Hydro acquires additional 20 percent of Vianode

London, September 09, 2024, (Oilandgaspress) ––On September 6, the private equity fund Altor has exercised its put option, requiring Hydro to acquire additional 20 percent of Vianode, resulting in equal 50/50 ownership stake for both parties.

Vianode is a synthetic graphite manufacturer for the batteries industry operating an industrial pilot plant in Kristiansand, Norway, since 2021, and is expecting to complete an industrial scale production facility at Herøya Industripark in Norway by end 2024.

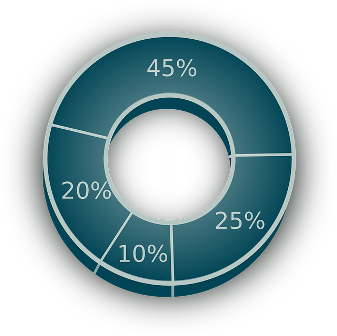

Following Elkem’s exit from Vianode in March 2024, Altor and Hydro remained shareholders with 70 and 30 percents ownerships respectively. The shareholder agreement includes a put-and-call option where each party can require a 50/50 percent ownership and share costs accordingly.

The transaction is pending competition clearance, expected within six to eight weeks. Hydro incurs no additional costs for this acquisition.

According to Hydro’s updated 2030 strategy, Hydro’s Batteries unit remains focused on successful execution of its current investments, while additional capital allocation will depend on attractiveness.

Information Source: Read More

Oil and gas press covers, Energy Monitor, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas,