project and will be the designated engineering, procurement, and construction (EPC) company, as well as asset manager (AM) and operations and maintenance (O&M) service provider. Construction and operation of the power plants will be managed by Scatec’s organisation in South Africa. Read full article

Scatec ASA, has signed an agreement with Fortis Green Fund I Rwanda Holdings Ltd and Axian Energy Green Ltd to sell its 54% equity share in the 8.5 MW solar power plant in Rwanda for USD 1.38 million (NOK 14.2 million), in line with the company’s strategy.

“This transaction is aligned with our strategy to consolidate our operating portfolio through divestments of assets in non-prioritised markets,” says Scatec CEO Terje Pilskog. The ASYV power plant in Rwanda commenced operations in 2014. The power was sold under a 25-year Power Purchase Agreement with the state-owned utility EWSA, guaranteed by the Government of Rwanda. The transaction is subject to the customary regulatory consents and is expected to close in 2024. Scatec is also exiting from the operations & maintenance and asset management agreements as part of the sale. Read full article

In a significant step towards a sustainable and resilient future, Scatec ASA, has officially started producing and supplying electricity to the national grid from the three Kenhardt plants in the Northern Cape Province, in South Africa. The Kenhardt project is positioned to make a notable impact on the renewable energy landscape as one of the world’s first and largest hybrid solar and battery storage facilities. With an installed solar capacity of 540 MW and a battery storage capacity of 225MW/1,140MWh, this innovative and large-scale project delivers 150 MW of dispatchable power from 5 am to 9.30 pm year-round to the national grid under a 20-year Power Purchase Agreement with Eskom. With a total investment of approximately USD 1 billion, the Kenhardt project marks the largest commitment in Scatec’s history and will generate solid returns to Scatec’s shareholders. The project debt is provided by a group of lenders which includes The Standard Bank Group as lead arranger and British International Investment (BII). Read full article

Petrobras informs that it has received a communication from Mubadala Capital proposing the formalization of recent discussions on the formation of a potential strategic partnership for the development of downstream in Brazil, in continuity with the memorandum of understanding released on September 4, 2023. The initiative has as its scope businesses focused on traditional refining, as well as the development of a biorefinery, both in the state of Bahia.

The aim of the future partnership is to strengthen the business environment in the sector and increase the supply of renewable fuels in our country. The business model to be analyzed will take into account future investments and the development of new technologies in conjunction with Mubadala Capital. Read full article

Petrobras was the big winner of the 4th Cycle of the Permanent Offer. The company acquired 29 blocks in the Pelotas Basin, under the concession regime, in an auction held today (Dec 13th) by the National Agency of Petroleum, Natural Gas and Biofuels (ANP). The company prioritized assets in offshore areas and operated in consortium with other companies. Petrobras will be the operator in all the blocks acquired, three in a consortium with Shell (30%) and CNOOC (20%) and 26 in a consortium with Shell alone (30%). The new blocks are in the coastal area of Rio Grande do Sul. Read full article

Petrobras, following up on the Material Facts of 03/01/2023, 04/27/2023 and 12/22/2023, informs that it will pay today the third installment of the remaining remuneration to shareholders for 2022. The gross amount to be distributed today is R$ 0,56252157 per common and preferred share in the form of dividends. Read full article

Yanbu Refinery has become the fourth Aramco facility to be added to the World Economic Forum (“WEF”) Global Lighthouse Network (the “Network”), having been recognized for its pioneering deployment of cutting-edge technologies to deliver a range of operational, commercial and environmental benefits. Only manufacturing facilities that can demonstrate the successful adoption of Fourth Industrial Revolution (“4IR”) technologies at scale are considered for inclusion in the Network. Yanbu Refinery is Aramco’s fourth facility to be included, joining the company’s Abqaiq oil processing and crude stabilization facility, Uthmaniyah Gas Plant and Khurais oil complex. Yanbu Refinery is one of 21 new facilities added to the prestigious Network, which now includes a total of 153 manufacturing facilities around the globe. Aramco is the only international energy company to be represented by more than two facilities. Read More

The UK financial services sector faces an emerging green skills gap and is not moving fast enough to close it, jeopardising the UK’s Net Zero goals, according to the latest report by PwC in its Green Jobs Barometer series.

