Energy News to 20 May 2022. OPEC daily basket price stood at $112.04/bl, 19 May 2022

WTI for June delivery fell $2.81 to settle at $109.59 a barrel in New York

Brent for July settlement fell $2.82 to $109.11 a barrel.

Woodside shareholders voted to approve the proposed merger (the Merger) with the petroleum business of BHP Group Limited at today’s Annual General Meeting. 98.66% of the votes submitted were in favour of the Merger. All conditions precedent necessary to implement the Merger that require a positive action or event in order to be satisfied have now been satisfied or waived. Woodside expects completion of the Merger to occur on 1 June 2022. The new Woodside shares to be issued to or for the benefit of BHP shareholders are expected to commence trading on the

Australian Securities Exchange (ASX) on 2 June 2022. Trading of Woodside American Depositary Shares on the New York Stock Exchange is expected to commence on 2 June 2022. Trading of Woodside shares on the Main Market for listed securities of the London Stock Exchange is expected to commence on 6 June 2022 Read More

KBR (NYSE: KBR) announced that it was awarded two task orders under the Department of Defense Information Analysis Center’s (DoD IAC) multiple-award contract (MAC) vehicle totaling $106 million for the Air Force Life Cycle Management Center (AFLCMC). Through the task orders, KBR will support the modernization and sustainment of the C-130 Hercules aircraft and the development of recommendations on cyber security strategies, engineering analysis, and assessment of testing for the International Air Traffic Control Radar Beacon System, Identification Friend or Foe (IFF) and Mark XIIB System (AIMS) Program Office. These DoD IAC MAC task orders are awarded by the U.S. Air Force’s 774th Enterprise Sourcing Squadron to develop and create new knowledge for the enhancement of the Defense Technical Information Center (DTIC) repository and the R&D and S&T communities.

One of the contracts is a five-year, $65 million recompete task order in support of the AFLMC Mobility and Training Aircraft Directorate (WLN). KBR will provide critical, adaptable acquisition management, systems engineering, test and evaluation management, logistics planning and analysis, and cybersecurity solutions for multiple variants of the C-130 aircraft. This work will support current and upcoming avionics upgrades and aircraft block modification programs; digital engineering transformation efforts; and all production, modernization and sustainment requirements.

The “utility player” of the Air Force, the C-130 Hercules performs a number of diverse roles, including Antarctic ice resupply, aeromedical missions, weather reconnaissance, firefighting duties for the U.S. Forest Service, and support for humanitarian missions. The craft also serves as the prime transport for airdropping troops and equipment into hostile areas. “With our highly experienced team, rich history and firm understanding of the C-130, KBR will continue to assist the Air Force in rapidly fielding effective, sustainable and cost-efficient capabilities for this tactical transport aircraft,” said Byron Bright, KBR Government Solutions president. The company will carry out these duties at Wright-Patterson Air Force Base in Ohio; Robins Air Force Base in Georgia; U.S. Coast Guard Base Elizabeth City in North Carolina; and in British Columbia, Canada. Read More

Hess Corporation (NYSE: HES) has once again been named to the 100 Best Corporate Citizens list, ranking No. 38 on the 2022 list for outstanding environmental, social and governance (ESG) transparency and performance. The annual list ranks the Russell 1000 Index of publicly held U.S. companies based on an independent assessment by ISS-ESG, the responsible investment research arm of Institutional Shareholder Services. Hess has been named to the list for 15 consecutive years and is the only energy company to earn a place on the 2022 list. The full list is available here. “We are honored to once again be recognized as a leader for the quality of our environmental, social and governance performance and disclosure,” said CEO John Hess. “As we continue to help meet the world’s growing need for affordable, reliable and secure energy, our company will be guided by our longstanding commitment to sustainability.” The 100 Best Corporate Citizens List by 3BL Media is based on an independent assessment by ISS-ESG of 155 environmental, social and governance factors in eight categories: climate change, employee relations, environment, finance, governance, human rights, stakeholders and society, and ESG performance. Read More

With the US national average cost for regular gas steadily climbing, three states—Georgia, Kansas, and Oklahoma—are still holdouts for crossing the $4 per gallon mark. The national average for a gallon of gasoline is now $4.48. The increase is primarily due to the high cost of crude oil, which is hovering near $110 a barrel.

“The high cost of oil, the key ingredient in gasoline, is driving these high pump prices for consumers,” said Andrew Gross, AAA spokesperson. “Even the annual seasonal demand dip for gasoline during the lull between spring break and Memorial Day, which would normally help lower prices, is having no effect this year.”

According to new data from the Energy Information Administration (EIA), total domestic gasoline stocks decreased by 3.6 million bbl to 225 million bbl last week. Gasoline demand also decreased slightly from 8.86 million b/d to 8.7 million b/d. Typically, lower demand would put downward pressure on pump prices. However, crude prices remain volatile, and as they surge, pump prices follow suit. Pump prices will likely face upward pressure as oil prices stay above $105 per barrel. Read More

Watson Farley & Williams advised enercity Erneuerbare GmbH, on its acquisition of the ‘Horizon’ wind farm portfolio from the owners of the Norderland Group. The closing of the transaction is subject to pending customary regulatory approvals and the parties have agreed not to disclose financial details.

The ‘Horizon’ portfolio comprises 60 onshore wind farms with 166 wind turbines and a total capacity of 365 MW. With this acquisition, enercity doubles its total wind power capacity to 712 MW and becomes one of the largest players in German onshore wind. The majority of the 60 wind farms are located close to the coast in north-west Lower Saxony in areas with favourable wind conditions, with others in Brandenburg, Saxony and Saxony-Anhalt. The majority of the turbines are new and have a high repowering potential.

enercity is a provider of sustainable and intelligent energy solutions. With a turnover of €5bn and more than 3,000 employees, it is one of the largest municipal energy service providers in Germany as of 2022. It supplies around 1m people with electricity, heat, natural gas and drinking water. enercity also offers other energy-related services focussed on electromobility, energy efficiency, decentralised customer solutions, telecommunications and smart infrastructure.

The Norderland Group, based in Westerholt (East Frisia), is one of the pioneers of wind energy in Germany and has successfully built up the ‘Horizon’ portfolio since the early 1990s. The multidisciplinary WFW Germany team that advised enercity was led by Düsseldorf Energy Partner Dr Thorsten Volz, Hamburg Corporate Partner Dr Marcus Bechtel and Düsseldorf Energy Managing Associate Britta Wißmann. They were supported by Hamburg Partners Dr Christine Bader (Regulatory), Gerrit Bartsch (Tax), Thomas Hollenhorst (Projects & Structured Finance) and Carolin Woggon (Corporate), Düsseldorf Of Counsels Dr Thomas Wölfl (Real Estate) and Dr Christoph Benedict (Commercial), Senior Associates Katharina Flehr (Energy/Real Estate), Inès Stefen (Energy/Regulatory) and Roman Schneider (Real Estate) and Associates Robert Nagy (Corporate), Paul Philipp Breunig (Regulatory), Carlos Landschein (Real Estate) and Manuel Rustler (Tax). Read More

Enercity AG agreed to acquire a 365-MW portfolio of onshore wind farms in Germany in a deal that will double its total wind generation capacity to 712 MW. The Horizon portfolio consists of 60 onshore wind parks with 166 turbines most of which are located in windy areas in north-western Lower Saxony. Other wind farms are located in the states of Brandenburg, Saxony and Saxony-Anhalt. The purchase will boost Enercity’s annual power production by 767 GWh and raise the share of renewables to over 50%.

The acquired wind parks offset 920,000 tonnes of carbon emissions a year and supply some 240,000 households. Read More

Vattenfall has been awarded GBP 9.3 million in innovation funding from the Net Zero Innovation Portfolio Low Carbon Hydrogen Supply 2 fund by the UK Government. The funding will be used to develop the world’s first hydrogen-producing offshore wind turbine, with the electrolyzer sited directly onto an existing operational turbine. The pilot project at Vattenfall’s Offshore Wind Farm in Aberdeen Bay will have an output of 8 MW and will be able to produce enough hydrogen every day to power a hydrogen bus to travel 24,000 kilometers. The hydrogen will be piped to shore at Aberdeen Harbor. More

Germany and Denmark have agreed to launch cooperation on green hydrogen based on renewable energy both onshore and offshore as part of efforts to strengthen energy security and diversify the energy supply in Europe.

The areas of collaboration include the development of the regulatory framework on a European level to support the creation of a green hydrogen economy, an increase in sector integration such as the usage of surplus heat from electrolysers to produce fuels and chemicals in the district heating system as well as support for the use of green hydrogen in industrial processes such as steel and ammonia to decarbonise energy-intensive industries. Read More

UK’s COP26 President, Alok Sharma, met with Colombia’s President, Iván Duque, to discuss the importance of mobilising climate finance at scale to accelerate Colombia’s transition to a green future.

On the occasion of the President’s visit to the UK, both governments celebrated our successful collaboration in addressing climate change and protecting Colombia’s incredible natural resources through the UK-Colombia Partnership for Sustainable Growth. They welcomed the launch of three new initiatives that will continue to build on this legacy and accelerate progress. These initiatives will bring together the public and private sectors, helping to mobilise finance to support emissions reductions, sustainable growth and the protection of biodiversity in Colombia.

These initiatives build on a long history of collaboration and mutual ambition in addressing climate change, which both countries demonstrated at COP26 in Glasgow through ambitious new commitments. Through our successful Partnership, the UK and Colombia have shown how collaboration is key to meet the goals of the Paris Agreement. Through its continued commitment to high ambition and to the Glasgow Climate Pact, Colombia is setting an example to the region and to the world. These new joint initiatives announced today are important tools that will help to turn ambition into action. Read More

The U.S. Department of Energy Solar Energy Technologies Office awarded 16 small solar companies $200,000 each through the Small Business Innovation Research and Small Business Technology Transfer (SBIR/STTR) 2022 Phase I Release 2 funding opportunity.

These companies submitted ideas for innovative solar technologies in integration of photovoltaic systems with agriculture and transportation systems, integration of solar with storage and electric vehicle charging, next-generation power electronics, solar forecasting, photovoltaics, and concentrating solar-thermal power hardware and software solutions. They will now prove the feasibility of their technologies for the chance to receive a follow-up award of up to $1 million. Read More

| Oil and Gas Blends | Units | Oil Price $ | change |

| Crude Oil (WTI) | USD/bbl | $111.65 | Up |

| Crude Oil (Brent) | USD/bbl | $111.77 | Up |

| Bonny Light | USD/bbl | $114.08 | Up |

| Saharan Blend | USD/bbl | $113.32 | Up |

| Natural Gas | USD/MMBtu | $8.08 | Down |

| OPEC basket 19/05/22 | USD/bbl | $112.04 | Down |

The U.S. Department of Energy (DOE), in partnership with Israel’s Ministry of Energy and the Israel Innovation Authority, today announced $4 million in available funding for developing innovative clean energy technologies. This year’s call for proposals focuses explicitly on combating climate change through innovation that scales up carbon-free technologies and reduces the climate impact of natural gas and other associated infrastructure, such as carbon capture and methods to reduce leakage in natural gas systems. Funding for the projects comes through Binational Industrial Research & Development (BIRD) Energy program, which promotes U.S.–Israel partnerships in bringing renewable and energy efficiency technologies to market.

“For over ten years the BIRD Energy program has demonstrated success in driving clean energy innovation and we are excited to expand upon this progress with a crucial focus on using technology to fight the global crisis of climate change,” said U.S. Secretary of Energy Jennifer M. Granholm. “The BIRD program is proof positive that the more we share resources and ideas with allies around the world, the closer we get to the clean energy solutions needed to reach net-zero carbon emissions by 2050.”

Established by the Energy Independence and Security Act of 2007, the BIRD Energy program supports research and development that benefits both the United States and Israel, with a focus on commercializing sustainable energy technologies that improve economic competitiveness, create jobs, and increase energy security. Read More

U.S. Department of Energy (DOE) today announced $15.3 billion in energy savings through the Better Buildings Initiative, a public-private partnership with more than 900 businesses, state and local governments, utilities, housing authorities, and other organizations across the United States pursuing ambitious energy, waste, water, and/or greenhouse gas reduction goals and sharing their solutions. These savings represent 155 million metric tons of carbon emissions, or roughly the amount of greenhouse gases emitted by 20 million homes in one year. Decarbonizing America’s building sector is a key part of President Biden’s plan to reach a net-zero carbon economy by 2050. Read More

An International Monetary Fund (IMF) mission, led by Tokhir Mirzoev, visited to Amman, Jordan, during May 14-18, 2022, to discuss with the Iraqi authorities recent economic developments, the impact of global events on the economic outlook, and the country’s policy priorities. At the conclusion of the visit, Mr. Mirzoev issued the following statement:

“The economic recovery is well underway. In 2021, buoyed by the resumption of activity, a more accommodative fiscal stance, and stimulus measures by the central bank, real non-oil GDP rebounded by an estimated 20 percent and is poised to expand by around 5 percent this year. Oil output is projected to reach its pre-pandemic level and bring overall real GDP growth to 10 percent in 2022. The war in Ukraine is affecting Iraq mainly through its global impact on commodity prices. In 2022, soaring oil revenues will more than offset the increased food and energy import bills. As a result, the fiscal and current account balances are projected to post double-digit surpluses in percent of GDP. Nonetheless, headline inflation is expected to climb to 6.9 percent, up from 6 percent last year, driven in part by higher food prices, which are adversely affecting the poorest segments of the population.

“Cushioning the impact of surging food prices on the most vulnerable is thus the most urgent priority. With fiscal policy paralyzed by the absence of the 2022 budget—which limits current fiscal expenditures to last year’s level—strengthening spending efficiency, maintaining tight control over public hiring, and reprioritizing expenditures within the overall budget cap will be essential to enable boosting targeted cash transfers to the most vulnerable and containing the poverty impact of the rising cost of living. Read More

Tesla’s stock price sank to the lowest level in 2022, wiping out $12.3 of Elon Musk’s wealth, Bloomberg said in its report.

Tesla’s exclusion the trigger Musk’s ranting began with the exclusion of Tesla from the S&P 500, a list of companies ranked by their social, environmental, and governance (ESG) policies. As Reuters reported, the S&P 500 is a relatively new benchmark that investors use prior to making their investment decisions. It is then obvious that companies that make the list have made considerable decisions to protect the environment and transition society into a new era. Read More

| Region | Period | Rig Count | Change from Prior |

| U.S.A | 13 May 2022 | 714 | +9 |

| Canada | 13 May 2022 | 88 | -3 |

| International | April 2022 | 806 | -9 |

Cleary Gottlieb has won the Infrastructure and Energy Projects Team of the Year award at Law.com International’s Middle East Legal Awards 2022.

Cleary was recognized for advising on the Republic of Iraq’s gas growth integrated project, one of the largest projects ever in Iraq. Cleary partner Andrew Bernstein and associate Jad Nasr were also mentioned as part of the team advising the Iraqi government in a Law.com International article about the deal. The Middle East Legal Awards, now in their 10th year, recognize outstanding achievement, excellence, and innovation among legal practitioners and firms in the region. Read More

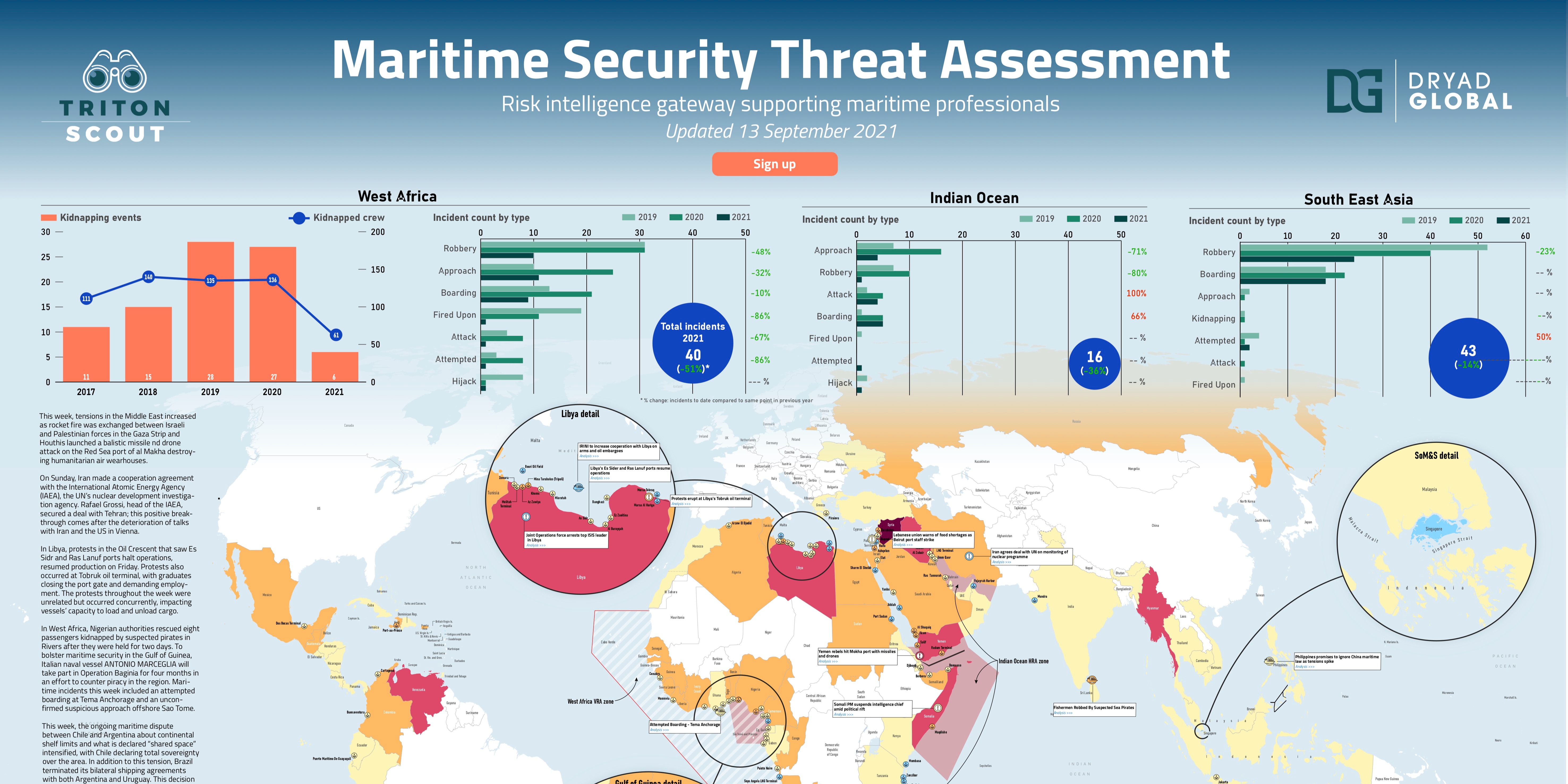

Access the latest Triton Scout Maritime Security Threat Advisory for the week commencing 16th May 2022.

👉 Two Russian naval anchor mines that washed up on the Odesa coast have since been deactivated.

👉 President Zelensky has called for international assistance in lifting the Russian blockade of Odesa which has prevented billions of dollars of wheat from reaching global markets.

👉 Industry-wide insured marine losses from the Russia-Ukraine conflict could range from $3-6 billion due to a number of ships being damaged or lost in the course of the conflict.

Access the latest intelligence reports and security updates for the Black Sea and the Gulf of Odessa and the rest of the world Read More

Does the energy price cap apply to businesses?

Millions of UK households have been hit with higher energy bills after the energy price cap on standard variable rate tariffs (SVTs) increased by 54% as of April 1. This means the average cost of an SVT has risen by £693 to £1,971 a year. Households on prepayment meters have seen average annual bills rise by £708 to £2,017 a year.

Under normal circumstances, the level of the price cap affects around 11 million UK households. But it’s expected to impact around twice that number this time around as more people have rolled onto their supplier’s SVT to take advantage of the price protection offered by the cap amid high prices brought on by the energy crisis (as outlined above).

This is the price cap’s highest level – by some distance – since it was introduced in January 2019. It’s worth noting that the cap sets the prices that suppliers can charge for each unit of energy and the standing charge (which has doubled in some areas), but that doesn’t mean there’s a limit to how much people can pay. The figure of £1,971 is the average a household can expect to pay if they’re on their supplier’s standard variable rate tariff. In short, the more gas and electricity you use, the higher your bills will be.

But what does this mean for SMEs? No price cap on business energy means that suppliers can increase their out of contract rates by as much as they see necessary to cover their increased costs. This has seen out of contract rates (also known as deemed rates) rise by an average of 100% since August 2021. This means any business that lets a fixed rate deal expire without arranging a new one could see huge price hikes even though they’re using no more energy than before. The only way to protect against these rate rises is to switch to a new business energy deal. This is because the government is showing no appetite for helping the millions of small businesses across the UK. Although the Spring Statement outlined some assistance in the form of changes to business rates and National Insurance Contributions, it’s up for debate whether these measures go far enough. And there was no mention of any support at all for business owners struggling with their energy bills. This is an issue that will affect all businesses, from industrial and large businesses to the small corner shops, mechanics, and salons. Every business needs energy to keep running, and business owners can only set aside a certain amount of money to cover these costs, regardless of how much they’re using each month. A 100% increase on the cost of energy could be catastrophic for any business owner. What if you run your business from home? Read More

West African crude exports to China continue to decline in May, following multi-year lows in April. This is largely driven by faltering Chinese demand and discounted Russian crude. These West African barrels have however found some solace in Europe, the reasons behind which will be explored in this insight piece. This slowdown in exports is driven largely by reduced crude import appetite from Chinese refiners in lieu of weak domestic demand and a ramp up of seasonal maintenance this quarter. Being purchased on a spot basis, West African crude is typically seen as the marginal barrel for Chinese refiners, meaning flows are likely to decline quickly as refiners cut runs. This contrasts against Middle Eastern grades, which are typically sold on long-term contracts, guaranteeing a minimum off-take volume by Chinese refiners every month. Exports of Angolan grades, such as Cabinda, Mostarda and Pazflor, fell 200kbd m-o-m collectively, accounting for a large proportion of the decline in exports. Read More

Gas stations in Washington reprogram pumps to prepare for $10-a-gallon fuel as Bidenflation sends average price soaring to $4.57 – almost twice the $2.41 during Trump’s final month. The move by 76 comes as the nation’s average gasoline price soars to $4.57-a-gallon, almost twice the $2.41 average during Trump’s last month in office.

A spokesperson for ’76’ gas stations confirmed that the national chain has begun reconfiguring its pumps to ‘make room’ for the possibility of double-digit prices, The Post Millennial reported. Read More

OilandGasPress Energy Newsbites and Analysis Roundup |Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Oil and gas press covers, Energy, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas, News and Analysis