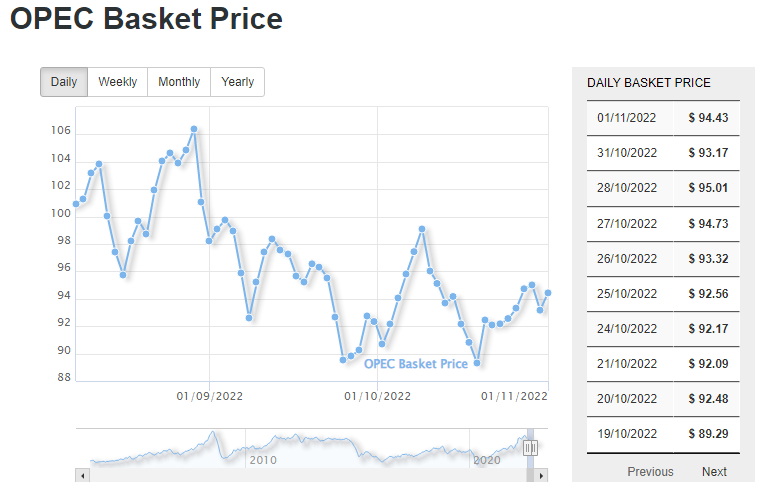

Energy News to 02/11/22. OPEC daily basket price stood at $94.43/bl, 01 Nov. 2022

Oil prices up on demand hopes after US crude stocks drawdown

Mitsubishi Heavy Industries, Ltd. (MHI), and PT. PLN Indonesia Power, a sub-holding of Indonesia’s state-owned electricity provider PT. PLN (Persero) (PLN), yesterday concluded a Memorandum of Understanding (MoU) to commence three feasibility studies on co-firing less carbon intensive fuels at power plants owned and operated by Indonesia Power. The three studies will be conducted jointly by Indonesia Power and MHI with support from its power solutions brand, Mitsubishi Power, and will aid in the advancement of solutions to accelerate the decarbonization of energy systems in Indonesia.

The first study will examine the technical and economic feasibility of co-firing up to 100% biomass at the Suralaya coal-fired power plant (CFPP). The study will consider various aspects of the biomass supply chain, including handling, storage, transport and boiler modification. The second study, which will also use Suralaya CFPP as the reference plant, will investigate co-firing of ammonia produced by existing ammonia plants in Indonesia. A particular area of focus will be the potential to establish a blue ammonia supply chain with production and transportation from the ammonia plant and ammonia co-firing technology to apply in existing boiler. The third study will evaluate technical and economic feasibility of hydrogen co-firing in an M701F gas turbine at the Tanjung Priok gas turbine combined cycle (GTCC) facility. MHI completed construction of the plant’s Unit 2 GTCC system in 2019 as part of PLN’s plans to build an 880 MW plant under the Jawa-2 Project. Read More

This week’s UN Report states that “Staying under 1.5C is no longer credible.”

Going over 1.5C locks in the loss of the coral reefs, the loss of 25% of the world’s fish stocks, the destruction of hundreds of millions of livelihoods and millions of innocent lives.

Going over 1.5C means island nations going underwater. This constitutes an act of illegal war.

This is just the beginning. From today Just Stop Oil will pause its campaign of civil resistance. We are giving time to those in the government who are in touch with reality to consider their responsibilities to this country at this time. If, as we sadly expect, we receive no response from ministers to our demand by the end of Friday 4th November, we will escalate our legal disruption against this treasonous government. Our action will be proportionate to the task of stopping the crime against humanity which is new oil and gas. The facts are crystal clear – drilling for more oil and gas is taking us over 1.5C. There is no greater crime Read More

Africa Oil Corp. reports the following share capital and voting rights update in accordance with the Swedish Financial Instruments Trading Act.

As a result of the share cancellations and the exercise of stock options under the Company’s Stock Option Plan, Africa Oil now has 470,062,781 common shares issued and outstanding with voting rights as at October 31, 2022. Read More

India Govt cuts windfall tax on crude oil, hikes taxes on aviation fuel, diesel. The government has maintained that the levy was introduced in view of the windfall gains made by the domestic crude producers and refiners due to high global crude and product prices.According to the govt, the changes in the windfall tax on oil products will be applicable from November 2. Read More

China’s Nio, the EV maker, has suspended manufacturing activities due to Covid restrictions amid the latest flare-up in infections in the country. “The news that production at Nio’s factories has been temporarily suspended is true and this will have an impact on production and delivery schedules,” a company representative told Reuters.

The latter cited a Chinese tech media outlet as having reported that Nio had been having difficulties with production since mid-October because of Covid lockdowns. This is the second time this year Nio is suspending production, after it had to shut down its two factories in April, too, amid lockdowns. Meanwhile, hopes are growing that the lockdowns will soon end, based on unverified reports on social media. China’s foreign ministry spokesman said Tuesday that he was not aware of any plans to relax Bejing’s zero-Covid policy, which dampened optimism but it appears that the hope remains China will at some point drop the strict measures. Read More

There were nearly 102,000 vehicles stolen in England and Wales in 2021; 32,294 vehicles were stolen in London last year alone which makes it official – London is the UK capital of car crime. In 2020/21 London had the highest rate of ‘interference with a motor vehicle’ in the country, with 151.06 offences recorded per 100,000 people. Bedfordshire came in second with a rate of 144.51 per 100,000 people, while South Yorkshire followed in third place with a rate of 134.83 per 100,000. London also tops the list for the highest number of thefts of belongings from a vehicle. In 2020/21 there were 687.51 offences per 100,000 people. Read More

More than a tenth of the UK’s 35,000 public chargers are free to use according to research by Peugeot UK in which the company plotted a 2,688-mile journey around the coastline of mainland Britain to highlight the extent of the cost-saving infrastructure. Starting at Land’s End, the route runs along England’s southern and eastern coasts, up through Scotland via John O’Groats before returning to Land’s End through Wales using only free public chargers.

The furthest distance between two free charge points on the route between Chelmsford and Sandringham, is 168 miles, within the 225-mile (WLTP) range of the Peugeot e-208. To make life on the road easier, the Peugeot e-208 supports up to 100kW rapid charging, with an 0-80 percent charge taking just 30 minutes.

Many of the approximately 4,400 free charge points in Britain are located in retail parks, hotels and public car parks and are funded by retailers, landowners and some Local Authorities, allowing drivers to charge overnight or run errands while their vehicles charge. The ChargePlace Scotland network features more than 2,000 chargers, with the majority available for free to users who have the ChargePlace Scotland app or who pay a one-off £10 fee for a charging card.

Driving the same route in a petrol or diesel version of the same car can cost drivers up to £421. Read More

Vestas Wind Systems third quarter of 2022 results

In the third quarter of 2022, the business environment with supply chain instability and cost inflation did not wane. Additionally, delays on project deliveries lead to higher costs related to executing on customer commitments. Consequently, Vestas is adjusting the full-year guidance:

Revenue is now expected to range between EUR 14.5bn and 15.5bn (previously EUR 14.5bn-16.0bn)

EBIT margin before special items is adjusted to approx. (5) percent (previously (5)-0 percent)

Total investments (excl. acquisitions of subsidiaries, joint ventures, associates, and financial investments) are now expected to amount to approx. EUR 850m (previously approx. EUR 1,000m)

Service revenue is now expected to grow min. 20 percent (previously min. 10 percent) due to strong performance and additional repowering activities. The Service EBIT margin before special items is now expected to be approx. 22 percent (previously approx. 23 percent).

It should be emphasised that there is greater uncertainty than usual around forecasts related to execution in 2022, and the outlook seeks to take into account the current situation and challenges.

In relation to forecasts on financials from Vestas in general, it should be noted that Vestas’ accounting policies only allow the recognition of revenue when the control with a project has passed to the customer, either at a point in time or over time. Disruptions in production and challenges in relation to shipment of wind turbines and installation hereof, for example bad weather, lack of grid connections, and similar matters, may thus cause delays that could affect Vestas’ financial results for 2022. Further, the full-year results may also be impacted by movements in exchange rates from current levels. Read More

Halliburton Company announced new products that highlight innovative technologies and sustainable solutions as part of its presence at the Abu Dhabi International Petroleum Exhibition and Conference (ADIPEC). In addition, Halliburton Chairman, President, and CEO Jeff Miller will participate Tuesday, Nov. 1 at 1:45 p.m. on the strategic panel, “Reconciling upstream oil and gas investment and the energy transition to meet global energy demand growth.” Miller will discuss how the industry addresses its commitment to decarbonization and the energy transition while ensuring the worldwide economy has the fuel it needs to continue to grow.

Collectively, the new technologies promote more precise and efficient drilling performance, remote automation for enhanced safety, and a reduced carbon footprint for its cementing activities. Read More

Halliburton Company announced a net income of $544 million, or $0.60 per diluted share, for the third quarter of 2022. This compares to net income for the second quarter of 2022 of $109 million, or $0.12 per diluted share, and the adjusted net income for the second quarter of 2022, excluding impairments and other charges, of $442 million, or $0.49 per diluted share. Halliburton’s total revenue for the third quarter of 2022 was $5.4 billion compared to total revenue of $5.1 billion in the second quarter of 2022. Reported operating income was $846 million in the third quarter of 2022 compared to reported operating income of $374 million and adjusted operating income of $718 million in the second quarter of 2022. Read More

The era of “exponential” growth in the U.S. oil and gas industry is over as most shale firms are returning cash to investors instead of going into debt to drill more, according to Halliburton, the world’s largest fracking services provider.

“We’ll see growing investment, but quite frankly, nothing even close to what we saw from 2008 to 2014,” Halliburton’s CEO Jeff Miller said at a panel at the ADIPEC energy conference in Abu Dhabi on Tuesday, as carried by The National.