The report, in collaboration with Financial Services Skills Commission (FSSC) and the Aldersgate Group, explores the pivotal role of the Financial Services sector in achieving a Net Zero future and how it’s fuelling a rising demand for green jobs in the industry.

The report finds the proportion of job vacancies in the sector that are identified as green increased from 0.26% in the 2019-2020 timeframe to 2.2% in 2022-2023, growing from a total of 4,900 jobs to 16,700. Given the scale of the green investment needed to meet Net Zero goals, in the UK and globally, this growth is expected to accelerate.

The growth in green job openings has been driven by two factors: the creation of new green jobs in the finance sector such as sustainable investment analysts, climate strategists and ESG analysts and the greening of existing jobs. For example, portfolio managers in asset management have expanded their roles beyond conventional tasks and their duties now encompass tasks like analysing ESG fund trends and producing and evaluating climate risk assessments for client portfolios. Read More

The global petrochemical industry – essential to the production of clothing, tyres, detergents, fertilisers, and countless other everyday products – is currently going through a momentous period of transition. Driving this change is a towering wave of new petrochemical plants, most notably in China. This is shifting oil demand to the country as it increases production of plastics and synthetic fibres, while generating increasingly cutthroat competition among those that previously dominated the market. The speed and scale of the expansion of China’s petrochemical sector dwarfs any historical precedent, roughly doubling the pace of earlier capacity additions in the Middle East and United States. Between 2019 and 2024, China is set to add as much production capacity for ethylene and propylene – the two most important petrochemical building blocks – as presently exists in Europe, Japan and Korea combined. Read More

China expects to build more ships running on cleaner fuels than on oil-derived marine fuels that currently dominate the global fleets, its Ministry of Industry and Information Technology said on Thursday, as reported by Reuters.

U.S. Rig Count is up 2 from last week to 622 with oil rigs up 2 to 500, gas rigs unchanged at 120 and miscellaneous rigs unchanged at 2.

Canada Rig Count is down 60 from last week to 86, with oil rigs down 54 to 27, and gas rigs down 6 to 59.

International Rig Count is up 16 rigs from last month to 978 with land rigs up 15 to 758, offshore rigs up 1 to 220.

| Region | Period | Rig Count | Change |

| U.S.A | 29 December 2023 | 622 | +2 |

| Canada | 29 December 2023 | 86 | -60 |

| International | November 2023 | 978 | +16 |

Kraken announced the acquisition of Sennen, a provider of advanced software for the delivery and operation of large-scale renewable energy generation.

Kraken Technologies is part of Octopus Energy Group. Its tech platform, Kraken, connects up all parts of the energy system, from customer billing to flexible management of renewable generation and energy devices. It is also revolutionising service for other utilities such as water and broadband.

Kraken allows for extended analytics, real time monitoring, optimisation and control of energy devices, such as solar and wind generation, batteries, heat pumps and electric cars, and enables companies to drive efficiency and meet important net zero targets.

The Sennen software uses the latest cloud technology to streamline oversight, maintenance and daily operation of renewable energy projects. Joining forces with Sennen will enhance Kraken’s asset management offering, allowing it to develop more innovative products and services.

The acquisition of Sennen will increase Kraken’s contracted energy generation and storage assets sixfold, growing them from 6.5GW to 36GW. It also marks the first time the platform will be actively managing the operation of offshore wind farms.

Players in asset management have traditionally relied on legacy systems, lacking the bleeding edge tech that modern renewable energy operations demand. Sennen’s in-depth maintenance and analytics platform supports 1000s of sites including offshore wind farms, solar farms and grid scale batteries.

Sennen’s talented team has extensive experience and a strong reputation in its field. Its 25 employees will move over to the Kraken family and continue to work from their office in Bristol. Kraken is currently contracted to manage over 6.5 GW across 130,000 green energy assets in 12 countries. Read full article

Oil and Gas News Undiluted !!! �The squeaky wheel gets the oil�

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: @OilAndGasPress on Twitter |

Oil and gas press covers, Energy Monitor, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas,