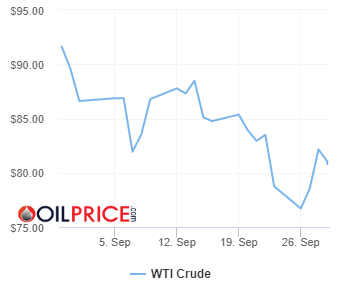

Energy News to 29/09/22. OPEC daily basket price stood at $90.27/bl, 28 Sept. 2022

U.S. crude stockpiles increased by much more than expected last week, the API reported Tuesday. U.S. offshore regulator said that 190,358 barrels per day of production was shut down in the Gulf of Mexico on hurricane disruptions.

The global LNG market has more than doubled in size since 2011, ushering in dozens of new entrants and the expansion of smaller players in Asia. In recent years, smaller traders accounted for 20% of LNG imports in China alone. But a spike in spot LNG cargo prices to $175-$200 million, from around $15-$20 million two years ago, has had a seismic impact on physical trading activity for many smaller players. The capital needed to trade the market soared after benchmark LNG prices rose from record lows below $2 per million British thermal units (mmBtu) in 2020 to highs of $57 in August. Read More

Nissan Motor Co., Ltd. has greatly expanded the archive of news releases on its Global Newsroom website for the media. Nissan’s corporate purpose is “Driving innovation to enrich people’s lives.” This online archive is a valuable resource to learn about the company’s initiatives and innovations to date.

Nissan’s Global Newsroom was launched in 1999 to provide information on Nissan’s corporate activities, new products and new technologies. Until now, only news releases issued after the website’s launch were archived there. News releases issued before 1999 in both Japanese and English were compiled into physical reference books and stored in-house.

Nissan has now scanned and digitized all its existing pre-1999 releases and made them available on the newsroom as PDFs of the original print versions, complete with old logos, diagrams and data tables. This archive provides information on the products, technologies and various business activities that Nissan created in its spirit of “Dare to do what others don’t.” Read More

Nissan Motor Co., Ltd. and Nissan Motorsports & Customizing Co., Ltd. (NMC) today revealed the Nissan Z GT4, based on the all-new Nissan Z.

GT4-spec racing machines are based on production vehicles, modified for severe competition use. To that end, NMC’s NISMO Racing Division took the street version of the new Z – which is receiving acclaim around the world – and tuned the VR30DDTT engine, optimized its chassis and suspension, enhanced its aerodynamics to the limit of regulations and created a cockpit that works for drivers of all types. This created a race car that is a Nissan Z in all aspects – accessible to enthusiast drivers and hard-core professionals.

“Motorsports for Nissan is an expression of our passion and unrivaled expertise. The Nissan Z continues to maintain its position as an exciting sports car that fascinates drivers with its driving dynamics and flexible powertrain,” said Nissan COO Ashwani Gupta. “We are confident that this track-ready GT4-category Nissan Z will be ready to write another chapter in the Nissan Z’s 50-plus-year legacy of speed.”

The Nissan Z GT4 was developed at NISMO’s engineering facilities, at multiple track-test sessions and also as a test-entry vehicle which participated in the Fuji 24 Hour Race in June, as well as additional Super Taikyu Series events at Motegi and more. Read More–>

Southeast Asian countries can meet their growing energy demand with renewables and cut 75% of their energy-related CO2 emissions by 2050, half of the emissions compared to today. Released by the International Renewable Energy Agency (IRENA) during the ASEAN Energy Ministerial, the 2nd edition of the Renewable Energy Outlook for ASEAN: Towards a regional energy transition shows that almost doubling renewable power by 2030 creates significant regional business and investment opportunities. ASEAN is home to one of the youngest coal power plant fleets in the world. Yet, an increasing number of ASEAN Members have set net-zero emissions targets by around mid-century. Planning the transition must begin now if climate goals are to be met, with coal power substitution as a top priority not least to avoid stranded assets. IRENA’s Outlook identifies transition pathways focusing on renewables, electrification, and emerging technologies such as hydrogen and batteries. It builds on the political momentum for change in the region. Read More

During the period from September 20 to September 23, 2022, Eni acquired n. 8,978,936 shares, at a weighted average price per share equal to 11.2083 euro, for a total consideration of 100,638,451.62 euro within the authorization to purchase treasury shares approved at Eni’s Shareholders’ Meeting on 11 May 2022, previously subject to disclosure pursuant to art. 144-bis of Consob Regulation 11971/1999.

On the basis of the information provided by the intermediary appointed to make the purchases, the following are details of transactions for the purchase of treasury shares on the Euronext Milan on a daily basis: Read More

Petrofac has been awarded a two-year Field Maintenance Services contract extension with Abu Dhabi National Oil Company (ADNOC) Group’s, Al Dhafra Petroleum in the United Arab Emirates. Under the agreement, Petrofac will continue to support operations at the Haliba oil field, located onshore along the south-east border of Abu Dhabi, providing specialist personnel to maintain and support facilities. Read More–>

VAALCO Energy, Inc. announced that the Government of Equatorial Guinea has approved the Venus – Block P Plan of Development (“POD”). VAALCO has an 80% participation interest in the project and is the operator. Upon the execution of final documents, VAALCO will proceed directly to project execution which targets first oil in 2026 and adds 23.1 million barrels of oil (“MMBO”) of 2P CPR gross reserves, and 18.5 MMBO of 2P CPR Working Interest (“WI”) reserves (16.2 MMBO net 2P reserves).1

Highlights

Substantially adds to VAALCO’s 2P CPR WI reserves;

Adds 18.5 MMBO of 2P CPR WI reserves as of September 2022, which includes 9.1 MMBO of WI proved undeveloped reserves (“PUDs”);

Additional future upside with Europa development and exploration upside with Saturno and Southwest Grande prospects;

Allows VAALCO to proceed with the development of the Venus discovery;

Plans to spud first development well in early 2024;

Acquire, convert and install production facilities over the next three years;

Expects to spud an additional development and a water injection well in 2025/2026;

Estimates the preliminary project cost of drilling two development wells, an injection well and related production facility to be approximately $310 million gross, or approximately $13.40 per barrel of 2P gross reserves;

Anticipates first oil production from Block P in mid to late 2026 Read More

VAALCO Energy Inc. announced the successful drilling of the North Tchibala 2H-ST well that was drilled from the Southeast Etame North Tchibala (“SEENT”) platform in the Etame field, offshore Gabon. Additionally, the Company provided an operational update on the Teli Floating Storage and Offloading vessel (“FSO”) installation and field reconfiguration at Etame.

Drilling and Completion Highlights

Successfully drilled and cemented 9-5/8-inch casing string with multiple potentially productive sands in the Dentale 18/19 pay zones behind casing;

Encountered nearly 100 meters of gross Dentale pay sands (72 meters net), exceeding expectations;

The Dentale 18/19 sands initially targeted for production in this well are analogous to Dentale sands previously productive in the North Tchibala field, with similar porosity and permeability;

Additional Dentale sands were encountered in the wellbore that can be targeted for testing and production in the future;

Preparing to complete the North Tchibala 2H-ST well utilizing a fracture stimulation vessel that will provide support with multiple stimulation and frac-pack operations;

Following clean up and stabilization of flow rate, VAALCO expects a stable flow rate by the end of October. Read More

Petrel Resources plc (AIM: PET) today announces unaudited financial results for the six months ended 30th June 2022.

Petrel is a hydrocarbon explorer with interests in Iraq, and Ghana.

Highlights

• Petrel’s Iraqi business is being re-built although as explained below our Iraqi Director, Riadh Ani has had to resign – but requires formation of a Government for the Company to progress new funding.

• An updated Merjan oil field development proposal has been submitted to the Ministry.

• Iraqi oil output recovered to 4.65 million barrels daily in August 2022.

• Ratification discussions on Tano 2A block underway with Ghanaian authorities – though acreage adjustments likely.

• Board considers there are new expansion opportunities presented by oil price and demand recovery.

Prior to the recent elections, the Iraqi authorities had suggested that Petrel initially target “exploration of blocks in the western desert of Iraq, and present past studies done on the Merjan-Kifl-West Kifl discoveries, and Petrel’s work on the Mesozoic and Paleozoic plays in the Western Desert”. Our updated development proposal requires an operating Iraqi Government in order to proceed. Read More

Shell and Exxon Mobil have launched a simultaneous sale process of a large package of offshore natural gas assets in the southern UK and Dutch North Sea, three industry and banking sources said.

Investment bank Jefferies was hired to run the sale, which could raise over $2 billion, the sources said.Reuters reported that Shell was preparing to launch the sale in February.

Shell and Exxon are also trying to sell their stakes in their British southern North Sea gas hub, which include the Clipper Leman Alpha hubs as well as the Bacton terminal in eastern England, the sources said. Read More

Solar mini grids can provide high-quality uninterrupted electricity to nearly half a billion people in unpowered or underserved communities and be a least-cost solution to close the energy access gap by 2030. But to realize the full potential of solar mini grids, governments and industry must work together to systemically identify mini grid opportunities, continue to drive costs down, and overcome barriers to financing, says a new World Bank report.

Around 733 million people – mostly in Sub-Saharan Africa – still lack access to electricity. The pace of electrification has slowed down in recent years, due to the difficulties in reaching the remotest and most vulnerable populations, as well as the devastating effects of the COVID-19 pandemic. At the current rate of progress, 670 million people will remain without electricity by 2030. The deployment of solar mini grids has seen an important acceleration, from around 50 per country per year in 2018 to more than 150 per country per year today, particularly in countries with the lowest rates of access to electricity. This is the result of falling costs of key components, the introduction of new digital solutions, a large and expanding cohort of highly capable mini grid developers, and growing economies of scale.

Solar mini grids have become the least-cost way to bring high-quality 24/7 electricity to towns and cities off the grid or experiencing regular power cuts. The cost of electricity generated by solar mini grids has gone down from $0.55/kWh in 2018 to $0.38/kWh today. Modern solar mini grids now provide enough electricity for life-changing electric appliances, such as refrigerators, welders, milling machines or e-vehicles. Mini grid operators can manage their systems remotely, and paidsmart meters enable customers to pay as they use the electricity. Connecting 490 million people to solar mini grids would avoid 1.2 billion tonnes of CO2 emissions. Read More

Halliburton Company signed a Memorandum of Understanding (MoU) with the Saudi Data and Artificial Intelligence Authority (SDAIA) to address national and global energy challenges with DS365.ai to create data science and artificial intelligence (AI) applications and solutions.

Through the Artificial Intelligence Center for Energy (AICE), which is a joint center between Ministry of Energy and SDAIA, the collaboration agreement pairs AICE’s significant efforts and resources in the data and AI space with Halliburton’s cloud-first AI and machine learning exploration and production tools along with its solutions that support more sustainable upstream operations. The two groups will share technologies and co-develop innovative solutions to aid in sustainability and subsurface prediction efforts for the oil and gas sector. Read More

Staple food prices in sub-Saharan Africa surged by an average 23.9 percent in 2020-22—the most since the 2008 global financial crisis. This is commensurate to an 8.5 percent rise in the cost of a typical food consumption basket (beyond generalized price increases).

Global factors are partly to blame. Because the region imports most of its top staple foods—wheat, palm oil, and rice—the pass-through from global to local food prices is significant, nearly one-to-one in some countries.

Prices of locally sourced staples have also spiked in some countries on the back of domestic supply disruptions, local currency depreciations, and higher fertilizer and input costs. In Nigeria for example, the prices of both cassava and maize more than doubled even though they’re mainly produced locally. In Ghana, prices for cassava escalated by 78 percent in 2020-21, reflecting higher production costs and transport constraints, among other factors. Using price data from 15 countries on the five most consumed staple foods in the region (cassava, maize, palm oil, rice, and wheat), we find that in addition to global food prices, net import dependence, the share of staples in food consumption, and real effective exchange rates drive changes in local staple food prices. Read More

The Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN) hiked the benchmark interest rate by 150 basis points to 15.5% after a two-day meeting ended today while the cash reserve ratio was adjusted upward to 32.5%.

The monetary tightening comes amidst inflation rate pressure continuing to worsen in Africa’s largest economy with about $450 billion in gross domestic product. In August, the consumer price index rose to 20.52%, the level seen seventeen years ago.

At the meeting, the monetary policy committee evaluated the developments in the global economy and domestic environment so far in 2022, particularly the rising energy prices and supply chain disruption triggered by the ongoing war between Russia and Ukraine.

The committee also reviewed the global and domestic financial environment as well as the outlook and possible risks for the remaining months in 2022. Twelve members of the committee were in attendance and they decided to raise the monetary policy rate for the third consecutive time in the year.Nigeria’s foreign receipts from crude oil exports is down as both production volume in the country and global prices of oil slide. Read More

| Oil and Gas Blends | Units | Oil Price $ | change |

| Crude Oil (WTI) | USD/bbl | $80.41 | Up |

| Crude Oil (Brent) | USD/bbl | $87.43 | Up |

| Bonny Light | USD/bbl | $89.02 | Up |

| Saharan Blend | USD/bbl | $89.94 | Up |

| Natural Gas | USD/MMBtu | $6.99 | Up |

| OPEC basket 28/09/22 | USD/bbl | $90.27 | Up |

The Organization of the Petroleum Exporting Countries (OPEC) today marks the sixth anniversary of the adoption of the landmark ‘Algiers Accord’ on 28 September 2016 in Algiers, Algeria.

Six years ago, the OPEC Conference held its 170th (Extraordinary) Meeting in the Algerian capital to discuss oil market developments and deliberate ways to address the severe market imbalance. Among the key decisions taken was the establishment of a high-level committee mandated to develop a framework for consultations between OPEC and non-OPEC oil-producing countries.

These pivotal decisions eventually led to the signing of the ‘Vienna Agreement’ at the 171st Meeting of the OPEC Conference on 30 November 2016 and the historic ‘Declaration of Cooperation’ (DoC) between OPEC and non-OPEC participating countries on 10 December of the same year in Vienna, Austria.

In reflecting on the anniversary, HE Haitham Al Ghais, OPEC Secretary General, said: “The signing of the ‘Algiers Accord’ signifies an important moment in the history of the global oil industry, as it laid the foundation for what later became an unprecedented framework of cooperation between OPEC Member Countries and non-OPEC oil-producing countries, known as the ‘Declaration of Cooperation’. Read More

Shell’s incoming Chief Executive, Wael Sawan, is set to accelerate the group’s drive to build its renewable energy business, including through a possible “transformative” clean power acquisition, company and industry sources have told Reuters.

But this could mean a further cutting down of the multinational’s activities in Nigeria’s oil and gas industry, with pressure mounting on the company, which has operated in Nigeria for over six decades to slow down its investment in hydrocarbons. Read More

Fitch has rated Fortum Oyj (BBB/Negative) on a standalone basis (i.e. deconsolidating Uniper SE) since the announcement of the stabilisation plan agreed between Fortum and the German state in July 2022. We see the recent agreement by the German state to buy Fortum’s stake in Uniper as credit positive for the company, as it would improve its financial profile, while eliminating any residual contagion risk from Uniper’s gas business losses. The transaction is subject to regulatory clearances and approval by Uniper’s Extraordinary General Meeting. We expect to update our rating case after the transaction closes in a few months and we gain visibility on Fortum’s new strategy. The amendment of the stabilization plan agreed in September 2022 implies the full acquisition by the German state of Fortum‘s shares in Uniper for EUR0.5 billion. The agreement also entails the repayment of Fortum’s EUR4 billion intercompany loan to Uniper, which would lead to a strong de-leveraging of Fortum and improve its liquidity position. Read More

Fitch Solutions has launched a new product, Fitch Ratings ESG Relevance Scores Data, which allows market participants to transparently and easily analyse credit risk as it relates to environmental, social and governance factors for Fitch-rated entities.

Fitch Ratings ESG Relevance Scores Data provides ESG relevance scores for the majority of Fitch Ratings’ publicly rated entities and transactions across corporates, banks, non-bank financial institutions, insurance, public finance (international and US municipal), global infrastructure and structured finance (ABS, CMBS and RMBS).

Dan Champeau, Global Head of Ratings Data & Research, Fitch Solutions said: “Fitch Ratings ESG Relevance Scores provide a transparent and easily understandable view of which issues are material and relevant to credit ratings. They are based on the ratings case forecasts being used by Fitch’s ratings analysts, so they are forward looking not historical.”

Previously, the latest ESG Relevance Scores were available only individually in rating action commentaries and as PDFs. The ESG Relevance Scores will now be available as a data feed which allows users to access the data quicker and more conveniently. There are currently over 140,000 data points which cover almost 10,000 issuers and transactions within the new service. Read More

Hertz and General Motors Co. announced an agreement in which Hertz plans to order up to 175,000 Chevrolet, Buick, GMC, Cadillac and BrightDrop EVs over the next five years. Hertz and GM believe this plan is the largest expansion of EVs among fleet customers and the broadest because it spans a wide range of vehicle categories and price points — from compact and midsize SUVs to pickups, luxury vehicles and more.

The agreement will encompass electric vehicle deliveries through 2027 as Hertz increases the EV component of its fleet and GM accelerates production of EVs broadly. Over this period, Hertz estimates that its customers could travel more than 8 billion miles in these EVs, saving approximately 1.8 million metric tons of carbon dioxide equivalent emissions compared to similar gasoline-powered vehicles traveling such a distance. Read More

Stellantis is collaborating with researchers, scientists and engineers around the world – one of the largest networks of cooperative innovation – to speed the development and implementation of ground-breaking technologies to help the Company deliver the goals of the Dare Forward 2030 strategic plan, including reaching carbon net zero emissions by 2038.

With more than three decades working with public institutions, other R&D centers, academies and various stakeholders, Stellantis is capitalizing on that experience by building one of the biggest and widest collaborative ecosystems in the world, which today numbers 164 running projects and over 1,000 different partners involved worldwide.

These projects can combine private and public funding, bringing together the expertise of Stellantis’ extensive technical community and top-tier institutions with their highly skilled talent, to seek solutions to the most-challenging issues in global mobility. Together, Stellantis and its unprecedented collaborations are building the common roadmap to cutting-edge freedom of mobility. Read More

DNO ASA, the Norwegian oil and gas operator, has completed buybacks in the DNO03 bond (ISIN: NO0010852643) totaling USD 19,565,657. The purchased bonds will be cancelled. Following cancellation, the outstanding amount of the DNO03 bond will be USD 131,162,339. The buybacks do not change the fixed maturity date of the DNO03 bond. Read More

Ofgem is consulting on issuing two energy suppliers with final orders to compel them to make £1,021,943.60 in outstanding payments to comply with the Renewable Obligations (RO) scheme. The suppliers are Delta Gas and Power (“Delta”), which is non-domestic and Logicor Energy Limited (“Logicor”) which is a domestic supplier.

Under the Government’s Renewables Obligation (RO) scheme, the suppliers had to demonstrate they had sourced enough electricity from renewable sources to meet their obligation. Suppliers are required to present Renewables Obligation Certificates (ROCs) to Ofgem by 1 September, or instead make payments to the buy-out fund administered by Ofgem by 31 August 2022 deadline. Where suppliers fail to meet these deadlines, they have until 31 October to make a late payment plus interest. If the suppliers do not pay, Ofgem could start the process of revoking their licences to supply energy. Read More

EPA Administrator Michael S. Regan announced that EPA is establishing a new national office charged with advancing environmental justice and civil rights. The creation of the new Office of Environmental Justice and External Civil Rights delivers on President Biden’s commitment to elevate these critical issues to the highest levels of the government and solidifies the agency’s commitment to delivering justice and equity for all.

Administrator Regan announced the creation of the new office alongside environmental justice and civil rights leaders in Warren County, North Carolina Read More

| Region | Period | Rig Count | Change from Prior |

| U.S.A | 23rd September 2022 | 764 | +1 |

| Canada | 23rd September 2022 | 215 | +4 |

| International | August 2022 | 860 | +27 |

The Bank of England on Wednesday made an emergency intervention to protect Britain’s “financial stability” after Kwasi Kwarteng’s shock mini-Budget.

The Bank said it would buy back billions of pounds of Government debt to try to drive down the interest rate on public borrowing which has soared since the fiscal statement on Friday. It stressed that it was also seeking to protect households and businesses from the crisis, who also face spiralling mortgage and other borrowing costs.

In a statement, the Bank said: “In line with its financial stability objective, the Bank of England stands ready to restore market functioning and reduce any risks from contagion to credit conditions for UK households and businesses. To achieve this, the Bank will carry out temporary purchases of long-dated UK Government bonds from September 28. The purpose of these purchases will be to restore orderly market conditions. The purchases will be carried out on whatever scale is necessary to effect this outcome. The operation will be fully indemnified by HM Treasury.”

The Treasury insisted the “purchases will be strictly time limited, and completed in the next two weeks.” Read More

Etihad Cargo, the cargo and logistics arm of Etihad Aviation Group, has advanced its sustainability journey by becoming the first Middle Eastern carrier to participate in The International Air Cargo Association’s (TIACA) BlueSky programme.

Following the March 2022 launch announcement of the air cargo industry’s first multi-sector sustainability verification programme and successful pilot programme, Etihad Cargo is one of the first participants to join the programme’s live operations. Other participants include organisations from airline, airport, ground handler, and general sales and service agents sectors. Read More

Marignane, Airbus and Ecocopter have signed a Memorandum of Understanding to start collaborating on the launch of urban air mobility services across various countries in Latin America. This is a major step toward the co-creation of a functioning urban air mobility ecosystem in the region.

With this agreement, the partners will explore and define launch scenarios for air mobility operations, notably in Ecuador, Chile and Peru. This includes joint activities to develop UAM operations over the continent, as well as ways to target first use cases and pilot cities and regions. This partnership is an expansion of the manufacturer’s strong relationship with Ecocopter, who operates a fleet primarily comprised of Airbus helicopters for aerial work missions in a variety of industrial sectors. Read More

EPA announced the results of a study that estimates the economic benefits of cleaning up facilities under the Resource Conservation and Recovery Act (RCRA) Corrective Action program. EPA’s analyses of 79 cleanups revealed that these facilities support 1,028 on-site businesses, which provide economic benefits including: $39 billion in annual sales revenue; over 82,000 jobs; and $7.9 billion in estimated annual employment income. EPA also developed brief profiles for more than 40 facilities to showcase the economic benefits that can be fostered through RCRA Corrective Action cleanups.

“EPA’s study illustrates the incredible potential RCRA cleanups have to contribute significant environmental and economic benefits to communities across nation,” said Carlton Waterhouse, EPA Deputy Assistant Administrator for the Office of Land and Emergency Management. “While our primary focus is protecting the environment and public health, these profiles demonstrate real-world examples of development opportunities that can bolster our local economies, create job opportunities and improve the quality of life for impacted communities.”

EPA and states work with owners and operators of hazardous waste treatment, storage, and disposal facilities to ensure cleanups effectively protect human health and the environment and support reuse as well as continued use. Facilities that are cleaned up under RCRA are often redeveloped for a wide array of commercial, recreational, and energy production purposes. These cleanups also enable on-site industrial and commercial businesses to continue operating while protecting human health and the environment.

EPA collected economic data for 79 facilities, a subset of all the Corrective Action facilities, for this study to assess the number of jobs and magnitude of economic benefits from these facilities post cleanup. Since the analysis is from a small subset of the nearly 4,000 facilities being cleaned up, the benefits associated with all RCRA Corrective Action cleanups are likely much greater. EPA plans to continue to evaluate economic benefits and develop more profiles in the future. Read More

OilandGasPress Energy Newsbites and Analysis Roundup |Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: @OilAndGasPress on Twitter |

Oil and gas press covers, Energy, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas, News and Analysis