“Companies were spending at a rate of 120 percent of their cash flow and that can’t go on indefinitely,” Miller said.

Since the pandemic crash, however, the U.S. shale patch has focused on returning money to shareholders, paying down debt, and healing balance sheets. U.S. oil and gas production has rebounded but the growth rate is nowhere near the record growth from 2018 or 2019.

This year, supply chain delays and cost inflation have combined with U.S. shale’s newfound spending discipline to hold back production growth. Read More

Rovco Awarded Contract at Galloper Offshore Wind Farm

We are delighted to announce that we have been awarded a contract for the provision of offshore rock bag deployment and installation at the Galloper Offshore Wind Farm in the Outer Thames Estuary.

The project scope covers the application of an operator engineered solution for the installation of rock bags, which need to be placed at precise locations on and around the Cable Protection Systems (CPS) on the wind farm, located 27km off the Suffolk coast.

Following previous subsea surveys, rock bag placement was selected from a number of options considered by the operator as the most suitable solution to eliminate or vastly reduce excess cable movement of the CPS, stabilising and prolonging the life of the array cables which carry the generated electricity from the wind turbines.

Our team will deploy the DPII subsea support vessel VOS Star, on charter from Vroon Offshore Services, during the project. The vessel will be pre-installed with cutting-edge survey equipment and our powerful Seaeye Leopard WROV which will be fully calibrated, and system tested for swift commencement.

The project is led by personnel from our experienced offshore team and a dedicated onshore project manager, who will be assigned to the project throughout, to ensure safe and efficient operations. Read More

CME Group today reported its October 2022 market statistics, showing average daily volume (ADV) increased 11% to 22.7 million contracts during the month, representing the company’s highest October volume on record.

October 2022 ADV across asset classes includes:

Interest Rate ADV of 9.8 million contracts

Equity Index ADV of 8.5 million contracts

Options ADV of 4.5 million contracts

Energy ADV of 1.8 million contracts

Agricultural ADV of 1.2 million contracts

Foreign Exchange ADV of 1 million contracts

Metals ADV of 489,000 contracts Read More

| Oil and Gas Blends | Units | Oil Price $ | change |

| Crude Oil (WTI) | USD/bbl | $88.22 | Up |

| Crude Oil (Brent) | USD/bbl | $94.48 | Up |

| Bonny Light | USD/bbl | $95.85 | Up |

| Saharan Blend | USD/bbl | $96.86 | Up |

| Natural Gas | USD/MMBtu | $5.96 | Up |

| OPEC basket 01/11/22 | USD/bbl | $94.43 | Up |

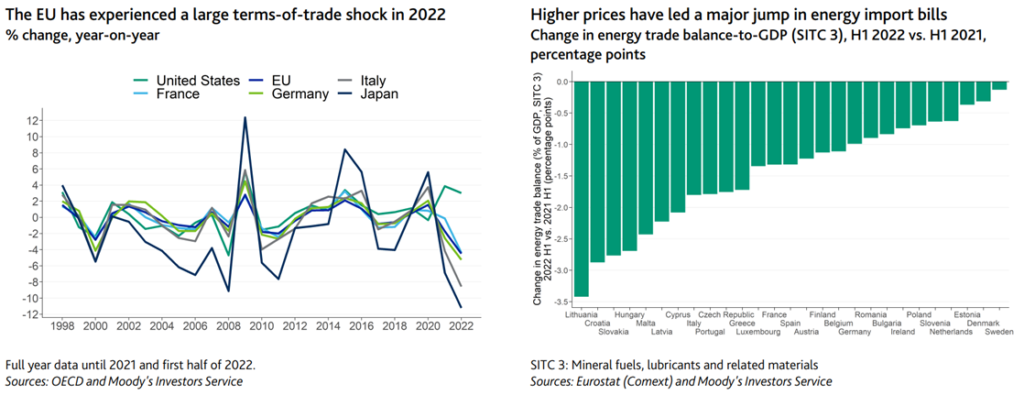

Today’s Moody’s research on what’s next to come for Europe because of energy crisis from sovereigns perspective:

Europe’s energy crisis is expected to last with higher energy prices over the medium term. Although natural gas prices have moderated from their highs in the summer, we expect that a prolonged period of geopolitical uncertainty, coupled with the need to fundamentally change Europe’s energy mix, will keep the region’s energy prices well above their historical levels over the medium term

Elevated energy prices pose a major terms-of-trade shock to European economies. This holds especially relative to low-energy-cost competitors like the US (Aaa stable). This disadvantage could weaken the region’s long-term price competitiveness and lead to a structural decline in European Union’s (EU, Aaa stable) industrial bases over the medium term in the absence of effective government support.

- Risk of rationing will weigh on investment until alternative supplies are secured, which we expect will take years

- CEE, and among the largest five EU countries, Italy and Germany are most exposed to the risk of economic scarring

Information Source: Read More

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: @OilAndGasPress on Twitter |