Energy News to 28/10/22. OPEC daily basket price stood at $94.73/bl, 27 Oct. 2022

The European Union has finalized an agreement to phase out internal combustion engine cars by 2035 by enforcing a zero-emission regulation on carmakers in the bloc. National government negotiators, the European Parliament, and the European Commission all agreed to make carmakers reduce their emissions to zero by 2035, which is an effective ban on the sales of fossil-fuel-powered vehicles after that year. Read More

The Board of Directors of Chevron Corporation (NYSE: CVX) today declared a quarterly dividend of one dollar and forty-two cents ($1.42) per share, payable December 12, 2022, to all holders of common stock as shown on the transfer records of the Corporation at the close of business November 18, 2022. Read More

Just Stop Oil supporters have blocked a key junction at Mansion House in London. They are demanding that the government halts all new oil and gas licences and consents.

At 9 am this morning, 31 Just Stop Oil supporters walked onto Cannon St, Queen Victoria St and Garlick Hill near Mansion House tube station, and disrupted traffic by sitting in the road with banners. Some supporters have glued onto the tarmac and eight supporters have locked on to each other. Read More

Nigeria’s bid to claim compensation from a British subsidiary of mining and trading group Glencore over bribes paid to officials at Nigeria’s state oil company was denied by a London court on Wednesday, according to a Reuters report.

Lawyers representing the country told London’s Southwark Crown Court that Nigerian officials should be permitted to address the court on Nov. 2 and 3, when Glencore Energy is to be sentenced having pleaded guilty to seven counts of bribery in connection with oil operations in five African countries including Nigeria.

But Judge Peter Fraser ruled that Nigeria does not have the right to be heard, as only the prosecution, in this case, the UK Serious Fraud Office (SFO), and the defence can make arguments at a sentencing hearing. Nigeria said in written arguments it is “an identifiable victim of Glencore’s admitted criminal activity”, as two of the charges to which Glencore Energy has pleaded guilty relate to payments made to Nigerian National Petroleum Corp. officials. Read More

UK economy’s inflation rate reached a 40-year high of 10.1%

The UK government’s introduction of the mini-budget negatively affected the country’s economy, which was already reeling from high inflation, the Russia-Ukraine conflict, Brexit, and the supply chain issues triggered by the pandemic. Against this backdrop, GlobalData, a leading data and analytics company, expects the UK economy to grow at 3.5% in its October 2022 forecast compared to the previously estimated 4.3% in February 2022 before sliding into a recession (-0.2%) in 2023.

Aiming to kickstart the UK economy, the mini-budget, through ‘The Growth Plan’, announced a range of measures including tax cuts worth £45 billion, a freeze in energy bills, VAT free shopping for non-UK visitors and a reversal of the National Insurance rise. Since these were unfunded measures, putting the public finances on an ‘unsustainable path’, investors lost confidence in the UK market which resulted in a financial market disruption.

Following the announcement of the mini-budget, the FTSE 100 hit a three-month low and pound sterling depreciated sharply against the dollar. The UK stock market was down by 7.1% and pound per dollar depreciated by 16.4% on a year-to-date basis on October 21, 2022.

Arnab Nath, Economist at GlobalData, comments: “A sharp depreciation of the currency will make imports (including raw materials) costlier and will further increase the price of products making life more difficult for UK consumers. However, excluding a cut in stamp duty and a national insurance rise reversal, most of the measures announced in the mini-budget have been scrapped by the new finance minister, but getting the economy back on track remains a real challenge for the government.” Read More

The Central Bank of Nigeria (CBN) has concluded plans to redesign certain denominations of the local currency, the apex bank chief said today. Godwin Emefiele who is the CBN Governor said during a press conference in Abuja said that the apex bank had obtained the approval of President Muhammadu Buhari to redesign N200, N500 and N1,000 notes.

According to Emefiele, the process is a discharge of the apex bank’s key function of currency management. “Currency management is the key function of the CBN as enshrined in the CBN Act. The integrity of a local legal tender, the efficiency of its supply and its efficiency are some of the functions of a great central bank.Emefiele said the new currencies and the existing ones would remain legal tender and circulate together until Jan. 31, 2023. He urged Deposit Money Banks currently holding existing denominations to begin returning them back to the CBN immediately. Read More

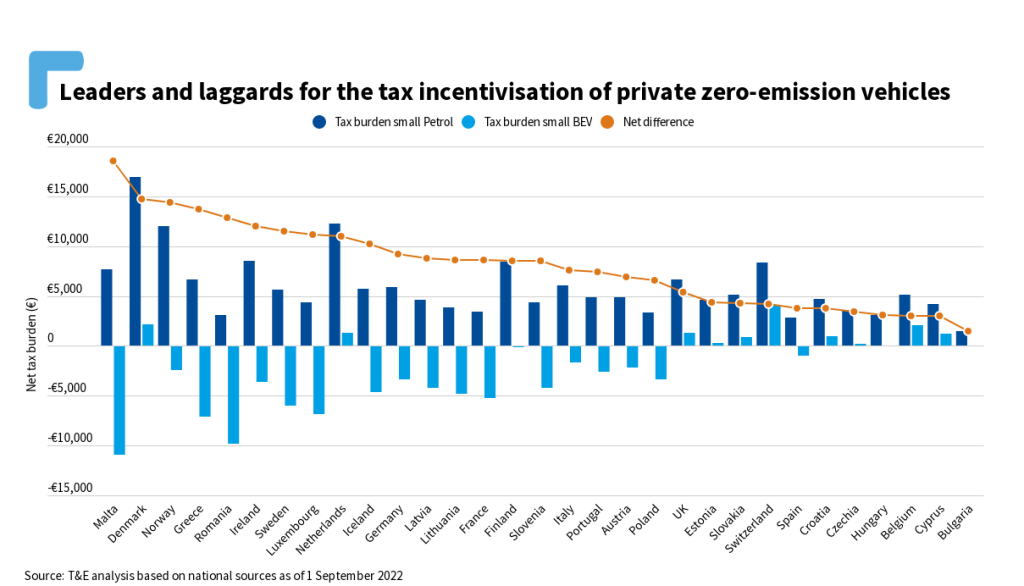

The first ever report comparing systems of car taxation across European countries.This report is the first time that systems of car taxation are directly compared across European countries. The comparisons cover 31 countries, seven forms of taxation, and two registration types (private and corporate). The results detail the different tax methods used and the resulting tax burden for typical car ownership and usage. By calculating the different taxes that are levied on the same car in each country, a total tax burden can be compared across countries. The range in tax burden is substantial. For a small petrol car, the tax burden over ten years of private ownership ranges from €1,500 in Bulgaria to €17,000 in Denmark. For a compact petrol SUV, the range is from €2,800 to €51,400. Importantly for the zero-emission transition, our report calculates the tax burden between vehicle types (small car and compact SUV) and powertrains (petrol, plug-in hybrid, battery electric vehicle – BEV) and the tax differential between them.Our results reveal that the tax differential between a BEV and petrol private car varies greatly across countries. The highest tax differentials are in Malta, Denmark, and Norway while the lowest are in Bulgaria, Cyprus, and Belgium. The tax comparisons offer explanations for these findings: Read More

Fuel duty cuts in Europe outweigh EU windfall tax as oil companies announce huge profits

EU’s €25 bn windfall tax on oil and gas does not cover the nearly €30 bn in taxpayer-funded cuts to fuel duty, which has propped up demand for oil.he expected revenues from the EU’s windfall tax will not even cover the €29 billion oil companies benefit from in the form of fuel duty cuts[1], new Transport & Environment (T&E) analysis shows.In September the EU announced its eye-catching €140 billion windfall tax on energy companies’ profits. Read More

Energean plc confirm that first gas has been safely delivered at the Karish field, offshore Israel.

Highlights

• First gas has been achieved on the Karish project

• Gas is being produced from the Karish Main-02 well and the flow of gas is being steadily ramped up

• Preparation for transmission through the gas sales pipeline is progressing and gas sales to Energean’s customers are expected to commence in the next couple of days

• Karish Main-01 and Karish Main-03 wells are expected to be opened up in approximately two and four weeks, respectively

The Energean Power FPSO and the sales gas pipeline have an ultimate capacity of 8 bcm/yr. The initial

capacity is up to 6.5 bcm/yr, and commercial gas sales are expected to reach this level approximately four to six months following first gas. Energean’s growth projects – the Karish North development, the second oil train and the second export riser – are on track for completion in late 2023, following which Energean will be able to produce to the full 8 bcm/yr capacity of its infrastructure. < Click here for full Release

| Oil and Gas Blends | Units | Oil Price $ | change |

| Crude Oil (WTI) | USD/bbl | $87.61 | — |

| Crude Oil (Brent) | USD/bbl | $95.73 | Up |

| Bonny Light | USD/bbl | $96.23 | Up |

| Saharan Blend | USD/bbl | $96.71 | Up |

| Natural Gas | USD/MMBtu | $5.78 | Up |

| OPEC basket 27/10/22 | USD/bbl | $94.73 | Up |

Affiliates of QatarEnergy and ExxonMobil have agreed to independently offtake and market their respective proportionate equity shares of LNG produced by the Golden Pass LNG Export Project located in Sabine Pass, Texas in the United States of America (“Golden Pass LNG”). Pursuant to the agreement, QatarEnergy Trading LLC, a wholly owned subsidiary of QatarEnergy, will offtake, transport, and trade 70% of the LNG produced by Golden Pass LNG.

The construction of Golden Pass LNG, which has a total production capacity in excess of 18 million tons of LNG per annum, is well underway with first LNG production expected by the end of 2024. Commenting on this development, His Excellency Mr. Saad Sherida Al-Kaabi, the Minister of State for Energy Affairs, the President and CEO of QatarEnergy, said: “The energy market is highly dynamic and undergoing a period of transformation, and LNG will continue to play a key role in meeting global energy demand and ensuring security of supply. This agreement is an important addition to our efforts to meet demand for cleaner energy and to support the economic and environmental requirements for a practical, equitable and realistic energy transition.” H.E. Minister Al-Kaabi added: “QatarEnergy is the global leader in LNG, the cleanest of all fossil fuels, and it is only natural for us to increase focus on LNG trading and portfolio optimization to deliver innovative LNG solutions that meet the needs of our customers across the globe. I am proud of what QatarEnergy Trading has achieved in the very short time since its inception and with this new addition to its portfolio, I am confident that QatarEnergy Trading will accelerate its efforts to deliver on our aspiration of becoming a world leader in LNG trading in the near future.”

As a result of this arrangement, Ocean LNG Limited, a joint venture established in 2016 between affiliates of QatarEnergy and ExxonMobil for the purpose of offtaking and marketing the entire production of Golden Pass LNG, has ceased operations, and will be wound down. Read More

Republicans on the House Oversight Committee have accused President Joe Biden of improperly tapping into the nation’s strategic petroleum reserve to soften the blow of Saudi Arabia-led OPEC+’s decision to dramatically cut its oil production. The president announced the release of 15 million oil barrels earlier this month, just weeks before the November midterm elections where his party stands to lose the majority in one or both houses of Congress. In a letter sent to Energy Secretary Jennifer Granholm on Wednesday, Rep. James Comer (R-KY) and Rep. Nancy Mace (R-SC) are demanding the Biden administration answer for the 180 million barrels released from the strategic reserve since the springtime, according to the letter obtained by DailyMail.com

DEME Offshore has been awarded the export cable contract for Vattenfall’s Norfolk Boreas Wind Farm in a consortium with LS Cable & System. The consortium is also selected as the preferred bidder for the remaining projects in Vattenfall’s Norfolk Zone.

The contract includes the design, engineering, procurement, manufacturing and testing of around 360 km of High Voltage Direct Current (HVDC) export cables and fibre optic cables, including the offshore installation and onshore jointing. For DEME, the share in the project represents a sizable contract (1).

Philip Scheers, Business Unit Director at DEME Offshore, comments: “We are delighted that Vattenfall has selected DEME and LS Cable & System for this major wind farm. Our dedicated vessels, renowned for their performance in the industry, and expert team enable us to provide a very efficient solution for such a large-scale cabling scope. We are proud to partner with Vattenfall, which shares our views for a sustainable world, and to play a role in delivering green energy to millions of UK homes. We look forward to working with our consortium partner LS Cable & System to successfully and safely deliver this project.” Works will be executed in 2026, involving a cable installation vessel, a trailing suction hopper dredger and a fallpipe vessel from the DEME fleet. Read More

Crude oil trades higher for a third day supported by a general improvement in risk appetite and the market worrying about the ability and price of fuel products over the coming months. OPEC+ production cuts reducing the availability of higher distillate yielding crude oil, the EU embargo on Russian oil together with a global refinery capacity struggling to meet robust demand, have all helped drive refinery margins and prompt spreads sharply higher, an indication that we could be facing high winter prices for diesel and heating oil.

Crude oil trades higher for a third day supported by a general improvement in risk appetite as the dollar and US yields trade trade softer on increased speculation that the FOMC, following another 75 basis rate hike next week, may slow it’s aggressive rate hike pace in order to ascertain the economic impact of the actions already taken. In addition, the market continues to worry about the availability and price of fuel products over the coming months when OPEC+ cuts production and the EU embargo on Russian crude and fuel imports start.

While crude oil has been mostly rangebound since July, the fuel product market has continued to tighten as supplies in Europe and the US has become increasingly scarce, thereby driving up refinery margins for gasoline and especially distillate products such as diesel, heating oil and jet fuel. Some relief has been provided by China which recently issued its biggest fuel-export quota this year in order to help revive its economy hit by Covid lockdowns and a property slump. The move not only highlighting the slowdown in demand in China but also how incredible profitable refining activity has become. So far, however, the product futures markets in Europe and the US are not showing any signs of relief from additional barrels flowing from China with Asian consumers potentially benefitting the most. Read More

Eni’s Board of Directors, chaired by Lucia Calvosa, approved the possible issue of one or more bonds by 31 December 2023, to be placed with retail investors in Italy and to be listed on one or more regulated markets, including on the Mercato Telematico Obbligazionario (MOT), with a value up to a maximum aggregate amount of 2 billion euro.

The bonds, which will be issued in the form of sustainability-linked bonds in line with Eni’s financial strategy, will enable Eni to pre-fund potential future financial needs, to maintain a well-balanced financial structure and to further diversify financial sources. Read More

The European Central Bank (ECB) has announced a new jumbo hike of interest rates in a bid to bring down record inflation in the eurozone.

The bank’s three key interest rates were each bumped by three-quarters of a percentage point, the same as they did in September.

The central bank’s interest rates have a cascading effect across the eurozone and directly influence the rates that commercial banks offer to households and businesses. The decision to raise interest rates was confirmed on Thursday afternoon, following days of speculation around the size of the increase, and will take effect on 2 November. It marks the third hike this year for the 19 EU countries that use the euro. Read More

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: @OilAndGasPress on Twitter |

Oil and gas press covers, Energy, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas, energy monitors,