Hess Reports Estimated Results for the First Quarter of 2022

Hess Corporation (NYSE: HES) today reported net income of $417 million, or $1.34 per share, in the first quarter of 2022, compared with net income of $252 million, or $0.82 per share, in the first quarter of 2021. On an adjusted basis, the Corporation reported net income of $404 million, or $1.30 per share, in the first quarter of 2022.

First Quarter Financial and Operational Highlights:

• Net income was $417 million, or $1.34 per share, compared with net income of $252 million, or $0.82 per share, in the first quarter of 2021; Adjusted net income1 in the first quarter of 2022 was $404 million, or $1.30 per share

• Oil and gas net production, excluding Libya, was 276,000 barrels of oil equivalent per day (boepd); Bakken net production was 152,000 boepd

• E&P capital and exploratory expenditures were $580 million, compared with $309 million in the prior-year quarter

Key Developments:

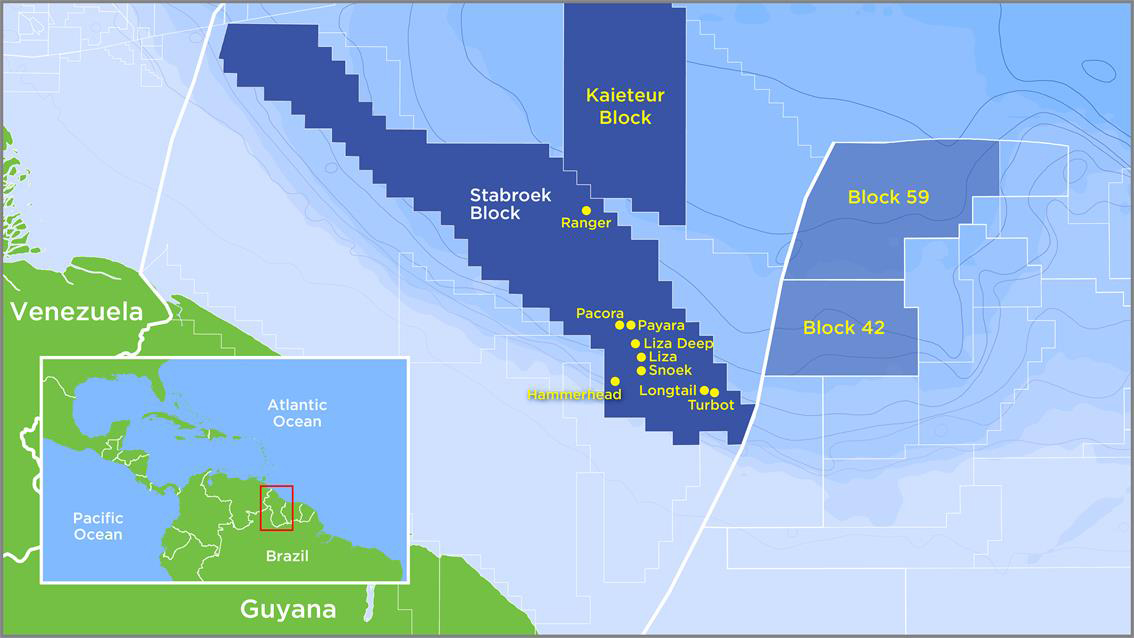

• Announced new discoveries at Barreleye, Lukanani, and Patwa on the Stabroek Block, offshore Guyana; discoveries further underpin the development potential of the Block

• Increased the gross discovered recoverable estimate for the Stabroek Block to approximately 11 billion barrels of oil equivalent (boe), up from the previous estimate of

more than 10 billion boe

• Sanctioned development of Yellowtail, the fourth and largest development on the Stabroek Block, with a production capacity of approximately 250,000 gross barrels of oil per day (bopd); first oil is expected in 2025

• Commenced production from the Liza Phase 2 development on the Stabroek Block in February; production is expected to reach capacity of approximately 220,000 gross bopd by the third quarter

• The third development on the Stabroek Block, Payara, is ahead of schedule and is now expected to startup in late 2023 with a production capacity of approximately 220,000 gross bopd

• Improved returns to shareholders through a 50 percent increase in the first quarter dividend to $0.375 per share and reduced debt by prepaying the remaining $500 million of

the Corporation’s $1 billion term loan

Information Source: Read More–>

Energy, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Commodity, Coal, Electric Power, Energy Transition, LNG, Natural Gas, Oil,