Energy News to 14/12/22 . OPEC daily basket price at $78.34/bl, 13 Dec. 2022

Russian oil prices saw steeper declines in November. Urals in Northwest Europe fell by nearly $30 per barrel to $43 a barrel by early December, well below the $60 per barrel price cap finally agreed by G7, Australia, and the EU, per IEA assessments.

On 13 December 2021, Savannah announced that it had entered into a Share Purchase Agreement (“SPA”) with PETRONAS (E&P) Overseas Ventures SDN. BHD. (“PETRONAS”) to acquire PETRONAS’ upstream and midstream asset portfolio in Chad and Cameroon. Completion of the proposed acquisition remained subject to satisfaction of certain conditions precedent which have not yet been satisfied, and Savannah and PETRONAS have, therefore, mutually agreed to terminate the SPA with immediate effect. Read More

Following recent press statements relating to Savannah’s acquisition of ExxonMobil’s interest in the Doba fields and the TOTCO Pipeline completed on 9 December 2022, Savannah wishes to make the following statement:

Savannah’s acquisition of ExxonMobil’s interest in the Doba fields and the TOTCO Pipeline completed on 9 December 2022 was conducted in full conformity with the requirements of the governing documents and the applicable law. Read More

Utilita Energy (‘Utilita’) has agreed to pay out £830,000, after a robust assessment by regulator Ofgem suggested the supplier was not taking individual circumstances into consideration when deciding whether or not to provide additional support credits needed for customers topping up prepayment meters.

The assessment was based on a review of scripts of employees talking to customers, training materials, procedures, policies and recorded calls with customers.

Utilita currently serves over 775,000 electricity and 648,000 gas customers, and those affected included some customers in vulnerable situations and with medical conditions.

Utilita was issued with a Provisional Order related to this issue on Friday 9 September 2022, which lapsed last week (Friday 9 December 2022) as Utilita has taken steps which we consider to be appropriate to secure compliance. In recognition of its failings, Utilita has now agreed to this financial redress package instead of a penalty.

This means those customers affected will get the payment directly and more quickly. Read More

Ofgem published the results of the 2022 Annual Iteration Process (AIP) for Gas Transmission (GT2), Electricity Transmission (ET2) and the Electricity System Operator (ESO) network companies under its network price controls.

As part of the ‘Revenue = Incentives + Innovation + Outputs’ (RIIO) price controls for network companies, Ofgem makes annual adjustments to the revenue that it allows the energy network companies to collect through the AIP.

The AIP updates allowed revenues for the next regulatory year (April 2023 – March 2024) based on the submission of actual expenditure and performance data for the regulatory year ending in March 2022 and updated forecasts for the remainder of the price control period.

For GT2, ET2 and ESO, this year’s AIP has increased the allowed revenue that companies will collect relative to the values published at the last AIP123 by approximately £1,145 million, £544 million and £119 million in nominal prices for GT2, ET2 and the ESO price controls, respectively. This is driven by:

Gas prices – forecast gas prices have increased significantly over the past year, which results in an increase in costs and therefore revenues. Read More

On 27 February 2022, bp’s board decided that bp would exit its 19.75% shareholding in Rosneft and its other business in Russia. bp was the first international company to announce such an exit. That decision remains unchanged and bp has no intention of returning to business as usual in Russia.

bp has no operations in Russia.

bp’s nominated directors stood down from Rosneft’s board immediately and bp withdrew its international staff from the country. bp has since withdrawn businesses such as lubricants and aviation.

The decision to leave Russia had a material impact on bp. bp’s board took the decision to exit Russia only after a thorough process and bp remains confident it was the right decision. As a result, bp took a post-tax charge of $24.4 billion in its 1Q 2022 results – the largest such impact on any company globally. bp no longer reports any equity share of oil and gas reserves or production or of earnings from Rosneft – reducing bp’s reported oil and gas reserves by more than 50%, reported oil and gas production by around one third, and reported earnings by around $2 billion a year.

bp has not received any dividends or other revenues nor reported any profits from Russia since its decision – and does not expect to. bp is aware of statements regarding Rosneft’s payment of dividends but it has not received any payments since its decision of 27 February. It has no expectation of receiving any in the future. bp continues to actively pursue the disposal of its shareholding in Rosneft. The process is complex due to both international sanctions and Russian regulations. bp is actively engaged in marketing the asset, but its ability to sell is constrained by Russian legislation and the Russian government, who have effective approval rights on any buyer, as well as by limitations resulting from international sanctions. It was anticipated that this would be – and it is proving to be – a drawn-out process. Read More

British man dies and another is seriously hurt following ‘incident’ on Qatar oil rig

A worker was found dead in his room while another is fighting for life in hospital

Police were flown by helicopter to the rig which is closed for investigations

Foreign Office has confirmed the man’s family have been told of his death Read More

China’s natural gas imports are set for a 7-percent rise next year as the country reopens after Covid lockdowns, which could aggravate an already tight supply situation globally.

The 7-percent import increase forecast was made by state-owned energy major CNOOC, which said, as quoted by Bloomberg, that it was already looking for LNG cargoes for next year.

The report notes that gas inventories at ports in the northern part of the country are depleting at a faster rate than usual because the weather is colder, pushing consumption higher, and this will, too, have an effect on future demand for imports.

What’s more, pipeline supply of natural gas from Central Asia is in decline, which means China will need to rely more on LNG in its gas import mix to make up the difference. And this means more intense competition for a limited number of cargoes between Asia and Europe next year as well.

This year, Chinese gas demand has been trending lower for most of the year, with imports declining consistently over the first ten months of the year, per a report by Energy Intelligence. LNG imports were down by a sizeable 21.6 percent over the ten-month period, reflecting the effects of lockdowns and other restrictions under the country’s zero-Covid policy.

Yet now this policy is being reversed, mass mandatory testing is being dropped and analysts expect a rebound in economic activity before too long. This will drive higher demand for energy and contribute to higher prices due to the tight supply situation in both oil and gas.

This reversal of Beijing’s Covid policy surprised many, who expected tepid demand for energy to continue in one of the world’s largest consumers. If activity rebounds fast, securing sufficient gas supply for the next heating season will likely become a major problem for most importers. Read More

The latest IEA’s Monthly Gas Statistics report including September 2022 data shows that for Total OECD:

Production of natural gas increased by 5.2% compared to September 2021.

Imports (entries)1 of natural gas were 10.8% lower on a year-on-year basis, and total OECD exports (exits)1 decreased by 8.9% in the same period.

· Gross consumption of natural gas increased by 3.1% in September 2022 on a year-on-year basis. Read More

The latest IEA’s Monthly Oil Statistics report including September 2022 data shows that for Total OECD:

Total OECD production of crude oil, NGL and refinery feedstocks increased by 6.7% in September 2022 compared to September 2021.

Refinery gross output of total products grew by 4.3% on a year-on-year basis.

Net deliveries of total products remained unchanged in September 2022 compared to September 2021.

Oil stock levels on national territory decreased by 2 389 kt in September 2022 compared to the closing stock levels in August 2022 and closed at 472 million metric tons.

The IEA and Ukraine today signed a two-year joint work programme to help the country’s energy system recover from the destruction caused by Russia’s invasion and lay the foundations for its transition to a secure and sustainable energy future.

The agreement was signed at the IEA’s Paris headquarters following a meeting between IEA Executive Director Fatih Birol and Ukraine’s Minister of Energy German Galushchenko. They discussed Ukraine’s ongoing efforts to restore heat and power to its citizens in the wake of Russian attacks. Dr Birol and Minister Galushchenko also explored pathways to further deepen institutional ties after Ukraine became an IEA Association country in July.

The joint work programme focuses on key Ukrainian short- and long-term energy priorities, with an emphasis on energy security, the clean energy transition, and Ukraine’s recovery plan. Workstreams outlined in the programme include power-system security, hydrogen, renewables, biogas and collaboration on data and statistics.

“The IEA continues to stand firm with Ukraine, which is part of the IEA Family – and central to both European and global energy security,” Dr Birol said. “I’m happy to be signing this new joint work programme, which reinforces and underlines the IEA’s support for Ukraine in its immediate needs as well its post-war reconstruction efforts.” Read More

Tullow Oil plc announced the signing of a Production Sharing Contract (PSC) for offshore exploration licence CI-803 in Côte d’Ivoire. Tullow will operate the licence with 90% equity, the remaining 10% is held by PetroCi. CI-803 covers an area of 1,345 square kilometres and is adjacent to licence CI-524 which is also held by Tullow (90%, operator) and PetroCi (10%).

With this new exploration licence, Tullow strengthens its position in the Tano Basin where significant prospectivity has been identified within the proven Cretaceous turbidite plays, similar to the plays which are producing in the adjacent TEN and Jubilee Fields. The work programme for the initial two and a half years includes reprocessing of existing 3D seismic data, along with prospect evaluation. In CI-524, a number of drill candidates are being matured while preparations continue for an exploration well to be drilled during 2024. Read More

Neste has again reached the Leadership level and A- rating for its climate actions in the annual listing of companies excelling in their sustainability work by the global non-profit organization CDP. For the sixth consecutive year, Neste has been included in the Leadership level (A or A-) in the Climate Change assessment.

Moreover, Neste has received good results in CDP’s Forests and Water Security assessments. From the Forests category, Neste achieved an A- rating from palm oil and an A- rating from cattle products. As for Water Security, Neste received a B rating. The 2022 results are based on Neste’s sustainability performance in 2021.

“Being acknowledged among the most sustainable companies in the CDP’s prestigious lists for Climate Change and Forests, showcases our long-term commitment to climate and the environment. While we constantly strive for improvement, we are pleased with our results in CDP’s 2022 assessments. We will continue to help our customers in the road transportation, aviation as well as in polymers and chemicals sectors to make their business more sustainable,” says Minna Aila, Senior Vice President, Sustainability and Corporate Affairs, Neste. Read More

On Monday, the U.S. Environmental Protection Agency (EPA) released its annual Automotive Trends Report, which shows that model year (MY) 2021 vehicle fuel economy remained at a record high while emission levels reached a record low. The report also shows all 14 large automotive manufacturers achieved compliance with the Light-duty Greenhouse Gas (GHG) standards through at least MY2020.

“Today’s report demonstrates the significant progress we’ve made to ensure clean air for all as automakers continue to innovate and utilize more advanced technologies to cut pollution,” said EPA Administrator Michael S. Regan. “Working together across the public and private sector, we can deliver on EPA’s mission to protect public health, especially our most vulnerable populations, and advance President Biden’s ambitious agenda to combat the climate crisis.”

Key highlights of the report:

For MY 2021, vehicle fuel economy remained at an all-time high of 25.4 miles per gallon (mpg), and new vehicle real-world carbon dioxide (CO2) emissions decreased to a record low of 347 grams per mile (g/mi).

All vehicle types are at record low CO2 emissions; however, the market shift away from cars and towards sport utility vehicles and pickups has offset some of the fleetwide benefits.

Since MY 2004, average fuel economy in the U.S. has increased by 32%, or 6.1 mpg.

The average estimated real-world CO2 emission rate for all new vehicles fell by 2 g/mi to 347 g/mi, the lowest ever reported.

Since MY 2004, CO2 emissions have decreased 25%, or by 114 g/mi. Over that time, CO2 emissions have been reduced in 14 of the past 17 years.

Overall, advancements in technology are helping industry reach these carbon reduction achievements. In model year 2021, hybrid vehicles reached a new high of 9% of all production. These vehicles can use a larger battery to recapture braking energy and provide power when necessary, allowing for a smaller, more efficiently operated engine. The combined category of electric vehicles (EVs), plug-in hybrid electric vehicles (PHEVs), and fuel cell vehicles (FCVs) increased to 4% of nationwide production in MY 2021. This annual report is part of EPA’s commitment to provide the public with information about new light-duty vehicle GHG emissions, fuel economy, technology data, and auto manufacturers’ performance in meeting the agency’s GHG emissions standards. Read More

The U.S. Environmental Protection Agency (EPA) announced a $186 million Water Infrastructure Finance and Innovation Act (WIFIA) loan to the City of Chattanooga, Tennessee, to support its Wastewater Compliance and Sustainability Project. With this WIFIA loan, EPA is helping the City of Chattanooga improve its wastewater system’s energy efficiency and resilience to extreme weather while saving ratepayers millions of dollars.

“As Chattanooga continues to grow in population, it’s more urgent than ever to provide effective wastewater services to protect this burgeoning community,” said EPA Assistant Administrator for Water Radhika Fox. “At the same time, I’m excited EPA can partner with Chattanooga to create 3,000 jobs in construction and operation locally.”

The Wastewater Compliance and Sustainability Project will modernize the Moccasin Bend Wastewater Treatment Plant, which serves customers throughout the City of Chattanooga and adjacent communities in Hamilton County, Tennessee, and Walker County and Catoosa County, Georgia. The City of Chattanooga will improve storage and treatment capacity at the plant to provide resiliency during extreme weather events and support compliance with its consent decree.

“Chattanooga’s outdoor resources are our greatest competitive advantage, and innovative funding solutions are critical to ensuring we have the resources needed to preserve them for future generations,” said Chattanooga Mayor Tim Kelly. “That’s why I’m incredibly grateful for EPA’s partnership on these low-interest loans, which will allow us to future-proof our sewer system and better protect our beloved waterways, all while maintaining low rates for Chattanooga residents.”

The City of Chattanooga is helping keep rates affordable by taking advantage of the WIFIA program’s flexibility to defer principal repayment until 2032, six years after construction completion. By financing with a WIFIA loan, the City of Chattanooga will save approximately $48 million. Construction and operation are estimated to create approximately 3,0000 jobs. Read More

U.S. Environmental Protection Agency (EPA) announced a proposed rule under the American Innovation and Manufacturing (AIM) Act to advance the transition to more efficient heating and cooling technologies by restricting the use of super-polluting hydrofluorocarbons (HFCs) in certain products and equipment where more climate friendly alternatives are available. The proposed rule, which would apply both to imported and domestically manufactured products, will help ensure a level playing field for American businesses that are already transitioning to next-generation, safer alternatives and more energy efficient technologies.

“With this latest proposal under the bipartisan AIM Act, EPA continues to advance President Biden’s ambitious climate agenda while investing in American innovation and ingenuity,” said EPA Administrator Michael S. Regan. “This proposal will support a transition away from super-pollutant HFCs in key sectors of our economy while promoting American leadership in manufacturing of new climate-safe products, making our nation more globally competitive and delivering significant environmental and economic benefits.

The bipartisan AIM Act authorizes EPA to limit or prohibit the use of HFCs in specific sectors and to phase in these requirements over time as appropriate. The proposed rule addresses petitions granted in October 2021 and would restrict the use of climate-damaging HFCs used in certain foams, aerosol products, and refrigeration, air conditioning, and heat pump equipment beginning in 2025. The HFCs that are being restricted under this proposal are those that have higher global warming impacts.

Under the AIM Act, the Biden-Harris Administration is implementing a national HFC phasedown to achieve a 40% reduction below historic levels starting in 2024 and an 85% reduction by 2036. Today’s proposed rule will help guide this overall phasedown by accelerating the transition away from HFCs in areas where substitutes are available or being introduced, helping to unlock additional climate benefits and savings. EPA estimates that this action would provide greenhouse gas emissions reductions of up to 35 million metric tons of carbon dioxide equivalent (MMTCO2e) per year, equivalent to annual fuel consumption of roughly 7.5 million gasoline-powered cars. The cumulative savings for industry and consumers—which largely result from improved energy efficiency and lower cost refrigerants—is estimated to be up to $8 billion through 2050.

The proposal is in response to petitions from companies, industry associations, non-governmental environmental organizations, and 12 states and the District of Columbia that requested that EPA restrict the use of certain HFCs in products and equipment across 40 subsectors. EPA developed the proposed restrictions after reviewing petitions, holding stakeholder workshops, and considering an extensive list of factors as specified in the AIM Act, including the availability of substitutes, safety, and the overall economic and environmental impacts.

To ensure a level playing field for companies complying with the AIM Act’s national HFC phasedown, EPA has also established robust enforcement mechanisms, drawing from experience globally with illegal HFC trade and with past attempts to illegally introduce ozone-depleting substances into the U.S. market. Companies now need allowances for producing or importing HFCs.

The bipartisan AIM Act provides the tools that allow the United States to implement a national HFC phasedown to comply with the Kigali Amendment, as well as provisions to help transition technologies away from HFCs and manage the use of HFCs through maximizing their reclamation and minimizing their release. Read More

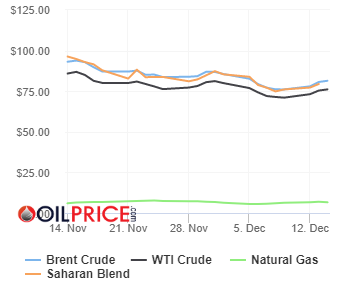

| Oil and Gas Blends | Units | Oil Price $ | change |

| Crude Oil (WTI) | USD/bbl | $76.15 | Up |

| Crude Oil (Brent) | USD/bbl | $81.38 | Up |

| Bonny Light | USD/bbl | $79.26 | Up |

| Saharan Blend | USD/bbl | $79.42 | Up |

| Natural Gas | USD/MMBtu | $6.53 | Down |

| OPEC basket 13/12/22 | USD/bbl | $78.34 | Up |

Chinese first pure solar car

Tianjin is completely driven by pure solar energy, does not use any fossil fuels and external power sources, and achieves “zero emissions”.

Baker Hughes Rig Count

U.S. Rig Count is down 4 from last week to 780 with oil rigs down 2 to 625, gas rigs down 2 to 153 and miscellaneous rigs unchanged at 2.

Canada Rig Count is up 7 from last week to 202, with oil rigs up 3 to 131, gas rigs up 4 to 71.

| Region | Period | Rig Count | Change from Prior |

| U.S.A | 09 December 2022 | 780 | -4 |

| Canada | 09 December 2022 | 202 | +7 |

| International | November 2022 | 910 | -1 |

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: @OilAndGasPress on Twitter |

Oil and gas press covers, Energy Monitor, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas, energy monitors,