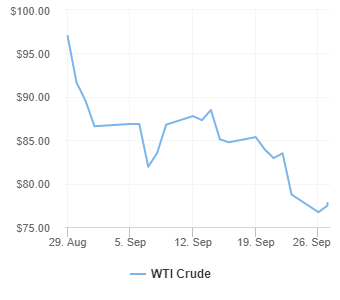

Energy News to 27/09/22. OPEC daily basket price stood at $89.50/bl, 26 Sept. 2022

The pound dropped to an all-time low of $1.035 against the US dollar today as the dollar increased its dominance in global trade, cranking up inflationary pressure in Britain. As the FTSE 100 opened slightly up in London at 8am, sterling recovered slightly to $1.06 this morning as Liz Truss faced a Tory revolt with MPs braced for further turmoil with the pound down eight per cent since she was elected PM three weeks ago. The weak pound spells huge trouble for UK businesses, who face increasingly higher costs of importing goods from abroad. Read More

Bell Textron Inc., a Textron Inc. (NYSE:TXT) company, announced the signing of an agreement with Cleantech Solar, a leading provider of renewable energy solutions in Southeast Asia and India, to develop a 1.8 MWp rooftop solar photovoltaics (PV) system at the Bell facility in Singapore.

Cleantech Solar will operate the solar PV system under a long-term Power Purchase Agreement (PPA). Scheduled to be commissioned in Q1 2023, the solar PV system will replace a portion of Bell’s electricity consumption with clean energy generated at Bell’s Singapore facility.

During its lifetime, Bell’s solar PV system is expected to generate close to 40 GWh of clean energy, which will amount to a reduction of over 16 kilotons of CO2 emissions. In addition, Cleantech Solar will also install two charging stations to support Bell Singapore employees who drive electric vehicles. Read More

The United Arab Emirates agreed to an LNG supply deal with Germany’s RWE during Chancellor Olaf Scholz’s visit to the Gulf.

The deal only covers one tanker of LNG, or 137,000 cubic meters, to be delivered later this year for trials at a floating LNG import terminal that is currently being constructed in Germany. According to the Financial Times, which cited unnamed sources, there are plans for five more LNG shipments to be sent by Emirati ADNOC to RWE in 2023. Read More

The cost of charging an electric car using public charge points on a pay-as-you-go basis has risen by 42% in just four months, according to the RAC.

The motoring group said the average price for using the chargers has increased by 18.75p per kilowatt hour (kWh) since May, reaching 63.29p per kWh.

The latest figures show a driver exclusively using rapid or ultra-rapid public chargers pays around 18p per mile for electricity, compared with roughly 19p per mile for petrol and 21p per mile for diesel. The rise has been blamed on the soaring wholesale costs of gas and electricity. Read More–>

Russia’s invasion of Ukraine and the curtailment in Russian gas supplies to Western Europe are the main reasons for the high energy prices in 2022. However, the surge in energy prices started already in 2021 due to the rapid growth in energy demand following the COVID-19 pandemic. In 2022, this was combined with poor weather conditions, lower wind speeds in Northern Europe, reduced power production from nuclear power plants, and lower levels in the Norwegian water reservoirs affecting the energy supply. This impacts both private consumers and companies.

The current situation on the European energy markets is unprecedented, and at Ørsted, we agree with the European governments and the EU Commission that several initiatives are needed to mitigate the negative consequences of the high energy prices.

We need to save energy

Ørsted expects that the current volumes of gas and power are sufficient for the coming winter. However, to bring down energy prices, we all need to save energy. Therefore, Ørsted supports the Danish government’s initiatives to save energy through energy efficiency measures and reductions in energy consumption. We will save as much energy as possible in our own buildings by, for example, lowering temperatures to 19 °C and by keeping the use of indoor and outdoor lighting to a minimum.

Companies with windfall profits should contribute financially

We also believe that the companies which have made windfall profits from the high energy prices should contribute financially by returning some of that profit to the consumers. Considering the extraordinary circumstances, this seems fair and should be implemented as part of the short-term response to the energy crisis. Read More

Transocean received a contract award for the harsh environment semisubmersible Transocean Norge from Wintershall Dea and OMV, granting the exclusive right to drill all of the wells for their respective drilling campaigns starting in 2023 through 2027, subject to rig availability and other conditions.

The contract provides that the Transocean Norge will drill eleven wells for Wintershall Dea and six wells for OMV. A portion of this work is subject to operator and government approvals. Assuming that all approvals are received, the full contract period is 1,071 days at an average dayrate of $408,000 which would contribute $437 million in backlog, excluding bonuses and additional services. In addition, the contract contains additional fixed price option wells. Read More

Fitch Ratings has affirmed India-based Bharat Petroleum Corporation Limited’s (BPCL) Long-Term Foreign-Currency Issuer Default Rating (IDR) at ‘BBB-‘. The Outlook is Stable. We have also affirmed BPCL’s senior unsecured rating and the ratings on its outstanding senior unsecured debt at ‘BBB-‘. Fitch has also affirmed the rating on subsidiary BPRL International Singapore Pte. Ltd.’s US-dollar guaranteed notes at ‘BBB-‘.

Fitch equates BPCL’s rating with its largest shareholder, India (BBB-/Stable), under our Government-Related Entities (GRE) Rating Criteria. Read More–>

Fitch Ratings (Thailand) has assigned an ‘A+(tha)’ rating to Thai Oil Public Company Limited’s (TOP; A+(tha)/Negative) proposed senior unsecured debentures of up to THB12 billion. The proposed debentures constitute direct, unsecured, unconditional and unsubordinated obligations of the company and are rated at the same level as TOP’s National Long-Term Rating, in line with its other senior unsecured debt. The proceeds will be used as working capital, to refinance existing debt and to fund capex and investment. Read More

Fitch Ratings has placed EnVen Energy Corporation, Energy Ventures GoM LLC and EnVen Finance Corporation’s ‘B-‘ Long-Term Issuer Default Rating (IDR) on Rating Watch Positive. In addition, Fitch has placed the issue-level ratings for Energy Ventures GoM LLC’s ‘BB-‘/’RR1’ reserve-based lending credit facility (RBL), and ‘B-‘/’RR4’ senior secured notes on Rating Watch Positive. The rating action follows the announcement that Talos Energy will acquire EnVen.

The Rating Watch Positive reflects the credit accretive nature of the acquisition and increased production scale. Read More

Fitch Ratings has downgraded Ghana’s Long-Term Local- and Foreign-Currency Issuer Default Ratings (IDRs) to ‘CC’, from ‘CCC’. Fitch typically does not assign Outlooks to issuers with a rating of ‘CCC’ or below.

According to the rating note, it said the downgrade reflects the increased likelihood that Ghana will pursue a debt restructuring given mounting financing stress, with surging interest costs on domestic debt and a prolonged lack of access to Eurobond markets. Read More

Moody’s quote on Total’s partnership with Qatar Energy

“TotalEnergies being selected for the second large LNG project in Qatar is credit positive, as it allows the company to strengthen its ties with the 3rd biggest LNG producer globally and secure much needed gas volumes for the European market. Even though this individual project on its own will not have a significant impact on TotalEnergie’s overall performance, it underlines its leading position in the global LNG market” – Janko Lukac, Vice President, Senior Analyst, Moody’s. Read More

Subsea 7 S.A. will publish its third quarter results for the period ended 30 September 2022 on 17 November 2022 at 07:00 UK time.

A conference call and simultaneous webcast for the investment community will be held on 17 November 2022 at 12:00 UK time.

From 07:00 UK time the results announcement and the presentation to be reviewed on the conference call and webcast will be available on the Subsea 7 Read More

TotalEnergies and SARIA, a leader on the European market for the collection and valorization of organic materials into sustainable products, have concluded an agreement to develop sustainable aviation fuel (SAF) production on the Grandpuits (Seine-et-Marne) zero-crude platform.

This agreement is a major step in securing feedstock supply (used cooking oils and animal fats) eligible to produce SAF and will enable the SAF production capacity to reach 210,000 tons per year, 25% higher than foreseen in the initial project announced in 2020.

Under this agreement, TotalEnergies will take 50% of a production activity of SARIA, that will supply animal fat esters to Grandpuits. SARIA will take an equivalent stake in the biofuels business of the Grandpuits biorefinery, which will remain operated by TotalEnergies. SARIA will also directly supply used cooking oils. Read More

RWE is testing two innovative, promising technologies at a new onshore wind farm in Spain. These technologies are intended to reduce the impact on the environment during the construction phase of the plant on the one hand and greenhouse gas emissions during subsequent operation on the other. Specifically, the company has now made the investment decision for the Orkoien pilot project near Pamplona. There, in the north of the country, a 5.7-megawatt turbine is being built to gather experience with the two technologies. Construction works are underway and commissioning is planned for summer 2023.

In the first method, special plastic mats are used for the first time in the construction phase.

Their great advantage: in temporary work areas such as access roads and storage areas, they minimise the construction-related impact on the soil. Normally, these areas are excavated and gravelled. Now, only the surface is smoothed with the excavator. Then the access and storage areas are temporarily covered with the plastic overlays. Following the work, the vegetation can regenerate completely. Another advantage: the mats, which are partly made of recycled material, can be reused in other projects.

A significant reduction in greenhouse gas emissions is made possible by the second technology, which is being used for the first time in the Orkoien pilot project. In the medium-voltage switchgear at the base of the turbine tower, the use of an insulating agent in the circuit breaker is necessary to interrupt the electrical currents by cooling and extinguishing the arc that occurs when a circuit is opened. Until now, the gas SF6 (sulphur hexafluoride), which is colourless, odourless, neither toxic nor flammable and harmless to humans and animals, has been used for this purpose. However, SF6 is a greenhouse gas that impacts the climate. Read More

RWE’s Pembroke Power Station recently marked 10 years of safe and successful operations. Staff, past and present, and their families, came together in a number of events to celebrate this milestone and to hear more about the future decarbonisation of the site. RWE is Wales’ largest energy generator and also the largest renewable generator with 12 sites including onshore and offshore wind, hydro and the most efficient gas plant in the UK – Pembroke. The station plays an essential role in supporting the UK’s energy transition as it can flexibly power up and down in response to availability of renewable power, provides excellent reliability and is key to ensuring security of supply across Wales and the UK. Power has been generated at the site since 1968 and today the station has the ability provide energy to around 4 million households boasts an efficiency of 61%. Read More

| Oil and Gas Blends | Units | Oil Price $ | change |

| Crude Oil (WTI) | USD/bbl | $77.83 | Up |

| Crude Oil (Brent) | USD/bbl | $85.21 | Up |

| Bonny Light | USD/bbl | $86.24 | Down |

| Saharan Blend | USD/bbl | $86.34 | Down |

| Natural Gas | USD/MMBtu | $7.04 | Up |

| OPEC basket 26/09/22 | USD/bbl | $89.50 | Down |

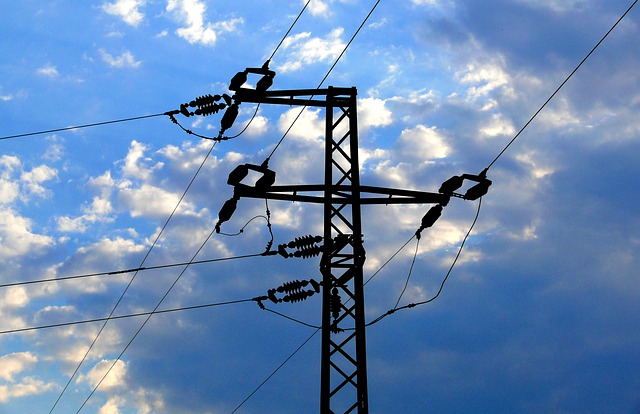

Nigeria’s national electricity grid woes show no signs of abating with the grid collapsing again on Monday, leaving many parts of the country without power. Nigeria’s national power grid has collapsed at least four times this year, with the authorities blaming technical problems for the breakdowns.

A month ago, workers from the Transmission Company of Nigeria (TCN) went on strike, temporarily shutting the grid. Nigeria has an installed capacity of 12,500 megawatts but only manages to produce about a quarter of that thus forcing many Nigerians and businesses to rely on diesel-powered generators. Back in July, the grid suffered another meltdown, with national output crashing from 3,921.8 megawatts to a mere 50MW. Read More

U.S. Rig Count is 764, with oil rigs up 3 to 602, gas rigs down 2 to 160 and miscellaneous rigs unchanged at 2.

Canada Rig Count is 215, with oil rigs up 2 to 146, gas rigs up 2 to 67.

| Region | Period | Rig Count | Change from Prior |

| U.S.A | 23rd September 2022 | 764 | +1 |

| Canada | 23rd September 2022 | 215 | +4 |

| International | August 2022 | 860 | +27 |

PETRONAS has signed a Memorandum of Cooperation (MoC) with the Ministry of Economy, Trade and Industry of Japan (METI) as well as a Memorandum of Understanding (MoU) with Japan Bank for International Cooperation (JBIC), to collaboratively pursue mutual sustainability goals of achieving carbon neutrality by 2050.

The signing of the documents took place on 26 September 2022 on the sidelines of the Asia Green Growth Partnership Ministerial Meeting (AGGPM) in Japan. PETRONAS President and Group CEO Datuk Tengku Muhammad Taufik signed on behalf of PETRONAS, while METI was represented by its Commissioner, Agency for Natural Resources and Energy Hosaka Shin and JBIC by its Governor Hayashi Nobumitsu.

The MoC with METI aims to enhance the cooperation between PETRONAS and Japan in the development as well as utilisation of energy sources and technologies to achieve pragmatic energy transition.

The MoU with JBIC focuses on expanding and enhancing bilateral cooperation between PETRONAS and Japanese companies in projects undertaken by PETRONAS globally in a variety of sectors including value chain development of hydrogen and ammonia, renewable energy, carbon capture and storage (CCS), and green mobility. Read More

INEOS and its partners in the Solsort Unit, Danoil and Nordsøfonden, have agreed on Final Investment Decision regarding the development of the Solsort West field in the Danish part of the North Sea after having received the approval of the development from the Danish Energy Agency.

The Solsort development consist of two wells. The Solsort oil and gas will be produced via the Syd Arne installation operated by INEOS. First oil and gas from Solsort is expected in Q4 2023. The production from Solsort will be a valuable contribution to Danish and European energy supply and self-sufficiency. When Solsort starts production the gas from INEOS will cover up to 10 % of the Danish gas consumption. Read More

Santos said it has received a binding conditional offer from Kumul Petroleum Holdings Limited (Kumul) to acquire a 5 per cent project interest in PNG LNG for asset value of US$1.4 billion, including a proportionate share of project finance debt of approximately US$0.3 billion (the Offer).

Kumul is Papua New Guinea’s national oil and gas company and existing partner in the PNG LNG project.

To secure the Offer, Kumul has paid an amount of US$55 million to Santos which will be held in escrow to be released to Santos as a deposit for part payment of the Offer price if it accepts the Offer. The Offer is conditional on Kumul obtaining the waivers of certain pre-emptive rights by each other PNG LNG project participant under the project operating agreement to allow the transaction to proceed. The Offer is expressed to be irrevocable, except in limited circumstances, and will remain open for acceptance until 31 December 2022. Santos has agreed to deal exclusively with Kumul during this period regarding the sale of equity in PNG LNG. Read More

OilandGasPress Energy Newsbites and Analysis Roundup |Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: @OilAndGasPress on Twitter |

Oil and gas press covers, Energy, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas,