Latest Energy / Automotive News As Reported; Mercedes-AMG dealerships now taking orders for the AMG EQE 53 4MATIC+ SUV

London, 08 June, 2023, (Oilandgaspress) : Shale well refracturing and new drilling innovations is giving U.S. drillers the potential to double oil output from existing wells.

Eni and oil and gas operator KazMunayGas (KMG) will work together to build Kazakhstan’s first hybrid renewables-gas power plant, the Italian energy group said on Thursday following a meeting with the Kazakh president in Astana.

“The project we announced today marks a further step towards growing Eni’s renewable generation capacity, while supporting Kazakhstan’s decarbonisation path,” Eni Chief Executive Claudio Descalzi said.

Neither the Kazakh authorities nor KMG could immediately be contacted for comment.Reuters reports

The decision by OPEC+ to extend current production cuts and an additional voluntary 1 million b/d reduction for July from Saudi Arabia should provide support for prices in the rest of 2023, according to Wood Mackenzie. “Setting aside various markets’ fears of possible global recession, the outlook for oil demand and supply remains broadly supportive for Brent prices in the second half of 2023,” said Ann-Louise Hittle, Vice President Macro Oils, at Wood Mackenzie. “We forecast a significant implied global stock draw in Q3 2023, and we expect the OPEC+ 4 June decision to increase the implied stock draw for that quarter due to mostly the additional voluntary production cuts Saudi Arabia announced.”

Wood Mackenzie Macro Oils Service projects global oil demand to rise 2.4 million b/d on an annualized basis, eclipsing a 1.5 million b/d year-on-year gain in total liquids supply, with Brent forecast to average $84.70/bbl in 2023. Wood Mackenzie expects global oil demand to surpass total liquids supply in Q2 through Q4 2023, provided market concerns about economic weakness ease.

“OPEC+ faced several tricky issues at its biannual meeting,” said Hittle. “Mainly, ongoing fears in the greater financial markets that China’s economic recovery is not happening and therefore demand growth is seen as a risk, as well as the geopolitical complications of reorganizing, reassigning and agreeing on an additional production cut for the rest of this year.” However, Hittle points out that “by OPEC+ rolling over the current agreement, and with Saudi Arabia announcing a further voluntary cut, the group has gone some way towards achieving its goal of supporting prices.”

Wood Mackenzie’s latest outlook shows oil demand growth of almost 1 million b/d for China on an annualized basis in 2023, with about half of that growth in gasoline and jet fuel due to a robust recovery in personal mobility.

Dana Incorporated (NYSE: DAN) announced that it has been named one of America’s Climate Leaders 2023 by USA Today.

The list, compiled by the newspaper’s research partner, Statista, recognizes the top 400 companies for their 2021 greenhouse gas (GHG) reduction performance against a 2019 baseline.

The companies were evaluated on six measures, sourced from the Carbon Disclosure Project (CDP):

• Reduction of Scope 1 and 2 emissions, adjusted by revenue growth, from 2019 to 2021;

• Energy intensity, taking 2021 GHG emissions per $1 million in company revenue;

• Total reduction of core GHG emissions from 2019 to 2021;

• Reported scope 3 emissions;

• CDP score; and

• Commitment and targets set with the Science Based Targets initiative (SBTi).

“Dana’s vision of a zero-emissions future encompasses a wholistic, science-based approach to sustainability,” said Doug Liedberg, Dana senior vice president and chief sustainability officer. “We are proud to be a company that leads by example in reducing our carbon footprint but also in developing technologies that enable others to meet their sustainability objectives. This recognition by USA Today is another endorsement of our strategy.”

Over the past few months, Dana has also been named among the “World’s Most Ethical Companies” for 2023 by Ethisphere and as one of “America’s Most Responsible Companies 2023” by Newsweek.

In March, the company announced it had accelerated its climate commitments, with a goal of achieving net zero by 2040. As part of this commitment, Dana plans to reduce Scope 1 and 2 greenhouse gas (GHG) emissions to achieve a reduction of greater than 75 percent by 2030.

The company also announced that the SBTi has validated the company’s previous climate commitments of reducing Scope 1 and 2 GHG emissions by more than 50 percent and Scope 3 GHG emissions by more than 25 percent before 2030. Dana has already initiated the validation process for its updated targets with SBTi.

With respect to renewable energy, Dana’s United States wind facility became operational in December 2022 and is now generating approximately 345,000 megawatt hours of renewable electricity annually, offsetting 100 percent of Dana’s emissions from purchased electricity in the United States and Canada. Dana has also completed a renewable power purchase agreement with Enel Green Power for an upcoming solar project in Spain. The agreement, commencing January 2025, will supply Dana with approximately 240,000 megawatt hours per year of renewable energy, offsetting 100 percent of Dana’s emissions from purchased electricity in Europe. Read More

Ørsted and Vestas, global leaders in renewable energy, are announcing a commercial sustainability partnership. Ørsted will procure low-carbon steel wind turbine towers and blades made from recycled materials from Vestas in all joint offshore wind projects.

The deployment of offshore wind is crucial to enhancing energy security, advancing affordable energy for all, and not least curbing the climate crisis. Today, wind produces energy with a 99 % lower carbon footprint than coal, but on the scientific path to net-zero, we must limit the carbon that the manufacturing of materials and components used in wind farms emits. This is also becoming increasingly demanded by consumers of renewable energy and policymakers.

Meeting this need requires cost-efficient solutions to address the most critical decarbonisation and circularity challenges in the wind industry, namely steel and blades. To address these challenges, Ørsted and Vestas will install low-carbon steel towers and, when commercially available, blades made from recycled materials at all future joint offshore wind farms.

By committing to integrate sustainable procurement not just as a one-off but in all future offshore projects between the two companies, Ørsted is creating ongoing demand for Vestas’ innovative low-carbon and circular solutions.

The partnership entails that for all joint future offshore wind farms, the two companies will:

• Procure and install a minimum of 25 % low-carbon steel towers in joint projects

Over the last years, Vestas has spearheaded cross-industrial collaboration to establish availability of low-carbon steel for wind turbine towers. With the new partnership, Ørsted and Vestas are sending a strong demand signal to the steel industry to further accelerate the scaling of cost-competitive decarbonised steel for offshore wind. By utilising scrap steel manufactured with on-site renewable electricity, carbon emissions from heavy steel plates used in towers can be reduced by up to 70 %.

• Scale circular blade recycling technology and procure blades made from recycled materials Vestas and its partners in the CETEC project have pioneered the first solution to break down composite materials in both existing and future epoxy-based blades and use the recovered epoxy resin for new blades. This addresses the industry’s biggest circularity challenge, namely the many blades in operation today that need to be recycled at their end-of-life. Vestas is currently scaling up the circular recycling value chain together with its partners Olin and Stena Recycling. When ready for commercial manufacturing, Ørsted will procure wind turbines blades made from recycled materials from Vestas to further accelerate the scaling of the technology. Read More

Stellantis Launch Second Tranche of Its Share Buyback Program

Stellantis N.V. announced today that pursuant to its Share Buyback Program (the “Program”) announced on February 22, 2023, covering up to €1.5 billion (total purchase price excluding ancillary costs) to be executed in the open market with the intent to cancel the common shares acquired through the Program and following the completion of the first tranche of the Program as announced on May 18, 2023, Stellantis has signed a share buyback agreement for the second tranche of its Program with an independent investment firm that makes its trading decisions concerning the timing of purchases independently of Stellantis.

This agreement will cover a maximum amount of up to €500 million. The second tranche of the Program shall start on June 7, 2023 and end no later than September 7, 2023. Common shares purchased under the Program will be cancelled in due course. Any buyback of common shares in relation to this announcement will be carried out under the authority granted by the general meeting of shareholders held on April 13, 2023, up to a maximum of 10% of the Company’s capital, or any renewed or extended authorization to be granted at a future general meeting of the Company. The purchase price per common share will be no higher than an amount equal to 110% of the market price of the shares on the NYSE, Euronext Milan or Euronext Paris (as the case may be). The market price will be calculated as the average of the highest price on each of the five days of trading prior to the date on which the acquisition is made, as shown in the official price list of the NYSE, Euronext Milan or Euronext Paris. The share buybacks will be carried out subject to market conditions and in compliance with applicable rules and regulations, including the Market Abuse Regulation 596/2014 and the Commission Delegated Regulation (EU) 2016/1052. Read More

SHARE NOW Celebrates One Million Users in Italy

SHARE NOW, the European leader in free-floating car-sharing, is proud to announce that it has surpassed the significant milestone of one million users in Italy. As of May 2023, SHARE NOW boasts a total of 1,013,434 members, representing an impressive 14 % growth over the past year. Since SHARE NOW first came to Italy in 2013, the company has been committed to enhancing the quality of life in cities through its sustainable urban mobility solution. SHARE NOW currently operates in 17 European cities, offering a fleet of 10,000 vehicles, including 3,000 electric cars. In Italy alone, there are 2,000 vehicles available, with 5 % of them being electric. The highest number of registered users can be found in Milan (480,000), followed by Rome (369,000), and Turin (174,000).

The widespread availability of SHARE NOW vehicles across various Italian cities has undoubtedly contributed to its exponential adoption. By providing a diverse range of shared cars, including electric vehicles, SHARE NOW allows users to choose

environmentally friendly options that align with their values. The numerous benefits of car-sharing, such as reduced traffic congestion, lower emissions, and increased affordability, have resonated with an ever-growing number of individuals seeking flexible and sustainable transportation solutions. SHARE NOW’s milestone achievement in Italy underscores the positive impact that car-sharing services can have on urban mobility and the environment. Read More

DS Automobiles is unveiling an interior design manifesto, the result of its thinking around the future of the car.

The DS DESIGN STUDIO is unveiling M.i. 21, one of its research media, illustrating the vision for the Brand’s future interiors.

This research medium strictly for internal use makes it possible to represent on an object the joint thinking of the design and product teams around new concepts, original shapes, technical evolutions, redesigned ergonomics and HMI (Human-Machine Interface) plus explorations in CMF (colours, materials and finishes), for application before the end of the decade.

The manifesto is also a valuable communication tool inside the Brand, with the engineering and senior management groups. And it is a creative stimulus for the DS design team. Unlike a concept car, a manifesto incorporates certain regulatory, industrial and economic demands to be able to ensure faster production.

With the M.i. 21 manifesto, DS shares its vision with the public for the first time, at the Révélations exhibition, the international biennial for craft and design held in Paris, at the Grand Palais Ephémère, from 7 to 11 June 2023. Read More

Mercedes-Benz AG and H2 Green Steel secure supply deal

Mercedes-Benz signed a supply agreement with Swedish start-up H2 Green Steel (H2GS) over approximately 50,000 tonnes almost CO₂-free steel per year for its European press shops and deepened its partnership through a Memorandum of Understanding (MoU) with the aim to establish a sustainable steel supply chain in North America.

After taking an equity stake in H2GS in 2021, the new supply agreement enables Mercedes-Benz to bring almost CO₂-free steel into series production. The partner plans to start its production during 2025.

As part of a broader effort to decarbonise the supply chain, Mercedes-Benz and H2GS agreed to aim to establish a supply chain for green steel produced in North America for local Mercedes-Benz manufacturing plants. Extending the strategic partnership with H2GS to North America marks another important milestone in increasingly pursuing the strategy of procuring close to Mercedes-Benz production sites. Read More

Mercedes-AMG EQE 53 4MATIC+ SUV can be ordered now

Mercedes-AMG dealerships are now taking orders for the new Mercedes‑AMG EQE 53 4MATIC+ SUV (combined WLTP power consumption: 25.6-23.0 kWh/100 km; WLTP CO₂ emissions: 0 g/km; WLTP range: 407-455 km)[2]. The list price is 139.438,25 euros[1]. In addition, the online configurator is now live. Online orders are possible, too. The extensive standard equipment includes AMG RIDE CONTROL+ air suspension with adaptive adjustable damping and 21-inch wheels, electromechanical active roll stabilisation AMG ACTIVE RIDE CONTROL, DIGITAL LIGHT, AMG SOUND EXPERIENCE and the AMG Performance steering wheel with steering wheel buttons.

With its variable interior and performance-oriented drive concept, the new EQE 53 4MATIC+ SUV is the most versatile electric vehicle in the Mercedes-AMG portfolio. The all-rounder also offers generous space for passengers and luggage. Two powerful electric motors and the fully variable all-wheel drive AMG Performance 4MATIC+ form the basis for the hallmark AMG dynamic driving experience. Read More

Shell adverts banned

Shell has had some of its adverts banned for misleading claims about how clean its overall energy production is.

The ban applies to one TV advert, a poster displayed in Bristol and a YouTube ad, all shown in 2022.

The Advertising Standards Authority (ASA) ruled they all left out information on Shell’s more polluting work with fossil fuels.

Shell said it “strongly” disagreed with the ASA’s findings.

The adverts cannot be shown in their current form again, the ASA ruled. Shell had stated that the ads were intended to raise awareness of the lower emissions energy products and services it is investing more money in. The ASA ruled that the YouTube advert incorrectly gave the impression that low-carbon energy products made up a significant proportion of Shell’s energy products, when in fact they did not. Shell said that people who saw the adverts would already be well-informed of its operations and would mainly associate the brand with petrol sales. But the ASA said the selection of ads were likely to mislead consumers as they “misrepresented the contribution that lower-carbon initiatives played, or would play in the near future” compared with the rest of the company’s operations. Read More

1.5-degree ambition is becoming increasingly difficult to achieve

Energy Perspectives paints the outcome space for the long-term development of the world’s energy markets. Driven by factors such as geopolitics, technology, climate and energy policy, and company and consumer behaviour, energy demand projections are made, but become increasingly uncertain the further out in time we forecast.

The world is far from being on track to meet targets and ambition set out in the Paris Climate Agreement. Increased levels of geopolitical conflict have unfortunately made the energy transition more fragmented, and positive developments are in many cases offset by negative ones. Read More

President of Kazakhstan meets Eni CEO

The President of Kazakhstan Kassym-Jomart Tokayev and Eni Chief Executive Officer Claudio Descalzi met today in Astana to discuss Eni’s current activities, future projects and decarbonization initiatives in the country, including a Hybrid Renewables-Gas Power Plant in Mangystau Region.

Claudio Descalzi illustrated to President Tokayev Eni’s gas valorization strategy in Karachaganak and Kashagan to meet domestic gas demand, as well as further boosting energy transition investments in renewables and bio-feedstocks.

Following the meeting with the President Tokayev, KazMunayGas (KMG) and Eni have announced a joint 250 MW Hybrid Renewables-Gas Power Plant Project in Zhanaozen, Mangystau Region undertaken pursuant to an Agreement signed between the two companies. The project, which is the first-of-its-kind in the country, comprises a solar power plant, a wind power plant and a gas power plant for the production and supply of low-carbon and stable electricity to KMG subsidiaries in the area. The Project leverages Eni’s international industrial expertise and pioneers the hybrid combination of various technologies: state-of-the-art renewable power plants developed by Eni’s subsidiary Plenitude in cooperation with KMG, and gas power plants for balancing capacity. The hybrid model addresses the diversification and decarbonization of energy supply for the Mangystau Region’s oil and gas assets. In addition, it will contribute to the human capital development in the renewable energy sector. Read More

