Energy News to 12/12/22 . OPEC daily basket price at $74.78/bl, 09 Dec. 2022

U.S. Rig Count is down 4 from last week to 780 with oil rigs down 2 to 625, gas rigs down 2 to 153 and miscellaneous rigs unchanged at 2.

Canada Rig Count is up 7 from last week to 202, with oil rigs up 3 to 131, gas rigs up 4 to 71. UK’s overreliance on wind and solar has led to further increase in electricity prices, as challenging weather is affecting supply.

Patrick Pouyanné, Chairman and CEO of TotalEnergies, received His Excellency Walid Fayad, Minister of Energy and Water of Lebanon, at the Company’s headquarters.

During the meeting, Patrick Pouyanné and Walid Fayad discussed the development of TotalEnergies’ activities in Lebanon, and Patrick Pouyanné confirmed that the teams in charge of drilling operations on Block 9 were now mobilized.

To date, in addition to the Operations Manager, more than 10 people are involved in the preparation of the well. By the end of March, the team mobilized in Beirut will reach more than 20 employees. The call for tenders to secure the drilling rig has been launched and should lead to a selection of the rig in the first quarter of 2023. Pre-orders have also been placed with suppliers for equipment required for the well. In parallel, offshore resources are being mobilized to contribute to the environmental studies which will be finalized by the end of June 2023.

All those TotalEnergies teams are working in collaboration with LPA to prepare the well in order to achieve the objective of TotalEnergies and its partner ENI to complete the drilling as soon as possible in 2023. Read More

A global mining company is focusing on hydrogen as the centrepoint of its zero-emission plans, and is pairing with a Seattle-based tech company to develop a fleet of hydrogen-powered haul trucks.

Anglo American has worked with First Mode to develop its nuGen haul truck pilot project. The diesel engine has been removed from a Komatsu 930E-4 ultra-class haul truck and replace it with a hybrid hydrogen fuel cell that provides roughly half of the power for operation, while a battery pack allows energy recovery from braking.

First Mode and Anglo American have signed a binding agreement to combine the nuGen zero emission haulage solution to accelerate the transition of mining and other heavy industries to diesel-free futures. First Mode will supply several nuGen systems to Anglo American, including retrofit of approximately 400 ultra-class haul trucks with First Mode’s proprietary hybrid fuel cell battery powerplant and related infrastructure.

The supply agreement includes provision of supporting infrastructure like refuelling, recharging, and facilitation of hydrogen production. Rollout to Anglo American’s haul truck fleet will take place over the next 15 years. Read More

Neste has been selected in the Dow Jones Sustainability Indices (DJSI) for the 16th consecutive year. Neste is included in both DJSI World and DJSI Europe listings, among the leading sustainable companies in the world.

Neste’s performance received the industry’s best scores in materiality, environmental and social reporting, human rights, and human capital development, contributing to the company’s inclusion among the top performers.

”Neste is strongly driven by its ambitious sustainability vision and climate commitments. This year’s recognition of being again included in the Dow Jones Sustainability Indices verifies that we have made the right progress to become a global leader in renewable and circular solutions. Our people have fully taken charge of making this change happen, and we are very proud of this recognition, which is also highly valued by our stakeholders,” says Minna Aila, Senior Vice President, Sustainability and Corporate Affairs, Neste.

The companies eligible for S&P Dow Jones Indices are selected for inclusion based on their comprehensive assessment in the S&P Global Corporate Sustainability Assessment (CSA). Since 1999, the CSA in collaboration with Dow Jones Indices (now S&P Dow Jones Indices) has been one of the most important and leading global sustainability benchmarks. The assessment of companies this year is based on their performance in 2021. Only leading companies in each industry are included in the indices each year. Read More

TC Energy has shut the Keystone pipeline — which connects Alberta to the US — after 14,000 barrels of crude oil spilled into a creek in Kansas.

Pipe operator TC Energy announced the pipeline’s shutdown at 5.35 a.m. CT on Thursday. The Canadian company said it initiated an energy shutdown and response at 8 p.m. CT on Wednesday after alarms went off detecting a pressure drop in the system.

The cause of the leak is not known. It is not immediately clear as of presstime when the pipeline is expected to come back online.

The affected segment of the Keystone pipeline system “has been isolated” and remains shut, the company said.

The leak at Keystone is the largest oil leak since a Tesoro Corp. pipeline leak in October 2013 that released more than 20,000 barrels of oil in North Dakota, Reuters reported, citing data from the US Pipeline and Hazardous Materials Safety Administration, or PHMSA. Read More

Octopus Energy customers across the country have been paid £1 million for reducing their energy usage during the company’s first four ‘Saving Sessions’.

Octopus’ revolutionary energy-saving scheme is enabled by National Grid ESO’s new ‘Demand Flexibility Service’ which allows households to get paid for shifting their energy usage out of peak times.

Over a quarter of a million customers took part in each of the hour long sessions. There have been four sessions in total so far where the National Grid is looking for reduced energy demand to help balance the grid. In total, nearly half a million customers have signed up to the scheme so far and will still have a chance to rake

Together, Octopus customers lowered the energy demand on the grid during each of these peak periods by over 100MW – the same amount as a gas power station can produce in an hour. Across all four sessions, customers moved almost 450MWh of energy consumption out of peak times, that’s enough energy to fully charge one smartphone per UK household.

Customers saved on average over £4 across the first four sessions, with the top 5% of savers bringing in almost £20*.

This evening, on Monday 12th December, there will be another ‘Saving Session’ for participating Octopus customers, offering them the chance to make money for all the electricity demand they reduce between 5-7PM. Read More

Octopus Energy Group’s generation arm announces the acquisition of UK solar developer and asset manager Zestec Renewable Energy to build cheap solar power on British businesses’ roofs, helping to drive down energy bills.

