Latest Energy News As Reported | U.S. Rig Count is down 5 to 675

London, 17 July, 2023, (Oilandgaspress) : China’s second-quarter growth report came in weaker than expected, fuelling concern about oil demand.China’s gross domestic product grew 6.3% year on year in the second quarter, data released by the National Bureau of Statistics showed, compared with analysts’ forecast for growth of 7.3%

From the collaboration between Automobili Lamborghini and Montegrappa – renowned Italian leader in the luxury pen sector – Automobili Lamborghini 60° is born: the limited edition collection of fountain pens and rollerballs inspired by the sixties of super sports car design. Automobili Lamborghini 60° is a precious all-Italian, handcrafted limited edition that blends advanced materials, technical prowess and futuristic design to pay homage to an Italian icon in its anniversary year.

The collection includes sixty fountain pens and sixty rollerballs in six distinctive Lamborghini colors – Arancio Apodis, Bianco Siderale and Verde Viper in bright shades, Blu Aegeus, Grigio Titans and Nero Noctis in the matt version – for a total of 720 pens with pure surfaces, precise outlines and proportions that celebrate the design of super sports cars. The Lamborghini style codes are also present in the ultra-light hexagonal profile of the pen made of numerically-milled aerospace aluminum and covered in forged carbon fiber. The mechanical performance is of the highest level: in fountain pens, Montegrappa’s Power-Push offers writers speedy ink-filling with a single touch. Both models feature a unique release system for quick access to the ink chamber. Taking cues from the iconic Lamborghini aeronautical-inspired red toggle start button, a red alloy snap switch located on the base of the pens activates a mechanism integrated into the luxury writing instrument. Read More

Bolide, firing on all 16-cylinders of its unmatched 8.0-liter heart, races through the famed hillclimb route channeling blistering performance at high speeds with ease, focus and finesse. The Bolide’s galvanizing hillclimb at Goodwood over the weekend marks the first time Bugatti’s track-only hyper sports car is shown to the public in the UK having made its global public debut with a track lap last month at the centenary of the 24 Hours of Le Mans in France. Over the weekend the Bolide continues to entertain the Goodwood Festival of Speed community, taking to the hillclimb every day in the Batch 6a Supercar Run. Legendary motorsport driver and Bugatti Pilote Officiel, Andy Wallace, is the person charged with taking the wheel of Bugatti’s most extreme modern day car at the Festival of Speed.

“To be behind the wheel of the Bolide as it takes to the hillclimb at this year’s Goodwood Festival of Speed is an incredible feeling,” said Andy following his opening drive. “The Bolide captured the hearts and minds of onlookers at Le Mans last month during its incredible track lap, but to drive this supremely focused and motorsport-inspired Bugatti at the Festival of Speed – on the revered road that is intimately close to spectators – is a very special and unique experience. The Bolide lets the driver feel things that other hypercars simply can’t generate – the downforce and g-forces, for example, are simply staggering. These outstanding and distinctive characteristics, together with an excellence in exquisite craftsmanship, ensure that the Bolide remains true to the Bugatti DNA in being simply incomparable. The Bolide is the incomparable track-only Bugatti limited to only 40 units. At its center is Bugatti’s iconic quad turbo 8.0-litre W16 heart delivering 1,600 PS, deftly encased within an aerodynamically optimized lightweight carbon body that weighs just 1,450 kg, giving the car an incredible weight-to-power ratio. Read More

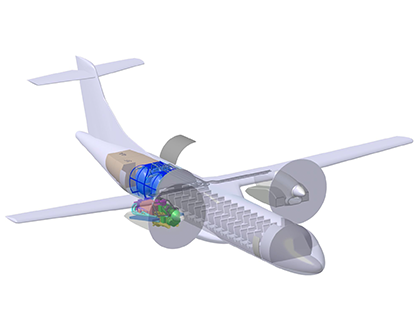

Ecotricity Founder Dale Vince’s has set out plans for his next venture – a UK-based airline that will operate only hydrogen-electric planes.Vince announced his intention to create ‘EcoJet’ today and is aiming to operate the first flights in 2024. He has described the airline as “a flag carrier for green Britain” that will prove the commercial viability of next-generation aircraft. In the first instance, EcoJet will operate a route between Edinburgh and Southampton using 19-seater aircraft. It will then add additional routes between the UK and Europe by the end of 2026. EcoJet is in the process of applying for licences for take-off and landing slots. EcoJet will operate aircraft that convert green hydrogen to electricity on-board. Green hydrogen is produced by running water through electrolysers powered exclusively by renewable electricity. Read More

Enel S.p.A. (“Enel”), acting through its fully-owned subsidiary Enel Green Power S.p.A. (“EGP”), has signed an agreement with INPEX Corporation (“INPEX”), for the sale of 50% of the two entities owning all of the Group activities in Australia, namely Enel Green Power Australia Pty Ltd and Enel Green Power Australia Trust (together “Enel Green Power Australia”, or “EGPA”), currently wholly owned by EGP, for a total consideration of approximately 400 million euros enterprise value, 100% basis, of which around 140 million euros in debt. The deal is in line with Enel’s current Strategic Plan, which envisages the implementation of partnerships in certain businesses and geographies to enhance value creation. Upon the transaction’s closing, EGP and INPEX are expected to jointly control EGPA, overseeing the company’s current renewable generation portfolio and continuing to develop its project pipeline, targeting an increase of EGPA’s installed capacity. This ensures EGPA will continue to drive the energy transition underway in Australia, accelerating its contribution to achieve the Country’s net zero target.

The overall transaction is expected to generate a positive impact of around 87 million euros on the 2023 Group’s ordinary and reported EBITDA. Moreover, the deal is expected to generate a positive effect on the Group’s consolidated net debt of approximately 145 million euros associated with the 50% stake sold by EGP to be accounted for in 2023, whereby this amount does not include approximately 203 million euros as net debt deconsolidated in 2022, since EGPA was already reported as “held for sale”. The closing of the sale is subject to certain conditions precedent customary for these kinds of transactions, including clearance from the Australian Foreign Investment Review Board and the competent Antitrust authorities.

EGPA currently operates 3 plants totaling 310 MW of installed gross capacity powered by solar as well as one 76 MW wind project under construction and one 93 MW solar project in execution. EGPA is also developing a significant portfolio of wind, solar, storage and hybrid projects, across Australia, alongside expanding its activities in innovative solutions within its retail and trading operations. Read More

Enel S.p.A. (“Enel”) and its listed subsidiary Enel Chile S.A. signed a stock purchase agreement with Sonnedix Chile Arcadia S.p.A. and Sonnedix Chile Arcadia Generación S.p.A. (“Purchasers”), both companies controlled by the international renewable energy producer Sonnedix, for the sale of the entire equity interests (“Equity Interests”) held by Enel (approx. 0.009%) and Enel Chile (approx. 99.991%) in the share capital of Arcadia Generación Solar S.p.A. (“Target Company”), a Chilean company which owns a portfolio of four operating photovoltaic (PV) plants. The assets are located in the regions of Atacama and Antofagasta, in northern Chile, and have a total installed capacity of approximately 416 MW. The closing of the sale is subject to certain conditions precedent customary for these kinds of transactions, including the clearance from the Chilean antitrust authority Fiscalía Nacional Económica (FNE).

The agreement provides that the Purchasers, for the entire Equity Interests, will pay a total consideration, subject to adjustments customary for these kinds of transactions, of 550 million US dollars, equivalent to approximately 504 million euros1, corresponding to the 100% enterprise value agreed by the Parties. As such, the transaction is expected to generate a positive impact on Enel Group’s net debt of around 504 million euros and on reported Group net income for 2023 of approximately 20 million euros. Conversely, the transaction is set to bear no impact on Group ordinary economic results. Read More

Odfjell Drilling Ltd. announced that further to the announcement on 31 March 2023, the contracts provided for in the two Letters of Intent for the Deepsea Atlantic to conduct operations in the North Sea region have now been signed with Equinor.

As previously announced, the contracts have a combined firm duration of 23 months and a value of approximately USD 290 million excluding integrated services, upgrades / modifications or mobilisation fees. The contracts also include provisions for performance bonuses and fuel incentives.

In addition to the firm contract periods, there are four priced one well options as well as three further optional periods of approximately one-year each, with the rates for each period to be mutually agreed prior to exercising. The work will begin immediately following completion of the Special Periodic Survey for the Deepsea Atlantic, which is currently planned during the first half of 2024.

The Deepsea Atlantic is now signed up to firm contracts until mid-2026, with options which extend to 2029.

Together with the two contracts, Odfjell Drilling and Equinor have also entered into a Strategic Collaboration Agreement to focus on matters of mutual strategic importance. With a focus on safety, drilling efficiency and lower emissions this agreement shall provide the framework for a joint effort and longer-term

collaboration on these key matters. Read More

Petrofac, a leading provider of services to the global energy industry, has been awarded a facilities management contract by CNR International (CNRI) offshore the Ivory Coast, West Africa. The initial three-year, multi-million pound, contract will see Petrofac’s Asset Solutions business providing integrated services for the Espoir Ivoirien Floating Production Storage and Offloading (FPSO) vessel. Around 110 personnel currently supporting the FPSO, including those onshore and on the vessel, will transition to Petrofac from BW Offshore following the recent sale of the vessel to CNRI. The transition of people and operatorship is expected to complete before the end of July. The contract builds upon Petrofac’s existing strong relationship with CNRI in the UKCS, which has centred around the provision of operations and maintenance services. The contract will be managed from Petrofac’s technical hub in Aberdeen, using decades of experience in the mature and highly regulated UKCS market. This latest award builds on contract successes achieved throughout 2022, including decommissioning in Mauritania for Tullow Oil, operations and maintenance for Tullow Oil in Ghana and the provision of offshore operations services for bp’s Greater Tortue Ahmeyim (GTA) Project, including an FPSO, in Mauritania and Senegal. Read More

Petrofac has been awarded the Gold Impact Seal for delivering on our sustainability strategy in the UAE. The Gold Impact Seal is the country’s official federal recognition that certifies, measures and rewards entities leading sustainable impact practices aligned with environmental, social and governance (ESG) criteria, the UN Sustainable Development Goals (SDGs) and national priorities.

The award of our Gold Impact Seal highlighted areas of excellence including the alignment of Petrofac’s procurement approach with the UAE’s national objectives and driving in-country value. Advances in new energies and digital solutions to overcome sustainability issues were also commended, along with our approach to promoting innovation in the workplace. The Gold Impact Seal is administered by Majra, the National CSR Fund, a federal authority setting the framework and governance for Corporate Social Responsibility in the UAE. Read More

Longboat Energy, the full-cycle E&P company, confirmed that its transaction with Japan Petroleum Exploration Co., Ltd (“JAPEX”) to establish a joint venture in Norway has now been completed with the initial investment of US$16 million received by the renamed entity Longboat JAPEX Norge AS (“Longboat JAPEX” or the “JV”). As part of the transaction, Longboat JAPEX will use part of the JAPEX investment to repay an intercompany loan of NOK 45.5 million (approximately £3.5 million) to Longboat Energy. The contingent consideration of US$4 million, payable by JAPEX into the JV, associated with the recently announced production acquisition, will be paid on completion of that transaction which is anticipated toward the end of the year. The third tranche (the “Velocette Tranche”) of up to US$30 million is contingent on a successful discovery on the Velocette well, which is expected to spud in September. The amount payable under the Velocette Tranche is based on a sliding scale applied to the gross resources approved for development by the Norwegian Ministry of Petroleum and Energy.

Having completed the transaction, the US$100 million Acquisition Financing Facility to finance acquisitions and associated development costs has been established and is available for drawing by the JV. Longboat JAPEX is owned 50.1% by Longboat and 49.9% by JAPEX. Read More

Nel Hydrogen Electrolyser AS, has signed a contract for 40 MW of alkaline electrolyser equipment for about EUR 11 million with Bondalti for its first phase of the H2 Enable project in Estarreja, Portugal.

“We continue to experience good momentum for our electrolysers, and we are happy to partner with a quality company such as Bondalti, an exciting client committed to decarbonisation”, says Nel’s CEO, Håkon Volldal.

Bondalti is the largest company in the Portuguese chemical industry. The electrolyser plant, which is aimed to commence production in the beginning of 2026, will inject green hydrogen into the natural gas grid, supply long-haul transport and cater for Bondalti’s own hydrogen demand for chemical processes.

The client’s strategic objectives include a significant incorporation of green hydrogen into its value chain, with the aim of decarbonising current operations and, at the same time, contributing towards the climate and energy targets established at European level, specifically those of the “Fit for 55” initiative for the chemicals sector.

“Our commitment to decarbonisation is not new, we already incorporate 40% of renewable energy in our operations, and this value will be 100% by 2030. The H2 Enable project is another main milestone for the reduction of the carbon footprint in the Estarreja Chemical Complex, as well as a major contribution to decarbonize other hard-to-abate sectors”, says Bondalti’s COO, André de Albuquerque.

This is a firm purchase order for alkaline stacks. Wood has been contracted as EPC for the FEED study. The electrodes will be produced in the Herøya facility in Norway, the world’s first fully automated electrolyser production line. Read More

U.S. Rig Count is down 5 from last week to 675 with oil rigs down 3 to 537, gas rigs down 2 to 133 and miscellaneous rigs unchanged at 5.

Canada Rig Count is up 12 from last week to 187, with oil rigs up 3 to 114, gas rigs up 9 to 73.

| Region | Period | Rig Count | Change |

| U.S.A | 14 July 2023 | 675 | -5 |

| Canada | 14 July 2023 | 187 | +12 |

| International | June 2023 | 967 | +2 |

Oil and Gas News Undiluted !!! �The squeaky wheel gets the oil�

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: @OilAndGasPress on Twitter |

Oil and gas press covers, Energy Monitor, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas,