Energy News to 13/10/22. OPEC daily basket price stood at $95.11/bl, 12 Oct. 2022

Oil prices fell as the American Petroleum Institute (API) reported a large build this week for crude oil of 7.054 million barrels. U.S. crude inventories have grown by roughly 28 million barrels so far this year, according to API data, while the U.S. Strategic Petroleum Reserves fell by nearly seven times that figure, at 184 million barrels.

APM announced that Petroleum Development Oman (PDO), Oman’s leading oil and gas exploration and production company, has become the first company in the Middle East to be successfully accredited in achieving a recognised route to Chartered Project Professional status.

This accreditation means that senior PDO project managers who go through the company’s competence development scheme will have a fast-track to attaining the coveted Chartered Project Professional (ChPP) status. Gaining this accreditation confirms that the PDO Project Management competence development system is on a par with other major international capital-intensive organisations. Representatives from PDO including Head of Project Management, Ali Cox, joined APM team members including Milla Mazilu, Board Chair, Rebecca Fox, Director of Membership and Business Development and Mark Hepworth, Deputy CEO and other team members at the Institute of Directors in London to celebrate the achievement. Read More

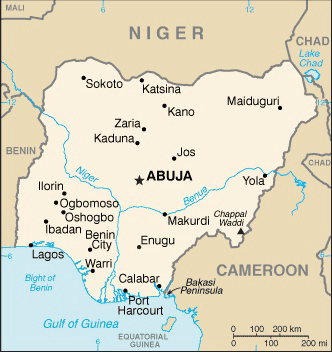

The Shell Petroleum Development Company of Nigeria Limited (SPDC) says the Forcados Oil Terminal will resume export operations by the end of the month when ongoing essential repairs would have been completed. “In addition to the repairs, we are working to remove and clamp theft points on the onshore pipelines to ensure full crude oil receipt at the terminal,” SPDC’s Media Relations Manager, Abimbola Essien-Nelson, said in a statement on Wednesday. According to Essien-Nelson, the active illegal connections to SPDC joint venture’s production lines and facilities in western Niger Delta as well as the inactive illegal connection to the onshore section of the 48” Forcados Export Line are in the company’s ongoing programme to remove illegal connections on the pipelines that feed the terminal. Read More

In its quarterly mergers and acquisitions report, energy intelligence and analytics firm Enverus notes that the 3rd quarter ending September 30 was the most active quarter in oil and gas so far this year. In a signal that the pace of transactions might continue during the year’s final three months, big Permian Basin producer Diamondback EnergyFANG -0.8% announced a $1.6 billion deal to acquire the assets of Midland Basin driller Firebird Energy LLC shortly before the Enverus report was released. Enverus notes that the value of upstream segment deals in the domestic oil and gas industry totaled to more than $16 billion. Shell and ExxonMobil announced the sale of the venerable oil recovery joint venture Aera Energy to Germany-based IKAV for almost $4 billion. The deal brings an end to the two major oil companies’ involvement in the pursuit of oil and gas in the state of California, which, as I noted in a story yesterday, is an increasingly difficult endeavor. Thus, the sale of Aera represents the end of an era. Read More

Enverus Intelligence Research (EIR), a subsidiary of Enverus, the most trusted energy-dedicated SaaS platform, has released its latest Macro Forecaster, a report that looks at near-term oil and gas balances, recession risks, the impacts of the Russia-Ukraine war and the effects of COVID-19 lockdowns on Chinese oil demand.

“OPEC’s decision to roll back its tiny September supply increase in October indicates it is back in price defense mode as demand expectations are downgraded,” said Bill Farren-Price, report author and a director at EIR.

Looking at the European gas market, the report noted that European total gas storage has surpassed its 80% November fill target. Enverus forecasts it could be more than 90% by November.

Key takeaways the report:

Total U.S. annual demand averaged 19.6 MMbbl/d for the past four weeks ended Sept. 16, off 7% from the same period in pre-pandemic 2019. Similarly, Chinese demand declined Q/Q for the first time in history primarily due to continued COVID-19 challenges. Slow demand recovery supports Enverus’ view that global oil demand will remain below pre-pandemic levels until 2023.

In gas markets, if EU countries are successful in maintaining the targeted 15% demand reduction from August to March, Enverus predicts winter stock levels will be sufficient to keep gas flowing through the winter with average temperatures. U.S. natural gas storage inventories are 332 Bcf below the five-year average. Enverus expects injections to outpace the five-year rate to close this deficit to ~150 Bcf by the end of summer. Read More

Just Stop Oil supporters target Downing Street on 12th day of disruption in London

Supporters of Just Stop Oil have blocked one entrance to Downing Street today on the twelfth day of action during October. They are demanding that the government halts all new oil and gas licences and consents. Today’s actions follow eleven days of continuous disruption by supporters of Just Stop Oil in which they have experienced over 337 arrests. On Tuesday, 28 people were arrested after Just Stop Oil supporters blocked Knightsbridge and Brompton Road. Since the campaign began on April 1st, Just Stop Oil supporters have been arrested over 1,600 times.[ Read More

The seventh High-level Regional Financing Arrangements (RFAs) Dialogue was held on 12 October 2022 in Washington DC amidst a highly uncertain global outlook and slowing growth. The discussion focused on ways to strengthen cooperation in the face of the multiple shocks that are testing the resilience of the world economy, and how to contribute to a stronger Global Financial Safety Net (GFSN).

The IMF and the heads of RFAs (the Arab Monetary Fund, the ASEAN+3 Macroeconomic Research Office cum the Chiang Mai Initiative Multilateralisation, represented by the People’s Bank of China as its 2022 co-chair, the BRICS Contingent Reserve Arrangement, represented by the South African Reserve Bank, the Eurasian Fund for Stabilization and Development, the European Commission, the European Stability Mechanism, and the Latin American Reserve Fund) exchanged views on the global and regional conjunctures and risks going forward. In this period of heightened fragility and multiple shocks facing the global economy, they reaffirmed their commitment to cooperate closely to help members overcome these difficult challenges. In this context, the French co-chair of the G20 International Financial Architecture Working Group updated participants on the group’s priorities, including supporting vulnerable economies and increasing the resilience of the international financial architecture. Read More

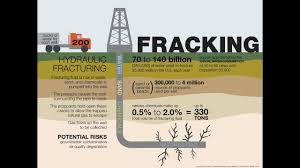

UK fracking and drilling for new oil and gas in the North Sea is green and good for the environment, Liz Truss’s new climate minister said on Wednesday.

Graham Stuart insisted that awarding more than 100 licences to companies for North Sea drilling, covering almost 900 locations, and rolling out fracking across the countryside, were green policies. He told MPs on the environmental audit committee that drilling for new fossil fuels would help the UK reach net zero by 2050. Read More

Truck decarbonisation at bp

Tackling it will require new types of trucks, new forms of lower carbon energy to power them, and new infrastructure to deliver that energy efficiently. The EU and national governments have set ambitious targets for reducing CO2 emissions from trucks. In the UK, the government is aiming to reduce heavy-duty truck emissions by 15% from 2015 levels by 2025, and the German government has introduced road tolls for heavy-duty vehicles with exemptions for trucks that run on CNG and LNG1. In response to these measures, truck manufacturers are rapidly pivoting their portfolios to lower carbon models. Most manufacturers have pledged that by 2040, 100% of their sales will be either electric-powered or fuel cell-powered vehicles.

However, while the truck manufacturers are moving quickly to develop new vehicles, the industry needs to move just as quickly to develop the infrastructure required to deliver these new lower carbon fuels. Data suggests that zero-emission vehicles will represent 37% of all medium-duty and heavy-duty vehicle sales in Europe by 2030.2 This will need to be supported by 140,000 public and destination electric charging points and 1,500 hydrogen fuelling stations.3

The next generation of lower carbon fuels

The decarbonisation of the trucking sector will be a significant challenge for fleet operators. Lower carbon and zero-emission trucks and the infrastructure needed to fuel them are, today, relatively expensive and not yet widely available. In addition, there is greater complexity in decarbonising trucks than in the transition to electric passenger vehicles.

Electric and hydrogen fuel cell trucks, and the technology needed to support them, are not yet available at scale. Therefore, other ‘transition’ fuels, such as renewable diesel and bio-LNG could help fleet managers take some important first steps towards decarbonising their operations. All of this means that truck fleet operators are going to need a range of transition fuels at different points over the next decade and beyond. Read More

Heydar Aliyev Foundation and bp yesterday publicly presented a new film they have jointly supported to promote Azerbaijan’s ancient and rich history and culture. The premiere of the film “Treasures of the World– Azerbaijan” took place yesterday at the Heydar Aliyev Centre with about 1,000 people in audience. The film features the fabulous and remarkable treasures of Baku, Shusha, Gobustan and Sheki and represents yet another contribution to the global promotion of Azerbaijan’s fascinating cultural legacy.The author of the film is prof. Bettany Hughes, historian, broadcaster, the writer and presenter of the wonderful series of Treasures of the World. Prof. Hughes travelled to Azerbaijan in June to explore the country and make one of her fascinating historical and cultural discovery films about the treasures of Azerbaijan. Read More–>

Sabah Energy Corporation Sdn Bhd (SEC) and PETRONAS have signed key agreements on the supply of natural gas to SEC and on the sale of selected gas pipeline assets and businesses in Sabah.The signing of the agreement for the supply of 120 million standard cubic feet per day (MMscfd) of natural gas, took place here today witnessed by Minister of Local Government and Housing, and Finance Minister II Datuk Seri Panglima Masidi Manjun representing Sabah Chief Minister Datuk Seri Panglima Haji Hajiji Haji Noor. Also present was PETRONAS President and Group Chief Executive Officer Datuk Tengku Muhammad Taufik. SEC was represented by its CEO, Adzmir Abdul Rahman, while Senior General Manager of Integrated Hydrocarbon Management, Malaysia Petroleum Management (MPM), Aidid Chee Tahir signed on behalf of PETRONAS. Read More

U.S. President Joe Biden is re-evaluating the United States’ relationship with OPEC’s de facto leader Saudi Arabia after the Kingdom led the OPEC+ group to announce a major oil production cut last week, John Kirby, the coordinator for strategic communications at the U.S. National Security Council, said on Tuesday.“As to the relationship going forward, we’re reviewing a number of response options. We’re consulting closely with Congress,” Secretary Blinken said last week. Read More

Diamondback Energy, Inc. announced that it has entered into a definitive purchase agreement to acquire all leasehold interest and related assets of FireBird Energy LLC (“FireBird”) in exchange for 5.86 million shares of Diamondback common stock and $775 million of cash. The cash portion of this transaction is expected to be funded through a combination of cash on hand, borrowings under the Company’s credit facility and/or proceeds from a senior notes offering. The cash outlay at closing is expected to be approximately $700 million due to the expected Free Cash Flow to be generated on the asset between the effective date and expected closing date late in the fourth quarter of 2022. Read More

A shortage of European feedstocks for sustainable aviation fuels (SAF) will limit European aviation’s ability to reduce greenhouse gas emissions from 2035 onwards. This is one of the main conclusions of a new study by Royal NLR and Delft University of Technology. This shortage means that greenhouse gas emissions will only be 40% lower in 2050 compared to a situation with aircraft powered solely by fossil kerosene, whereas sufficient SAF availability could double this reduction.

Limited availability of European feedstocks required for producing sustainable aviation fuels is standing in the way of meeting medium and long-term uptake targets proposed by the European Commission. “Although we’ve found that feedstock availability is sufficient to meet the targets up to 2030, we have identified a substantial and increasing gap between supply and projected demand from 2035 onwards,” says Johan Kos, project manager and lead author of the study. These conclusions hold for two situations evaluated in the study. In one such situation, aircraft powered by green hydrogen are being operated from 2035 on short and medium-haul flights. In the other situation, such aircraft do not enter service, and additional SAF-powered aircraft are used instead. Read More

KBR (NYSE: KBR) announced today that it will host a conference call to discuss its third quarter 2022 financial results on Wednesday, October 26, 2022 at 7:30 a.m. Central Time (8:30 a.m. Eastern Time). The company plans to issue its third quarter 2022 earnings release and earnings presentation in advance of the call.

The conference call will be webcast simultaneously through the Investor Relations section of KBR’s website at investors.kbr.com. Read More

Just Stop Oil supporters block South London roundabout on 13th day of disruption in the capital

Supporters of Just Stop Oil have blocked a key south London roundabout today on the thirteenth day of action during October. They are demanding that the government halts all new oil and gas licences and consents. [1]

At 9am, 26 Just Stop Oil supporters established a series of roadblock on the roads adjoining St. George’s Circus in Southwark. They are sitting in the road with banners and some have glued themselves to the tarmac. Read More

Jones Walker LLP have just released the findings of its 2022 Ports &Terminals Cybersecurity Survey, noting that cyber attacks are on the rise at US ports & terminals

An overwhelming majority (95%) of port and terminal respondents indicated they believed that their industry is “very” or “somewhat” prepared for any cybersecurity threat. A similarly large majority (90%) reported that their own facilities and organizations are “very” or “somewhat” prepared to withstand a cyber-breach incident.

Despite this level of confidence, keeping pace with the increasing prevalence of cyber attacks remains a significant challenge. 74% of respondents indicated that their systems or data had been the target of a breach or breach attempt within the past year. Read More

DNO ASA, the Norwegian oil and gas operator, refers to the 11 October 2022 announcement on the closing of the transaction with RAK Petroleum plc (“RAK Petroleum”) by which the Company will acquire assets in West Africa.

Pursuant to the approval given by DNO’s Extraordinary General Meeting of 13 September 2022, the Company has issued 78,943,763 new shares to RAK Petroleum as consideration for the asset transfer between the companies. The new shares have today been registered with the Norwegian Register of Business Enterprises (Brønnøysundregistrene).

Following the registration, DNO’s share capital is NOK 263,594,127.25 divided into 1,054,376,509 shares, each with a nominal value of NOK 0.25. Read More

| Oil and Gas Blends | Units | Oil Price $ | change |

| Crude Oil (WTI) | USD/bbl | $87.18 | Down |

| Crude Oil (Brent) | USD/bbl | $92.44 | Down |

| Bonny Light | USD/bbl | $94.23 | Down |

| Saharan Blend | USD/bbl | $94.17 | Down |

| Natural Gas | USD/MMBtu | $6.53 | Down |

| OPEC basket 12/10/22 | USD/bbl | $95.11 | Down |

Baker Hughes Rig Count

International Rig Count is up 19 rigs from last month to 879 with land rigs up 10 to 660, offshore rigs up 9 to 219.

| Region | Period | Rig Count | Change from Prior |

| U.S.A | 07 October 2022 | 762 | -3 |

| Canada | 07 October 2022 | 215 | +2 |

| International | September 2022 | 879 | +19 |

| Rig Count Overview & Summary Count Read More OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress. Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice. Information posted is accurate at the time of posting, but may be superseded by subsequent press releases Please email us your industry related news for publication info@OilAndGasPress.com Follow us: @OilAndGasPress on Twitter |  Oil and gas press covers, Energy, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas, News and Analysis Oil and gas press covers, Energy, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas, News and Analysis |