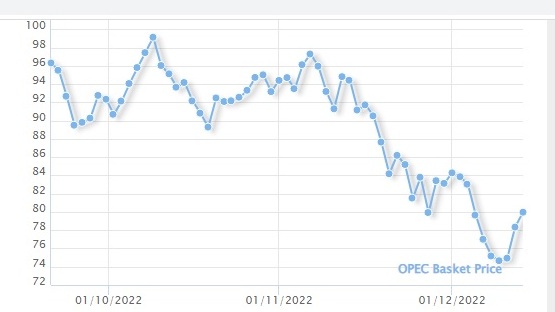

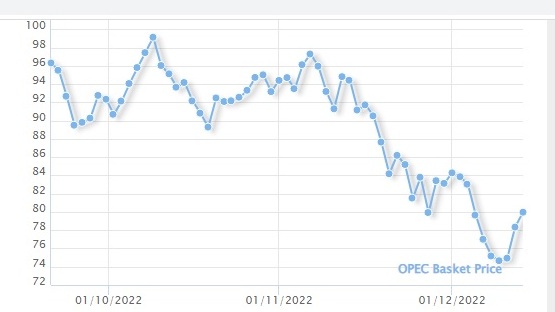

Energy News to 15/12/22 . OPEC daily basket price at $79.07/bl, 14 Dec. 2022

Oil prices rose across the board on this morning.

Germany in talks with Kazakhstan on supplying oil for Schwedt refinery – German govt Read More

Vietnam and the International Partners Group, including the European Union, the United Kingdom, France, Germany, the United States, Italy, Canada, Japan, Norway and Denmark have on 14 December agreed a bold Just Energy Transition Partnership (JETP). The Partnership will support Viet Nam to deliver on its ambitious Net Zero 2050 goal, accelerate the peaking of its greenhouse gas emissions and transition away from fossil fuels to clean energy.

The JETP will mobilise an initial $15.5 billion of public and private finance over the next three to five years to support Viet Nam’s green transition.

The Partnership will support Viet Nam in working towards a number of ambitious new targets:

Bringing forward the projected peaking date for all greenhouse gas emissions in Viet Nam from 2035 to 2030.

Reducing peak annual power sector emissions by up to 30 percent, from 240 megatons to 170 megatons, and bringing forward the peaking date by five years to 2030.

Limiting Viet Nam’s peak coal capacity to 30.2 gigawatts down from a current planning figure of 37 gigawatts.

Accelerating the adoption of renewables so that renewable energy accounts for at least 47 percent of electricity generation by 2030, up from the current planned generation share of 36 per cent.

The successful delivery of these ambitious targets will result in around 500 megatons (0.5 billion tonnes) of emissions saved by 2035. Read More

ExxonMobil today announced successful startup of one of the largest advanced recycling facilities in North America. The facility at the company’s integrated manufacturing complex in Baytown, Texas, uses proprietary technology to break down hard-to-recycle plastics and transform them into raw materials for new products. It is capable of processing more than 80 million pounds of plastic waste per year, supporting a circular economy for post-use plastics and helping divert plastic waste currently sent to landfills. Read More

bp ventures has made a $20 million AUD investment in 5B Holdings Pty Ltd, an Australian renewable company with technology that enables rapid deployment of solar power at scale. The investment closes 5B’s $55 million AUD Series B funding round, which was co-led by existing investors The AES Corporation and Artesian.

5B’s leading solar technology, the 5B Maverick®, consists of up to 90 solar panels mounted on specially designed frames that can be unfolded and installed at speed. To date, 5B has deployed its technology across more than 100 sites worldwide with total generating capacity of over 60MW.

This year 5B Maverick was used to deploy panels with 1.1MW capacity – covering the equivalent of a soccer pitch – in a single day, with a team of only 10 at AES’ Andes Solar II B facility in the Atacama Desert in Chile.

