Energy top stories to 16/08/22. OPEC daily basket price stood at $100.04/bl, 15 August 2022

Ford Motor Company announced a new price list for its electric vehicles (EV) due to “significant material cost increases and other factors.” Ford is adjusting the MSRP on the F-150 Lightning for the first time since it was revealed in May 2021 and has honored MSRP for all customer orders to date. Due to significant material cost increases and other factors, Ford has adjusted MSRP starting with the opening of the next wave of F-150 Lightning orders. Read More–>

China announced more military drills around Taiwan as the self-governing island’s president met with members of a new U.S. congressional delegation on Monday, threatening to renew tensions between Beijing and Washington just days after a similar visit by U.S. House Speaker Nancy Pelosi angered China. Read More–>

Allstar Business Solutions Limited, the UK’s leading fuel management and EV charging card company, announces a new partnership with leading sustainable energy business, GRIDSERVE. The collaboration means that the Allstar One Electric card is now accepted as the first third-party payment method alongside contactless on the GRIDSERVE Electric Highway.

The partnership enables the Allstar One Electric card and roaming cards that are part of the Allstar Network, such as Mina Chargepass to have full access to the GRIDSERVE Electric Highway including their two flagship Electric Forecourts® in Braintree and Norwich, as well as their High Power Electric Super Hubs and Medium Power Electric Hubs that cover 85% of the UK’s motorway service areas. The two companies working together will give more EV charging options through the Allstar One Electric card for fleet customers charging on the road. For fleet managers, drivers using the Allstar One Electric card, over the standard contactless payment method, allows for continued control and visibility during the transition to fleet e-mobility. More

Siemens Gamesa has secured its first order in India with Azure Power India Private Limited (Azure Power) to supply 96 SG 3.6-145 wind turbines for a 346 MW project in the state of Karnataka.

The project opens a new partnership in India with Azure Power, a leading independent sustainable energy solutions provider and power producer in India. Azure has a pan India portfolio of over 7.4 GW of renewable energy assets either operational or under construction in the country, primarily in solar.

The wind turbine supply agreement, a first for Azure, will cater to its projects under the SECI Hybrid IV, SECI XI tenders and its other energy pipelines. When fully deployed these wind turbines will produce enough clean energy to meet the power needs of over one million Indian homes. Read More

Siemens Gamesa has secured a new deal with ACEN CORPORATION (ACEN), a leading renewables developer in Southeast Asia, to supply 14 units of the SG 5.0-145 turbines in the Philippines following the country’s first round of renewable energy auctions.

The order follows the signing last year of the country’s largest wind project with the same customer for the 160 MW Pagudpud wind farm in Balaoi & Caunayan. This project came as the country’s wind industry emerged again in 2021 having been suspended for several years.

The awarded 70 MW Capa wind farm, located in Caparispisan, Ilocos Norte province, is expected to be completed and start operations by the first quarter of 2024. Siemens Gamesa also secured a contract to provide five years of operation and maintenance services for the wind project.

The first 81 MW wind farm in Caparispisan by North Luzon Renewables was installed in 2014 and has operated as ACEN’s largest wind project in the Philippines. This project was also supplied by Siemens Gamesa. To date, Siemens Gamesa has installed 60% of the total wind power capacity in the country. Read More–>

Engineers at MIT and elsewhere have found that, with no need for any new investment in equipment, the energy output of such wind farm installations can be increased by modeling the wind flow of the entire collection of turbines and optimizing the control of individual units accordingly.

The increase in energy output from a given installation may seem modest — it’s about 1.2 percent overall, and 3 percent for optimal wind speeds. But the algorithm can be deployed at any wind farm, and the number of wind farms is rapidly growing to meet accelerated climate goals. If that 1.2 percent energy increase were applied to all the world’s existing wind farms, it would be the equivalent of adding more than 3,600 new wind turbines, or enough to power about 3 million homes, and a total gain to power producers of almost a billion dollars per year, the researchers say. And all of this for essentially no cost. Read More

Commodity correction may have exhausted itself

The correction that for some commodities already started back in March has since the end of July increasingly been showing signs of reversing, driven by recent economic data strength, dollar weakness and signs inflation may have peaked. With the broad position adjustments having run their course, the focus has returned to supply which in many cases remains tight, thereby providing renewed support, especially across the sectors of energy and key agriculture commodities.

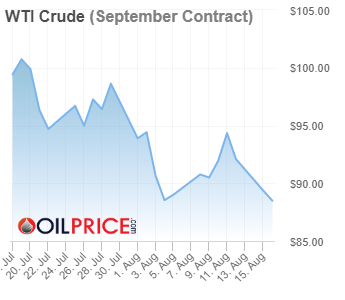

Crude oil

The downward trending price action in WTI and Brent for the past couple of months is showing signs of reversing on a combination of the market reassessing the demand outlook amid continued worries about supply and who will and can meet demand going forward. The recovery from below $95 in Brent and $90 in WTI this week was supported by signs of softer US inflation reducing the potential peak in the Fed fund rates, thereby improving the growth outlook. In addition, the weaker dollar and improving demand, especially in the US where gasoline prices at the pumps have fallen below $4 per gallon for the first time since March.

In addition, the International Energy Agency (IEA) lifted its global consumption estimate by 380 kb/d, saying soaring gas prices amid strong demand for electricity is driving utilities to switch from expensive gas to fuel-based products. Meanwhile, OPEC may struggle to raise output in the coming months due to limited spare capacity. While pockets of demand weakness have emerged in recent months, we do not expect these to materially impact on our overall price-supportive outlook. Supply-side uncertainties remain too elevated to ignore, not least considering the soon-to-expire releases of crude oil from US Strategic Reserves and the EU embargo of Russian oil fast approaching. With this in mind, we maintain our $95 to $115 range forecast for the third quarter.

Gold (XAUUSD)

The recently under siege yellow metal was heading for a fourth weekly gain, supported by a weaker dollar after the lower-than-expected US CPI and PPI data helped reduce expectations for how high the Fed will allow rates to run. However, rising risk appetite as seen through surging stocks and bond yields trading higher on the week have so far prevented the yellow metal from making a decisive challenge at key resistance above $1800/oz, and the recent decline in ETF holdings and low open interest in COMEX futures points to a market that is looking for a fresh and decisive trigger. We believe the markets newfound optimism about the extent to which inflation can successfully be brought under control remains too optimistic and together with several geopolitical worries, we see no reason to exit our long-held bullish view on gold as a hedge and diversifier.

Gold has found some support at the 50-day moving average line at $1783, and needs to hold $1760 in order to avoid a fresh round of long liquidation the short-term. While some resistance is located just above $1800 gold needs a decisive break above $1829 in order to trigger the momentum needed to attract fresh buying in ETFs and managed money accounts in futures. Read More

Commodities

Speculators in commodities reacted very mixed to the mentioned developments with strong gains in metals, both precious and industrials being more than offset by losses in energy and agriculture commodities, most notably natural gas, gas oil, wheat, and sugar.

Overall, the Bloomberg Commodity index traded softer by 0.6% with speculators showing no firm conviction after increasing bullish bets across the 24 major commodity futures tracked in this by 1% to 853k, a small recovery from the two-year low recorded the previous week. Biggest reductions seen in crude oil, natural gas and sugar with net buying concentrated in metals, soybeans, and corn.

Energy: The recent weakness in crude oil prices and refinery margins in response to signs of softening demand helped drive an overall 29k contracts reduction in bullish crude oil bets to 353k lots, the second lowest level since April 2020. The reduction was primarily driven by speculators exiting gross WTI longs amid a continued release of oil from strategic reserves and weekly data pointing to a softening in gasoline demand. Read More

Bentley’s latest models achieved the sign-off required to begin production of the Bentayga Extended Wheelbase, on their return to the factory after summer shutdown.

The Bentayga EWB defines the benchmark for combining world-class luxury and technological innovation whilst demonstrating new heights of craftsmanship and comfort. Over 132 hours are required to handcraft the new Bentley flagship by the skilled craftspeople at home of Bentley’s carbon neutral luxury automotive factory in Crewe, England. The new model showcases lofted quilting, intricate veneer and metal overlays, and offers a unique interior ambience with Bentley’s Diamond Illumination.

Over 50% of customer orders include the Bentley Airline Seat Specification or Bentley Diamond Illumination, whilst circa 30% of customers include the extended paint range, metal overlays in the veneer and open pore wood. All demonstrating the importance of the hand craftsmansip at Crewe.

Digital Craftsmanship

Bentley’s instantly recognisable diamond quilting has been reimagined in a dramatic and contemporary new design. Like all great design, the final execution looks simple, but the obsession to detail behind it encapsulates all that is unique about Bentley interiors.

Developed and executed through a combination of digital craftsmanship and precision technology, the symmetrical pattern at the top of the seat backs stretches the diamonds as they move away from the centre line of the seats. The doors, in turn, boast an asymmetric pattern, that accentuates the length of the door and the rear cabin as a whole.

Within each diamond, the flawless leather is perforated with holes of less than 1 mm diameter. Each hole has been digitally positioned with precision by one of Bentley’s interior designers to achieve a cohesive overall design – the ‘digital-crafting’ process.

Read More

In the United States, tidal energy has the potential to power up to 21 million homes (about 15% of the country’s total number of houses). But today, the technologies are still in the early stages of development. They are also expensive, which is why Bharath recently partnered with one of the country’s few tidal energy test sites, the University of New Hampshire’s Living Bridge project, where researchers can study a real-world tidal turbine beneath New Hampshire’s Portsmouth Memorial Bridge. Collaborating with the University of New Hampshire team, Bharath and his NREL researchers will perform a crucial job for the project. They will design and build tools to collect the data needed to understand how well this turbine is operating so tidal energy can grow into an affordable clean energy resource for communities across the United States.

“Tides are an awesome renewable energy resource because they’re very predictable,” Bharath said. “To mess up the tidal cycles, you’d have to stop the moon or stop Earth’s rotation.” That predictability makes tidal energy a valuable complement to solar power and wind energy; when the sun sets and winds lag, tides keep on surging.

Tides are also the practical choice to power the University of New Hampshire’s so-called “smart bridge.” Outfitted with sensors that monitor the bridge’s structural health as well as weather, traffic patterns, and the Piscataqua River flowing beneath it, the bridge is a kind of living laboratory to study bridge structures, the latest sensor designs, and renewable energy technologies. The experimental tidal turbine installed in the river not only powers those sensors; it also provides clean energy to raise and lower the bridge, allowing boats to pass through, and even powers a few homes nearby. Read More

HydrogenOne Capital Growth plc announced that it has signed definitive agreements for an investment of £8.4m (EUR 10m) in Strohm Holding B.V. (“Strohm”). HydrogenOne is investing alongside Strohm’s existing investors Shell Ventures,Chevron Technology Ventures and Evonik Venture Capital, in the first close of a funding round totalling £11.8m (EUR 14m). HydrogenOne may also invest up to a further £1.7m (EUR 2m) in the second close of this funding round, which is anticipated to be at least £5.1m (EUR 6m) in aggregate in addition, expected later in 2022.

Following the investment in Strohm, HydrogenOne will have the right to a board seat Read More

Reference is made to Aker BP’s press release from 8 August 2022, where the company announced its plan to buy up to 1,000,000 own shares in connection with the company’s employee share saving plan.

In the period from 9 August to 12 August, the company purchased 200,000 shares at an average price of NOK 325.57.

After these transactions, Aker BP ASA owns a total of 525,655 own shares, corresponding to 0.08% percent of the company’s share capital. Read More

| Oil and Gas Blends | Units | Oil Price $ | change |

| Crude Oil (WTI) | USD/bbl | $88.52 | Down |

| Crude Oil (Brent) | USD/bbl | $93.88 | Down |

| Bonny Light | USD/bbl | $118.06 | Down |

| Saharan Blend | USD/bbl | $117.77 | — |

| Natural Gas | USD/MMBtu | $8.78 | Up |

| OPEC basket 15/08/22 | USD/bbl | $100.04 | Down |

The shares in Aker BP ASA will be traded ex dividend USD 0.525 (NOK 5.20559) as from today, 16 August 2022.

The payment date will be on or about 24 August 2022. Read More

Aker BP (operator) and licence partners Petoro and LOTOS Exploration & Production Norge submitted a plan for development and operation (PDO) for Trell & Trine to the Ministry of Petroleum and Energy (MPE). This development will utilise the planned extended lifetime for the Alvheim field, increase production and reduce both unit costs and CO2 per barrel.

“Trell & Trine is the third PDO submission in the Alvheim area in just one year, following close on the heels of Frosk and Kobra East & Gekko (KEG). This is yet another confirmation of a success story on Alvheim that we and our partners can be proud of,” says Aker BP CEO Karl Johnny Hersvik. Read More

Aker BP has made its second hydrocarbon discovery in a month near the Skarv field off the coast of Norway, according to a filing by the Norwegian Petroleum Directorate (NPD) on August 12.

The Norwegian player drilled a well 14 km northeast of the Skarv field in the Norwegian Sea, which encountered an oil and gas column some 115 m in length, the NPD said. Preliminary estimates place the discovery’s size at between 1.7 and 5.7mn m3 of recoverable oil equivalent, or 10.7-35.9mn barrels of oil equivalent.

Aker BP, the operator of production licence 941 where the find was made, along with its Polish partner PGNiG, which controls the remaining 20%, will consider exploiting it via the Skarv field, which is also operated by Aker BP, the NPD said. This is the first well to be drilled at the licence. Read More

PetroChina Company Limited (HKSE stock code 0857; NYSE symbol PTR; SSE stock code 601857) announced that it has notified the New York Stock Exchange (the “NYSE”) on 12 August 2022 (Eastern Time in the U.S.) that it will apply for a voluntary delisting of its American Depositary Shares (“ADSs”) from the NYSE pursuant to the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”) and relevant rules. Read More

MCWA Celebrates Completion of New Solar Array

Monroe County Water Authority joined with the New York Power Authority (NYPA), developer Sol Systems, local dignitaries and elected officials to celebrate the completion of its new 5 MW ground-mounted solar array in Penfield with a ‘flip the switch’ ceremony. The project is one of the first in New York State to utilise bifacial solar modules and single axis tracking, which allows light to enter both sides of a panel, increasing total energy generation and also adjusting to track the movement of the sun. Read More

U.S. Rig Count is down 1 from last week to 763 with oil rigs up 3 to 601, gas rigs down 1 to 160 and miscellaneous rigs down 3 to 2.

Canada Rig Count is down 2 from last week to 201, with oil rigs down 3 to 137, gas rigs up 1 to 64.

| Region | Period | Rig Count | Change from Prior |

| U.S.A | 12 August 2022 | 763 | -1 |

| Canada | 12 August 2022 | 201 | -2 |

| International | July 2022 | 833 | +9 |

The New York Power Authority and National Grid NY announced the greenlighting of a critically important transmission line build in the North Country, known as Smart Path Connect. The New York State Public Service Commission (PSC) approved the 100-mile transmission line project at its regularly scheduled monthly meeting yesterday. The transmission line build out is necessary to help meet the requirements of the Climate Leadership and Community Protection Act and reinforces the foundational pillars and strategic priorities of the Power Authority’s Vision 2030 Strategic Plan. Read More

OilandGasPress Energy Newsbites and Analysis Roundup |Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: @OilAndGasPress on Twitter |