Zestec is developing a pipeline of over 160 MW of new UK solar energy which will be sold to the organisations hosting the solar panels via power purchase agreements (PPA). This will allow SMEs, public sector organisations like schools and local councils, as well as large corporations to benefit from self-generated green power without footing the cost of the installation of the solar system.

Through a fund managed by Octopus Energy Generation, over 100 projects will be built by 2027, ranging from 100 kW to 7 MW. The clean energy generated will help reduce gas reliance and emissions, and is the equivalent of taking 40,000 petrol cars off the road.

Octopus is one of Europe’s largest renewable energy investors, and has invested in solar since 2010. The deal builds on Octopus’ existing partnership with Zestec announced last year to rapidly grow UK solar assets. Acquiring Zestec will boost the solar assets Octopus manages by up to 11%.

This is the latest in a string of deals by Octopus to drive the creation of new green power across the UK. This includes investing in solar and storage developer Exagen, floating offshore wind developer Simply Blue, and onshore wind developer Wind2 – all on behalf of the funds the team manages. Read More

Mercedes-Benz said Monday it planned to inject more than one billion euros into a new plant in Poland dedicated to building fully electric vans.

The site will be located in Jawor, southwestern Poland, where the group has already been manufacturing combustion engines since 2019 and battery systems since 2021.

“We will build our first pure electric plant in Jawor,” Mathias Geisen, head of Mercedes‑Benz Vans, said in a statement.

The move would “ensure our leading position in the field of all-electric light commercial vehicles” while at the same time “preserving the long-term prospects of the existing plants in Europe”, he added.

At a press conference in Warsaw, Geisen said the group planned to spend more than a billion euros on setting up the new site.

“The investment announced by Mercedes today is for Poland a very, very important investment,” Polish Prime Minister Mateusz Morawiecki told reporters.

It comes as Mercedes-Benz and rival automakers around the globe are spending vast sums as part of a major industry-wide shift towards electrification.

Mercedes had initially planned to partner with US start-up Rivian and build all-electric vans in Europe together. Read More

Chevron Corporation today announced 2023 organic capital expenditure budgets of $14 billion for consolidated subsidiaries (capex) and $3 billion for equity affiliates (affiliate capex), which total near the high end of the company’s guidance range.

The company’s 2023 capex budget is up more than 25% from 2022 expected spend, excluding acquisitions. Affiliate capex in 2023 is down modestly from 2022 expected spend. These budgets support Chevron’s objective to safely deliver higher returns and lower carbon and include approximately $2 billion in lower carbon capex, more than double the 2022 budget.

“We’re maintaining capital discipline while investing to grow both traditional and new energy supplies,” said Chevron Chairman and CEO Mike Wirth. “Our 2023 capex budgets are consistent with our long-term plans to safely deliver higher returns and lower carbon.”

Chevron’s 2023 capex budget assumes cost inflation that averages in the mid-single digits with certain areas higher, such as the Permian Basin that assumes low double-digit cost inflation.

“Our capex budgets remain in line with prior guidance despite inflation,” Wirth continued. “We’re winning back investors with capital efficient growth, a strong balance sheet, and more cash returned to shareholders.” Read More

Lithium Power International Limited announced that it has completed the acquisition of water rights covering its Maricunga lithium project in Chile.

With this acquisition of the 62 litres/second CAN 6 rights, the company can replace a long-term lease that it previously held for part of its water requirements.1This will secure the supply for future needs of both its Stage One project and any future expansions. Owning the water rights allows LPI to control its future water consumption without the risk of external interference from third parties.

The Stage One project will produce an average of 15,200 tonnes per year of highly pure, battery grade lithium carbonate and will have a low, freshwater consumption, of just 8 l/s.

Lithium Power International’s Chief Executive Officer, Cristobal Garcia-Huidobro, commented:

“Water rights are critical to the operation and development of lithium brine projects. Owning all of the CAN 6 water rights, allow us not only to secure the future needs of water for the Stage One project and future expansions at Maricunga, but improves LPI’s position looking forward.” Read More

As provisional winner of a lease area on the Outer Continental Shelf off California, Equinor continues to lead the way in growing the US’ offshore wind industry.

Five leases were offered by the Bureau of Ocean Energy Management (BOEM) in thefirst-ever offshore wind lease sale on the US west coast and the first-ever US sale to support commercial-scale floating offshore wind energy development opportunities. With a bid of USD 130 million for 80.062 acres in the Pacific Ocean, Equinor secured a ~2-gigawatt (GW) lease in the Morro Bay area that has the potential to generate enough energy to power ~750 000 US homes.

About two-thirds of America’s offshore wind energy potential is in deep waters. The narrow outer continental shelf running along the Pacific seaboard, drops down swiftly to 1,000 meters (3,280 feet) or more, opening up for new power opportunities for the west coast – floating offshore wind. As the world’s leading floating offshore wind operator and developer, Equinor looks forward to applying its experience to create a sustainable offshore wind industry in California.

Following regulatory approvals, the new lease will be added to Equinor’s existing US portfolio – which includes the Empire Wind and Beacon Wind projects on the US Northeast coast – and has the potential to generate a total capacity of at least 2 GW of renewable power for the West Coast. Read More

The Italian Agency for Development Cooperation (AICS), the Embassy of Italy in Nairobi and Eni have launched SEMAKENYA II programme to test climate-resilient agronomic practices and technologies in Makueni County.

The initiative, funded by the Italian Cooperation for an amount of 2 million euro, is supported by the Mediterranean Agronomic Institute of Bari (CIHEAM Bari) in partnership with the Kenya Agricultural and Livestock Research Organisation (KALRO).

SEMAKENYA II will support the cultivation of castor-oil plant varieties on pilot fields and the valorisation of local drought-resistant crops, such as legumes and tropical fruits, with strong commercialisation potential on national and international markets. A digital platform will also be introduced that will directly connect farmers to buyers, with the aim of ensuring fairer trade for farmers and a quality product that meets market demands.

The event organised at the Residence of the Italian Ambassador in Nairobi was attended by the Governor of Makueni County H.E. Mutula Kilonzo Junior, CBS and the Deputy Governor H.E. Lucy Mulili, the Secretary – Research and Innovation at the Ministry of Agriculture and Livestock Development Dr. Oscar Magenya, Deputy Director of CIHEAM Bari, Biagio Di Terlizzi, and the Managing Director of Eni Kenya, Enrico Tavolini. Also present were the Director of the Nairobi Regional Office of the Italian Development Cooperation Agency, Giovanni Grandi, and representatives of the Italian private sector, local institutions and civil society.

SEMAKENYA II represents the first concretisation of the Memorandum of Understanding signed by Eni Kenya and AICS’ Nairobi Office in 2021 to strengthen the “Italian System” in Kenya by implementing joint cooperation initiatives. Read More

Marks & Spencer (M&S) and bp pulse have signed an exclusive agreement to bring high-speed electric vehicle (EV) charge points to the M&S store estate across the UK.

The agreement will see M&S and bp pulse, bp’s electric vehicle charging business, work together to install an initial 900 electric vehicle charge points in around 70 of M&S’ national stores in the next two years.

The roll-out will significantly expand bp pulse’s network, growing the UK’s charging network and adding up to 40,000 kWhs of charging capacity to the UK’s EV infrastructure.

In order to provide the appropriate speed for each need, a combination of ultra-fast (≥150kW) and rapid (≥50kW) charge points will be installed during the roll-out.

15 rapid (50kW) charge points are already live and open to the public at M&S Maidstone Eclipse and Southgate following successful pilot installations.

bp and M&S have a long-standing relationship, first teaming up in 2005 to introduce M&S Food stores at bp retail sites. Over 250 bp pulse charge points are already available at over 60 bp-operated forecourts which also offer M&S Food.

This new agreement is a major extension of this relationship and spotlights how both companies are working together to achieve net zero ambitions. Read More

bp signed a memorandum of understanding (MoU) with the Government of Egypt under which it will explore the potential for establishing a new green hydrogen production facility in the country.

The MoU was signed by bp, Egypt’s New and Renewable Energy Authority (NREA), the Egyptian Electricity Transmission Company (EETC), the General Authority for Suez Canal Economic Zone (SCZONE) and the Sovereign Fund of Egypt for Investment and Development (TSFE).

Under the MoU, bp will carry out several studies to evaluate the technical and commercial feasibility of developing a multi-phase, large scale green hydrogen (gH2) export hub in Egypt. It is intended that high potential locations across Egypt will be considered as part of the feasibility study, targeting best-in-class resources. Green hydrogen is produced by the electrolysis of water, powered by renewable energy.

Anja-Isabel Dotzenrath, bp’s executive vice president of gas and low carbon energy, said: “bp is proud of our long history in Egypt and significant role in the country’s energy industry. Egypt has world-class renewable energy resources, and we look forward to working with the Government to explore how we can support its ambitious low carbon strategy.” Read More

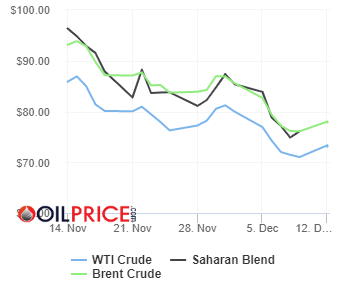

| Oil and Gas Blends | Units | Oil Price $ | change |

| Crude Oil (WTI) | USD/bbl | $73.18 | Down |

| Crude Oil (Brent) | USD/bbl | $77.92 | Down |

| Bonny Light | USD/bbl | $75.81 | Down |

| Saharan Blend | USD/bbl | $76.08 | Down |

| Natural Gas | USD/MMBtu | $6.66 | Down |

| OPEC basket 09/12/22 | USD/bbl | $74.78 | Down |

The Declaration of Cooperation (DoC) between OPEC Member Countries and 10 non-OPEC oil-producing countries turned six today, 10 December 2022.

On this day in 2016, OPEC Member Countries and Azerbaijan; the Kingdom of Bahrain; Brunei Darussalam; Equatorial Guinea, which later joined OPEC; Kazakhstan; Malaysia; Mexico; the Sultanate of Oman; the Russian Federation; the Republic of Sudan; and the Republic of South Sudan, met at the OPEC Headquarters in Vienna, Austria, and decided to establish the DoC as a platform for cooperation and dialogue in the interest of oil market stability. Other producers attended the meeting in support of these extraordinary efforts.

The pivotal decisions taken at the inaugural OPEC and non-OPEC Ministerial Meeting built on the successful ‘Algiers Accord’ signed in Algiers, Algeria, on 28 September 2016 at the 170th (Extraordinary) Meeting of the OPEC Conference and the subsequent ‘Vienna Agreement’ decided on 30 November of the same year in Vienna, Austria, at the 171st Meeting of the OPEC Conference.

OPEC Secretary General, HE Haitham Al Ghais, said, “The Declaration of Cooperation is an unprecedented collaborative framework of 23 oil-producing countries that is based on trust, mutual respect and dialogue. Six years later, the framework continues to play an instrumental role in supporting market stability, which is essential for growth and development, as well as attracting the necessary investment to ensure energy security.”

The DoC aims to secure sustainable oil market stability through cooperation and dialogue, including at the research and technical levels, for the benefit of all producers, consumers and investors, as well as the global economy at large. Read More

The Board of Directors of Hess Corporation (NYSE: HES) today declared a regular quarterly dividend of 37.5 cents per share payable on the Common Stock of the Corporation on December 29, 2022 to holders of record at the close of business on December 19, 2022. Read More

ExxonMobil announced its corporate plan for the next five years, with a sizeable increase in investments aimed at emission reductions and accretive lower-emission initiatives, including its Low Carbon Solutions business. The corporate plan through 2027 maintains annual capital expenditures at $20-$25 billion, while growing lower-emissions investments to approximately $17 billion. This disciplined approach prioritizes high-return, low-cost-of-supply assets in the Upstream and Product Solutions businesses and supports efforts to reduce greenhouse gas emissions intensity from operated assets, as well as those emitted from other companies. The plan is expected to double earnings and cash flow potential by 2027 versus 2019 and supports the company’s strategic priorities, which include leading the industry in safety, shareholder returns, earnings and cash flow growth; cost and capital efficiency; and reductions in greenhouse gas emissions intensity.

“Our five-year plan is expected to drive leading business outcomes and is a continuation of the path that has delivered industry-leading results in 2022,” said Darren Woods, chairman and chief executive officer. “We view our success as an ‘and’ equation, one in which we can produce the energy and products society needs – and – be a leader in reducing greenhouse gas emissions from our own operations and also those from other companies. The corporate plan we’re laying out today reflects that view, and the results we’ve seen to date demonstrate that we’re on the right course.”

Corporate plan calls for strong growth from high-return projects

Investments in 2023 are expected to be in the range of $23 billion to $25 billion to help increase supply to meet global demand. The company also remains on track to deliver a total of approximately $9 billion in structural cost reductions by year-end 2023 versus 2019.

Upstream earnings potential is expected to double by 2027 versus 2019, resulting from investments in high-return, low-cost-of-supply projects. More than 70% of capital investments will be deployed in strategic developments in the U.S. Permian Basin, Guyana, Brazil, and LNG projects around the world. By 2027, Upstream production is expected to grow by 500,000 oil-equivalent barrels per day to 4.2 million oil-equivalent barrels per day with more than 50% of the total to come from these key growth areas. Approximately 90% of Upstream investments that bring on new oil and flowing gas production are expected to have returns greater than 10% at prices less than or equal to $35 per barrel, while also reducing Upstream operated greenhouse gas emissions intensity by 40-50% through 2030, compared to 2016 levels.

Near-term Upstream investments are projected to keep production at approximately 3.7 million barrels of oil equivalent per day in 2023 assuming a $60 per barrel Brent price, offsetting the impact of strategic portfolio divestments and the expropriation of Sakhalin-1 in Russia. Read More

High oil prices have provided Iraq’s economy with much-needed respite after a near-crisis in 2020. Nevertheless, underlying imbalances and oil dependence continued to increase. Using the opportunity provided by high oil revenues to reverse the trend of rising vulnerabilities and modernize the economy will be of paramount importance in the face of multiple looming challenges, which could severely test the limits of the current economic model. A meaningful economic transformation must start with a prudent, patient, and disciplined fiscal policy aimed at building financial buffers, reducing oil dependence, and reorienting expenditures toward priority investment and social needs. A careful calibration of the 2023 budget will be crucial to preserve gains from recent policy efforts. Alongside, decisive structural reforms will be critical to improve socio-economic conditions and promote private sector development as the key driver of growth and employment.

Economic Outlook and Risks

- The economy is gradually recovering amid rising underlying vulnerabilities. Real GDP is projected to grow by 8 percent in 2022, driven by a 12-percent expansion in oil output. Meanwhile, real non-oil GDP is expected to expand at a more moderate pace of 3 percent after rebounding by 21 percent in 2021. Inflation has been relatively contained, averaging 5 percent during the first 10 months of 2022, as the pass-through from high global commodity prices has been muted by food and fuel subsidies. Helped by high oil prices, this year’s fiscal and external current account balances are expected to reach surpluses of 6 and 11 percent of GDP, respectively, while foreign exchange reserves of the central bank could exceed $90 billion by end-year. At the same time, these surpluses veil widening of the non-oil fiscal balance, and Iraq’s dependence on oil continued to increase with the oil price needed to balance the government budget (“budget breakeven oil price”) reaching US$66 per barrel in 2022, up from US$52 per barrel in 2019. Read More

Philippe François Mathieu has been appointed executive vice president for Exploration and Production International (EPI), with effect from 1 January 2023.

Mathieu succeeds Al Cook who will leave the company to pursue a CEO position outside the company. Mathieu comes from the position as senior vice president corporate strategy.

“I am very pleased to welcome Philippe to the corporate executive committee. He has a broad background from several senior leadership roles and has contributed to shape Equinor’s updated strategy and ambition to become a leading company in the energy transition. I am confident he will lead EPI into the future and bring valuable perspectives to the corporate executive committee,” says CEO Anders Opedal.

“I look very much forward to join the corporate executive committee to further develop our international portfolio, that has an important role for the realization of Equinor’s strategy in the energy transition,” says Philippe F. Mathieu.

Mathieu has held several senior leadership roles across multiple business areas and geographies since joining Equinor in 1995. Read More

Baker Hughes (NASDAQ: BKR), an energy technology company, announced Monday it has been added to the Nasdaq-100® Index, the top 100 largest domestic and international non-financial companies on The Nasdaq based on market capitalization. Nasdaq announced the inclusion on Friday, Dec. 9, which will become effective prior to market open on Monday, Dec. 19.

“We are proud to be included in the Nasdaq-100 as one of its first energy companies and the first energy technology company,” said Baker Hughes Chairman and CEO Lorenzo Simonelli. “This recognition is testament to the significant progress Baker Hughes has made and continues to make along our strategic roadmap — taking energy forward as we transform our core operations, invest for growth in new energy and industrial sectors, and consistently deliver strong returns for our shareholders.”

Baker Hughes transferred its stock exchange listing to Nasdaq in late 2021, joining a select group of companies at the forefront of technology, innovation and sustainability.

Established in January 1985, the Nasdaq-100 Index is home to category-defining companies on the forefront of innovation. The Nasdaq-100 is updated annually and is subject to change. Read More

Askeladd on stream

Phase 1 of Askeladd will bring 18 billion cubic metres of gas and two million cubic metres of condensate to the market via the Hammerfest LNG plant on Melkøya.

Askeladd is a satellite field of the Snøhvit Field and developed as a subsea tie-in to the Snøhvit facility and Hammerfest LNG.

“Askeladd is now producing, the gas will help extend plateau production from Hammerfest LNG on Melkøya up tothree years,” says Thor Johan Haave, Equinor’s vice president operations & maintenance, Hammerfest LNG.

During normal production, Hammerfest LNG (HLNG) delivers 18.4 million standard cubic metres of gas per day, or 6.5 billion cubic metres per year. This corresponds to the needs of around 6.5 million European households, or 5% of all Norwegian gas exports.

“HLNG delivers significant volumes to customers in Europe, and the gas from the Barents Sea reinforces our position as a predictable and reliable gas supplier. Askeladd and other projects in the region will ensure further value creation and production from HLNG for decades,” Haave adds.

The project was originally completed in 2020, but start-up had to wait until the Melkøya plant resumed operations after the fire the same year. The development was delivered on schedule and NOK 650 million below the cost estimate of NOK 5.2 billion.

“Just over 1.5 million person-hours of work have gone into the project, most of them performed by our suppliers. During the project period, Askeladd generated 250–300 person-years of work in Northern Norway, mainly in Hammerfest. In addition, many employees and suppliers have helped restart Hammerfest LNG, which makes it possible to phase in both Askeladd and future projects,” says Trond Bokn, Equinor’s senior vice president for project development.

Askeladd is the first of several projects in the further development of the Snøhvit field and the infrastructure around HLNG. Next up is Askeladd West with two new wells tied back to existing infrastructure, before further development continues with onshore compression and electrification through the Snøhvit Future project. Read More

Golar LNG Limited (“Golar”) announces the result of the offer announced on 5 December 2022 to buy back parts of its USD 300 million senior unsecured bonds. The “Reverse Dutch Auction” closed on 9 December 2022 at 16:00 CET, and Golar has accepted offers up to and including a price of 100% of par value plus accrued and unpaid interest, equaling a total nominal amount of approximately USD 140 million. Cash settlement for the repurchase is expected to occur on 15 December 2022. DNB Markets acted as Manager for the buy-back. Read More

Baker Hughes Rig Count

U.S. Rig Count is down 4 from last week to 780 with oil rigs down 2 to 625, gas rigs down 2 to 153 and miscellaneous rigs unchanged at 2.

Canada Rig Count is up 7 from last week to 202, with oil rigs up 3 to 131, gas rigs up 4 to 71.

| Region | Period | Rig Count | Change from Prior |

| U.S.A | 09 December 2022 | 780 | -4 |

| Canada | 09 December 2022 | 202 | +7 |

| International | November 2022 | 910 | -1 |

Eni announces the beginning of production at the photovoltaic plant under its operation in Tataouine, southern Tunisia, following connection to the national grid. The event was celebrated today during a ceremony that saw the attendance of Neila Gonji, Tunisia’s Minister of Industry, Energy and Mines, and local authorities.

The plant, which has an installed capacity of 10 MW, will supply over 20 GWh of power per year to the national grid, while ensuring savings of around 211,000 tons of CO2 equivalent over its lifetime. The electricity produced will be supplied to STEG (Société Tunisienne de l’Electricité et du Gaz) as agreed through a 20-year Power Purchase Agreement.

The plant was built by Société Énergie Renouvelables Eni Etap (SEREE), a joint venture between Eni and ETAP (Entreprise Tunisienne d’Activités Pétrolières) operating in the production of power from renewable energy sources.

In Tunisia, Eni also operates the ADAM photovoltaic field, with a peak capacity of 5 MW and which supplies electricity to the adjacent ADAM field in the Governorate of Tataouine, thus allowing gas savings as well as emissions reductions of over 6,500 tons of CO2 equivalent per year. The plant is a hybrid generation system, one of the most innovative and efficient currently available.

The initiative confirms Eni’s contribution to the decarbonisation process of the Tunisian energy system, as well as the company’s commitment to achieving zero scope 1, 2 and 3 emissions by 2050, in line with Eni’s medium-to-long term strategy. Read More

Neptune Energy announced today that the Board of Directors of Neptune Energy Group Limited have declared a dividend and preference share redemption totalling $1.149 billion for the financial year ending 31 December 2022. The dividend will be paid to shareholders in December 2022. Read More

The global energy crisis is driving a sharp acceleration in installations of renewable power, with total capacity growth worldwide set to almost double in the next five years, overtaking coal as the largest source of electricity generation along the way and helping keep alive the possibility of limiting global warming to 1.5 °C, the IEA says in a new report.

Energy security concerns caused by Russia’s invasion of Ukraine have motivated countries to increasingly turn to renewables such as solar and wind to reduce reliance on imported fossil fuels, whose prices have spiked dramatically. Global renewable power capacity is now expected to grow by 2 400 gigawatts (GW) over the 2022-2027 period, an amount equal to the entire power capacity of China today, according to Renewables 2022, the latest edition of the IEA’s annual report on the sector.

This massive expected increase is 30% higher than the amount of growth that was forecast just a year ago, highlighting how quickly governments have thrown additional policy weight behind renewables. The report finds that renewables are set to account for over 90% of global electricity expansion over the next five years, overtaking coal to become the largest source of global electricity by early 2025.

“Renewables were already expanding quickly, but the global energy crisis has kicked them into an extraordinary new phase of even faster growth as countries seek to capitalise on their energy security benefits. The world is set to add as much renewable power in the next 5 years as it did in the previous 20 years,” said IEA Executive Director Fatih Birol. “This is a clear example of how the current energy crisis can be a historic turning point towards a cleaner and more secure energy system. Renewables’ continued acceleration is critical to help keep the door open to limiting global warming to 1.5 °C.”

The war in Ukraine is a decisive moment for renewables in Europe where governments and businesses are looking to rapidly replace Russian gas with alternatives. The amount of renewable power capacity added in Europe in the 2022-27 period is forecast to be twice as high as in the previous five-year period, driven by a combination of energy security concerns and climate ambitions. An even faster deployment of wind and solar PV could be achieved if EU member states were to rapidly implement a number of policies, including streamlining and reducing permitting timelines, improving auction designs and providing better visibility on auction schedules, as well as improving incentive schemes to support rooftop solar.

Beyond Europe, the upward revision in renewable power growth for the next five years is also driven by China, the United States and India, which are all implementing policies and introducing regulatory and market reforms more quickly than previously planned to combat the energy crisis. As a result of its recent 14th Five-Year Plan, China is expected to account for almost half of new global renewable power capacity additions over the 2022-2027 period. Meanwhile, the US Inflation Reduction Act has provided new support and long-term visibility for the expansion of renewables in the United States.

Utility-scale solar PV and onshore wind are the cheapest options for new electricity generation in a significant majority of countries worldwide. Global solar PV capacity is set to almost triple over the 2022-2027 period, surpassing coal and becoming the largest source of power capacity in the world. The report also forecasts an acceleration of installations of solar panels on residential and commercial rooftops, which help consumers reduce energy bills. Global wind capacity almost doubles in the forecast period, with offshore projects accounting for one-fifth of the growth. Together, wind and solar will account for over 90% of the renewable power capacity that is added over the next five years.

The report sees emerging signs of diversification in global PV supply chains, with new policies in the United States and India expected to boost investment in solar manufacturing by as much as USD 25 billion over the 2022-2027 period. While China remains the dominant player, its share in global manufacturing capacity could decrease from 90% today to 75% by 2027.

Total global biofuel demand is set to expand by 22% over the 2022-2027 period. The United States, Canada, Brazil, Indonesia and India make up 80% of the expected global expansion in biofuel use, with all five countries having comprehensive policies to support growth.

The report also lays out an accelerated case in which renewable power capacity grows a further 25% on top of the main forecast. In advanced economies, this faster growth would require various regulatory and permitting challenges to be tackled and a more rapid penetration of renewable electricity in the heating and transport sectors. In emerging and developing economies, it would mean addressing policy and regulatory uncertainties, weak grid infrastructure and a lack of access to affordable financing that are hampering new projects.

Worldwide, the accelerated case requires efforts to resolve supply chain issues, expand grids and deploy more flexibility resources to securely manage larger shares of variable renewables. The accelerated case’s faster renewables growth would move the world closer to a pathway consistent with reaching net zero emissions by 2050, which offers an even chance of limiting global warming to 1.5 °C. Read More

The European Union faces a potential shortfall of almost 30 billion cubic metres of natural gas in 2023 – but this gap can be closed and the risk of shortages avoided through stronger efforts to improve energy efficiency, deploy renewables, install heat pumps, promote energy savings and increase gas supplies, the IEA says in a new report released today.

The report – How to Avoid Gas Shortages in the European Union in 2023 – sets out a suite of practical actions that Europe can take to build on the impressive progress that has already been made in 2022 in reducing reliance on Russian gas supplies and filling gas storage ahead of this winter. The report cautions that 2023 may well prove to be an even sterner test for Europe because Russian supplies could fall further, global supplies of liquified natural gas (LNG) will be tight – especially if Chinese demand for LNG rebounds – and the unseasonably mild temperatures seen at the start of the European winter are not guaranteed to last.

IEA Executive Director Fatih Birol launched the report alongside European Commission President Ursula von der Leyen at a press conference in Brussels today – ahead of the Extraordinary Meeting of EU Energy Ministers on 13 December and the Meeting of the European Council on 15 December.

“We have managed to withstand Russia’s energy blackmail. With our REPowerEU plan to reduce demand for Russian gas by two-thirds before the end of the year, with a mobilisation of up to €300 billion of investments. The result of all this is that we are safe for this winter,” said European Commission President Ursula von der Leyen. “So we are now turning our focus to preparing 2023, and the next winter. For this, Europe needs to step up its efforts in several fields, from international outreach to joint purchasing of gas and scaling up and speeding up renewables, and reducing demand.”

“The European Union has made significant progress in reducing reliance on Russian natural gas supplies, but it is not out of the danger zone yet,” said IEA Executive Director Fatih Birol. “Many of the circumstances that allowed EU countries to fill their storage sites ahead of this winter may well not be repeated in 2023. The IEA’s new analysis shows that a stronger push on energy efficiency, renewables, heat pumps and simple energy saving actions is vital to head off the risk of shortages and further vicious price spikes next year.”

As a result of measures taken by European governments and businesses throughout 2022 in response to the energy crisis, as well as the demand destruction caused by huge price spikes, the amount of gas in EU storage sites was well above the five-year average at the start of December, providing an important buffer going into winter. Consumer actions, increased non-Russian gas supplies and mild weather also helped compensate for the drop in Russian deliveries in 2022.

Measures already taken by EU governments on energy efficiency, renewables and heat pumps should help reduce the size of the potential gas supply-demand gap in 2023. A recovery in nuclear and hydropower output from their decade-low levels in 2022 should also help narrow the gap. Despite all of this, the EU’s potential gas supply-demand gap could reach 27 billion cubic metres in 2023 in a scenario in which gas deliveries from Russia drop to zero and China’s LNG imports rebound to 2021 levels, according to the report. Read More

Worldwide sales of heat pumps are set to soar to record levels in the coming years as the global energy crisis accelerates their adoption, the International Energy Agency says in a new special report released today.

The heating of most buildings around the world – such as homes, offices, schools and factories – still relies on fossil fuels, particularly natural gas. Heat pumps are a hyper-efficient and climate-friendly solution, which help consumers save money on bills and enable countries to cut reliance on imported fossil fuels, according to the IEA special report The Future of Heat Pumps, the first comprehensive global outlook on the subject.

The heat pump market has been growing strongly in recent years, due to falling costs and strong incentives. Global heat pump sales rose by nearly 15% in 2021, double the average of the past decade, led by the European Union where they rose by around 35%. Sales in 2022 are set to hit record levels in response to the global energy crisis, especially in Europe where some countries are seeing sales double in the first half of 2022 compared with the same period last year.

Annual sales of heat pumps in the EU could rise to 7 million by 2030 – up from 2 million in 2021 – if governments succeed in hitting their emissions reduction and energy security goals. Heating buildings accounts for one-third of EU gas demand today. Heat pumps could reduce that demand by nearly 7 billion cubic metres (bcm) in 2025 – roughly equal to the natural gas supplied via the Trans Adriatic Pipeline in 2021. This annual gas saving would grow to at least 21 bcm by 2030 if EU climate targets are met. Read More

SLB announced an award to its OneSubsea® business and Subsea Integration Alliance of a large contract by bp for its Cypre gas project offshore Trinidad and Tobago. The contract scope covers the engineering, procurement, construction, and installation (EPCI) of the subsea production systems and subsea pipelines. The award represents Subsea Integration Alliance’s first fully integrated EPCI single contract with bp and the alliance’s first development in the Caribbean nation.

The Subsea Integration Alliance team delivered the initial front-end engineering and design phase for the project and will now transition into the full EPCI phase. Offshore installation is scheduled to commence in 2024.

OneSubsea, the subsea technologies, production, and processing systems business of SLB, will deliver the subsea production systems, which will include seven horizontal subsea tree systems, subsea controls and connection systems, distribution and control systems and aftermarket services. Subsea7, also part of Subsea Integration Alliance, will deliver the subsea pipelines for the project.

“By leveraging early engagement, digital solutions and field-proven, standard equipment, we were able to quickly define the development concept for bp’s Cypre project and place early orders for key components, derisking the project timeline,” said Don Sweet, director of SLB’s Subsea Production Systems business. Read More

SLB (NYSE: SLB) today announced the early results of the previously announced offer by Schlumberger Holdings Corporation, an indirect wholly-owned subsidiary of SLB (“SHC”), to purchase for cash up to an aggregate purchase price amount, including premium but excluding any Accrued Interest (as defined below), of $500,000,000 (such amount, as it may be amended, the “Maximum Purchase Price”) of the notes listed in the table below (the “Notes”). The offer to purchase the Notes is referred to herein as the “Offer.” Additionally, SLB announced the increase of the Maximum Purchase Price from $500,000,000 to up to $800,000,000, and no Notes with Acceptance Priority Levels 3 and 4 will be accepted for purchase. All other terms of the previously announced Offer remain unchanged.

The Offer is made upon the terms and subject to the conditions set forth in the offer to purchase, dated November 21, 2022 (as may be amended or supplemented from time to time, the “Offer to Purchase”). Capitalized terms used but not defined in this press release have the meanings given to them in the Offer to Purchase. Read More

SLB (NYSE: SLB) announced the consideration payable in connection with the previously announced offer (the “Offer”) by Schlumberger Holdings Corporation, an indirect wholly-owned subsidiary of SLB (“SHC”), to purchase for cash up to a certain amount of the notes listed in the table below (the “Notes”), pursuant to the terms and subject to the conditions set forth in the offer to purchase, dated November 21, 2022 (as may be amended or supplemented from time to time, the “Offer to Purchase”). Capitalized terms used but not defined in this press release have the meanings given to them in the Offer to Purchase. Read More

Tullow Oil plc (Tullow) announce the appointment of Richard Miller as Chief Financial Officer (CFO) and as an Executive Director of Tullow. Richard is currently Interim CFO and Group Financial Controller. The effective date of the appointment will be 1 January 2023.

Richard brings extensive oil & gas and financial experience to the role. He has been acting as Interim CFO since April 2022 and has been with Tullow for over 11 years. During that time Richard led the Tullow Finance team, supporting a number of acquisitions, disposals and capital markets transactions. Richard played a significant role in the continued turnaround of Tullow with the successful rebasing of Tullow’s cost structure, the resetting of the balance sheet and the change to a more focussed capital allocation. Richard is a Chartered Accountant and he joined Tullow from Ernst and Young LLP where he worked in the audit and assurance practice. Read More

Continental Resources, Inc. announced today President and Chief Operating Officer (COO) Doug Lawler will assume the role of President and Chief Executive Officer (CEO).

“Doug is a transformative leader who will build on all we have achieved in our company’s 55-years. Doug is exactly the right person to inspire our employees and grow our company and our culture as we meet the world’s energy challenges. Operating as a private company unlocks endless possibilities, and I look forward to working with Doug as we fiercely champion American energy for decades to come,” said Founder and Chairman Harold Hamm.

“I do not take lightly the immense privilege to lead one of the world’s premier exploration and production companies. Since joining Continental, I have seen first-hand the impact of our unique ‘Culture of the Possible’ as we continue to raise the bar for our industry. I am honored to have the opportunity to work side by side with Harold, one of our industry’s great icons, as we champion American energy,” said Lawler.

Lawler has spent over three decades in the oil and gas industry and joined Continental in February 2022. Lawler will transition to President and CEO at the start of 2023 upon the retirement of William Berry. Read More

VAALCO Energy, Inc. today provided an operational update including additional information on the North Tchibala 2H-ST well.

Highlights

In Gabon, the North Tchibala 2H-ST well was brought online in early November and flowed at a low, controlled rate to allow for cleanup and to minimize negative impact to the completion;

Through early December, the well has flowed, but with temporary interruptions for operational activity and shut-ins for pressure build up analysis with the following results:

Produced approximately 8,000 gross barrels of oil, or about 275 gross barrels of oil per day (“BOPD”);

Recovered about 33% of injected completion fluid;

Cleanup is continuing and pressure transient analysis indicates the lower stimulated zones may not be contributing;

Conducting chemical analysis on oil recovered from the well that will help determine if all zones that were fracture stimulated are producing;

Post-frac modeling suggests that the well is capable of producing rates at or above 1,500 gross BOPD;

On December 4th, the first lifting from the new FSO “TELI” was successfully completed at the same time that the final remaining volumes from the Nautipa FPSO were removed; In Egypt, VAALCO expects to spud the first horizontal well on December 12th, with completion operations planned for first quarter 2023;

In Canada, the tie in of the 4-10 well is expected in late December with an expected flow rate of about 200 barrels of oil equivalent per day before year end; and

Also in Canada, construction on the 14-25-29-04W5 surface lease has been completed with drilling expected to start in early January 2023.

George Maxwell, Chief Executive Officer, commented, “We continue to monitor the fluids flowing from the North Tchibala 2H-ST well to better understand its results. During cleanup, the well has been producing about 275 gross BOPD, however our post-frac modeling indicates that the well is capable of producing rates in excess of 1,500 gross BOPD. The well is not cleaning up as expected, with only about 33% of completion fluid recovered. We are continuing to gather information to understand why the lower stimulated zones may not yet be contributing any meaningful production. We will continue to monitor the well and plan to provide additional information to the market once we have analyzed all the data. Read More

Dalmore Capital, an independent fund management company that acquires, manages and holds infrastructure assets, to deliver long term value for investors, is delighted to announce that Cory, one of the UK’s leading waste and recycling businesses, and in which Dalmore is the largest investor, has reached financial close for its second Energy from Waste (EfW) facility, Riverside 2. The funding of this project is provided by a combination of bank debt and equity financing from Dalmore Capital’s managed funds and other existing shareholders Cory via an equity rights issue.

Riverside 2 will be one of the UK’s largest EfW facilities and will divert around 650,000 tonnes of non-recyclable waste a year from landfill, converting it into enough low-carbon electricity to power up to 140,000 homes; and will have the lowest Nitrogen Oxide (NOx) levels of any UK EfW facility.

Once complete, the facility will provide c.140 new jobs across operations, river infrastructure and head office including apprenticeship opportunities.

The future growth of the business is underpinned by a commitment to sustainability and reducing environmental impacts on the local area. As part of this, Cory is progressing an industry-leading decarbonisation project, which will also be located at the Belvedere site and has the potential to deliver 1.4 million tonnes of CO2 savings per annum by 2030. The planned project includes Carbon Capture and Storage (CCS) technology as well as green hydrogen generation – both elements have recently been designated as Nationally Significant Infrastructure Projects by the Department for Business, Energy and Industrial strategy. One of the UK’s largest heat networks is also planned, to be delivered in partnership with Vattenfall. Read More

DNO ASA, the Norwegian oil and gas operator (the “Company”), today announced the initiation of a share buyback program (the “Program”) through which the Company will repurchase up to 53,107,326 shares, representing approximately five percent of total shares outstanding, for a maximum total consideration of USD 80 million.

The Program will be conducted in accordance with article 5 of the Market Abuse Regulation (EU) No 596/2014, as adopted in the Norwegian Securities Trading Act of 2007, ancillary regulations and the Oslo Stock Exchange’s Guidelines for buyback programmes and price stabilisation of February 2021.

Buyback transactions will be executed at market prices on the Oslo Stock Exchange. The Program will be managed by Arctic Securities AS, which will make its trading decisions in relation to the Program independently of the Company; this may result in DNO acquiring shares through periods where the Company otherwise would have been restricted from doing so.

The Program will be in force from 9 December 2022 and until the earlier of i) the maximum number of shares as set out above has been acquired, ii) the maximum total consideration has been reached or iii) 30 April 2023.

The Program is based upon the authorization to acquire treasury shares granted to the Board of Directors at DNO’s Annual General Meeting on 25 May 2022 and registered in the Norwegian Register of Business Enterprises. According to the authorization, the maximum number of shares that can be acquired is 97,543,272, the minimum price that can be paid per share is NOK 1 and the maximum price is NOK 100. The authorization is valid until the Company’s 2023 Annual General Meeting, but no later than 30 June 2023.

The purpose of the Program is to reduce the capital of the Company. The Board of Directors plans to propose to the Annual General Meeting in 2023 to cancel repurchased shares under the Program as well as 26,269,183 treasury shares (approximately 2.5 percent of shares outstanding) already held by the Company. Read More

————————————————————————————————

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: @OilAndGasPress on Twitter |

Oil and gas press covers, Energy Monitor, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas, energy monitors,TotalEnergies, Shell, BP, Chevron