MLT Analytics Report—New Solar Cell Technologies Accelerate a Transformational Shift in Encapsulant Sheet Adoption

- Fast-emerging TOPCon cell structure promotes shift to POE encapsulant

- High cost of POE prompts sheet makers to innovate with multilayer structures

- New POE players in China a potential market disruptor

- Encapsulant sheet production set to globalize over the coming decade

SINGAPORE–(BUSINESS WIRE)–#AI–Ethylene-vinyl acetate (EVA) and polyolefin elastomer (POE) will coexist as the materials of choice for encapsulation of solar modules, albeit with various twists and turns anticipated over the next decade. This is the key takeaway from MLT Analytics’ (MLTA) newly-published report entitled “Global EVA/POE Solar Module Encapsulant Sheet Market—2024: A fast-growing market undergoing rapid transformation.” The report estimates the global solar encapsulant sheet market at in excess of 1.7 million tonnes in 2023, with around 28% of the market being POE based on MLTA’s proprietary market modelling. The base case scenario also forecasts growth averaging over seven percent per annum for encapsulant sheet over the next decade.

As noted in two previous reports published by MLTA covering the entirety of the EVA and POE markets, 2021 marked a significant increase in the adoption of POE as a solar encapsulation material, primarily due to a temporary shortage in EVA. Since then, POE usage has continued to grow primarily due to the performance requirements of the latest generation of TOPCon cell structure-based solar modules. “Potential-induced degradation, or PID concerns are the chief driver in the uptake of POE as an encapsulant material but as this material is now priced significantly higher than EVA, sheet makers are innovating with multi-layer structures that combine POE with EVA to achieve the right balance of price versus performance,” says MLT Analytics CEO and co-founder Stephen Moore. “However, the emergence of new POE producers in China has the potential to disrupt the forecast EVA/POE balance depending on their ability to develop appropriate materials for solar module encapsulation and their pricing strategies,” cautions Moore.

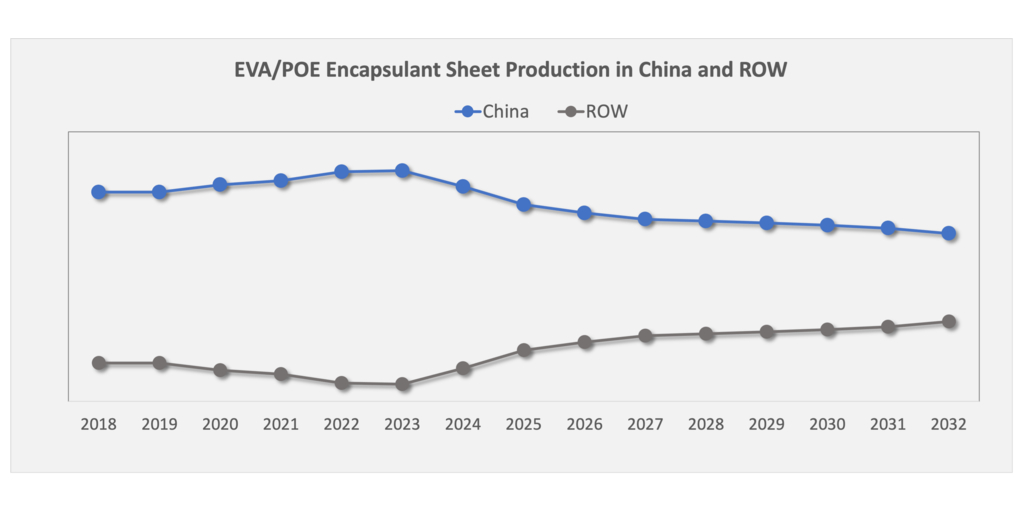

Another key finding of the Global EVA/POE Solar Module Encapsulant Sheet Market—2024 is the forecast globalization of encapsulant sheet production due to regional and national initiatives such as the U.S. Inflation Reduction Act (IRA) and local content requirements in India, as well trade-related barriers such as anti-dumping duties implemented in Europe and elsewhere. The share of sheet production outside of China is estimated to reach almost 35% by 2032 in the base case derived from MLTA market modeling.

For further information and to the purchase the report, please email; us at info@mltanalytics.com. Further information regarding MLTA can be found our website: www.mltanalytics.com.

About MLT Analytics

MLT Analytics was established in June 2021 in Singapore by plastics industry market research veteran Stephen Moore and data scientist Shelley Dong with the intent of applying machine learning technology (MLT) and artificial intelligence (AI), augmented by extensive hands-on industry knowledge, to develop rational, robust and reliable forecasts. The company believes that solid domain expertise is essentially in the successful application of AI and MLT. Hence, its team includes industry experts with decades of expertise in all types of plastics and elastomers, petrochemicals, and specialty chemicals. Expertise extends to processing, conversion and production equipment and plants, and end user industries such as automotive, hygiene, food and beverage, packaging, and agriculture.

Contacts

Stephen Moore

CEO

MLT Analytics

info@mltanalytics.com