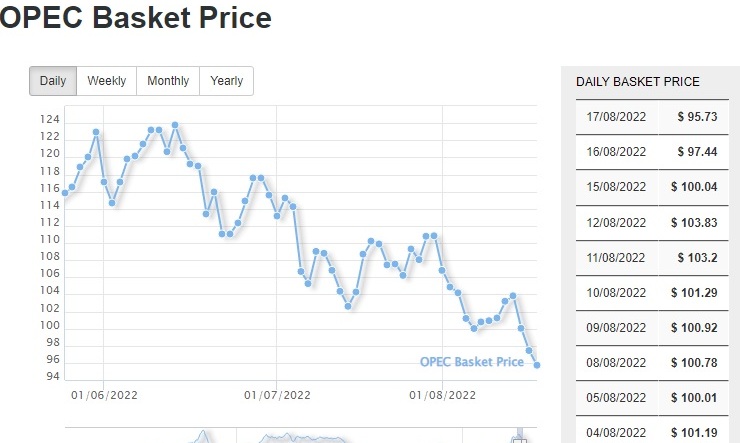

Energy top stories to 22/08/22. OPEC daily basket price stood at $99.86/bl, 19 August 2022

U.S. Rig Count is down 1 from last week to 762

DNO ASA, today entered into a transaction agreement pursuant to which RAK Petroleum plc will transfer its ownership of Mondoil Enterprises LLC to DNO. The all-share transaction comprises Mondoil Enterprises’ 33.33 percent indirect interest in privately-held Foxtrot International LDC whose principal assets are operated stakes in offshore production of gas and associated liquids in Côte d’Ivoire, forming a bridgehead for DNO in West Africa.

“As DNO targets expansion beyond the Kurdistan region of Iraq and the North Sea, the move into Côte d’Ivoire is an important first step into a highly prospective region offering a broad set of growth opportunities through acquisition of producing fields, development assets and exploration licenses,” said Bjørn Dale, DNO’s Managing Director. The Company is already evaluating other opportunities in the region, he added.

Foxtrot International holds a 27.27 percent interest in and operatorship of Block CI-27 offshore Côte d’Ivoire containing the country’s largest reserves of gas, produced together with condensate and oil, from four offshore fields tied back to two fixed platforms, meeting more than three-quarters of the country’s gas needs. Foxtrot International also operates an exploration license offshore Côte d’Ivoire, Block CI-12, in which it holds a 24 percent interest.

In addition to the Foxtrot gas field, which began production in 1999, Block CI-27 contains the Mahi gas field, developed in 2012, as well as the Marlin oil and gas field and the Manta gas field which began production in 2016, following a four-year, USD 1 billion development campaign by the joint venture. Gas produced from these fields is transported by pipeline to fuel power stations in Abidjan pursuant to a gas sale and purchase (take-or-pay) agreement put into force in June 1999 and subsequently increased to 140 million cubic feet per day with a base price of USD 6.00 per MMBtu, subject to an indexation formula which has lifted the current price to USD 6.47 per MMBtu. Read More

Ford Motor Company will soon be able to attribute all its electricity supply in Michigan to clean energy, a major step toward Ford’s goal to reach carbon neutrality. As part of the new agreement announced today, DTE will add 650 megawatts of new solar energy capacity in Michigan for Ford by 2025. The purchase is a strategic investment in Michigan through DTE’s MIGreenPower program and is the largest renewable energy purchase ever made in the U.S. from a utility.* According to data collected by the Solar Energy Industries Association, once installed, the arrays will increase the total amount of installed solar energy in Michigan by nearly 70%.

“This unprecedented agreement is all about a greener and brighter future for Ford and for Michigan,” said Jim Farley, president and CEO, Ford Motor Company. “Today is an example of what it looks like to lead… to turn talk into action.” Read More–>

A pair of Georgia siblings have been awarded $1.7billion in punitive damages from Ford for a 2014 car crash that killed their parents, the largest ever civil verdict to have been awarded in the state.

In 2014, Voncile and Melvin Hill died after their Ford F-250 blew a tire and rolled over. The couple – aged 62 and 74 – were on their way to pick up a new tractor part to be used on their farm in Georgia. A jury this week ruled that they should have survived the crash and would have had the roof of their F-250 been designed properly. Instead, it crunched under the impact of the roll and the pair later died of injuries.

The couple’s adult children Adam and Kim, both in their fifties, sued Ford and Pep Boys, the auto shop that fitted the vehicle’s tires four years before the crash.

They were first awarded $24million in compensatory damages, of which Ford is liable for 70 percent $16.8million) and Pep Boys, the autoshop, is liable for 30 percent ($7.2milion).

The jury then awarded the family $1.7billion in punitive damages, which are reflective not of compensation for the family but of the amount the jury feels is sufficient to punish Ford and deter it from making the same mistake in future.

Under Georgia law, the state is given 75 percent of the $1.7billion, leaving $425million for the Hill family to claim. In total, the family now stands to gain $450million from the car manufacturer. Ford, which is worth $60billion, says it will appeal the decision. Read More

Ford cuts 3,000 jobs in North America and India as it plays catch up with Tesla to develop EVs … months after firm’s heir said its $40k F-15 needs to be a success or it will put the company at risk Ford Chief Executive Jim Farley has been signaling for months that he believed the Dearborn, Michigan automaker had too many people, and that not enough of its workforce had the skills required for success as the auto industry shifts to electric vehicles and digital services. Read More

The International Air Transportation Association (IATA) is disappointed by Nigeria’s lack of action to address the repatriation of airline funds after Dubai-based Emirates announced the suspension of services to the country from September.

The association expressed concern over $464 million worth of foreign airlines’ funds currently trapped in the country, which increased from $450 million in July, the association said in a tweet.

The refusal by Nigeria to allow foreign airlines to repatriate their earnings is responsible for the development, it said.

IATA’s many warnings that failure to restore timely repatriation will hurt Nigeria with reduced air connectivity are proving true with the withdrawal of Emirates from the market, the association said in a tweet.

“Airlines can’t be expected to fly if they can’t realize revenue from ticket sales. Loss of connectivity harms the economy, hurts investor confidence, and impacts jobs and people’s lives. The government of Nigeria needs to prioritize the release funds before more damage is done,” another tweet read. Read More–>

| Oil and Gas Blends | Units | Oil Price $ | change |

| Crude Oil (WTI) | USD/bbl | $90.67 | Up |

| Crude Oil (Brent) | USD/bbl | $96.50 | Up |

| Bonny Light | USD/bbl | $118.10 | == |

| Saharan Blend | USD/bbl | $117.77 | — |

| Natural Gas | USD/MMBtu | $9.74 | Up |

| OPEC basket 19/08/22 | USD/bbl | $99.86 | Up |

U.S. Rig Count is down 1 from last week to 762 with oil rigs unchanged at 601, gas rigs down 1 to 159 and miscellaneous rigs unchanged at 2.

| Region | Period | Rig Count | Change from Prior |

| U.S.A | 12 August 2022 | 762 | -1 |

| Canada | 12 August 2022 | 201 | -2 |

| International | July 2022 | 833 | +9 |

TotalEnergies and Eni (operator) have made a significant gas discovery at the Cronos-1 well, in Block 6, offshore Cyprus. This discovery follows the Calypso-1 discovery made on the same Block in 2018. Located at approximately 160 km southwest of the Cyprus coast, Cronos-1 encountered several good quality carbonate reservoir intervals and confirmed overall net gas pay of more than 260 meters. “This successful exploration well at Cronos-1 is another illustration of the impact of our Exploration strategy which is focused on discovering resources with low technical cost and low carbon emissions, to contribute to energy security including to provide an additional sources of gas supply to Europe” said Kevin McLachlan, Senior Vice President, Exploration at TotalEnergies. The drilling of another exploration well on Block 6 is planned, in order to investigate significant additional resource upside and to evaluate the best development options. TotalEnergies holds a 50% interest in Block 6, where Eni is the operator (50%). In Cyprus, TotalEnergies is also present in offshore Block 11 (50%, operator), 7 (50%, operator), 2 (20%), 3 (30%), 8 (40%) and 9 (20%). Read More

OilandGasPress Energy Newsbites and Analysis Roundup |Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: @OilAndGasPress on Twitter |