Energy News to 29 Apr. 2022. OPEC daily basket price stood at $105.33/bl, 27 April 2022

China’s lockdown continues to weigh on crude sentiment despite fears of supply disruptions from continued embargo on Russian oil

LG Chem plans to target the market with its recent development of battery pack plastic materials that can delay thermal runaway of electric vehicle batteries for the longest period in the world.

With its own technology and manufacturing methods, LG Chem announced that it developed flame-retardant engineering plastic material that prevents deformation by heat.

Thermal runaway, a main cause of fire in electric vehicle batteries, is a phenomenon where battery cell suffers stresses from various origins and heats up subsequently. Flames arise once battery’s internal temperature rises above a certain level due to short circuit such as overvoltage and overdischarge. Lithium-ion battery has high reactivity to water, which makes it difficult to extinguish it with water in case of fire.

LG Chem’s newly developed special flame retardant is a high-functional engineering plastic material that consists of various material groups such as polyphenylene oxide (PPO), polyamide (PA), and polybutylene terephthalate (PBT). Read More

LG Chem (Chief Executive Officer Hak Cheol Shin) and the Korea Institute of Science and Technology (KIST; President YOON, Seok-Jin) are conducting joint R&D for commercialization of carbon neutrality technologies in full swing.

The two institutes announced that it held the technology transfer signing ceremony and joint research lab signboard hanging ceremony for the development of carbon neutrality technologies at the main building of KIST in Seoul on the 26th.

LG Chem and KIST signed an MOU for join R&D on technologies related to carbon neutrality, hydrogen energy, etc. in April of last year and drew up 10 prospective carbon neutrality technology projects. Among them, they decided to launch a joint research lab for the transfer of ‘electrochemical production technology of ethylene using CO₂ (carbon dioxide)’ and ‘biological production technology of organic acid using biomass/by-product gas.’

‘Electrochemical production technology of ethylene using CO₂ (carbon dioxide)’ refers to the technology of utilizing electricity to convert carbon dioxide directly into ethylene (C₂H₄) used as raw materials for various petrochemical products such as PVC. Once this technology is commercialized, it will be possible to not only use carbon dioxide to contribute to the realization of carbon neutrality, but also be able to directly produce ethylene that has high economic value, and therefore, it is expected that it will have huge ripple effects on the market. Read More

On the 27th, LG Chem announced that the company racked up revenue of KRW 11.61tn and operating profit of KRW 1.02tn in 1Q22.

Revenue reported +6.0% QoQ while operating profit reported +36.9% QoQ. On a yearly basis, the company reported +20.4% YoY in revenue and -27.3% YoY in operating profit.

Dong Seok Cha, Executive Vice President and CFO of LG Chem said, “Even under the harsh business environment, LG Chem achieved the highest-ever quarterly revenues and operating profits over KRW 1 trillion” and added

“The company expects revenue growth in the next quarter and will strive to generate sound profits by improving operational efficiency. This includes reducing costs, increasing sales price in accordance with rising raw material prices, strengthening product competitiveness, and improving customer satisfaction.”

1Q22’s performance breakdown for each business unit and 2Q22 projections are as follows:

The Petrochemicals Company reported revenue of KRW 5.96tn and operating profit of KRW 635bn. Under deteriorating external business environments including raw material price increases and lockdown in China, the company generated the highest-ever quarterly revenues and sound profitability based on its differentiated product portfolio that spans across POE(Poly Olefin Elastomer) for solar panel encapsulation films and SAP(Super Absorbent Polymer) for diapers. Read More

The Repsol Foundation and the Spanish Association of Automobile and Truck Manufacturers (ANFAC) signed a collaboration agreement for the joint development of actions to promote, disseminate, and boost sustainable, efficient, digitized, and safe mobility in all its aspects.

The agreement was signed by the Chairmen of Repsol and ANFAC, Antonio Brufau and Wayne Griffiths, respectively. The meeting and signing ceremony preceded a working meeting on the decarbonization of the sector, which was attended by various stakeholders in the automotive value chain, such as Foment del Treball, CIAC, and the UGT and CCOO trade unions, moderated by the professional services firm, Grant Thornton.

Both organizations share a common interest in collaborating to disseminate, raise awareness, and broaden society’s knowledge of the challenges and opportunities posed by the development of new mobility, characterized by its sustainability, connectivity, and decarbonization. In this sense, they aspire towards a global change both socially and in the public and private agents of the sector. To this end, they will focus on the joint organization of events and conferences on sustainable mobility, both nationally and locally. Read More

KBR Announces Strong First Quarter 2022 Financial Results

Revenue of $1.7 billion grew 17% compared to 2021.

Government Solutions posted revenue of $1,459 million in the quarter, a 25% increase over 2021, 21% organic. The increase in revenue is attributable to solid growth delivered across each of our government businesses, as follows:

Defense & Intel grew 8% compared to 2021 and 11% sequentially (all organic);

Science & Space grew 2% compared to 2021 and 10% sequentially (all organic);

Readiness & Sustainment grew 62% over 2021 (all organic), primarily attributable to elevated activity in the European Command as well as the wind down of Operation Allies Welcome; and

International grew 24% compared to 2021 and 14% sequentially due primarily to the acquisition of Frazer-Nash Consultancy.

Sustainable Technology Solutions posted $255 million of revenue in the quarter, a 14% decrease from 2021. The reduction compared to 2021 is attributable to the impact of our intent to exit commercial activities in Russia as well as timing of certain ongoing projects. In connection with our announced exit from Russian activities, we recorded a predominantly non-cash, pretax charge of $16 million, including a $17 million reduction in revenue and a $1 million net benefit in expenses. We have excluded the impact of these items from Adjusted EBITDA1 and Adjusted EBITDA1 margins.

Gross profit, net income (loss) attributable to KBR, adj. EBITDA1, and adj. EPS1 increased in line with the items described above and were impacted by the following:

Government Solutions profit contributions and adj. EBITDA1 margins were generally in line with management’s expectations. Margins in Government Solutions continue to benefit from strong project execution and performance scores in challenging technical areas that reflect high customer satisfaction. Read More

Achieving carbon neutrality by 2050 will require decarbonization in the energy sector, as well as such industries as steelmaking and transportation. The utilization of hydrogen energy is expected to play a significant part of this effort, and the Japanese government has included the establishment of elemental technologies for hydrogen production in its Green Growth Strategy.

The Japan Atomic Energy Agency (JAEA), a national research and development agency, and Mitsubishi Heavy Industries, Ltd. (MHI), have been contracted by the Agency for Natural Resources and Energy, part of the Ministry of Economy, Trade and Industry (METI), to conduct its Hydrogen Production Demonstration Project Utilizing Very High Temperature, and from this fiscal year initiated a program to produce hydrogen using a High Temperature Engineering Test Reactor (HTTR). Under this program, a newly built hydrogen production plant will be connected to an HTTR owned by JAEA, with the aim of proving the technology for hydrogen production utilizing the high temperature heat obtained from the HTTR.

The determination of specific renovations necessary to connect the hydrogen production plant, along with the licensing procedure, equipment modifications, and testing, will be conducted in stages. To support future advancements in technologies for hydrogen production, JAEA and MHI will also examine the feasibility of enlarging certain components to allow for large-scale hydrogen production (such as the high temperature isolation valve), and explore carbon-free hydrogen production technologies in combination with high temperature gas-cooled reactors. More

Galileo Technologies has secured a major cornerstone investment from Helmerich & Payne (“H&P”), North America’s largest land drilling solutions provider.

H&P invested $33 million into the Company in the form of a convertible note. The convertible note bears interest of 5% per annum and is due April 2027. If exercised, the note would convert into common shares of Galileo at an enterprise value of $1.35 billion.

The companies also plan to identify and pursue business development opportunities which, if successful, have the potential to reduce fuel costs and carbon emissions from power consumption on well-sites. Galileo’s technical expertise combined with H&P’s wide network of drilling sites provides significant opportunity for widespread application of the liquefaction technology in North America. Well drilling and completion is an energy intensive process and use of Galileo’s technology can enable the monetization of natural gas from any source (well head, flared, pipeline, stranded) by converting it into low carbon intensive LNG. The converted LNG can be reused on site or transported and stored with ease creating a virtual pipeline. The use of natural gas as a fuel source is economically and environmentally beneficial as it is significantly cheaper than other fuels such as diesel and has a lower carbon footprint. More

Neste’s Board of Directors has approved a merger plan according to which the company’s wholly-owned subsidiary Neste Engineering Solutions Oy will be merged into Neste Corporation. The merger is expected to take place on 30 September 2022 and it will only affect the Finnish operations. The entire personnel, approximately 750 professionals, will transfer to Neste Corporation. Contractual rights and obligations of Neste Engineering Solutions Oy will transfer to Neste Corporation upon completion of the merger.

Neste Engineering Solutions offers high quality technology and engineering services, including among others engineering, procurement and project management services for the oil & gas, petrochemicals and bio based industries. Neste Engineering Solutions operates in Finland, in Singapore and in the Netherlands.

In the next couple of months, Neste will further assess whether it is beneficial and feasible to also combine Neste Engineering Solutions’ businesses with Neste in the Netherlands and Singapore. Read More

Neste’s Interim Report for January–March 2022

Neste Corporation, Interim Report, 29 April 2022 at 9 a.m. (EET)

Strong financial performance amid markets impacted by the Ukraine war

First quarter in brief:

Comparable EBITDA totaled EUR 578 million (EUR 429 million)

EBITDA totaled EUR 916 million (EUR 585 million)

Renewable Products’ comparable sales margin was USD 806/ton (USD 699/ton)

Oil Products’ total refining margin was USD 10.3/bbl (USD 6.7/bbl)

Cash flow before financing activities was EUR -960 million (EUR -645 million)

Return on average capital employed (ROACE)* was 19.1% over the last 12 months (2021: 18.3%)

Leverage ratio was 12.0% at the end of March (31.12.2021: 0.6%). Renewable Products’ second-quarter sales volumes are expected to be slightly higher than in the previous quarter. Waste and residue markets are anticipated to remain tight as their demand continues to be robust. Following the oil product and renewable feedstock market price increases in the latter part of the first quarter, our second-quarter sales margin is expected to be within the range USD 675-750/ton. Read More

A recent YouGov survey shows that 58% of UK adults support the demand of Just Stop Oil to stop new oil and gas and rather than being counterproductive, disruptive action by Just Stop Oil has potentially increased the number of people in the UK willing to take climate action.

In polling commissioned by Social Change Lab, three nationally representative surveys of over 2,000 adults were conducted on 29th March, 9th April and 19th April.

Results from the latest survey on 19th April, showed that public awareness of Just Stop Oil increased from close to zero before the actions began, to over 63% in just two and a half weeks and that 58% of UK adults now support the demands of Just Stop Oil, compared with 23% against and 19% neutral.

The survey also measured people’s satisfaction with the efforts of the UK government and found that only 26.1% of UK adults thought the government was doing a lot to tackle climate change, while 46% disagreed with this statement.

The detailed results of the survey show that rather than putting people off taking climate action as some have claimed, three weeks after the Just Stop Oil protests began, the number of people who said they were likely to talk with friends and family about climate change, contact their MP about climate issues or attend a legal protest about climate change over the next 12 months had risen by a statistically significant amount – from 8.7% to 11.3%, equivalent to approximately 1.7 million adults. Read More

| Oil and Gas Blends | Units | Oil Price $ | change |

| Crude Oil (WTI) | USD/bbl | $106.50 | Up |

| Crude Oil (Brent) | USD/bbl | $109.10 | Up |

| Bonny Light | USD/bbl | $107.10 | Up |

| Saharan Blend | USD/bbl | $108.29 | Up |

| Natural Gas | USD/MMBtu | $6.82 | Down |

| OPEC basket 27/04/22 | USD/bbl | $105.33 | — |

Dana Incorporated to Participate in Oppenheimer Industrial Growth and Wells Fargo Industrials Conferences

Dana Incorporated (NYSE: DAN) announced today it will participate in the virtual Oppenheimer 17th Annual Industrial Growth Conference on May 3, 2022. Beginning at 12:45 p.m. EDT, Dana’s Senior Vice President and Chief Financial Officer Timothy Kraus will provide a brief overview of the company and answer questions for approximately 35 minutes. Dana will also be participating in the 2022 Wells Fargo Industrials Conference on May 5. Mr. Kraus will present and answer questions from 2 p.m. to 2:35 p.m. EDT. Read More

Wintermar Offshore Marine (WINS:JK) has announced results for 1Q2022. Total revenue was up 3% YOY to US$10.5 million, with stronger chartering revenues compensating for a drop in Owned Vessel revenue from COVID-19 delays.

Oil prices spiked in 1Q2022 as a result of the war in Ukraine and sanctions against Russian oil and gas. The ensuing oil shortage sparked a rise in investment in oil exploration and a resurgence in drilling programs in Asia. The Company was impacted quite severely by a spike in Omicron infections on the fleet, which led to prolonged delays in the commencement of operations in international as well as domestic charters in 1Q2022. Owned Vessel revenues declined but this was compensated by a jump in revenues from the Chartering and Other Services Divisions. Read More

U.S. Rig Count is up 2 from last week to 695 with oil rigs up 1 to 549, gas rigs up 1 to 144 and miscellaneous rigs unchanged at 2.

Canada Rig Count is down 2 from last week to 101, with oil rigs down 1 to 48, gas rigs down 1 to 53.

| Region | Period | Rig Count | Change from Prior |

| U.S.A | 22nd April 2022 | 695 | +2 |

| Canada | 22nd April 2022 | 101 | -2 |

| International | March 2022 | 815 | — |

In concert with his supplemental request to Congress to support Ukraine, President Biden will send a proposal for a comprehensive legislative package that will enhance the United States Government’s authority to hold the Russian government and Russian oligarchs accountable for President Putin’s war against Ukraine. The proposals were crafted in close consultation with interagency partners, including the Department of the Treasury, the Department of Justice, the Department of State, and the Department of Commerce. The Biden Administration looks forward to working closely with Members of Congress as a whole to implement this package of proposals.

This package of proposals will establish new authorities for the forfeiture of property linked to Russian kleptocracy, allow the government to use the proceeds to support Ukraine, and further strengthen related law enforcement tools.

Establishing a Streamlined Administrative Authority to Seize and Forfeit Oligarch Assets: This proposal aims to streamline the process for seizure of oligarch assets, expand the assets subject to seizure, and enable the proceeds to flow to Ukraine. It would:

Create a new, streamlined administrative process involving the Departments of the Treasury and Justice, for the forfeiture of property in the United States that is owned by sanctioned Russian oligarchs and that has a connection to specified unlawful conduct. A forfeiture decision would be reviewable in federal court on an expedited basis.

Create a new criminal offense, making it unlawful for any person to knowingly or intentionally possess proceeds directly obtained from corrupt dealings with the Russian government.

Enabling the Transfer of the Proceeds of Forfeited Kleptocrat Property to Ukraine to Remediate Harms of Russian Aggression Read More

US crude/condensates exports to Europe are rising in April as the continent pivots further away from Russian supplies. And the growing flows to Europe are being loaded onto larger tankers, likely reflecting a longer-term trend.

US crude exports to Europe stand at almost 1.5mbd so far this month, up by 200kbd from the March total. Departures along the route are currently at their highest for any month since March 2020. Rising US flows to Europe are underpinned by the desire from many European refiners to reduce exposure to Russian crude. European trading firms are also scaling down activity in Russian crude with numerous public statements made to stop trading Russian crude, in line with vague indications from European politicians.

In addition to the total flow volume rising, so too is the volume of cargo travelling on larger tankers. European buyers have historically received US crude/condensates cargoes on Aframax tankers, but the recent surge in demand is prompting flows via Suezmaxes and VLCCs. Read More

The war in Ukraine has dealt a major shock to commodity markets, altering global patterns of trade, production, and consumption in ways that will keep prices at historically high levels through the end of 2024, according to the World Bank’s latest Commodity Markets Outlook report.

The increase in energy prices over the past two years has been the largest since the 1973 oil crisis. Price increases for food commodities—of which Russia and Ukraine are large producers—and fertilizers, which rely on natural gas as a production input, have been the largest since 2008. Read More

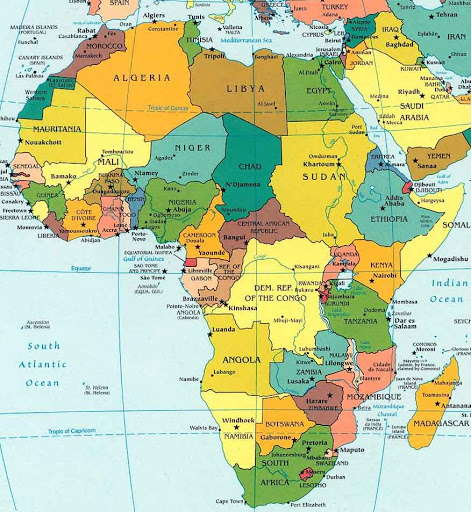

Sub-Saharan African countries find themselves facing another severe and exogenous shock. Russia’s invasion of Ukraine has prompted a surge in food and fuel prices that threatens the region’s economic outlook. This latest setback could not have come at a worse time—as growth was starting to recover and policymakers were beginning to address the social and economic legacy of COVID-19 pandemic and other development challenges. The effects of the war will be deeply consequential, eroding standards of living and aggravating macroeconomic imbalances. There are three main channels through which the war is impacting countries—with notable differentiation both across and within countries: Read More

ENI 2022 Oulook

The Company is issuing the following operational and financial guidance for the FY ’22 based on information available to date, management’s judgement of the possible risks and uncertainties associated with the ongoing war in Ukraine and assuming no material disruptions in Russian gas flow:

E&P: Hydrocarbon production is confirmed as expected at 1.7 million boe/d at the Company’s price deck of 80 $/bbl in 2022.

GGP: Revised upwardly the guidance of adjusted Ebit now forecast at around €1.2 billion vs a previous target of €0.9 billion considering the expected evolution of the market.

Our main price sensitivities foresee a variation of €140 million in free cash flow for each one-dollar change in the price of Brent crude oil and around €600 million for a 5 USD/cent movement in the USD/EUR cross rate vs our new assumption of 1.115 USD/EUR for 2022 and considering 90$/bbl Brent price.

Plenitude & Power: Plenitude EBITDA is expected higher than €0.6 billion in line with our guidance. We confirm our guidance of more than 2 GW of installed capacity of renewable generation at 2022 year-end (at 100%). We also confirm our plan to list on the Milan Stock Exchange our subsidiary Plenitude through an IPO within 2022 subject to market conditions.

Downstream: Adjusted Ebit (R&M with ADNOC pro-forma and Versalis) is raised to positive from our previous expectation of negative.

Adjusted cash flow before working capital at replacement cost is expected to be €16 billion at 90 $/bbl (from more than €15 billion previously).

Organic capex is seen at €8 billion in line with our original guidance of €7.7 billion assuming the EUR vs USD exchange rate of our initial planning assumptions.

Cash neutrality is expected at a Brent price of around 46 $/bbl.

Leverage ante IFRS 16 is seen well below our 0.2 ceiling at 2022 year-end. Read More

Oil prices have fallen particularly sharply over the past week as traders worry that China’s oil demand will take a big hit from reinstated lockdowns. Brent blend for June delivery fell USD 10.84/bbl w/w to settle at USD 102.32/bbl, while WTI for June delivery fell USD 9.07/bbl to USD 98.54/bbl. Values were more robust along the curve, with Brent for delivery five years out falling just USD 1.44/bbl w/w to USD 72.70/bbl.

The fall in prices gained pace on 25 April after testing of Beijing residents began following COVID cases being reported in the Chaoyang district of the city. While volatility in the energy markets remains high, there are signs that it’s declining, with intra-day trading ranges also trending lower. Front-month Brent appears to be in the latter stages of its third wave since Russia’s invasion of Ukraine. The amplitude of the waves from low to high is declining; the first wave spanned USD 43 per barrel; the second USD 23/bbl, and the third USD 14/bbl. The dampening of the cycles is mirrored in smaller intra-day trading ranges; there were 14 days in March with an intra-day trading range of more than USD 8/bbl, but there has been just one so far in April. Read More

OilandGasPress Energy Newsbites and Analysis Roundup |Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.