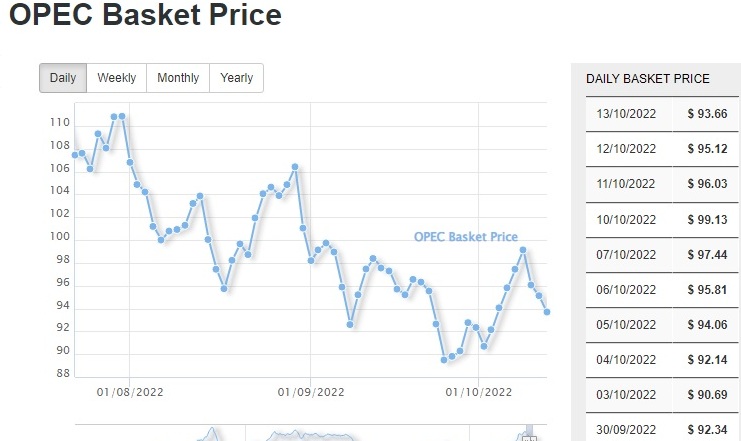

Energy News to 14/10/22. OPEC daily basket price stood at $93.66/bl, 13 Oct. 2022

Oil prices fell as the American Petroleum Institute (API) reported a large build this week for crude oil of 7.054 million barrels. U.S. crude inventories have grown by roughly 28 million barrels so far this year, according to API data, while the U.S. Strategic Petroleum Reserves fell by nearly seven times that figure, at 184 million barrels.

The Siemens Gamesa 5.X onshore platform has reached a huge milestone, with the 100th wind turbine installed at the 372 MW Björnberget wind farm near Ange, Sweden, for partners Prime Capital and Enlight.

The first Siemens Gamesa 5.X prototypes were installed in Denmark and Spain at the beginning of 2021, and the platform is already delivering green and secure energy for our customers and their end user.

Designed and built at our facilities in Agreda, Spain, and Vagos, Portugal, the Siemens Gamesa 5.X is now installed in six projects in Sweden and Brazil, just one year after it was first introduced at the Skaftaasen wind farm, in Sweden.

Indeed, the Siemens Gamesa 5.X wind turbine portfolio continues to evolve. This week the company launched a new variant called the SG 7.0-170, which will have a 7-MW rating helping customers to produce even more clean, green energy.

The Siemens Gamesa 5.X is the largest unit capacity in the onshore portfolio, with a rated capacity of up to 7-MW, and the largest rotor diameters, 155 and 170 meters, resulting in maximum performance in high, medium and low-wind conditions. The 170-meter rotor is among the largest in the onshore segment.

The Siemens Gamesa 5.X onshore platform incorporates the company’s proven technology, experience and expertise, based on its installed wind fleet of more than 104.5 GW worldwide, enough to power 90.2 million households. Read More

Sub-Saharan Africa’s economic activity is expected to slow significantly in 2022 and remain relatively modest in 2023. A downturn in advanced economies and emerging markets, tighter financial conditions, and volatile commodity prices, have undermined last year’s gains. Looking ahead, the outlook remains highly uncertain. Consequently, countries in the region are living on the edge, the International Monetary Fund (IMF) said in its latest Regional Economic Outlook for Sub-Saharan Africa.

“Late last year, sub-Saharan Africa appeared to be on a strong recovery path out of a long pandemic. Unfortunately, this progress has been abruptly interrupted by turmoil in global markets, placing further pressures on policymakers in the region,” stressed Abebe Aemro Selassie, Director of the IMF’s African Department.

The region is expected to grow by 3.6 percent in 2022, down from 4.7 percent in 2021, due to muted investment and the overall worsening of its balance of trade. Non-resource-intensive countries, which enjoy a more diverse economic structure, will continue to be among the region’s more dynamic and resilient economies, growing by 4.6 percent in 2022, compared to 3.3 percent in oil exporters and 3.1 percent in other resource-intensive countries. Read More

On Thursday October 27ᵗʰ 2022 at 07:00 BST (08:00 CEST and 02:00 EDT) Shell plc will release its third quarter results and third quarter interim dividend announcement for 2022 Read More

EU signed a €100 million grant agreement (about US$97.2 million) for the International Monetary Fund’s (IMF) Poverty Reduction and Growth Trust (PRGT). These funds will allow the IMF to make about €630 million worth of zero interest loans for PRGT-eligible countries, including African, Caribbean and Pacific countries (ACP), facing balance of payments difficulties. Access to affordable finance is key to help these countries address the economic and food crisis situation worsened by Russia’s invasion of Ukraine. The EU’s contribution is part of Team Europe’s response to the crisis as it complements pledges by EU Member States to channel Special Drawing Rights (SDR) to the IMF’s Trusts for on-lending and their grants to the IMF’s PRGT Subsidy Account. Team Europe has so far pledged to channel SDRs contributions equivalent to about $23 billion. Read More

Supporters of Just Stop Oil have blocked the road in front of New Scotland Yard on the fourteenth day of action during October. They are demanding that the government halts all new oil and gas licences and consents.

At 14:30, 31 Just Stop Oil supporters established a roadblock in front of New Scotland Yard, by sitting in the road and gluing themselves to the tarmac. One supporter has sprayed the iconic, triangular Metropolitan Police sign with orange paint. Read More

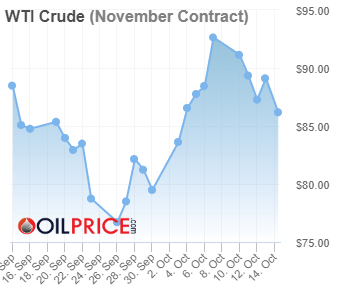

The commodity sector, led by crude oil and fuel products, continued to show strength despite ongoing concerns that central banks’ battles against inflation through aggressively hiking rates will tip the global economy into a deeper slowdown than already seen. While the market continues to focus on dollar and bond yield developments in order to gauge the wider economic outlook, the attention now turns to China and its twice-a-decade National Congress for initiatives that may support demand from the world’s biggest consumer of raw materials

The commodity sector, led by crude oil and fuel products, continued to show strength despite ongoing concerns that central banks’ battles against inflation through aggressively hiking rates will tip the global economy into a deeper slowdown than already seen. Not least in Europe, where the “hybrid war” with Russia has driven gas and power prices sharply higher. This is while there are raised concerns ahead of the February 2023 implementation of an embargo on fuel supplies from Russia.

Overall, the fourth quarter has started on a firm footing, with the Bloomberg Commodity index rising by more than 3% with support primarily from the OPEC-forced rally in crude oil and fuel products, not least distillates where low stocks have driving up refinery margins to a record in New York.Crude oil market navigating politics and demand concerns

Crude oil traded softer on the week in response to renewed demand concerns, but still higher on the month after OPEC+’s decision to cut their baseline production by 2 million barrels per day from November. The decision was heavily criticised by consuming nations for being premature and ill-timed and it triggered an unusually strong rebuke from the International Energy Agency who, in their monthly oil market report, said the cut would increase energy security risks worldwide, thereby leading to higher prices and volatility, and potentially ending up being the tipping point for a global economy already on the brink of recession.

With Saudi Arabia being one of a handful of producers having to cut production, the move, just ahead of an embargo against Russian exports, has been seen to benefit Russia at the expense of the global consumers, including China – the world’s biggest importer. Some support for the decision, however, was provided by OPEC, EIA and IEA after they all made downgrades to their 2023 demand outlook. However, with no one yet talking about a contraction in demand next year, the continued risk to supply from Russia and other producers struggling amid lack of investments and high costs, the risk of higher prices into an economic slowdown remains. Read More

The 2022 OPEC World Oil Outlook (WOO) will be launched at the Abu Dhabi International Petroleum Exhibition and Conference (ADIPEC) 2022 in the United Arab Emirates (UAE). The launch event will be held in the ICC Room on Monday, 31 October 2022 at 16.30, UAE local time.

OPEC’s Secretary General, HE Haitham Al Ghais, along with OPEC experts, will present the major findings of the WOO 2022, as well as introduce a video with key messages from the publication’s 16th edition. This will be followed by a panel discussion and Q&A with management and analysts from OPEC’s Research Division. The launch will also feature keynote remarks from Ministers and CEOs of oil companies.

First published in 2007, the WOO provides an in-depth review and analysis of the global oil and energy industries, and offers assessments of various scenarios in the medium- and long-term development of the oil industry. The publication provides insights into the upstream and downstream, supply and demand, investments, the potential impact of policies, and issues related to environment and sustainable development. It also provides expert analysis of many of the challenges and opportunities facing the global oil and energy industry. Read More

Experts at one of the UK’s leading price comparison websites Quotezone.co.uk, have offered car owners advice on how to make their fuel go further with simple adjustments to their driving habits. With fuel prices and living costs at record highs, households are looking to cut their monthly expenses and improving fuel efficiency is a good way to help stretch the budget. Obviously, Motorists are advised to avoid expensive petrol stations and search for the cheapest prices, for example it may be more cost effective to fill the tank at an independent retailer – so best check online for the nearest locations before setting off and include them as part of an upcoming journey before the fuel level hits low. Drive at 45 mph to make your fuel go further

One of the most crucial factors on fuel consumption is speed, as faster driving wastes more fuel – the optimal fuel-efficient speed for most cars is 45-50 mph. Van and motorbike owners can also save on their fuel by keeping a moderate cruise speed and not hitting the accelerator wastefully. In short, saving on speed can help you save on fuel. Read More

| Oil and Gas Blends | Units | Oil Price $ | change |

| Crude Oil (WTI) | USD/bbl | $86.05 | Down |

| Crude Oil (Brent) | USD/bbl | $91.93 | Down |

| Bonny Light | USD/bbl | $95.06 | Up |

| Saharan Blend | USD/bbl | $95.79 | Up |

| Natural Gas | USD/MMBtu | $6.47 | Down |

| OPEC basket 13/10/22 | USD/bbl | $93.66 | Down |

Baker Hughes Rig Count

International Rig Count is up 19 rigs from last month to 879 with land rigs up 10 to 660, offshore rigs up 9 to 219.

| Region | Period | Rig Count | Change from Prior |

| U.S.A | 07 October 2022 | 762 | -3 |

| Canada | 07 October 2022 | 215 | +2 |

| International | September 2022 | 879 | +19 |

UK Chancellor was today forced out of his job amid backlash over his mini-budget.

Kwasi Kwarteng flew home early from Washington for crisis talks with Liz Truss on quelling market turmoil with another humiliating U-turn on his fiscal policies on the horizon.

In his resignation letter, Mr Kwarteng said: “You have asked me to stand aside as your Chancellor.

“I have accepted. When you asked me to serve as your Chancellor, I did so in full knowledge that the situation we faced was incredibly difficult.

“As I’ve said many times in the past weeks, following the status quo, was simply not an option.” Read More

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: @OilAndGasPress on Twitter |

Oil and gas press covers, Energy, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas, News and Analysis