Energy News to 5 Apr. 2022. OPEC daily basket price stood at $106.23/bl, Mon. 4 April 2022

Oil futures rose in early trading as the potential for more sanctions following alleged war crimes by Russian troops in Ukraine added to concerns about supply disruptions, while Iran nuclear talks stalled.

Aramco, Hyundai Motor Group, and King Abdullah University of Science and Technology (KAUST), have agreed to jointly research and develop an advanced fuel for an ultra lean-burn, spark-ignition engine that aims to lower the overall CO2 emissions of a vehicle.

The 2-year partnership seeks the development of an optimal fuel formulation for use in combination with a novel combustion system coupled with an electrified hybrid vehicle.

The research team aims to unleash greater CO2 reduction potentials by deploying Hyundai Motor Group’s ultra-lean burn combustion design in a modern hybrid vehicle.

Each party brings unique expertise to the partnership. Aramco, which has significant R&D and operational experience in fuel formulations, will leverage in-house expertise to carefully design an optimal fuel formulation. Hyundai Motor Group, with its automotive and technology leadership, will provide a state-of-the-art ultra-lean gasoline engine for use by the research team. The tests will be conducted by researchers in the Clean Combustion Research Center (CCRC) at KAUST. Read More

Why Renewables Can’t Solve Europe’s Energy Crisis

Germany is preparing for gas rationing. France’s power grid operator is asking consumers to use less electricity. In the UK, protests are breaking out over the latest electricity price hike that plunged millions of households into what one local think tank called fuel stress. Europe has a serious energy problem. Read More

Abu Dhabi National Oil Company (ADNOC), Intercontinental Exchange (ICE) and partners in ICE Futures Abu Dhabi (IFAD) have officially celebrated the first anniversary of trading of the Murban Futures Contract on the IFAD commodities exchange.

IFAD began operations on 29 March 2021 and during its first year, the equivalent of around 1.5 billion barrels of Abu Dhabi’s flagship lower-carbon Murban crude oil was traded on the exchange. IFAD has attracted over 90 market participants and Murban is now more widely available to both physical purchasers of crude oil and financial market participants around the world, reinforcing the United Arab Emirate’s (UAE) role as a reliable global energy supplier.

The introduction of the Murban Futures Contract was backed by ICE, ADNOC and nine of the world’s largest energy companies who joined IFAD as founding partners; BP, GS Caltex, INPEX, ENEOS, PetroChina, PTT, Shell, TotalEnergies and Vitol. Read More

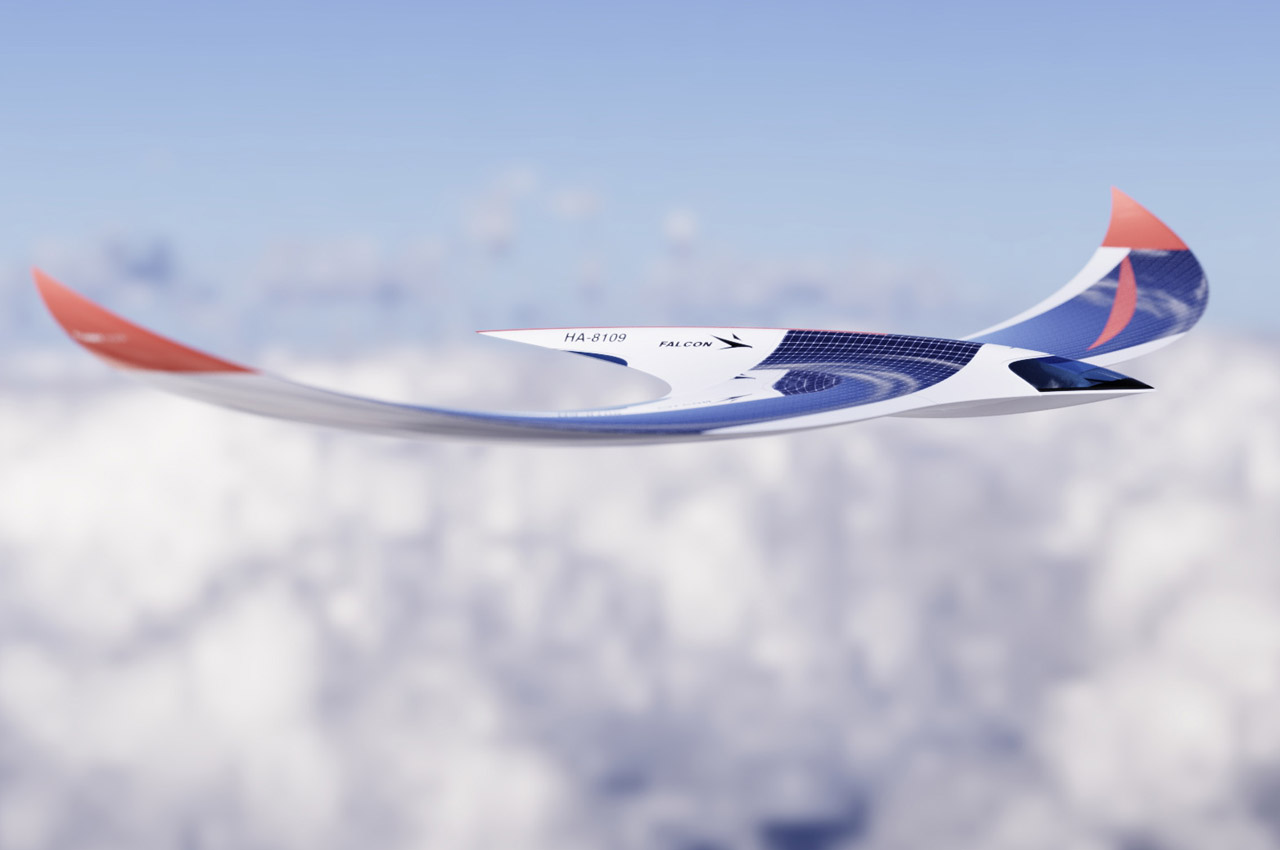

Solar-powered airplanes are the future in this quest, and this concept gives us a look at the horizon of air travel in a decade’s time.

Solar Impulse solar-powered aircrafts developed by US-Spanish aerospace firm Skydweller Aero have shown us what totally fuel independent flying machines are capable of – sans any dependence on hauling fuel or need to refuel by pit stop landing. Venturing on intercontinental flights and countless flying hours, the solar aircraft opened up the world to the possibilities of totally sustainable flights. Laszlo Nemeth wants to carry forward the zero-emission dream of commercial and private aircraft flights with this intriguing concept. There are no rudders or rear wing or vertical stabilizers which actuate the direction of the aircraft. Read More

Cenovus Energy Inc. (TSX: CVE) (NYSE: CVE) is announcing the suspension of its crude oil price risk management activities related to West Texas Intermediate (WTI). Given the strength of Cenovus’s balance sheet and liquidity position, the company has determined these programs are no longer required to support financial resilience. Cenovus will remain well positioned to generate significant free funds flow over the long term. The company plans to announce on April 27, 2022 its first-quarter results, details on its plan for increasing shareholder returns and updated 2022 corporate guidance.

Realized losses on all risk management positions for the three months ending March 31, 2022 are expected to be about $970 million. Actual realizations for the first quarter of 2022 will be reported with Cenovus’s first-quarter results. Based on forward prices as of March 31, 2022, estimated realized losses on all risk management positions for the three months ending June 30, 2022 are currently expected to be about $410 million. Actual gains or losses resulting from these positions will depend on market prices or rates, as applicable, at the time each such position is settled. Cenovus plans to close the bulk of its outstanding crude oil price risk management positions related to WTI over the next two months and expects to have no significant financial exposure to these positions beyond the second quarter of 2022. More

Petrobras informs that it received two official letters from the Ministry of Mines and Energy, confirming Mr. Luiz Rodolfo Landim to the election to the Board of Directors (CA) of the company and to the presidency of the CA, and of Mr. Adriano José Pires Rodrigues to the election to the Board of Directors and to the nomination for the presidency of Petrobras. The company clarifies that, so far, it has not received information from the Ministry of Mines and Energy about the replacements of the nominees. Read More

| Oil and Gas Blends | Units | Oil Price $ | change |

| Crude Oil (WTI) | USD/bbl | $104.10 | Up |

| Crude Oil (Brent) | USD/bbl | $108.40 | Up |

| Bonny Light | USD/bbl | $108.70 | Up |

| Saharan Blend | USD/bbl | $110.65 | Up |

| Natural Gas | USD/MMBtu | $5.85 | Up |

| OPEC basket 04/04/22 | USD/bbl | $106.23 | Up |

Petrobras, following up on the statement released on 12/14/2020, informs that its Executive Board has approved the closing of the competitive process, which was in the non-binding phase, for the sale of 50% of its interest in the concessions of Marlim, Voador , Marlim Leste and Marlim Sul, collectively known as Pole Marlim, located predominantly in deep waters in the Campos Basin. Read More