Lower Oil Prices as concerns about China’s future oil demand persist

London, July 26, 2024, (Oilandgaspress) –– Oil futures traded negative earlier in the session amid concerns about the health of China’s economy after the country’s central bank cut rates twice in a week. U.S. oil has lost 2.3% this week while Brent is down 0.3%. China’s oil imports were down 10.7% year over year in June, while refined product imports fell 32% during the same period, according to customs data. Read More

The 37th OPEC and non-OPEC Ministerial Meeting (ONOMM) held 02 June 2024 reiterated the critical importance of adhering to full conformity and the compensation mechanism. In light of the above, the OPEC Secretariat received compensation plans from Iraq, Kazakhstan, and the Russian Federation for their overproduced volumes for the first six months of 2024 (January through June), which totaled about 1,184 tb/d for Iraq, 620 tb/d for Kazakhstan, and 480 tb/d for the Russian Federation, according to assessments made by the independent sources approved in the Declaration of Cooperation (DoC).

The table below, prepared by the OPEC Secretariat, shows in detail that the entire over-produced volumes will be fully compensated for by September 2025. Read More

| Oil and Gas Blends | Units | Oil Price US$/bbl | Change |

| Crude Oil (WTI) | USD/bbl | $77.56 | — |

| Crude Oil (Brent) | USD/bbl | $81.58 | — |

| Bonny Light | USD/bbl | $86.00 | — |

| Saharan Blend | USD/bbl | $85.61 | — |

| Natural Gas | USD/MMBtu | $2.02 | — |

| Murban Crude | USD/bbl | $80.35 | — |

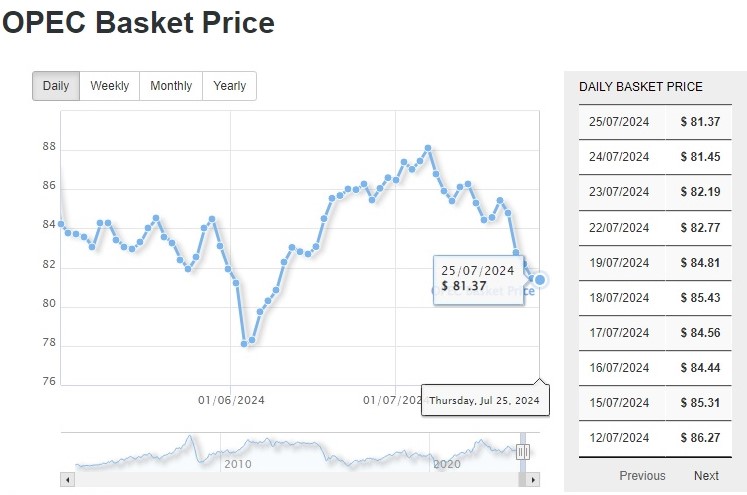

| OPEC basket 25/07/24 | USD/bbl | $81.37 | — |

Britain’s millions of motorists are still paying too much to fill up at petrol stations due to retailers pocketing bigger profits from every litre they sell, according to an ongoing investigation into the fuel sector by the UK competition watchdog. The Competition and Markets Authority (CMA) said that the fuel market is still ‘failing consumers’ a year on from its first report that laid bare the problems in the sector.

It said that retailers’ fuel margins – the difference between what they pay wholesale for their fuel and the price they sell it at – are ‘still significantly above historic levels’.

Increases in fuel margins cost drivers more than £1.6billion in 2023 alone, with supermarkets’ fuel margins now roughly double what they were in 2019, the CMA added.

The competition watchdog is calling on the Government to use recent legislation to launch a compulsory scheme to ensure that fuel retailers share price information to allow motorists to compare forecourt deals.

The CMA launched a temporary price data-sharing scheme after its initial report found problems in the market, but said it is voluntary and only covers 40 per cent of fuel retail sites across the UK. Read full article