The capital injection from bp ventures will support 5B’s technology development and growth. It will also accelerate 5B’s international expansion, and its plans to establish a manufacturing and assembly hub in North America. bp’s gas & low carbon energy (G&LCE) business and 50-50 joint venture Lightsource bp, together with 5B, will explore the best opportunities to collaborate on the deployment of 5B’s Maverick technology on future bp and Lightsource bp projects. All three companies will continue to work on deploying solar energy to meet the rising demand for reliable, accessible, and affordable electricity. Read More

Executive Board of the International Monetary Fund (IMF) completed the fifth review under the Extended Credit Facility (ECF) arrangement for The Gambia. The completion of the review enables the immediate disbursement of the equivalent of SDR20.55 million, about US$27.41 million, to help meet the country’s balance-of-payments and fiscal financing needs amid challenges, including the repercussions of the war in Ukraine and the lingering impact of the COVID-19 pandemic. This brings total disbursements under the ECF arrangement to SDR 65.55 million (about US$87.44 million).

The Executive Board also approved an augmentation of access under the ECF arrangement from SDR55 million to SDR70.55 million (or 113.4 percent of The Gambia’s quota in the Fund), which is the second augmentation of access under this ECF arrangement. Further, the Executive Board completed the financing assurances review and granted a waiver of nonobservance of a performance criterion on external arrears. The ECF arrangement with The Gambia was approved by the IMF’s Executive Board on March 23, 2020, with an initial total access of SDR35 million (or 56.3 percent of quota) that was augmented at the completion of the first ECF review on January 15, 2021 to SDR55 million (88.4 percent of quota). The Gambia has also benefited from an IMF Rapid Credit Facility disbursement of SDR15.55 million and received debt service relief from the IMF under

the Catastrophe Containment and Relief Trust, totaling SDR7.9 million. The Gambian economy is facing multiple exogenous shocks, including the repercussions of the war in Ukraine, the lingering impact of the COVID-19 pandemic, and a major flooding. Growth projections in 2022 have been revised downward from 5.6 percent to 4.5 percent.

Inflation reached a record-high level of 13.2 percent (year-on- year) in October 2022. The Central Bank of The Gambia increased further its policy rate to 13 percent in December 2022 to tackle inflationary pressures. The balance of payments is adversely affected by disruptions of timber and cashew exports, weaker-than-expected tourist arrivals, lower remittance inflows, high food and fuel import bills, and elevated freight costs. These shocks are generating foreign exchange shortages and weighing on forex reserves. Budget execution is facing pressures, Read More

TC Energy has restarted a segment of the Keystone oil pipeline that was not affected by the leak that caused the shutdown of the piece of infrastructure earlier this month.

“TC Energy has communicated with its regulators and customers about today’s restart of the Keystone Pipeline System sections unaffected by the Milepost 14 Incident. This restart facilitates safe transportation of the energy that customers and North Americans rely on. This section extends from Hardisty, Alberta, to Wood River/Patoka, Illinois,” the pipeline operator said in an emailed statement.

TC Energy shut down Keystone on December 8 following the detection of a leak into a creek in Kansas, near the border with Nebraska where the pipeline splits into two branches. Later the size of the leak was calculated at some 14,000 barrels of crude and it had spread downstream before being contained, which happened later the same week.

In the meantime, TC Energy continues to investigate the leak and repair the affected section, the company also said in its statement. “This segment will not be restarted until it is safe to do so and when we have regulatory approval from PHMSA,” it said.

The company still has no timeline for the full restart of the pipeline and has not made public the cause of the leak. Read More

GE Renewable Energy and Hyundai Electric announced today that they have signed a strategic partnership agreement as the next step in their efforts to work together to serve the South Korean offshore wind market. Under the terms of the agreement, Hyundai Electric will serve as a manufacturing associate to help localize assembly of the Haliade-X offshore wind turbines and generators in South Korea. The firm agreement follows a Memorandum of Understanding first announced by the two companies in February, 2022.

The latest agreement outlines plans for the establishment of a factory in South Korea for producing the nacelles and the generators used in Haliade X turbines, with potential to also leverage the South Korea base for exporting generator components.

In addition to signing the strategic partnership agreement, GE Renewable Energy and Hyundai Electric also signed a letter of intent to establish a joint venture if the collaboration of the two companies wins the larger volume of orders needed to support such efforts. Read More

GE Renewable Energy’s Grid Solutions business (NYSE: GE) and the transmission system operator TransnetBW have signed a contract for a turnkey solution to redesign the Pulverdingen 380 kV substation in the vicinity of Markgröningen, about 15 km northwest of Stuttgart.

The Pulverdingen substation needs to be redesigned for larger capacities and greater power fluctuations. As part of this redesign, the substation’s almost 50-year-old switchgear, will be upgraded and expanded during operation.

To support TransnetBW’s priorities to ramp up capacity, GE’s Grid Solutions team will design, produce, supply and commission 26 bays of 380 kV air-insulated switchgear (AIS) with associated buildings and control cabinets. Also in the plan is a 380 kV cable connection between the 380 kV/220 kV transformer and respective 380 kV switch panel. The overhead line connection to the substation will be executed in three phases. The erection of temporary overhead lines for several years is required in some cases to ensure safe operation of the switchgear during the construction period. The construction work is expected to take one decade, until the end of 2033.

This contract for a turnkey solution aligns with GE’s commitment to provide scalable power solutions to its customers that support the transformation of their electricity grids. The upgrade and expansion of the Pulverdingen substation will significantly improve short-circuit resistance, transmission capacity and voltage control. “The Pulverdingen substation will strengthen the security of power supply in the Stuttgart area in the long term,” said Christopher Kunstmann, project manager at TransnetBW. Read More

GE Renewable Energy’s Grid Solutions business (NYSE: GE) and the transmission system operator TransnetBW have signed a contract for a turnkey solution to redesign the Pulverdingen 380 kV substation in the vicinity of Markgröningen, about 15 km northwest of Stuttgart.

The Pulverdingen substation needs to be redesigned for larger capacities and greater power fluctuations. As part of this redesign, the substation’s almost 50-year-old switchgear, will be upgraded and expanded during operation.

To support TransnetBW’s priorities to ramp up capacity, GE’s Grid Solutions team will design, produce, supply and commission 26 bays of 380 kV air-insulated switchgear (AIS) with associated buildings and control cabinets. Also in the plan is a 380 kV cable connection between the 380 kV/220 kV transformer and respective 380 kV switch panel. The overhead line connection to the substation will be executed in three phases. The erection of temporary overhead lines for several years is required in some cases to ensure safe operation of the switchgear during the construction period. The construction work is expected to take one decade, until the end of 2033. This contract for a turnkey solution aligns with GE’s commitment to provide scalable power solutions to its customers that support the transformation of their electricity grids. The upgrade and expansion of the Pulverdingen substation will significantly improve short-circuit resistance, transmission capacity and voltage control. “The Pulverdingen substation will strengthen the security of power supply in the Stuttgart area in the long term,” said Christopher Kunstmann, project manager at TransnetBW. Read More

GE Digital, an energy software leader, today announced that ELPEDISON S.A., the first independent energy producer in Greece, has chosen its cloud-based Asset Performance Management (APM) Reliability application to improve the reliability of its combined cycle fleet. The software will be installed at ELPEDISON’s Thisvi and Thessaloniki power plants, making it the first energy company in the country to cover an entire combined cycle plant with digital twin technology.

APM Reliability helps reduce unplanned downtime by predicting equipment issues before they occur. The software provides asset-intensive organizations with operational visibility and a comprehensive set of analytical tools—including digital twin blueprints—to help reduce asset failures, control costs, and increase production availability. From the plant to the enterprise, it’s designed to work across a broad array of assets (fixed, rotating, and non-rotating), equipment types and manufacturers (GE and non-GE), and industries. Read More

HSBC has announced it will stop financing new oil and gas fields, as part of its efforts to drive down global greenhouse gas emissions.

Environment groups said the move sends “a strong signal” to fossil fuel giants that investment is waning. Europe’s largest bank said it made the decision after receiving advice from international energy experts. It comes following previous criticism of HSBC for funding oil and gas projects despite its green pledges. Read More

The UK government has pledged to relax restrictions on building onshore wind farms in England after a threatened rebellion from Conservative MPs.

A rule requiring new turbines to be built on pre-designated land will be rewritten, the levelling up department said.

Over 30 backbenchers had threatened to make the change through a planning bill going through Parliament.

New wind farms would still be subject to local approval.

The precise method of measuring local opinion will be part of a wider consultation which will conclude by next April. Read More

First UK coal mine in decades approved

Michael Gove has approved the first new UK coal mine in 30 years despite concern about its climate impacts among Conservative MPs and experts.

The proposed mine in Cumbria would dig up coking coal for steel production in the UK and across the world. Critics say the mine would undermine climate targets and demand for coking coal is declining. But supporters claim the mine, near Whitehaven, will create jobs and reduce the need to import coal. Read More

| Oil and Gas Blends | Units | Oil Price $ | change |

| Crude Oil (WTI) | USD/bbl | $77.01 | Up |

| Crude Oil (Brent) | USD/bbl | $82.48 | Up |

| Bonny Light | USD/bbl | $81.68 | Up |

| Saharan Blend | USD/bbl | $81.99 | Up |

| Natural Gas | USD/MMBtu | $6.49 | Down |

| OPEC basket 14/12/22 | USD/bbl | $79.97 | Up |

Electric Car Deaths

The UAE government saw its revenues jump in double digits during the third quarter of the year as economic activity has rebounded after the coronavirus pandemic.

Total revenues for the quarter reached AED 148.1 billion ($40 billion), growing by 17.2% from AED 126.3 billion recorded a year ago, according to the latest data from the Ministry of Finance.

Revenues from social contributions stood at AED3.8 billion, up by 10% from AED 3.4 billion during the third quarter of last year.

The UAE government’s total expenditures also grew by 5% to AED 96.5 billion during the same period, according to the preliminary results released on Wednesday. Read More

ONGC formalized its annual Memorandum of Understanding (MoU) for the financial year 2022-23 with its administrative Ministry i.e. Ministry of Petroleum & Natural Gas, Govt of India on 13 December 2022 with the signing of the official document between the Chairman Arun Kumar Singh, and MoPNG Secretary Pankaj Jain at Shastri Bhawan, New Delhi.The MoU is signed every year between ONGC Chairman, and PNG Secretary as a mark of commitment towards annual performance targets. It is not only a transparent reflection of our annual performance but also a document signifying the hard work, innovation, and competitive credentials of energy professionals of our distinguished organization. This document also captures the persistent spirit of ONGC group based on the larger perception of the industry and our key stakeholders including the Government of India.

ONGC will continue to be committed to the targets ranging from E&P, Refining, and Petrochemicals to renewables as has been entrusted upon in view of the larger energy mandate of the Nation, with due cognition to the evolving energy landscape. Read More

India is projected to witness the largest increase in energy demand of any country over the next two decades, as its economy continues to grow and create opportunities for its people, and the global value chain. Achieving India’s target of net-zero emissions by 2070 need to be weighed against the country’s growing economy, rising energy requirements, and the implementation of responsible energy sources over a transformation energy systems for the future.

The inaugural India Energy Week comes at a critical time, with the challenges of energy security and environmental sustainability impacting long-term energy transition and paths towards decarbonisation. As a rapidly developing country, and soon to be the world’s most populous nation, India’s energy transition will play a pivotal role in global energy markets. Read More

Baker Hughes Rig Count

U.S. Rig Count is down 4 from last week to 780 with oil rigs down 2 to 625, gas rigs down 2 to 153 and miscellaneous rigs unchanged at 2.

Canada Rig Count is up 7 from last week to 202, with oil rigs up 3 to 131, gas rigs up 4 to 71.

| Region | Period | Rig Count | Change from Prior |

| U.S.A | 09 December 2022 | 780 | -4 |

| Canada | 09 December 2022 | 202 | +7 |

| International | November 2022 | 910 | -1 |

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: @OilAndGasPress on Twitter |

Oil and gas press covers, Energy Monitor, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas, energy monitors,TotalEnergies, Shell, BP, Chevron