Hydro signs long-term power contract

Hydro Energi AS has signed a long-term power purchase agreement (PPA) with Statkraft for the delivery of 0.44 TWh per year to Hydro’s Norwegian aluminium plants in the period from 2024-2038. The PPA secures a total supply of 6.6 TWh of renewable power over a 15 year period to Hydro’s plants in NO3 from Statkraft’s power plants in the price area. Access to renewable power and modern technology enable Hydro to produce aluminium in Norway with a carbon footprint of about 75 percent less than the global average. Long-term power agreements at competitive prices are crucial for Hydro to continue to lead the way in low-carbon aluminium globally. Read More

UAE withdraws from US-led maritime coalition

The UAE has exited a US-led multinational security force that protects shipping in the Gulf, in a high-profile sign of the ongoing rift between Washington and a key Middle East security partner. “As a result of our ongoing evaluation of effective security cooperation with all partners, two months ago, the UAE withdrew its participation in the Combined Maritime Forces,” the Emirati Ministry of Foreign Affairs said on Wednesday. The statement was part of a response to a Wall Street Journal article a day earlier which said that Emirati officials had complained to Washington over its weak response to the Islamic Republic’s seizure of two oil tankers in the Gulf of Oman.

One oil tanker was seized on 27 April carrying oil from Kuwait to Houston, Texas, for Chevron. Read More

ADNOC Logistics & Services lands $975m deal

ADNOC Logistics & Services (ADNOC L&S) has won a $975m contract from ADNOC Offshore for the engineering, procurement and construction of an artificial island for the Lower Zakum offshore field. The first major deal for ADNOC L&S after it was listed on the Abu Dhabi Securities Exchange this month, includes dredging, land reclamation and marine construction. The award is part of Lower Zakum’s long-term development plan, aiming to safely and sustainably unlock greater value while helping to meet the increasing global energy demand. ADNOC Offshore said it has extensive experience in deploying the artificial island concept for project delivery, resulting in significant cost savings and environmental benefits compared to conventional approaches that require more offshore installations and infrastructure according to reports. Read More

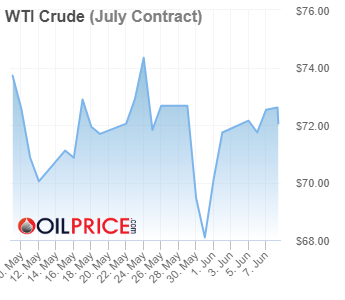

| Oil and Gas Blends | Units | Oil Price $ | change |

| Crude Oil (WTI) | USD/bbl | $71.77 | Down |

| Crude Oil (Brent) | USD/bbl | $76.35 | Up |

| Bonny Light | USD/bbl | $76.57 | Up |

| Saharan Blend | USD/bbl | $77.01 | Up |

| Natural Gas | USD/MMBtu | $2.31 | Up |

| OPEC basket 06/06/23 | USD/bbl | $75.47 | Down |

Baker Hughes Rig Count:

The Worldwide Rig Count for May was 1,783, down 25 from the 1,808 counted in April 2023, and up 155, from the 1,628 counted in May 2022.

U.S. Rig Count is down 15 from last week to 696 with oil rigs down 15 to 555, gas rigs unchanged at 137 and miscellaneous rigs unchanged at 4

Canada Rig Count is up 10 from last week to 97, with oil rigs up 9 to 51, gas rigs up 1 to 46.

International Rig Count is up 18 rigs from last month to 965 with land rigs up 9 to 729, offshore rigs up 9 to 236.

Oil and Gas News Undiluted !!! �The squeaky wheel gets the oil�

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: @OilAndGasPress on Twitter |

Oil and gas press covers, Energy Monitor, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas,